Virus Filtration Market Size & Overview

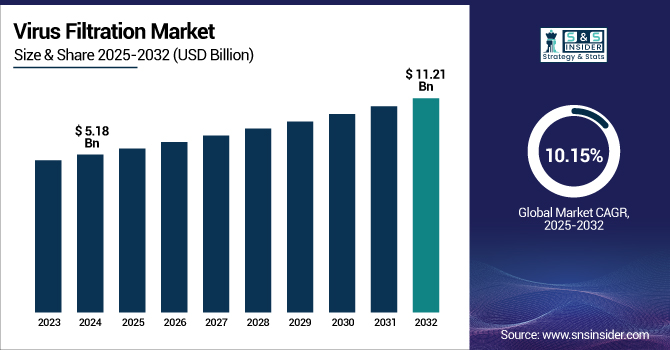

The Virus Filtration Market size was valued at USD 5.18 billion in 2024 and is expected to reach USD 11.21 billion by 2032, growing at a CAGR of 10.15% over the forecast period of 2025-2032.

To Get more information on Virus Filtration Market - Request Free Sample Report

Virus filtration is becoming an increasingly critical part of biologics manufacturing, air quality management, and infection control because of increased biopharmaceutical manufacturing, enhanced emphasis on viral safety, and post-pandemic awareness. Regulatory agencies like the FDA emphasize viral clearance in therapeutic production. The WHO also underlined the need for procedures for inactivating and eradicating viruses to preserve human blood plasma products safely, therefore stressing the need for strong virus filtration methods in medications generated from plasma.

As industries such as Asahi Kasei and TeraPore enhance membrane technologies for enhanced performance and versatility, the FDA underscores the necessity of virus removal in therapy production. The creation of monoclonal antibodies, vaccines, and gene therapies, and more general public health concerns involving airborne viral infection, further stimulates demand.

Sigma-Aldrich, for instance, supplies scalable viral clearance systems for GMP use; Parexel and PDA establish rigorous filtration policies to meet regulatory standards.

Increasing technological advancements support a promising future for virus filtration technology in a wide range of industries.

In December 2023, TeraPore Technologies introduced the IsoBlock VF line of products, utilizing its own Intelligent Membrane technology. In most instances, where protein content and pH vary, these nanofiltration membranes consistently eliminate viruses and function well with both traditional and single-use production processes.

Virus Filtration Market Dynamics

Drivers

-

Growing Cell Therapy and Vaccine Production Drives Market Momentum

The increasing requirement for viral safety in plasma-derived products, vaccines, and cell therapies significantly drives the virus filtration market growth. The global shift towards sophisticated biologics, particularly mRNA-based vaccines and engineered T-cell therapies, requires rigorous virus clearance procedures, which significantly impact the virus filtration market share. Recent market estimates project that around 500 cell and gene therapy candidates are in development, each of which involves viral filtration at various stages of production. This boom is driving the viral filtration market size directly. Additionally, fueling the demand for effective viral safety solutions is the expansion based on the expanding use of CHO cell lines and human-derived cell systems in biological production, which increases the risk of contamination. Firms are lengthening their R&D pipelines and investing in downstream purification technologies to guarantee ongoing compliance and product purity, thus fueling the expansion of the viral filtration market.

Restraints

-

High Technical Complexity and Costly Validation Restrict Accessibility

One of the main concerns is the complex process of virus filtering system certification, which frequently requires costly viral clearance studies with model viruses, GMP compliance, and much in-house expertise. Especially in early-stage or low-budget projects, these evaluations can drive manufacturing costs down by hundreds of thousands of dollars and extend development times by months. Established companies with established infrastructure and regulatory expertise continue to lead the virus filtration market share. Also, the effectiveness of the filter may vary with the amount of protein, differences in pressure, and the composition of the media; hence, proper pre-use testing and specialized process design are necessary and can reduce overall expenses. These operational needs decelerate growth in the size of the market among contract manufacturers and recently formed biotech companies.

Virus Filtration Market Segmentation Analysis

By Product

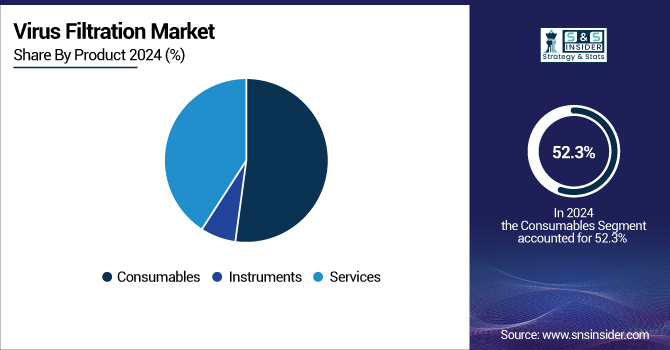

With 52.3%, consumables led the viral filtering market share in 2024. With their use in every production batch process, such as membrane filters, prefilters, and buffer solutions, necessary for any virus filtration system, they are in a position to demonstrate why they are superior. The need for reliable, high-performance virus removal filters continues to keep this market moving as manufacturing of biologics expands.

In 2024, Mirus Bio was acquired for around USD 600 million by MilliporeSigma, the U.S. and Canada Life Science division of Merck KGaA. This calculated action sought to improve their capacity for producing viral vectors, therefore highlighting the growing demand for consumables in virus filtration systems. The acquisition emphasizes how important consumables are to guaranteeing virus safety in biopharmaceutical production.

The services segment is likely to be the fastest-growing and is seeing substantial momentum due to the outsourcing of viral clearance validation and regulatory support services. Companies in the virus filtering market are extending their service offers to provide turn-key solutions as regulatory scrutiny increases and technological complexity in biopharma processes calls for it.

By Technology

The filtration segment led the market in 2024, with over 65.1% of the market share. Filtration methods are crucial in protecting against viruses, providing efficient and effective removal techniques that are key in biomanufacturing facilities. Filtration has emerged as a core process in biologics and vaccine manufacture, which is known for its reliability and economic benefits.

Chromatography is expected to emerge as the most rapidly evolving technology, driven by its capability of enhancing filtration through selective binding and enhanced virus separation. With the evolution of the filtration market, the simultaneous application of both technologies is becoming an important trend in virus filtration, offering increased viral clearance control.

By Application

In 2024, the biologicals segment accounted for a prominent 66.6% market share of the virus filtration market size, mainly due to its critical role in manufacturing monoclonal antibodies, gene therapies, and recombinant proteins. Growing numbers of approved biologic drugs globally have propelled demand for virus filtration technologies to ensure product safety and compliance with regulatory requirements.

In 2024, Roche complemented its biologics production capacity by incorporating advanced virus filtration systems across its monoclonal antibody and vaccine production processes. This growth emphasized the critical role of virus filtration in ensuring viral safety in biological therapeutics, affirming the segment's dominant market share.

The medical devices segment, with a share of 34.6%, is fastest growing as virus filtration systems are increasingly being adopted for use in the manufacture of sterile medical devices and implantable products. Virus filter use in device packaging and surface sterilization is a major contributor to this growing trend. This evolving demand profile indicates the dynamic nature of the virus filtration market analysis, in which existing applications and new applications fuel consistent growth within the virus filtration market.

By End-use

In 2024, biopharmaceutical and biotechnology companies accounted for the highest percentage of the virus filtration market share, fueled by their strong pipeline of biologic drugs and established GMP facilities, which contributed significantly to the overall size of the market. Their ability to invest in advanced virus filtration systems for clinical and commercial production ensures their status as the dominant end-user segment.

In 2024, Pfizer enhanced its virus filtering technologies in its biologics and mRNA manufacturing facilities by incorporating cutting-edge high-throughput filtration technologies to eliminate viruses and achieve international GMP requirements. This move confirmed biopharmaceutical firms as the top-end users of the virus filtration industry.

The medical device companies segment is growing at a fast pace, fueled by the growing application of virus filters in high-risk surgical devices, implantable devices, and extracorporeal life support systems. This shift is consistent with the growing emphasis on the provision of sterility in Class III medical devices, accelerating the growth of plasmid virus filtration and increasing its application in the market.

Virus Filtration Market Regional Outlook

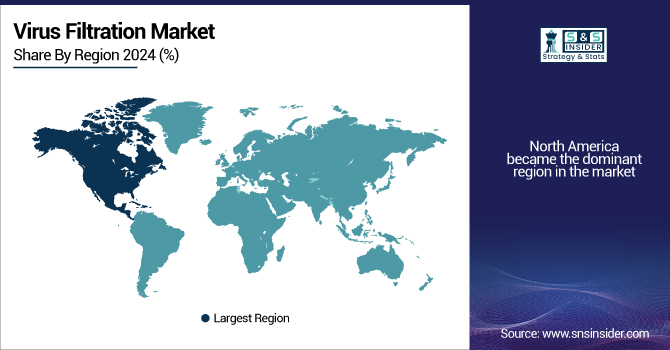

North America became the dominant region in the market, driven by the U.S. and its advanced healthcare and biopharmaceutical sectors. The U.S. holds a large share of the worldwide market, driven significantly by strong demand for vaccines and biologics, as well as strict regulatory demands related to viral clearance in therapeutics. The U.S. Food and Drug Administration (FDA) has stringent regulations that require virus filtration systems in biologics manufacturing, thus cementing the country's leadership in the sector. The U.S. virus filtration market size is expected to grow at a 9.12% compound annual growth rate (CAGR) from 2025 to 2032, from its valuation of USD 1.82 billion in 2024 to USD 3.66 billion by 2032.

In July 2024, Thermo Fisher Scientific introduced a new line of virus filtration products aimed at assisting drug manufacturers in addressing the increasing demand for biologic therapies.

Europe holds the second-largest share of the market and is dominated by Germany. Germany's strong pharmaceutical industry, with large volumes of biologic and vaccine manufacturing, has made it a hub for innovation in virus filtration technology. The country has leading companies like Sartorius and Merck that are on the cutting edge of innovation in virus removal technology. These countries include the UK, France, and Italy, and they are making significant contributions based on their commitment to high-quality drugs and strict regulatory standards.

In September 2024, Sartorius AG increased its manufacturing capacity for virus filtration products in Germany, highlighting the nation's prominence in pharmaceutical manufacturing.

The Asia Pacific region is witnessing the fastest growth in the virus filtration market, led by China. The fast growth of China's biopharmaceutical industry, combined with increasing healthcare investments and government initiatives to boost local vaccine and biologics manufacturing, has spurred market growth in the region. China is focusing on the development of its healthcare infrastructure, and that is raising the demand for advanced virus filter systems.

In March 2024, China National Pharmaceutical Group (Sinopharm) revealed its plans to enhance the production of monoclonal antibodies and biologics, which significantly depend on virus filtration technologies.

The Middle East and African region, comprising countries like the UAE, Saudi Arabia, and South Africa, is experiencing steady growth in the virus filtration market. Growing investments in the healthcare sector and increasing capabilities in biopharmaceutical production within the region are key growth drivers. Brazil, a dominant figure in Latin America, is a leader in developing biopharmaceutical production and upgrading the healthcare infrastructure. Government policies in these areas are encouraging the use of advanced filtration technologies, especially in vaccine and biologic manufacturing.

In May 2024, Brazil's National Health Surveillance Agency (ANVISA) authorized a new program aimed at enhancing the quality of biopharmaceutical production, focusing on the implementation of cutting-edge filtration technologies to ensure viral safety in vaccine production.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Virus Filtration Market

Merck KGaA, Danaher Corporation, Sartorius AG, Thermo Fisher Scientific, GE HealthCare, Charles River Laboratories, Asahi Kasei Medical, WuXi AppTec, Lonza Group, and Clean Biologics.

Recent Developments

-

In February 2025, Thermo Fisher Scientific revealed its acquisition of Solventum’s filtration business for a sum of USD 4.1 billion. This strategic initiative seeks to broaden Thermo Fisher’s expertise in bioprocessing and improve its virus filtration system offerings to address the increasing demand within biopharmaceutical applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.18 Billion |

| Market Size by 2032 | USD 11.21 Billion |

| CAGR | CAGR of 10.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Consumables (Kits and reagents, Others), Instruments (Filtration systems, Chromatography systems), Services] • By Technology [Filtration (Consumables, Instruments, Services), Chromatography (Consumables, Instruments, Services)] • By Application [Biologicals (Vaccines and therapeutics, Blood and blood products, Cellular and gene therapy products, Tissue and tissue products, Stem cell products), Medical devices, Water purification, Air purification] • By End-use [Biopharmaceutical & biotechnology companies, Contract research organizations, medical device companies, Academic institutes & research laboratories] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Merck KGaA, Danaher Corporation, Sartorius AG, Thermo Fisher Scientific, GE HealthCare, Charles River Laboratories, Asahi Kasei Medical, WuXi AppTec, Lonza Group, and Clean Biologics. |