Air Electron Gun Market Report Scope & Overview:

The Air Electron Gun Market Size was valued at USD 2.39 Billion in 2025E and is expected to reach USD 4.22 Billion by 2033, growing at a CAGR of 7.34% over the forecast period of 2026-2033.

The Air Electron Gun Market is witnessing steady growth, driven by increasing applications in semiconductor manufacturing, material science, and analytical instruments. Rising demand for precision electron sources in microscopy, additive manufacturing, and surface treatment technologies is propelling market expansion. Technological advancements in beam stability, efficiency, and compact design enhance performance and adoption.

Market Size and Forecast:

-

Air Electron Gun Market Size in 2025E: USD 2.39 Billion

-

Air Electron Gun Market Size by 2033: USD 4.22 Billion

-

CAGR: 7.34% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Air Electron Gun Market - Request Free Sample Report

Key Air Electron Gun Market Trends

-

Growing demand for compact and energy-efficient air electron guns in industrial and research applications to enhance precision and productivity.

-

Advancements in beam stabilization, emission control, and vacuum technology are improving performance and operational lifespan.

-

Rising adoption in semiconductor manufacturing, surface modification, and additive production processes for high-accuracy operations.

-

Integration of automation and digital control systems is enabling real-time monitoring and performance optimization.

-

Increasing investment in R&D by manufacturers to develop low-maintenance and cost-effective electron gun solutions.

-

Expansion of applications in aerospace, materials testing, and analytical instrumentation is broadening market reach and innovation potential.

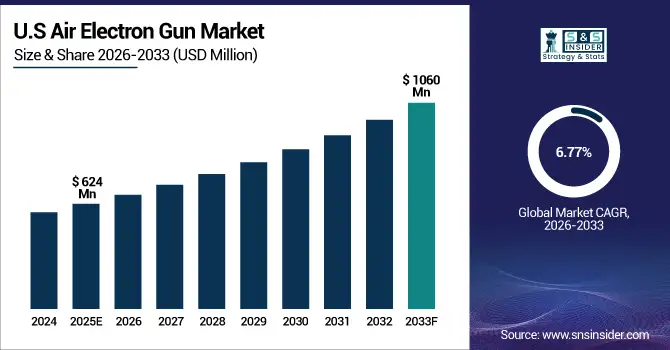

U.S. Air Electron Gun Market Insights

The U.S. Air Electron Gun Market size was USD 624 million in 2025 and is expected to reach USD 1060 million by 2033 growing at a CAGR of 6.77% over the forecast period of 2026-2033. the U.S. Air Electron Gun Market is witnessing steady expansion, primarily due to the increasing integration of precision electron beam technologies across industrial and research sectors. The rise in nanotechnology applications and demand for advanced surface modification tools have accelerated market adoption. Additionally, the development of compact, energy-efficient models with enhanced beam stability is boosting operational efficiency. Growing investment in semiconductor manufacturing and scientific instrumentation further reinforces market growth, driving innovation and modernization in production processes.

Air Electron Gun Market Growth Driver

-

Rising Demand for High-Precision Manufacturing Applications Accelerates the Growth of the Air Electron Gun Market

The increasing need for precision-based processes in semiconductor fabrication, material analysis, and nanotechnology research is driving the adoption of air electron guns. These devices enable accurate control of electron beams for high-resolution imaging, welding, and surface treatment. As industries demand finer tolerances and defect-free manufacturing, electron guns are being integrated into advanced production systems.

In May 2024, Thermo Fisher Scientific introduced an enhanced electron source for analytical instruments, improving beam stability and longevity. Such advancements underscore the growing reliance on air electron guns to improve productivity and ensure product consistency across multiple industrial sectors.

Air Electron Gun Market Restraint

-

High Equipment Costs and Complex Maintenance Requirements Hamper Wider Adoption of Air Electron Gun Technology

Despite their technological advantages, the high initial costs associated with air electron guns and their complex maintenance requirements act as key barriers to market growth. Manufacturers and research facilities often face financial constraints in acquiring and operating these systems, especially small-scale laboratories. Maintenance demands, such as periodic cathode replacement and vacuum system calibration, further elevate operational expenses. Additionally, the lack of skilled professionals to manage and maintain advanced electron gun systems limits broader adoption, particularly in developing regions where technical expertise and capital investment remain restricted.

Air Electron Gun Market Opportunity

-

Expanding Application of Electron Beam Technology in Additive Manufacturing Creates New Opportunities for Market Expansion

The growing integration of electron beam technologies in additive manufacturing and 3D metal printing offers a strong growth opportunity for the Air Electron Gun Market. Air electron guns are increasingly utilized in electron beam melting (EBM) processes to ensure precise energy delivery for metal powder fusion. The surge in demand for lightweight, high-strength metal components in aerospace, automotive, and energy industries further amplifies this trend. In February 2025, Sciaky Inc. launched an upgraded EBM system with an improved air electron gun design to enhance build accuracy and material efficiency, supporting the shift toward sustainable, high-performance manufacturing.

For instance, aerospace companies are adopting electron beam-based 3D printing systems to produce titanium aircraft components with superior mechanical properties. This application not only reduces material waste but also significantly cuts production time, highlighting how air electron gun technology supports innovation in advanced manufacturing.

Air Electron Gun Market Segment Highlights:

-

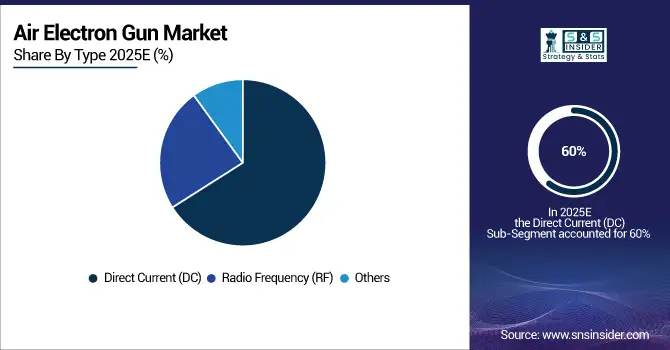

By Type: Direct Current (DC) – 60% (largest), Radio Frequency (RF) – 30%, Others – 10%

-

By Power: High‐Power Air Electron Guns – 55% (largest), Low‐Power Air Electron Guns – 45%

-

By Application: Aerospace – 28% (largest), Mechanical Engineering – 20%, Automotive Industry – 18%, Electrical Industry – 12%, Medical Technology – 10%, Oil & Gas – 7%, Chemical Industry – 5%

-

By End-User: Industrial Manufacturing – 40% (largest), Research Institutions / Laboratories – 30%, Academic Institutions – 12%, Government Facilities – 6%

Air Electron Gun Market Segment Analysis

By Type

The Direct Current (DC) segment dominates the Air Electron Gun Market with a 60% share, primarily due to its widespread use in precision applications such as electron microscopy, semiconductor manufacturing, and materials analysis. DC electron guns offer superior beam stability, controllability, and cost efficiency, making them the preferred choice in research and industrial setups. The Radio Frequency (RF) segment, holding 30%, is gaining traction for advanced scientific and high-energy physics experiments, driven by its high-power density and pulse modulation capabilities. The Others category, accounting for 10%, includes hybrid and emerging gun types used in customized research and niche industrial applications.

By Power

The High‐Power Air Electron Gun segment leads the market with a 55% share, attributed to its critical role in demanding industrial and research operations such as metal surface treatment, aerospace material testing, and particle acceleration. These systems provide enhanced beam intensity and energy efficiency required for large-scale and high-precision projects. The Low‐Power Air Electron Gun segment, representing 45%, is primarily used in laboratories, academic institutions, and compact research setups, where portability and cost-effectiveness are key. Growth in both segments is fueled by rising investment in electron beam technology and precision engineering applications.

By Application

The Aerospace segment leads the market with a 28% share, driven by the need for precision surface analysis, material testing, and component inspection in aircraft and spacecraft manufacturing. Mechanical Engineering (20%) and Automotive Industry (18%) segments leverage air electron guns for microstructural evaluation and quality control in production lines. The Electrical Industry (12%) and Medical Technology (10%) segments are expanding due to increased adoption of electron beam instruments for diagnostics, device fabrication, and sterilization processes. Meanwhile, Oil & Gas (7%) and Chemical Industry (5%) utilize these systems for corrosion analysis, coating development, and catalytic material testing.

By End-User

The Industrial Manufacturing segment dominates with a 40% share, owing to extensive usage in surface modification, defect analysis, and precision processing across automotive, aerospace, and electronics sectors. Research Institutions / Laboratories follow with 30%, as air electron guns are fundamental tools in advanced materials research and nanotechnology. Academic Institutions hold 20%, driven by growing focus on scientific education and innovation infrastructure. Government Facilities, accounting for 10%, utilize air electron guns in defense, space exploration, and energy research programs. Overall, segment growth is supported by technological advancements and rising demand for high-precision analytical instruments globally.

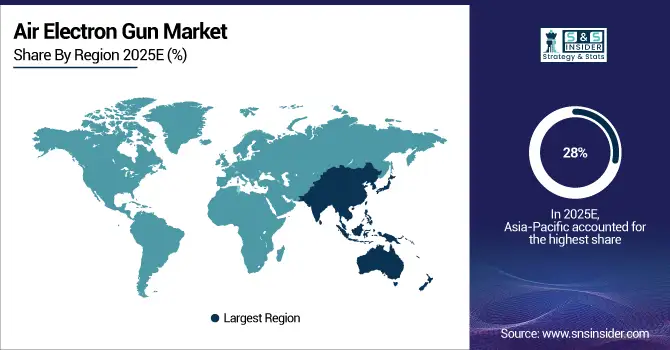

Air Electron Gun Market Regional Analysis

Asia-Pacific Air Electron Gun Market Insights

Asia-Pacific accounts for 28% of the Air Electron Gun Market in 2025, positioning it as the fastest-growing region due to rapid expansion in electronics, semiconductor, and aerospace sectors. China, Japan, South Korea, and India are key contributors, driven by investments in precision instrumentation, advanced materials, and research laboratories. Government-backed industrial modernization, innovation funding, and R&D incentives are fueling adoption. Collaborations between local manufacturers and global technology providers promote efficient production, enhance quality standards, and strengthen Asia-Pacific’s role as a major hub for Air Electron Gun innovation and deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Air Electron Gun Market Insights

North America dominates the Air Electron Gun Market with a 35% share in 2025, supported by robust growth across aerospace, electronics, and nanotechnology sectors. The United States leads the region due to its advanced R&D infrastructure, increasing adoption in material science laboratories, and integration in semiconductor inspection systems. Rising investments in electron beam technologies, vacuum systems, and surface analysis tools drive regional demand. Strategic collaborations among OEMs, research institutions, and industrial users foster innovation, ensuring North America remains the global leader in Air Electron Gun research, design, and application.

Europe Air Electron Gun Market Insights

Europe holds a 25% share of the Air Electron Gun Market in 2025, driven by a strong focus on precision engineering, material testing, and advanced microscopy applications. Germany, France, and the U.K. dominate regional growth due to their leadership in scientific research and high-tech manufacturing. The European Union’s emphasis on sustainable innovation, energy efficiency, and industrial modernization fuels market expansion. Collaborations between manufacturers and research centers enhance product customization, compliance, and technological excellence, establishing Europe as a key contributor to high-performance Air Electron Gun technologies.

Latin America and Middle East & Africa (MEA) Air Electron Gun Market Insights

Latin America accounts for 7% and the Middle East & Africa (MEA) for 5% of the Air Electron Gun Market in 2025. Brazil, Mexico, the UAE, and Saudi Arabia are leading adopters, supported by growing investment in aerospace, electronics, and industrial research infrastructure. Government initiatives aimed at boosting manufacturing capabilities and partnerships with international suppliers drive gradual technology penetration. Expanding R&D activities, industrial automation, and academic research applications are contributing to steady regional growth, enhancing both regions’ participation in the global Air Electron Gun ecosystem.

Competitive Landscape for Air Electron Gun Market:

VSR Industrietechnik

VSR Industrietechnik is a key player in precision engineering and industrial equipment, specializing in advanced electron beam and vacuum technologies for manufacturing and research applications.

-

In March 2025, VSR Industrietechnik launched its next-generation high-stability Air Electron Gun system, featuring enhanced beam alignment precision and energy efficiency for semiconductor and materials testing industries.

BSH Bauelemente-Steuerungsbau-Hofmann

BSH Bauelemente-Steuerungsbau-Hofmann focuses on developing electron emission systems and high-voltage control units for industrial automation and scientific instruments.

-

In July 2025, BSH introduced a modular Air Electron Gun control interface designed for integration with electron microscopes and industrial analysis chambers, improving operational accuracy and signal stability.

Altair Technologies

Altair Technologies manufactures advanced vacuum components and electron beam systems for aerospace, electronics, and scientific research sectors.

-

In January 2025, Altair expanded its California facility to increase production of precision Air Electron Guns used in microfabrication and nanotechnology R&D, enhancing its U.S. supply capabilities.

Nisshinbo Micro Devices Inc.

Nisshinbo Micro Devices Inc. develops high-performance electron emission and detection technologies for semiconductor, automotive, and defense applications.

-

In September 2024, Nisshinbo unveiled a compact Air Electron Gun module with reduced power consumption and improved electron emission stability for portable analytical equipment.

Air Electron Gun Market Key Players

Some of the Air Electron Gun Companies

-

VSR Industrietechnik

-

BSH Bauelemente-Steuerungsbau-Hofmann

-

Standard Industrie

-

AE Anlagenbau

-

OLI Vibrationstechnik GmbH

-

Altair Technologies

-

Nisshinbo Micro Devices Inc.

-

3M Company

-

Kerstgens Industrietechnik GmbH

-

A.C.F Germany

-

Contracor GmbH

-

Kimball Physics

-

Thermo Fisher Scientific Inc.

-

JEOL Ltd.

-

Hitachi High-Tech Corporation

-

Carl Zeiss AG

-

Oxford Instruments plc

-

Raith GmbH

-

Elionix Inc.

-

Sciaky Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.39 Billion |

| Market Size by 2033 | USD 4.22 Billion |

| CAGR | CAGR of7.34% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Direct Current (DC), Radio Frequency (RF), Others) • By Power (Low‐Power Air Electron Guns, High‐Power Air Electron Guns) • By Application (Mechanical Engineering, Automotive Industry, Aerospace, Oil & Gas, Chemical Industry, Medical Technology, Electrical Industry) • By End-User (Industrial Manufacturing, Research Institutions / Laboratories, Academic Institutions, Government Facilities) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | VSR Industrietechnik, BSH Bauelemente-Steuerungsbau-Hofmann, Standard Industrie, AE Anlagenbau, OLI Vibrationstechnik GmbH, Altair Technologies, Nisshinbo Micro Devices Inc., 3M Company, Kerstgens Industrietechnik GmbH, A.C.F Germany, Contracor GmbH, Kimball Physics, Thermo Fisher Scientific Inc., JEOL Ltd., Hitachi High-Tech Corporation, Carl Zeiss AG, Oxford Instruments plc, Raith GmbH, Elionix Inc., Sciaky Inc. |