Anti-snoring Devices Market Report Scope & Overview:

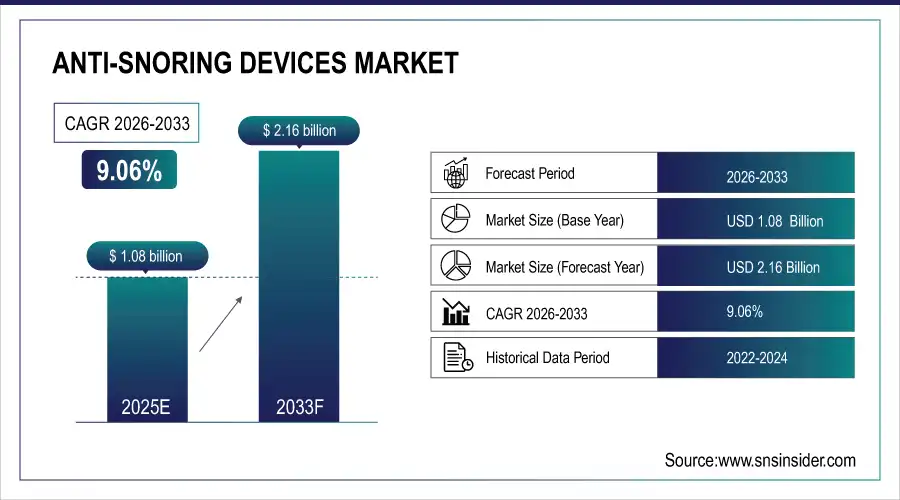

Anti-snoring Devices Market is valued at USD 1.08 billion in 2025E and is expected to reach USD 2.16 billion by 2033, growing at a CAGR of 9.06% from 2026-2033.

The anti-snoring devices market is growing due to the rising prevalence of sleep apnea and chronic snoring linked to obesity, aging, and lifestyle changes. Increasing awareness of sleep health, growing diagnosis rates, and preference for non-invasive, home-based treatment options are boosting demand. Technological advancements in oral appliances and nasal devices, along with improved comfort and customization, are encouraging adoption. Additionally, expanding online retail channels and greater acceptance of sleep therapy products are supporting sustained market growth.

81% of consumers and healthcare providers embraced anti‑snoring devices fueled by rising sleep apnea rates, heightened sleep health awareness, and innovations in comfort‑focused, home‑based solutions driving robust global market growth.

Anti-snoring Devices Market Size and Forecast

-

Market Size in 2025E: USD 1.08 Billion

-

Market Size by 2033: USD 2.16 Billion

-

CAGR: 9.06% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Anti-snoring Devices Market - Request Free Sample Report

Anti-snoring Devices Market Trends

-

Rising adoption of oral appliances as non-invasive alternatives to surgical and CPAP-based snoring treatments

-

Growing consumer preference for home-based sleep solutions driven by increasing awareness of sleep health

-

Technological advancements in smart anti-snoring devices enabling real-time monitoring and adaptive therapy

-

Increasing demand for customizable and dentist-fitted mandibular advancement devices to improve comfort and efficacy

-

Expansion of online retail and direct-to-consumer channels improving accessibility and product availability globally

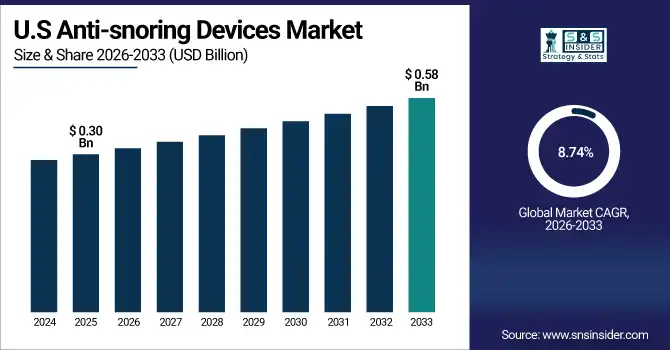

U.S. Anti-snoring Devices Market is valued at USD 0.30 billion in 2025E and is expected to reach USD 0.58 billion by 2033, growing at a CAGR of 8.74% from 2026-2033.

The U.S. anti-snoring devices market is expanding due to rising awareness of sleep apnea, increasing obesity rates, and an aging population. Strong consumer preference for non-invasive, home-based treatments, growing sleep clinic recommendations, and easy availability through online and retail channels are accelerating adoption and market growth.

Anti-snoring Devices Market Growth Drivers:

-

Rising prevalence of sleep disorders, including snoring and obstructive sleep apnea, is driving demand for anti-snoring devices globally across all age groups

The increasing incidence of sleep-related disorders such as habitual snoring, obstructive sleep apnea, and restless sleep is a major factor driving the anti-snoring devices market. Sedentary lifestyles, rising obesity rates, and aging populations contribute to higher prevalence, prompting individuals to seek effective solutions. Anti-snoring devices, including oral appliances, nasal dilators, and CPAP machines, help improve sleep quality and overall health. Growing awareness among patients and healthcare providers regarding the consequences of poor sleep is further fueling adoption, driving market expansion across both developed and emerging regions.

79% of healthcare providers reported increased patient demand for anti-snoring devices fueled by the rising global prevalence of snoring and obstructive sleep apnea across all age groups accelerating market expansion worldwide.

-

Increasing health awareness and growing focus on sleep quality are encouraging consumers to adopt anti-snoring solutions, boosting market growth

Consumers are becoming increasingly conscious of the importance of sleep for overall health, productivity, and well-being. Awareness campaigns, digital health platforms, and healthcare consultations emphasize the risks of untreated snoring and sleep apnea, motivating individuals to seek effective interventions. This rising focus on sleep hygiene is driving demand for anti-snoring devices that offer comfort, convenience, and medical efficacy. Additionally, healthcare providers are recommending preventive and corrective devices to manage sleep disorders, further expanding the market. The trend is particularly strong in urban populations, where stress and lifestyle factors increase sleep-related problems.

76% of consumers prioritized sleep health driving adoption of anti-snoring solutions and contributing to robust market growth as awareness of sleep-related wellness surged globally.

Anti-snoring Devices Market Restraints:

-

High device costs, limited insurance coverage, and affordability issues restrict adoption, especially in price-sensitive and emerging markets

Anti-snoring devices, particularly advanced oral appliances, CPAP machines, and smart wearable devices, are often expensive, limiting accessibility for cost-conscious consumers. Many insurance plans do not cover the cost of these devices, forcing individuals to pay out-of-pocket. In emerging economies, affordability challenges reduce widespread adoption, even though the prevalence of sleep disorders is increasing. The high upfront cost, combined with maintenance expenses, can deter long-term usage. As a result, these financial barriers slow market growth and limit penetration among middle- and low-income groups, restricting overall market potential in certain regions.

71% of consumers in price-sensitive and emerging markets refrained from purchasing anti-snoring devices due to high upfront costs and lack of insurance reimbursement significantly limiting market adoption.

-

Lack of awareness, social stigma, and reluctance to use medical devices hinder market penetration and slow consumer acceptance

Despite the growing prevalence of sleep disorders, many individuals remain unaware of the health risks associated with snoring and obstructive sleep apnea. Social stigma around using medical devices, discomfort during initial use, and misconceptions about efficacy reduce willingness to adopt anti-snoring solutions. Some consumers prefer home remedies or lifestyle changes instead of medical interventions. Limited patient education, inadequate guidance from healthcare professionals, and low visibility in retail or online channels further restrict adoption. These behavioral and social barriers significantly slow market growth, particularly in emerging markets and rural areas.

67% of potential users avoided anti-snoring devices due to low awareness, social stigma, and discomfort with medical-grade solutions limiting market penetration despite technological advances.

Anti-snoring Devices Market Opportunities:

-

Technological advancements in smart anti-snoring devices, wearable solutions, and mobile app integration present opportunities for innovative product development

The integration of technology into anti-snoring solutions is creating opportunities for manufacturers to develop innovative products. Smart devices equipped with sensors, Bluetooth connectivity, and mobile app interfaces allow real-time monitoring of sleep patterns, providing personalized interventions and feedback. Wearable anti-snoring devices, such as chin straps and smart nasal dilators, offer discreet and user-friendly options. These advancements improve comfort, effectiveness, and compliance, attracting tech-savvy and health-conscious consumers. Continuous innovation in design, materials, and connectivity expands market potential and positions manufacturers to cater to evolving consumer expectations globally.

75% of sleep health companies launched smart anti-snoring devices with wearable tech and app integration driving innovation and improving user adherence through real-time monitoring and personalized feedback.

-

Rising e-commerce penetration and online sales channels allow manufacturers to reach a broader consumer base, expanding market reach globally

The growth of online retail platforms, mobile apps, and direct-to-consumer sales channels has transformed distribution for anti-snoring devices. Consumers can easily access a wide variety of products, compare features, read reviews, and make informed purchasing decisions from the comfort of their homes. E-commerce allows manufacturers to target urban and remote regions that were previously underserved by traditional retail channels. Digital marketing campaigns and personalized promotions further enhance visibility and drive sales. The expansion of online sales networks provides significant growth opportunities, enabling manufacturers to increase market penetration and establish a global consumer base.

80% of manufacturers leveraged e-commerce and digital sales channels extending market reach to 50% more consumers globally and accelerating direct-to-customer engagement.

Anti-snoring Devices Market Segment Highlights

-

By Product Type: Mandibular Advancement Devices (MADs) led with 42.5% share, while Tongue Stabilizing Devices (TSDs) is the fastest-growing segment with CAGR of 12.8%.

-

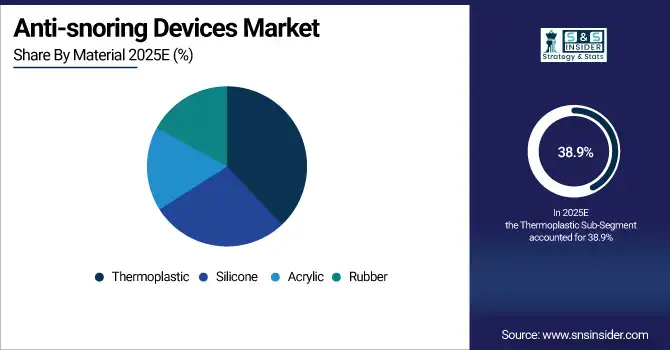

By Material: Thermoplastic led with 38.9% share, while Silicone is the fastest-growing segment with CAGR of 12.1%.

-

By Distribution Channel: Specialty Sleep Clinics led with 36.7% share, while Online Stores is the fastest-growing segment with CAGR of 13.5%.

-

By End User: Homecare Settings led with 41.3% share, while Sleep Laboratories is the fastest-growing segment with CAGR of 12.2%.

Anti-snoring Devices Market Segment Analysis

By Product Type: Mandibular Advancement Devices (MADs) led, while Tongue Stabilizing Devices (TSDs) is the fastest-growing segment.

Mandibular Advancement Devices (MADs) dominate the product segment due to their proven effectiveness in repositioning the lower jaw to maintain airway patency during sleep. They are widely recommended by sleep specialists and dentists, and are easy to use, comfortable, and adjustable. High adoption across homecare, clinics, and sleep laboratories, combined with established clinical validation, contributes to their market leadership. MADs’ versatility for mild to moderate snoring and obstructive sleep apnea cases ensures sustained demand globally, particularly in North America, supporting their dominant position in the market.

Tongue Stabilizing Devices (TSDs) are the fastest-growing product segment due to increasing demand for non-invasive, alternative snoring solutions. They are particularly preferred for patients who cannot tolerate MADs, offering effective tongue positioning to maintain airway openness. Rising awareness, improved device comfort, and growing adoption in Asia are driving CAGR growth. Their ease of use, compatibility with pediatric and adult patients, and availability through online channels and clinics are accelerating market adoption, making TSDs a rapidly expanding segment.

By Material: Thermoplastic led, while Silicone is the fastest-growing segment.

Thermoplastic materials dominate due to their affordability, durability, and customizability. They allow devices to be molded to individual oral structures, ensuring comfort and effectiveness, particularly in MADs and TSDs. High adoption in hospitals, specialty sleep clinics, and homecare settings contributes to sustained market share. Thermoplastics also enable cost-effective production of both standard and premium devices, facilitating widespread usage and reinforcing their dominant role across multiple device types and geographic regions.

Silicone is the fastest-growing material segment due to its biocompatibility, flexibility, and patient comfort. Silicone-based MADs, TSDs, and nasal devices are increasingly preferred for long-term use, particularly in mild to moderate snoring management. Growth is fueled by rising patient preference for softer, hypoallergenic devices, as well as availability via online stores and specialty clinics. Innovation in silicone molding and customization is also expanding adoption in emerging markets, especially in Asia, driving strong CAGR.

By Distribution Channel: Specialty Sleep Clinics led, while Online Stores is the fastest-growing segment.

Specialty Sleep Clinics dominate distribution because they offer expert-guided fitting, diagnosis, and follow-up care for snoring and mild obstructive sleep apnea. Clinics provide MADs, TSDs, and other devices with professional customization, ensuring optimal effectiveness and compliance. Patient trust, combined with integrated services such as polysomnography and behavioral therapy, supports high adoption. These clinics remain the preferred channel for moderate to severe cases, reinforcing their dominant position in the anti-snoring devices market.

Online Stores are the fastest-growing distribution channel due to convenience, privacy, and accessibility. Patients can purchase MADs, TSDs, and accessories directly, with guidance from online resources and teleconsultations. Subscription models, discounts, and home delivery increase adoption, particularly in regions with rising digital penetration like Asia. The growth of e-commerce, combined with increasing awareness of snoring management devices, has made online sales a rapidly expanding channel, complementing traditional clinics and retail outlets.

By End User: Homecare Settings led, while Sleep Laboratories is the fastest-growing segment.

Homecare Settings dominate as patients increasingly prefer self-administered anti-snoring treatments in the comfort of their homes. Devices like MADs, TSDs, and nasal aids are easy to use, with minimal supervision required. High adoption is driven by convenience, affordability, and accessibility through retail pharmacies and clinics. The ability to monitor and adjust device use without frequent clinical visits strengthens this segment’s dominance, particularly among adults managing mild to moderate snoring.

Sleep Laboratories are the fastest-growing end-user segment as awareness of diagnostic-driven snoring management rises. These facilities provide comprehensive evaluation using polysomnography and device testing, ensuring optimal treatment outcomes. Growth is driven by increasing referrals, rising prevalence of obstructive sleep apnea, and the adoption of MADs and TSDs under professional supervision. Expansion of sleep laboratories in Asia and emerging markets is fueling rapid CAGR growth, positioning them as a key growth segment in the anti-snoring devices market.

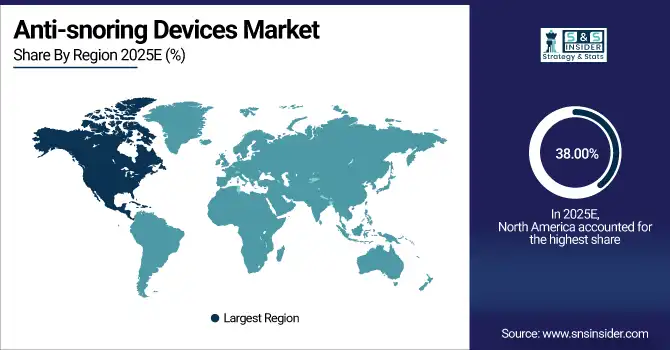

Anti-snoring Devices Market Regional Analysis

North America Anti-snoring Devices Market Insights:

North America dominated the Anti-snoring Devices Market with a 38.00% share in 2025 due to high awareness of sleep-related disorders, advanced healthcare infrastructure, and strong adoption of oral and nasal devices. Rising prevalence of obstructive sleep apnea, easy access to prescription and over-the-counter solutions, and presence of leading manufacturers strengthened regional leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Anti-snoring Devices Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 11.02% from 2026–2033, driven by increasing awareness of sleep disorders, rising disposable income, and expanding healthcare access. Growing adoption of minimally invasive oral devices, rising prevalence of lifestyle-related sleep issues, and expanding e-commerce distribution channels accelerate the market growth across the region.

Europe Anti-snoring Devices Market Insights

Europe held a significant share in the Anti-snoring Devices Market in 2025, supported by strong awareness of sleep health, widespread diagnosis of sleep apnea, and high adoption of oral appliances and nasal devices. Well-established healthcare systems, favorable reimbursement policies in select countries, and the presence of leading medical device manufacturers further strengthened the region’s market position.

Middle East & Africa and Latin America Anti-snoring Devices Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Anti-snoring Devices Market in 2025, driven by rising awareness of sleep disorders, improving healthcare infrastructure, and increasing availability of affordable anti-snoring solutions. Growing urbanization, expanding private healthcare facilities, and wider access through online and retail channels supported gradual market expansion across these regions.

Anti-snoring Devices Market Competitive Landscape:

ResMed Inc.

ResMed Inc. is a global leader in sleep and respiratory care, offering a wide range of anti-snoring and sleep-disordered breathing solutions. The company specializes in CPAP, APAP, and mask systems designed to improve airflow and reduce snoring. ResMed emphasizes digital health integration, data-driven monitoring, and patient-centric design. Its strong focus on innovation, clinical effectiveness, and comfort has established the company as a key contributor to the global anti-snoring devices market.

-

May 2024, ResMed introduced the AirFit N20i nasal mask, featuring Snore Response Technology an enhancement to its AirSense CPAP platforms that automatically adjusts pressure in response to detected snoring events.

Koninklijke Philips N.V.

Koninklijke Philips N.V. is a diversified health technology company with a strong presence in sleep and respiratory care solutions. Philips provides advanced anti-snoring and sleep apnea devices, including CPAP systems, masks, and connected sleep therapy platforms. The company focuses on patient comfort, safety, and smart technology integration. Through continuous research, innovation, and global distribution, Philips plays a significant role in improving sleep quality and addressing snoring-related disorders worldwide.

-

September 2023, Philips launched the SmartSleep Snoring Relief Band 2.0, a Class IIa CE-marked medical device that uses gentle positional therapy to reduce snoring in primary snorers and mild OSA patients.

Fisher & Paykel Healthcare Limited

Fisher & Paykel Healthcare Limited is a global medical device company specializing in respiratory and sleep therapy solutions, including anti-snoring devices. The company is known for its expertise in humidification systems, CPAP devices, and ergonomic mask designs that enhance patient comfort and compliance. With a strong emphasis on research, product innovation, and clinical performance, Fisher & Paykel Healthcare supports effective management of snoring and sleep-related breathing disorders across global healthcare markets.

-

January 2025, Fisher & Paykel Healthcare entered the consumer anti-snoring market with F&P Nasal Strips, FDA-registered Class I medical devices designed to improve nasal airflow and reduce snoring.

Anti-snoring Devices Market Key Players

Some of the Anti-snoring Devices Market Companies are:

-

ResMed Inc.

-

Koninklijke Philips N.V.

-

Fisher & Paykel Healthcare Limited

-

SomnoMed Ltd.

-

GlaxoSmithKline plc

-

Apnea Sciences Corporation

-

ZQuiet (Sleeping Well, LLC)

-

Airway Management Inc.

-

ProSomnus Sleep Technologies

-

Smart Nora

-

Zyppah

-

Tomed GmbH

-

Meditas Ltd.

-

Rotech Healthcare Inc.

-

Mitsui Chemicals, Inc.

-

SnoreMeds Inc.

-

PureSleep Company Inc.

-

Glidewell Laboratories

-

MPowrx Health and Wellness Products Inc.

-

DeVilbiss Healthcare

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.08 Billion |

| Market Size by 2033 | USD 2.16 Billion |

| CAGR | CAGR of 7.7% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Mandibular Advancement Devices (MADs), Tongue Stabilizing Devices (TSDs), Chin Straps, Nasal Devices, Positional Therapy Devices) • By Material (Thermoplastic, Silicone, Acrylic, Rubber) • By Distribution Channel (Online Stores, Retail Pharmacies, Specialty Sleep Clinics, Hospitals) • By End User (Homecare Settings, Hospitals, Sleep Laboratories, Clinics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ResMed Inc., Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, SomnoMed Ltd., GlaxoSmithKline plc, Apnea Sciences Corporation, ZQuiet (Sleeping Well, LLC), Airway Management Inc., ProSomnus Sleep Technologies, Smart Nora, Zyppah, Tomed GmbH, Meditas Ltd., Rotech Healthcare Inc., Mitsui Chemicals, Inc., SnoreMeds Inc., PureSleep Company Inc., Glidewell Laboratories, MPowrx Health and Wellness Products Inc., DeVilbiss Healthcare |