Antibody Drug Conjugates (ADC) Market Report Scope & Overview:

The Antibody Drug Conjugates [ADC] Market was valued at USD 12.95 billion in 2025 and is expected to reach USD 41.26 billion by 2035, growing at a CAGR of 12.29% from 2026-2035.

![Antibody Drug Conjugates [ADC] Market](/images/1758808328-Antibody-Drug-Conjugates-ADC-Market.webp)

Get More Information on Antibody Drug Conjugates (ADC) Market - Request Sample Report

The antibody drug conjugates market is expanding so fast due to increased cancer targeted treatment demand. The ADCs are a hot trend, which utilize the specificity of monoclonal antibodies to deliver potent cytotoxics to therapy-resistant cancer cells while sparing healthy tissue. Market Growth to Gain Increased Use of ADC Increasing development in the technology of ADC is currently promoting drug efficiency and limiting side-effects. Market growth will continue to be uplifted by newer developments in ADCs, such as the introduction of next-generation conjugates and new targeting approaches.

Innovations in linker chemistry, cytotoxic compounds, and targeting strategies are propelling market advancements. Firms such as Gilead Sciences and Bristol Myers Squibb are actively putting resources into ADC development, as clinical trials and regulatory approvals speed up. In January 2024, Johnson & Johnson purchased Ambrx Biopharma to utilize its unique ADC technology, concentrating on treatments for prostate cancer. In early 2024, Celltrion and WuXi XDC formed a partnership to enhance ADC development and production.

Market Size and Forecast:

-

Market Size in 2025: USD 12.95 Billion

-

Market Size by 2035: USD 41.26 Billion

-

CAGR of 12.29% From 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

Antibody Drug Conjugates [ADC] Market Trends:

-

Rising global cancer incidence is driving demand for targeted therapies like antibody-drug conjugates (ADCs).

-

ADCs offer precise delivery of cytotoxic drugs, reducing damage to healthy cells compared to traditional chemotherapy.

-

Increasing approvals of ADCs for breast, lung, and hematological cancers highlight growing clinical adoption.

-

Continuous advancements in linker chemistry, payloads, and targeting mechanisms are enhancing ADC efficacy and safety.

-

Collaborations and investments in ADC development and manufacturing are accelerating innovation and the number of ADCs entering clinical trials.

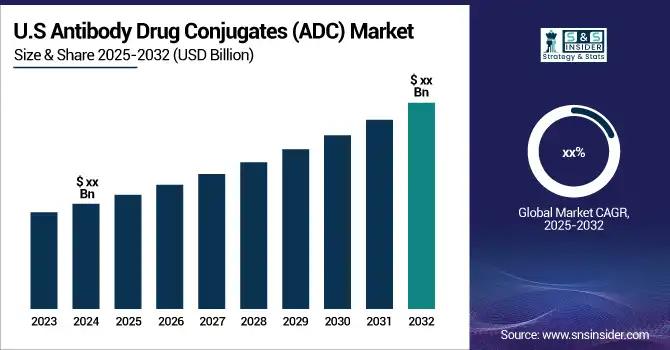

The U.S. Antibody Drug Conjugates (ADC) Market was valued at approximately USD 5.83 billion in 2025 and is expected to reach around USD 22.35 billion by 2035, growing at a CAGR of 13.20% from 2026–2035.Market growth is primarily driven by factors such as the increasing prevalence of cancer, launch of new targeted biologics, and investments for the development of ADCs.

Antibody Drug Conjugates [ADC] Market Growth Drivers:

- The global rise in cancer cases is one of the primary drivers propelling the Antibody Drug Conjugates (ADC) market.

One of the major factors propelling the Antibody Drug Conjugates (ADC) market is the increasing incidence of cancer worldwide. According to the World Health Organization (WHO) In 2022, it is estimated that 20 million new cases of cancer and 9.7 million deaths occurred. The estimated number of cancer survivors in 5 years post-diagnosis was 53.5 million. Approximately 1 in 5 persons develop cancer in their lifetime, and approximately 1 in 9 men and 1 in 12 women die from the disease. This rising cancer burden increases the need for more effective treatments. These antibody-drug conjugates (ADCs) deliver cytotoxic drugs directly to the cancer cell, in contrast to traditional chemotherapy, which can also affect healthy cells. Because of their targeting ability of specific tumor cells to occupy and decrease adverse effects, ADC may be an interesting tool in cancer therapy. Consequently, ADCs are increasingly attracting oncologists, especially for breast, lung, and hematological cancers.

The rising relevance of ADCs is further emphasized by the recent developments in this area, such as the approval of Trodelvy (sacituzumab govitecan) for the treatment of metastatic triple-negative breast cancer (mTNBC). In addition, the rising incidence of cancers in emerging markets due to lifestyle changes and an aging population also supports the growing need for innovative therapies such as ADCs.

-

Continuous advancements in ADC technology are significantly enhancing the efficacy and safety profiles of these therapies, driving market growth.

For instance, in January 2024, Celltrion collaborated with WuXi XDC to improve ADC development and manufacturing. Now, Peking University, Han's research team, and Huadong Medicine have the support of Fusion as a service intelligence network in establishing Huadong Medicine to yield better ADC technology by environmentally improving production processes and drug efficacy. For instance, the first approval of ADC was Kadcya (ado-trastuzumab emtansine) and Enhertu (fam-trastuzumab deruxtecan-nxki) further consolidated the capability of ADC in a new era of cancer which was used as a frontline treatment in cancer as well. These advancements in ADC technology, along with an increasing number of ADCs entering clinical trials, are projected to further propel MDC growth

Novel ADC technologies continue to progress and are improving the effectiveness and safety of these therapies meaningfully contributing to the growth of the market. Advances in linker chemistry, payloads, and targeting mechanisms are enhancing ADCs' capabilities to deliver cytotoxic agents directly to cancer cells while reducing systemic negativity. Novel mechanisms of action for next-generation ADCs garnering significant investment from pharma.

Antibody Drug Conjugates [ADC] Market Restraints:

- One of the key restraints for the Antibody Drug Conjugates (ADC) market is the high production costs associated with the development and manufacturing of these complex therapies.

ADCs are created by conjugating cytotoxic drugs to monoclonal antibodies using technologies that are cutting-edge and combine unique types of manufacturing processes. The complex production processes of the antibodies and cytotoxic agents and the conjugation process, in general, are expensive. The high costs associated with these therapies can result in expensive pricing for end-users, rendering ADCs less accessible in specific geographical regions or markets, and potentially hindering their adoption on a larger scale despite their enormous therapeutic potential. Moreover, the demanding regulatory scrutiny and quality control requirements elevate costs, which could dissuade small market participants or hinder investments in ADC R&D.

Antibody Drug Conjugates [ADC] Market Opportunities:

- Expanding Biomarker-Driven Oncology & Technological Advancements Drive Accelerated Growth in the Antibody Drug Conjugates (ADC) Market

The Antibody Drug Conjugates (ADC) Market offers immense opportunities for growth, thanks to its expanding use in various types of cancers, especially in HER2-low and other biomarker-selected patients. IAdvances in linker technology, site-specific conjugation techniques, and novel cytotoxins are increasing the safety and efficacy of ADCs, opening doors to their wider clinical applications. The trend of ADCs being used in combination with immunotherapies and targeted therapies is also showing positive results. Additionally, the strong late-stage clinical pipeline, increasing spending on cancer research and development, and the growing demand for personalized cancer therapies make ADCs a key innovation area with huge long-term market potential.

On January 27, 2025, the U.S. FDA approved fam-trastuzumab deruxtecan-nxki (Enhertu) for unresectable or metastatic HR-positive, HER2-low or HER2-ultralow breast cancer following progression on endocrine therapy. The approval was supported by the DESTINY-Breast06 trial, which demonstrated significantly improved progression-free survival compared to chemotherapy.

Antibody Drug Conjugates [ADC] Market Segment Analysis:

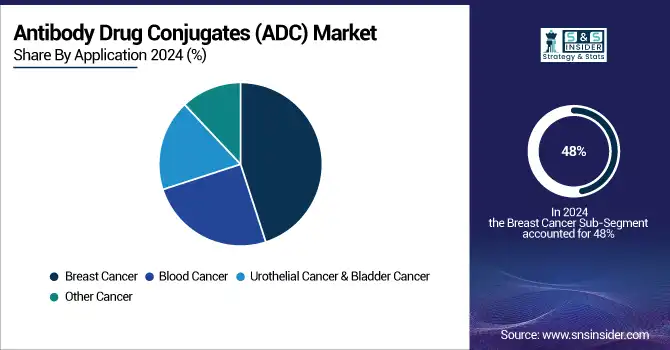

By Application, Breast Cancer Segment Dominates ADC Market in 2025, Blood Cancer Shows Fastest Growth

In 2025, the breast cancer segment dominated the market, contributing 48% of the market share to reasons such as a rising number of cases, promising pipeline products, and widespread usage of Kadcyla. Trodelvy, Enhertu, and Kadcyla are the drugs approved for treating breast cancer. The addition of Kadcyla for early breast cancer patients and the recent approvals of Enhertu and Trodelvy should provide a fillip to the segment. The

Blood cancer is exhibited to witness the fastest growth. Blood cancer is the 5th most common kind of cancer and the second leading cause of cancer deaths in the world. According to the National Foundation for Cancer Research, about 186,400 new cases of leukemia, lymphoma, and myeloma were diagnosed in the U.S. in 2022. Moreover, the approval of multiple products during the forecast period is expected to propel market growth.

By Target, HER2 Leads Target Segment in 2025, CD22 Emerges as Fastest-Growing Niche

In 2025, the HER2 segment, or human epidermal growth factor receptor 2, dominated the market with a significant share. HER2 is a crucial target. It's critical in the treatment of breast cancer, where overexpression is common. ADCs target HER2 with potent drugs that can be delivered directly to cancer cells, sparing healthy cells and enhancing treatment activity. Because of those things, the uptake is significant and that's contributed to propelling this segment’s leadership in the industry.

Over the forecast period, CD22 is one of the fastest-developing target segments. The field here is characterized by its broad application in cancer treatment, such as in leukemias, making it the fastest-growing niche in the area. CD22 antigen leukemia-associated diseases are increasingly indicating the growing demand for effective and low-side effect treatments CD22 targeted treatments are rapidly being regulated due to their clinical promise and are increasingly becoming a preferred treatment regimen among physicians and patients alike.

By Product, Kadcyla Remains Top Revenue-Generating ADC, Enhertu Witnesses Rapid Growth

Kadcyla dominated the ADC market in 2025, propelled by an increasing incidence of breast cancer and more approvals of ADCs specifically for breast cancer. In January 2022, Kadcyla received a big boost with a green signal for use in China by F. Hoffmann-La Roche Ltd., a new market with high growth potential. The broad uptake of Kadcyla also highlights a growing market for targeted cancer immunotherapies, marking the largest revenue-generating ADC addressable market.

Enhertu has become the fastest growing segment of the ADC market. The collaboration with Daiichi Sankyo and AstraZeneca has also driven Enhertu's rapid rise, especially after it was approved for HER2-low breast cancer in August 2022, a watershed moment in oncology treatment. Additionally, despite competitive activity from other brands that have entered the market, including second-line HER2-positive breast cancer indications for Enhertu since May 2022, this product has consistently claimed an early lead for share of new patients and signaled rapid adoption in the market. The continue expansion of its indications anticipated to bring continued growth in the forthcoming years.

Antibody Drug Conjugates [ADC] Market Regional Analysis:

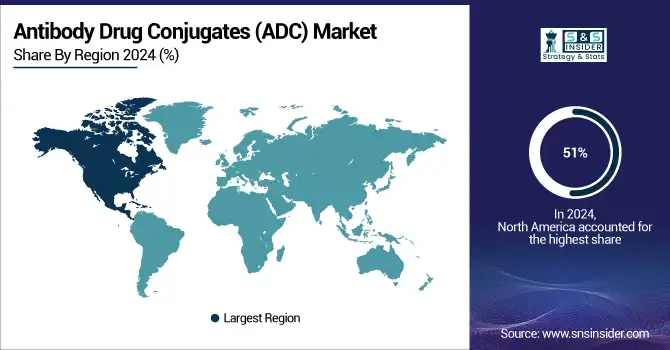

North America Antibody Drug Conjugates [ADC] Market Insights

North America dominated the Antibody Drug Conjugates (ADC) market with a 51% market share, owing to its sophisticated healthcare system, robust biopharmaceutical environment, and substantial funding in research and development. The area experiences a significant rate of cancer, increasing the need for advanced therapies such as ADCs, which provide targeted care with few side effects. The existence of key firms like Seagen, Pfizer, and ImmunoGen promotes innovation and speeds up ADC advancement. Moreover, the U.S. Food and Drug Administration (FDA) offers accelerated regulatory routes, allowing quicker approvals and market entry. North America gains significant financial support for cancer research and strategic partnerships among biopharma companies to improve ADC development. The region stays at the leading edge of the ADC market, significantly boosting its growth, due to its well-developed healthcare system and strong awareness of advanced treatments

Need any customization research on Antibody Drug Conjugates (ADC) Market - Enquiry Now

Asia Pacific Antibody Drug Conjugates [ADC] Market Insights

Asia Pacific region is the fastest growing region in the Antibody Drug Conjugates (ADC) market with the fastest growing CAGR of 15.73%, due to the increasing prevalence of cancer, rise in healthcare expenditure, and growing biopharmaceutical ecosystem in this region. With a vast and aging population, the region has a high cancer burden, leading to significant unmet demand for targeted therapies such as ADCs. China, India, South Korea, and a handful of others are evolving with major changes to healthcare infrastructure and biotechnology, encouraging breakthroughs and access to advanced treatment solutions. Local biopharma companies such as Shanghai Miracogen and Innovent Biologics participate in market expansion via clinical trials and affordable ADCs. Governments are also speeding up regulatory approvals, and awareness and access to cancer diagnostics and therapies are improving. Together, they propel the accelerated market growth.

Europe Antibody Drug Conjugates [ADC] Market Insights

Europe’s ADC market is expanding due to increasing cancer prevalence, advanced healthcare infrastructure, and growing adoption of targeted therapies. Rising approvals of novel ADCs for breast, lung, and hematological cancers, coupled with strong R&D investments and collaborations among pharmaceutical companies, are driving market growth. The focus on precision medicine and improved treatment efficacy further enhances regional adoption.

Latin America (LATAM) and Middle East & Africa (MEA) Antibody Drug Conjugates [ADC] Market Insights

The LATAM and MEA ADC market is growing with the increasing incidence of cancer, improving healthcare infrastructure, and awareness about targeted therapies. The emerging markets are experiencing an increase in clinical trials and collaborations, which are supporting the development of ADCs. The adoption of innovative ADC technologies and a shift towards patient-centric therapies are driving the growth of the market despite budget and accessibility issues.

Antibody Drug Conjugates [ADC] Market Competitive Landscape:

Celltrion, Inc. is a leading biopharmaceutical company specializing in the development and manufacturing of antibody-drug conjugates (ADCs). Leveraging advanced biotechnology and collaborative partnerships, Celltrion focuses on creating targeted cancer therapies that enhance efficacy while minimizing side effects. Its innovations in ADC technology support clinical advancements and broaden treatment options for oncology patients worldwide.

- In January 2024, Celltrion, Inc. and WuXi XDC signed a Memorandum of Understanding (MOU) to offer integrated services for the development and manufacturing of antibody-drug conjugates (ADCs). This collaboration aims to enhance the capabilities of both companies in delivering ADC solutions.

Antibody Drug Conjugates [ADC] Market Key Players:

-

Genentech

-

Seagen Inc.

-

AstraZeneca

-

Daiichi Sankyo

-

Pfizer

-

ImmunoGen

-

Bristol Myers Squibb

-

Amgen

-

ADC Therapeutics

-

MacroGenics

-

Bayer Zymeworks

-

Gilead Sciences

-

Mersana Therapeutics

-

Boehringer Ingelheim

-

Sanofi

-

Eli Lilly

-

Janssen Biotech

-

Roche

-

Curis Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 12.95 Billion |

| Market Size by 2035 | USD 41.26 Billion |

| CAGR | CAGR of 12.29% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Blood Cancer, Breast Cancer, Urothelial Cancer & Bladder Cancer, Other Cancer) • By Product (Kadcyla, Enhertu, Adcetris, Padcev, Trodelvy, Polivy, Others) • By Target (HER2, CD22, CD30, Others) • By Technology (Technology Type, Linker Technology Type, Payload Technology) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Genentech, Seagen Inc., AstraZeneca, Daiichi Sankyo, Pfizer, ImmunoGen, Bristol Myers Squibb, Amgen, ADC Therapeutics, MacroGenics, Bayer, Zymeworks, Gilead Sciences, Mersana Therapeutics, Boehringer Ingelheim, Sanofi, Eli Lilly, Janssen Biotech, Roche, Curis Inc., and other players. |