Anticoagulant Rodenticides Market Report Scope & Overview

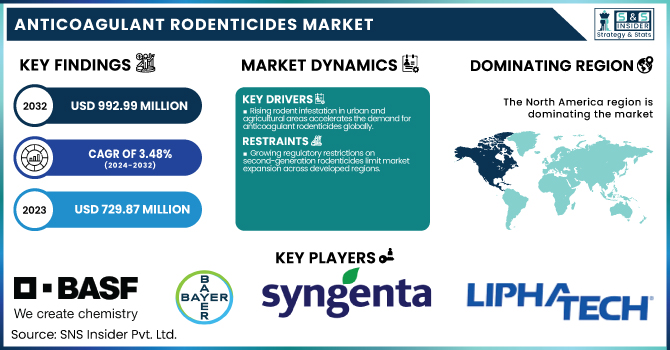

The Anticoagulant Rodenticides Market size was USD 729.87 million in 2023 and is expected to reach USD 992.99 million by 2032 and grow at a CAGR of 3.48% over the forecast period of 2024-2032.

To Get more information on Anticoagulant Rodenticides Market - Request Free Sample Report

This report provides comprehensive statistical insights and emerging trends across key areas. It covers 2023 data on production capacity and utilization by country and type, along with a detailed feedstock price analysis. The report evaluates regulatory impacts by nation and product type while also assessing environmental metrics, including emissions, waste management, and sustainability efforts by region. Innovation and R&D trends by hydrocarbon type are highlighted to gauge technological progress. Additionally, the report explores adoption rates of chemicals and materials software, regional compliance with regulations, and key software feature analysis. These insights collectively offer a data-driven understanding of market dynamics and future trajectories.

The United States held the largest market share in the Anticoagulant Rodenticides Market in 2023, with a market size of USD 189.88 million, projected to reach USD 239.69 million by 2032, growing at a CAGR of 2.62% during the forecast period. This dominance is primarily attributed to the country’s robust agricultural infrastructure, widespread urbanization, and stringent public health regulations. The presence of large-scale grain storage facilities, warehouses, and food processing units across the U.S. has led to consistent demand for rodent control solutions to prevent contamination and loss. Additionally, increased rodent infestations in urban areas due to climate change and expanding waste management concerns have spurred the adoption of second-generation anticoagulant rodenticides known for their high efficacy. Regulatory support for professional pest control services, combined with strong awareness among households and commercial establishments regarding rodent-borne diseases, has further reinforced the country’s leadership in the market.

Market Dynamics

Drivers

-

Rising rodent infestation in urban and agricultural areas accelerates the demand for anticoagulant rodenticides globally.

The growing prevalence of rodent infestations in both urban and rural agricultural zones is a significant driver for the anticoagulant rodenticides market. Urban expansion, coupled with poor waste management and warming climates, has increased rodent populations in cities. Simultaneously, in agriculture, rodents pose a serious threat to stored grains and crop fields, leading to considerable post-harvest losses. These concerns have led to heightened adoption of rodenticides across pest control companies, warehouses, and farms. Additionally, increasing government regulations mandating rodent control in food processing and storage units have further bolstered product demand. As a result, there is an escalating requirement for effective rodent management solutions, particularly second-generation anticoagulants due to their potency and longer activity. This trend is expected to continue, positioning rodenticides as a key component in integrated pest management systems.

Restrain

-

Growing regulatory restrictions on second-generation rodenticides limit market expansion across developed regions.

While anticoagulant rodenticides are effective, their use particularly of second-generation variants is increasingly restricted due to environmental and health concerns. Regulatory agencies in the United States, European Union, and other developed regions have imposed strict guidelines to minimize the risk of secondary poisoning in non-target wildlife such as birds of prey and domestic animals. These rodenticides, due to their long-lasting action, tend to bioaccumulate in ecosystems, raising ecological risks. As a result, manufacturers are facing compliance pressures that require reformulation or limited distribution of high-toxicity rodenticides. This has constrained market expansion in several regions and increased operational costs for companies striving to develop alternative formulations. Moreover, consumer awareness regarding environmental impact and ethical pest control has also shifted preferences towards non-lethal or eco-certified solutions, thereby acting as a restraint on traditional anticoagulant products.

Opportunity

-

Development of low-toxicity and biodegradable rodenticides offers growth potential in eco-sensitive and regulated markets.

As environmental awareness rises and regulations become more stringent, the demand for safer, low-toxicity, and biodegradable rodenticides is gaining momentum. This shift creates significant opportunities for manufacturers to invest in next-generation formulations that balance efficacy with ecological safety. Biodegradable anticoagulants and naturally derived active ingredients are being researched to reduce the risks associated with secondary poisoning and environmental contamination. These innovations are especially appealing to pest control agencies, agricultural operators, and urban authorities in regions where conventional rodenticides face regulatory scrutiny. Furthermore, companies leveraging green chemistry and securing eco-certifications are likely to see greater adoption in environmentally conscious markets. The growing trend of sustainable pest control solutions is also creating avenues for new product launches and strategic collaborations with public health and environmental agencies.

Challenge

-

Rodent resistance to anticoagulants poses a critical challenge to long-term effectiveness of control programs.

One of the most pressing challenges in the anticoagulant rodenticides market is the growing resistance of rodent populations to commonly used compounds. Over the years, continuous exposure to first- and second-generation anticoagulants has led to genetic mutations in rodent species, making them less susceptible or completely immune to certain active ingredients. This resistance diminishes the efficacy of rodenticides and leads to higher application frequencies, increasing both operational costs and environmental risk. In regions with documented rodent resistance, pest control programs often face setbacks, requiring integrated pest management and combination strategies to maintain control. This challenge not only affects product reliability but also compels companies to invest heavily in R&D to develop new active ingredients or delivery mechanisms, thereby stretching development timelines and regulatory approval processes.

Segmentation Analysis

By Product

Second-generation anticoagulant rodenticides (SGARs) held the largest market share around 62% in 2023. It is because of their high work effectiveness, long duration of action, and its effectiveness for rodent populations resistant to first-generation compounds. In contrast to first generation rodenticides, which cause death after several feedings, SGARs kill in a single feeding, making these rodenticides very effective for applications in heavily infested sites, such as warehouses, urban centers, or agricultural fields. This fact, in addition to their ability to rupture even species resistant to warfarin, has made them a favorite of pest control professionals and municipalities. Furthermore, SGARs are longer acting which means that they do not need to be applied as frequently, reducing cost through reduced labor. Their broad-spectrum activity, efficacy, and lower bait shyness have led to continued widespread use despite increasing regulatory scrutiny in some areas.

By Form

Blocks held the largest market share around 46% in 2023. It is owing to their resistance to various environmental conditions, durability, and ease of usage across different environments. The block formulations can tolerate adverse environments such as humidity, dust and extreme temperatures thus making them suitable for indoor and outdoor industrial and agricultural fields, warehouses, sewages and residential areas. They are dense, so they erode slowly and will give you years of bait, no need for frequent replacement. Block baits are also easily secured in bait stations which limits incidental grab by non-target organisms and increases safety in expected public or high-use areas. Block rodenticides have been established as the most widely used among pest control professionals and end-users alike because of their ultimate versatility in their placement, less mess when handled than other formulations such as pellets or powders and their reliable performance in a wide range of situations.

By Application

Pest Control Companies held the largest market share around 28% in 2023. It is due to their specialized expertise, consistent demand, and large-scale operational capabilities, pest control companies captured the largest segment of the anticoagulant rodenticides market. These companies cater to diverse sectors, including residential, commercial, agricultural, and industrial, where rodents can be a serious health, safety, and economic issue. With rodent populations evolving and city limits growing, a dependence on experts is present to carry out focused, confined, and near-ideal rodent extermination methodologies. Pest control companies used hi-tech formulations of rodenticide in the second-generation, such as in block form, to achieve a fast and permanent result. In addition to this, there are strict governing regulations and safety standards that necessitate applying these agents through trained personnel, which has increased the demand for outsourced pest control services.

Regional Analysis

North America held the largest market share around 36% in 2023. North America related to public health and high awareness about the risk of pest-related disease. Especially in the US, where the infrastructure of pest control is well established, with a myriad of licensed pest control service providers that serve residential, commercial, and agricultural segments. Inevitably, this resulted in a steady need for new rodenticides, particularly second-generation anticoagulants, due to the increasing rodent infestations in urban areas and food storage facilities. Moreover, regulatory authorities such as the U.S. Environmental Protection Agency (EPA) have defined guidelines for the application of rodenticides, which has compelled the producers to enhance their formulations targeting efficacy with lower toxicity. Moreover, North America has considerable disposable incomes, resulting in consumer expenditure on professional pest control services. All these factors, when put together foster the highest share of North America in the global anticoagulant rodenticides market.

Asia Pacific held a significant market share. It is owing to the rapidly increasing population in these developing regions, urbanization, and agricultural activities that promote a favorable environment infested with rodents. In countries like China, India, and Southeast Asia, IGR-herbivores with rats still are a major perennial threat to food security, public health, and public infrastructure. Rising demand for effective pest control measures in highly populated urban areas and large agricultural terrains have increased the adoption of anticoagulant rodenticides, especially block and pellet types. In addition, increased demand can be attributed to the growth of the food processing and storage sector and government initiatives to upgrade hygiene and pest control protocols. With increasing awareness of diseases transmitted by pests and decreasing crop yield in some regions, Asia Pacific is expected to be the focal point of investment by global and domestic rodenticides manufactures towards establishing scalable and effective rodent control.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Storm, Selontra)

-

Bayer AG (Harmonix Rodent Paste, Racumin)

-

Syngenta AG (Talon, Rodex)

-

Liphatech Inc. (FirstStrike, Generation)

-

PelGar International (Roban, Vertox)

-

Bell Laboratories Inc. (Contrac, Final)

-

Rentokil Initial plc (Eradibait, Raco)

-

Neogen Corporation (Havoc, Ramik)

-

JT Eaton & Co. Inc. (Top Gun, Bait Block)

-

Killgerm Group (Rodex Whole Wheat Bait, Roban Cut Wheat)

-

Ensystex Inc. (Rodenthor, Detex)

-

Orion Agroscience Ltd. (Pestoff, Tomcat)

-

Impex Europa S.L. (Rodilat, Rodine)

-

Abell Pest Control (Rodentex, SecureBait)

-

FMC Corporation (Goph-R-Go, Fumitoxin)

-

Russell IPM Ltd. (Rodex Pro, Rodex Eco)

-

Motomco (Jaguar, Hawk)

-

Zapi S.p.A. (Zapi Block, Zapi Pasta)

-

Quimunsa S.A. (Murin Forte, Fortox)

-

LiphaTech SAS (Maki, Rozol)

Recent Development:

-

In 2024, Syngenta AG broadened the availability of its Talon Soft Bait product line throughout Southeast Asia, emphasizing eco-conscious rodent control solutions tailored for urban environments.

-

In 2024, PelGar International Introduced Vertox Alpha, an advanced rodenticide specifically designed to combat resistant rodent populations in urban and industrial environments.

-

In 2024, Syngenta AG extended the reach of its Talon Soft Bait portfolio throughout Southeast Asia, emphasizing environmentally responsible solutions for urban rodent management.

| Report Attributes | Details |

| Market Size in 2023 | USD 729.87 Million |

| Market Size by 2032 | USD992.99 Million |

| CAGR | CAGR of3.48 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (1st Gen, 2nd Gen) • By Form (Pellets, Blocks, Powder/Spray) • By End Use Industry (Agriculture, Pest Control Companies, Warehouses, Urban Centers, Household, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Bayer AG, Syngenta AG, Liphatech Inc., PelGar International, Bell Laboratories Inc., Rentokil Initial plc, Neogen Corporation, JT Eaton & Co. Inc., Killgerm Group, Ensystex Inc., Orion Agroscience Ltd., Impex Europa S.L., Abell Pest Control, FMC Corporation, Russell IPM Ltd., Motomco, Zapi S.p.A., Quimunsa S.A., LiphaTech SAS |