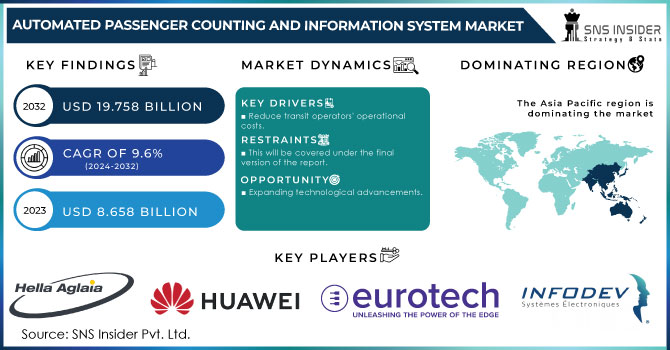

Automated Passenger Counting and Information System Market Size:

The Automated Passenger Counting and Information System Market Size was valued at USD 7.98 Billion in 2023 and is expected to reach USD 18.21 Billion by 2032 and grow at a CAGR of 9.7% over the forecast period 2024-2032. The market is driven by technological advancements, including the adoption of AI, machine learning, and IoT for enhanced passenger flow analytics and real-time data processing. Evolving sensor technologies like infrared, stereoscopic vision, and time-of-flight sensors are improving accuracy. Deployment trends show increased use across buses, trains, ferries, and airports, with a growing preference for cloud-based systems for scalability. Regulatory compliance, including GDPR, KYC, and AML, influences market dynamics. Additionally, the adoption of energy-efficient systems and sustainability initiatives is fueling market growth, reflecting a shift toward smarter, greener public transport.

Get more information on Automated Passenger Counting and Information System Market - Request Sample Report

Market Dynamics

Driver:

-

Increasing Demand for Real-Time Passenger Data Analytics and Smart Transport Solutions Boosts the Automated Passenger Counting and Information System Market Growth

The growing need for real-time passenger flow data analytics and smart transport solutions is significantly driving the growth of the Automated Passenger Counting and Information System (APCIS) market. Public transport agencies and operators seek systems that enable accurate, real-time monitoring of passenger numbers to optimize service delivery and operational efficiency. With rising urbanization and congestion, the demand for intelligent transport systems that leverage data to improve customer experiences, reduce costs, and manage traffic flow efficiently has amplified. APCIS technologies, such as AI-driven analytics and IoT-based sensors, are key to meeting this demand and facilitating smoother, more effective transportation networks.

Restraint:

-

High Initial Costs and Maintenance Expenses Associated with Automated Passenger Counting and Information Systems Limiting Market Growth Potential

Despite the advantages, the high initial investment and ongoing maintenance costs for Automated Passenger Counting and Information Systems (APCIS) present a significant restraint to market expansion. Many transportation agencies, especially in developing regions, face budget constraints that hinder their ability to implement advanced technologies like automated counting sensors and data management platforms. These systems often require substantial capital for deployment, as well as skilled personnel for operation and upkeep, making it a financial burden for smaller organizations. This financial limitation reduces the adoption rate, especially in less economically developed areas.

Opportunity:

-

Rising Adoption of Cloud-Based Solutions and IoT-Enabled Passenger Management Systems Creates Opportunities for Market Expansion

The growing adoption of cloud-based solutions and IoT-enabled passenger management systems presents a significant opportunity for the Automated Passenger Counting and Information System (APCIS) market. Cloud computing allows for more cost-effective data storage, real-time access, and scalable solutions, making it easier for public transportation agencies to adopt and integrate APCIS technologies. Furthermore, IoT-based systems facilitate better data collection and sharing between devices, improving operational efficiency. With increased investment in smart cities and public transport infrastructure, these technological advancements offer the potential to revolutionize the industry, leading to broader market adoption and expansion.

Challenge:

-

Data Privacy and Security Concerns in Handling Passenger Data Limit Widespread Adoption of Automated Passenger Counting Systems

A major challenge hindering the widespread adoption of Automated Passenger Counting and Information Systems (APCIS) is the growing concern over data privacy and security. With the increasing use of IoT and AI-powered technologies, the collection and storage of sensitive passenger data raises concerns about data breaches and unauthorized access. Stringent regulations, such as GDPR, require organizations to ensure compliance with data protection laws, making it challenging for many public transport operators to implement these systems without facing legal and security risks. Addressing these concerns is crucial for ensuring broader trust and acceptance of APCIS technologies.

Segments Analysis

By Type

In 2023, the Passenger Information Systems (PIS) segment led the market with a substantial 47% share, driven by increasing demand for real-time travel updates, better customer experiences, and efficient fleet management in the transportation industry.

For instance, Siemens unveiled a new digital platform that integrates predictive analytics for better passenger flow management. These developments align with the rise of Automated Passenger Counting (APC) and Information Systems, as both segments share a common goal of improving operational efficiency and enhancing passenger experience.

The Automated Passenger Counting Systems segment is growing at the highest CAGR of 10.45% within the forecast period, reflecting increasing investments in advanced tracking and monitoring technologies.

For example, Infodev Electronic Designers introduced a highly accurate, sensor-based APC solution that uses infrared sensors for precise data collection in real-time, offering seamless integration with transit systems. The demand for APC systems is fueled by a broader trend in the transportation industry towards data-driven decision-making and operational efficiency.

By Technology

In 2023, the Infrared technology segment captured the largest revenue share of 44%, driven by its reliability and accuracy in automated passenger counting systems. Infrared sensors are widely used for detecting the presence of passengers by measuring changes in infrared light as people move through entryways. Leading companies such as Infodev Electronic Designers and Vix Technology have made significant strides in this area by developing advanced infrared-based Automated Passenger Counting (APC) systems that ensure precision even in low-light or challenging environmental conditions.

The Stereoscopic Vision technology segment is witnessing the highest CAGR of 10.39% within the forecasted period, due to its advanced capabilities in depth perception and three-dimensional imaging. Companies such as Xovis and Eurotech are at the forefront of stereoscopic vision technology in passenger counting systems. Xovis recently introduced a 3D stereoscopic vision-based APC system that enhances the accuracy of passenger counting by capturing detailed images of passengers in motion, even in crowded environments.

By Application

In 2023, the Railways segment led the market with a 37% share, driven by increasing investments in advanced technology for efficient operations, passenger safety, and enhanced travel experiences. The integration of APC and PIS is particularly beneficial in the railway sector, as it enables train operators to track passenger numbers, optimize seating capacity, and manage schedules more effectively. The demand for advanced counting and information systems in railways is therefore aligned with the Automated Passenger Counting and Information System market, which is rapidly growing as rail operators seek more efficient and passenger-friendly solutions.

The Buses segment is expected to grow at the highest CAGR of 10.15% during the forecast period, reflecting the increasing demand for smart, data-driven solutions to enhance bus operations and passenger experiences.

For example, Vix Technology recently unveiled a new bus passenger counting system that utilizes infrared sensors and stereoscopic vision to improve accuracy and reliability in real-time passenger data collection. These systems help bus operators manage schedules better, optimize routes, and provide timely passenger updates.

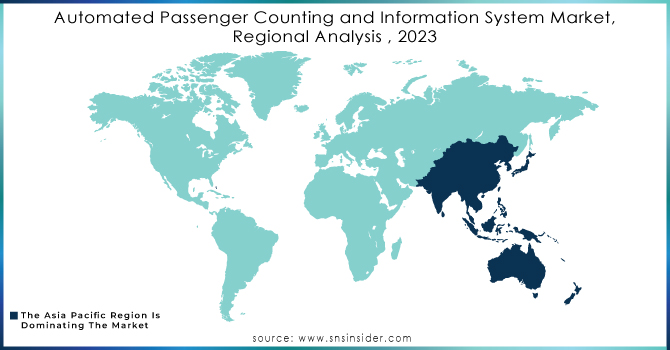

Regional Analysis

In 2023, North America dominated the Automated Passenger Counting and Information System market, holding a significant market share of approximately 40%. This dominance can be attributed to the strong infrastructure and technological advancements in transportation systems within the region. Countries like the United States and Canada are at the forefront of adopting smart transportation solutions, with major cities investing in advanced transit technologies to improve efficiency and passenger experience.

For example, New York City's Metropolitan Transportation Authority (MTA) has integrated advanced passenger counting and real-time information systems in its subway and bus networks, contributing to the region's market share.

The Asia Pacific region is the fastest-growing region in the Automated Passenger Counting and Information System market, with an estimated CAGR of 12.5% during the forecast period. This rapid growth is primarily driven by urbanization, increasing investments in transportation infrastructure, and a growing demand for more efficient public transit systems.

For instance, China's high-speed rail network has implemented integrated APC and PIS systems, provided real-time updates and improving operational efficiency. The fast adoption of these technologies is further supported by government initiatives promoting smart city development, making the region a key player in the global market's expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Automated Passenger Counting and Information System Market are:

-

Eurotech (IRMA, EDGE AI Platform)

-

Iris-GmbH (IRMA 6 R2 Sensor, HYDRA IP Video Surveillance System)

-

DILAX Intelcom GmbH (DILAX APC System, DILAX DataHub)

-

HELLA Agalia Mobile Vision (Agalia Intelligent Camera Systems, Agalia Display System)

-

Infodev EDI (Passenger Counting System, EDI-Locator)

-

Siemens (Siemens Mobility Passenger Information System, Sitraffic)

-

Hitachi (Hitachi Passenger Counting System, Hitachi IoT-enabled Sensors)

-

ACOREL SAS (ACOREL Passenger Counting System, ACOREL Smart Displays)

-

Advantech Co., Ltd. (Advantech APC Solution, Advantech IoT Gateways)

-

BlueSurge Technologies (BlueSurge Passenger Information System, BlueSurge Smart Sensors)

-

Cisco Systems, Inc. (Cisco Connected Transport Solutions, Cisco Meraki Cameras)

-

Clever Devices Ltd. (Clever APC System, Clever Transit Management System)

-

Exeros Technologies Ltd. (Exeros APC Sensors, Exeros Data Analytics Platform)

-

EYERIDE (EYERIDE Passenger Monitoring System, EYERIDE Smart Sensors)

-

Giken Trastem Co., Ltd. (Giken APC System, Giken Data Management Platform)

-

GMV Syncromatics (Syncromatics APC System, Syncromatics Data Hub)

Recent Trends

-

In November 2023, at the APTA EXPO 2023, iris-GMBH introduced the IRMA 6 R2 sensor generation and also launched the HYDRA IP video surveillance system, showcasing advanced technology in passenger monitoring and security solutions.

-

In July 2024, Siemens Mobility successfully secured four contracts valued at USD 690.5 million with HS2 Ltd, focusing on vital infrastructure and long-term maintenance, marking a major step forward in rail transport development.

-

In September 2024, DILAX joined the INIT Group, strengthening its expertise in automatic passenger counting technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.98 Billion |

| Market Size by 2032 | US$ 18.21 Billion |

| CAGR | CAGR of 9.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Automated Passenger Counting Systems, Passenger Information Systems, Display Systems, Announcement and Emergency Communication Systems, Infotainment Systems, Mobile Applications) • By Technology Type (Infrared, Stereoscopic Vision, Time of Flight, Others) • By Application Type (Buses, Trains and Trams, Ferries, Railways, Roadways, Airways) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eurotech, Iris-GmbH, DILAX Intelcom GmbH, HELLA Agalia Mobile Vision, Infodev EDI, Siemens, Hitachi, ACOREL SAS, Advantech Co., Ltd., BlueSurge Technologies, Cisco Systems, Inc., Clever Devices Ltd., Exeros Technologies Ltd., EYERIDE, Giken Trastem Co., Ltd., GMV Syncromatics |