Band Reject Filters Market Report Scope & Overview:

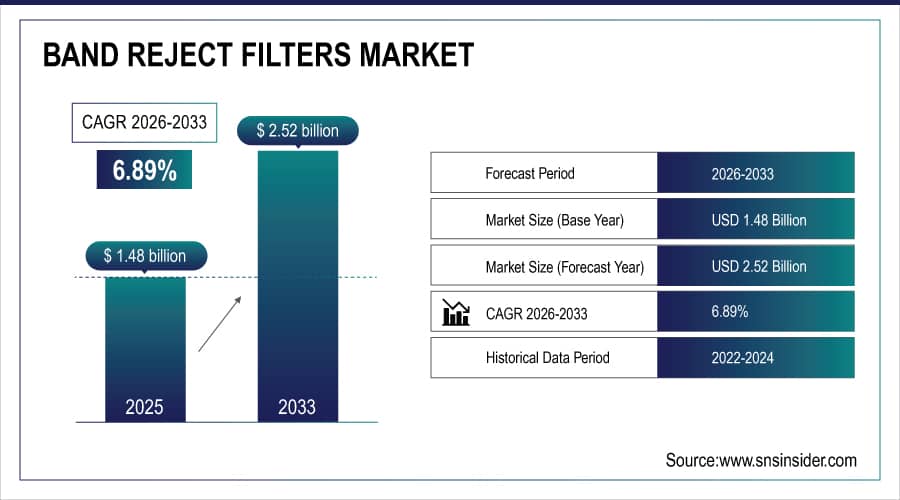

The Band Reject Filters Market size was valued at USD 1.48 Billion in 2025E and is projected to reach USD 2.52 Billion by 2032, growing at a CAGR of 6.89% during 2026–2033.

The Band Reject Filters Market is witnessing strong adoption as RF, telecom, medical, and defense systems require precise interference suppression and cleaner signal chains. Growing spectrum congestion, higher data rates, and stricter EMC regulations are accelerating deployment across base stations, radar, medical imaging, and automotive electronics. Band reject, or notch filters, are increasingly integrated into RF front-ends, modules, and subsystems to block unwanted bands while preserving desired signals.

Band Reject Filters Market Size and Forecast:

-

Market Size in 2025E: USD 1.48 Billion

-

Market Size by 2032: USD 2.52 Billion

-

CAGR: 6.89% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Band Reject Filters Market - Request Free Sample Report

Key Band Reject Filters Market Trends:

-

Rising deployment of 4G/5G base stations, small cells, and microwave backhaul is increasing demand for band reject filters to suppress adjacent-channel and co-site interference.

-

Expansion of radar, electronic warfare, and avionics platforms is driving higher consumption of high-power cavity and waveguide band reject filters for receiver protection and jamming mitigation.

-

Growing adoption of advanced medical imaging, patient monitoring, and diagnostic equipment is boosting the use of precise band-stop filters to remove specific noise bands while preserving signal fidelity.

-

Miniaturization of RF front-ends in smartphones, IoT devices, and wearables is accelerating development of compact thin-film and ceramic notch filters with high Q-factor and low insertion loss.

-

Increasing spectrum congestion in broadcasting, public safety, and critical communications is fueling demand for tunable and reconfigurable band reject filters at base stations and repeater sites.

-

Integration of filters into multifunction RF modules, front-end assemblies, and custom subsystems is rising as OEMs seek reduced BOM, improved linearity, and faster time to market.

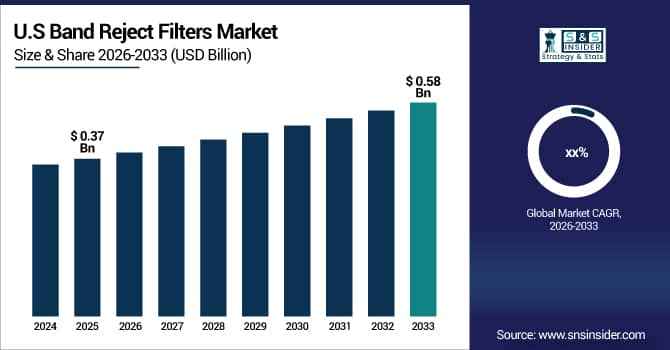

U.S. Band Reject Filters Market Insights

The U.S. Band Reject Filters Market size was USD 0.37 Billion in 2025E and is expected to reach USD 0.58 Billion by 2033. According to a study, increasing interference incidents in dense urban networks have led operators and OEMs to deploy advanced band reject filters, which can reduce harmful in-band interference events by over 25%, improving signal integrity and equipment uptime. This cause, rising performance and reliability expectations across telecom, defense, and medical sectors, effects rapid design-in of notch filters in 5G base stations, radar front-ends, and imaging systems, helping ensure clearer communications and diagnostics while controlling operational risks and lifecycle costs.

Band Reject Filters Market Driver:

-

Growing 5G, radar, and high-frequency system deployments increase demand for high-performance band reject filters across telecom and defense

Growing deployment of 5G base stations, small cells, radar networks, and high-frequency communication links is intensifying RF interference challenges, which directly increases the need for high-performance band reject filters in RF front-ends. This cause, rising spectrum reuse and co-location of multiple radios on shared sites and platforms, effects wider integration of cavity, ceramic, and thin-film notch filters to suppress adjacent-channel, co-site, and out-of-band signals without degrading desired channels. As operators and defense agencies seek higher sensitivity, throughput, and resilience, they increasingly specify custom or semi-custom band reject networks, encouraging manufacturers to innovate in high power handling, steep skirts, low insertion loss, and compact footprints.

For example, a defense contractor upgrading airborne radar platforms implemented high-power cavity band reject filters at the receiver front-end to block strong nearby communication signals while preserving weak target echoes, significantly improving detection range and tracking stability. This configuration allowed the radar to operate reliably in congested electromagnetic environments near urban centers and joint training ranges, reducing false alarms and avoiding costly redesign of the entire RF chain.

Band Reject Filters Market Restraint:

-

High customization requirements, engineering complexity, and qualification costs restrict faster adoption of advanced band reject filters among price-sensitive OEMs

High customization needs for center frequency, bandwidth, rejection depth, power handling, and mechanical format make band reject filters engineering-intensive components, which raises design and qualification costs for OEMs. This cause, stringent performance and reliability requirements across telecom, aerospace, defense, and medical applications, effects longer design cycles, higher non-recurring engineering expenses, and extended validation steps, especially where qualification and certification are mandatory. Smaller or cost-sensitive manufacturers often hesitate to adopt sophisticated or custom notch filters when lower-cost generic components or digital signal processing appear acceptable, slowing penetration into mid- and low-end devices. In addition, integration challenges within compact or densely populated PCBs, along with concerns over lead times and inventory risk for highly specific designs, can further restrict adoption, moderating overall market acceleration despite strong technical advantages.

For example, an industrial IoT device manufacturer opted for basic low-pass and band-pass networks combined with DSP-based noise reduction instead of a custom band reject filter, primarily to avoid upfront engineering charges and requalification of the RF module, accepting somewhat lower immunity to narrowband interferers in factory environments as a trade-off for faster time to market and lower initial system cost.

Band Reject Filters Market opportunity:

-

Integration of tunable, software-configurable band reject filters with SDR, IoT monitoring, and cloud analytics opens new service-based revenue opportunities

An emerging opportunity lies in combining tunable, software-configurable band reject filters with software-defined radios, IoT-based monitoring, and cloud analytics platforms. This cause, continuously changing interference patterns and dynamic spectrum usage across telecom, broadcasting, and critical infrastructure, effects rising interest in filters that can be remotely adjusted in center frequency, bandwidth, and rejection depth through control signals or firmware updates. Vendors can pair adaptive hardware with real-time analytics, interference mapping, and remote optimization services to create subscription-based offerings that go beyond one-time component sales. Such solutions allow operators and enterprises to monitor interference, reconfigure notches, and optimize RF performance over the equipment lifecycle, improving uptime and flexibility. As more networks evolve toward virtualized and software-driven architectures, this hardware–software convergence positions tunable band reject filters as key enablers of intelligent, service-centric RF ecosystems.

For example, a public safety network integrator deployed SDR-based repeaters equipped with remotely tunable band reject filters connected to a cloud analytics dashboard that continuously tracked noise floors and interferers across multiple sites.

Band Reject Filters Market Segmentation Analysis:

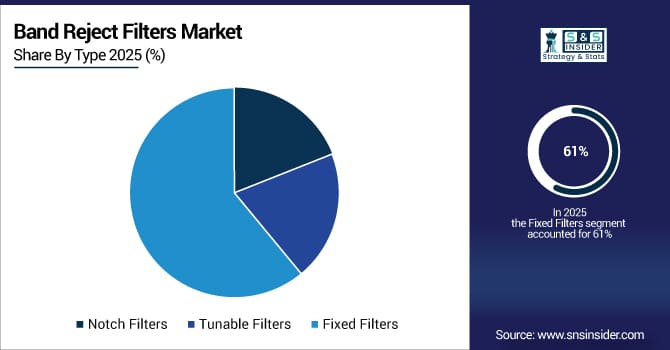

By Type, Fixed Filters Lead Market While Tunable Filters Register Fastest Growth

The Fixed Filters segment is dominated by the largest share of 61% of revenue in 2025E. Because fixed band reject filters offer proven reliability, stable performance, and cost-effective designs for well-defined frequency bands, they are widely adopted in telecom infrastructure, broadcasting, defense platforms, and test equipment with established spectrum allocations. This cause, strong preference for mature, qualified solutions in long-lived systems, effects continued dominance of fixed cavity, ceramic, and thin-film notch filters, which are optimized for specific interference scenarios and produced at scale.

The Tunable Filters segment is growing at the largest CAGR of 9.92% within the forecasted period. As networks transition toward flexible, software-driven architectures and interference patterns become more dynamic, OEMs increasingly require tunable band reject filters capable of adjusting center frequency and bandwidth in real time. This cause, rising need for reconfigurable and future-proof RF front-ends, effects accelerated adoption of electronically controlled and voltage-tunable designs in telecom, defense, test and measurement, and satellite systems.

By Frequency Range, Medium Frequency Leads Market While High Frequency Registers Fastest Growth

The Medium Frequency segment is dominated by the largest share of revenue at 55% in 2025E. Medium frequency band reject filters serve core applications across traditional cellular, broadcasting, and many radar and communication systems, where established spectrum allocations and large installed bases create consistent demand. This cause, concentration of legacy and current services in mid-band ranges, effects strong utilization of cavity and ceramic notch filters optimized for these frequencies, ensuring stable revenue streams.

The High Frequency segment is growing at the largest CAGR of 8.49% within the forecasted period. Expansion of millimeter-wave 5G, advanced radar, satellite communications, and high-frequency test systems is sharply increasing the need for high frequency band reject filters with precise control and low loss. This cause, push into higher bands for bandwidth and resolution advantages, effects rising adoption of specialized waveguide, thin-film, and advanced material filters tailored to high-frequency operation.

By Application, Telecommunications Lead Market While Medical Registers Fastest Growth

The Telecommunications segment is dominated by the largest share of revenue at 42% in 2025E. Rapid network densification, 4G and 5G rollouts, microwave backhaul, and small cell deployments create pervasive interference challenges that telecom operators address with band reject filters across base stations, repeaters, and customer-premises equipment. This cause, intense spectrum reuse and co-location of multiple radio systems, effects high-volume adoption of fixed and, increasingly, tunable notch filters to maintain signal quality, capacity, and coverage. Ongoing innovations in compact, low-loss designs tailored for telecom frequency bands further reinforce the dominance of this segment in the Band Reject Filters Market.

The Medical segment is growing at the largest CAGR of 8.93% within the forecasted period. Rising deployment of advanced imaging systems, patient monitoring devices, and connected medical equipment is increasing sensitivity to RF interference in clinical environments. This cause, growing need for noise-free diagnostic and monitoring signals, effects fast adoption of precision band reject filters designed to remove specific interference bands while preserving critical signal components.

By End User, Consumer Electronics Lead Market While Automotive Registers Fastest Growth

The Consumer Electronics segment is dominated by the largest share of revenue, with 43% in 2025E. Smartphones, Wi-Fi routers, set-top boxes, and connected home devices rely on compact RF front-ends where targeted interference suppression is increasingly important for user experience and regulatory compliance. This cause, proliferation of wireless functions within small consumer form factors, effects strong adoption of miniaturized band reject filters integrated into modules or chip-scale packages.

The Automotive segment is growing at the largest CAGR of 9.55% within the forecasted period. The rapid integration of ADAS radar, vehicle-to-everything communications, infotainment, and telematics in modern vehicles results in complex RF environments that demand robust interference mitigation. This cause, rising reliance on RF-based safety and connectivity features, effects growing use of band reject filters in radar sensors, communication modules, and mixed-signal control units to meet EMC standards and ensure reliable operation.

Band Reject Filters Market Regional Analysis:

North America dominates the Band Reject Filters Market in 2025E

In 2025E, North America holds an estimated 35% share of the Band Reject Filters Market, driven by extensive telecom infrastructure, strong defense and aerospace activity, and early adoption of advanced RF technologies. This cause, high investment in 5G, radar, satellite, and test systems, effects sustained demand for both fixed and tunable band reject filters across operators, defense contractors, and equipment manufacturers. Mature design ecosystems, high EMC standards, and emphasis on performance and reliability further reinforce regional leadership.

The United States leads North America’s Band Reject Filters Market. Strong 4G/5G rollouts, dense urban networks, and major radar, electronic warfare, and satellite programs concentrate demand for advanced notch filters across telecom, defense, and aerospace applications. U.S.-based OEMs and integrators frequently specify custom and semi-custom filters to meet stringent performance and qualification requirements, encouraging close collaboration with component manufacturers. High R&D spending, rapid prototyping capabilities, and a large installed base of high-value RF systems ensure that the U.S. remains the primary contributor to regional revenue, shaping technology and product roadmaps for the global market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific is the fastest-growing region in the Band Reject Filters Market in 2025

The Asia Pacific region is projected to register the fastest CAGR of around 8.39% in the forecasted period 2026-2033. Rapid expansion of telecom networks, growing electronics manufacturing, and increasing investments in radar, satellite, and automotive systems drive strong demand for band reject filters. This cause, rising industrialization and digitalization across emerging and developed economies, effects accelerated adoption of both cost-effective fixed filters and advanced tunable solutions. Local manufacturing ecosystems and supportive government initiatives in communications and defense technology further boost growth momentum, positioning Asia Pacific as the most dynamic regional market in the forecast period.

China Dominates Asia Pacific Band Reject Filters Market in 2025 Driven by Telecom, 5G, and Aerospace Investments

China dominates the Asia Pacific Band Reject Filters Market. A massive telecom infrastructure, extensive deployment of 5G and fiber backhaul, and significant investments in radar, aerospace, and satellite communications generate high-volume demand for RF filters. Domestic OEMs and module manufacturers integrate notch filters across base stations, terminals, and critical systems to manage dense interference and meet regulatory norms. Strong local supply chains, government-backed technology programs, and growing automotive and consumer electronics production solidify China’s leading position and influence on regional pricing, technology development, and product standards.

Europe Band Reject Filters Market insights, 2025

In 2025, Europe accounted for a significant share of the global Band Reject Filters Market, supported by advanced telecom infrastructure, strong aerospace and defense capabilities, and stringent EMC and safety regulations. This cause, regulatory focus on electromagnetic compatibility and spectrum efficiency, effects broad adoption of band reject filters across base stations, radar systems, medical devices, and industrial automation. European OEMs emphasize high-quality, energy-efficient, and reliable RF designs, driving demand for compact, high-performance cavity, ceramic, and thin-film notch filters tailored to regional standards and application needs.

Germany Leads Europe Band Reject Filters Market in 2025 Driven by Automotive, Industrial, and Telecom Demand

Germany leads Europe’s Band Reject Filters Market because its robust automotive, industrial, and smart manufacturing sectors, combined with strong telecom and defense programs, create diverse and high-value RF filter requirements. This cause, concentration of engineering-driven OEMs and systems integrators, effects sustained investment in advanced filters for ADAS radar, factory automation, communications, and test equipment. Germany’s emphasis on engineering quality, innovation, and compliance with strict EMC and safety norms promotes the use of sophisticated band reject filters, maintaining its central role in European market growth.

Middle East & Africa and Latin America Band Reject Filters Market insights, 2025

In 2025, the Band Reject Filters Market in the Middle East & Africa and Latin America showed steady growth, supported by telecom network expansion, modernization of broadcast infrastructure, and rising adoption of radar and defense systems. In Latin America, Brazil dominates due to its large mobile subscriber base, ongoing 4G/5G rollout, and growth in satellite and broadcast services, which increase the need for reliable interference mitigation through band reject filters in base stations and transmission equipment. In the Middle East & Africa, the Gulf countries, particularly the UAE and Saudi Arabia, lead adoption as they invest in advanced telecom networks, airport and maritime radar systems, and security infrastructure. This cause, regional focus on connectivity, surveillance, and national infrastructure protection, effects growing integration of band reject filters into critical RF systems, supporting gradual but sustained market development across both regions.

Band Reject Filters Market Key Players:

-

Anatech Electronics, Inc.

-

API Technologies Corp.

-

AVX Corporation

-

Bird Technologies Group

-

CTS Corporation

-

ECHO Microwave

-

EPCOS AG

-

Exodus Dynamics

-

Filtronetics, Inc.

-

K&L Microwave, Inc.

-

KR Electronics, Inc.

-

Lark Engineering

-

MtronPTI

-

Networks International Corporation

-

Qorvo, Inc.

-

RS Microwave Company, Inc.

-

Skyworks Solutions, Inc.

-

Smiths Interconnect

-

Wainwright Instruments GmbH

-

Murata Manufacturing Co., Ltd.

Competitive Landscape for the Band Reject Filters Market

Anatech Electronics, Inc.

Anatech Electronics, Inc. is a specialized RF and microwave filter manufacturer known for designing and producing custom and standard band reject, band pass, low pass, and high pass filters for telecom, defense, industrial, and commercial applications. The company offers cavity, ceramic, LC, and other topologies tailored to specific center frequencies, bandwidths, and power levels, supporting both low- and high-volume requirements. Its role in the Band Reject Filters Market is significant, as it provides engineered solutions that address challenging interference scenarios across base stations, repeaters, radar systems, and instrumentation. By focusing on application-specific performance, rapid prototyping, and flexible mechanical formats, Anatech helps OEMs integrate reliable notch filters into complex RF front-ends.

-

In recent years, Anatech Electronics has expanded its custom and semi-custom band reject filter portfolio for 5G, public safety, and defense applications, introducing designs with enhanced power handling, sharper rejection, and more compact housings to meet modern space and performance constraints in network and mission-critical systems.

API Technologies Corp.

API Technologies Corp., now operating under Spectrum Control, is a leading provider of RF, microwave, and electromagnetic solutions, including a broad range of band reject and other filters. The company supplies high-reliability components and subsystems to defense, aerospace, telecom, industrial, and medical customers, integrating filters into complex RF assemblies, modules, and signal conditioning platforms. Its role in the Band Reject Filters Market is central, as it combines engineering expertise, manufacturing scale, and qualification capabilities to deliver mission-critical notch filters for harsh environments and demanding specifications. By offering both catalog and fully customized solutions, API Technologies supports advanced radar, electronic warfare, satellite communication, and secure communication systems.

-

API Technologies has developed innovative 3D-printed and advanced-material RF filters, including band reject configurations, enabling lighter, more compact, and thermally efficient designs for aerospace and defense platforms, thereby reducing size, weight, and power while maintaining stringent performance criteria.

AVX Corporation (KYOCERA AVX)

AVX Corporation, part of KYOCERA AVX, is a global manufacturer of electronic components, including RF and microwave filters such as thin-film and ceramic devices used in band reject and related functions. The company focuses on compact, high-frequency, and high-performance solutions for mobile devices, IoT, automotive, telecom infrastructure, and industrial equipment. Its role in the Band Reject Filters Market is important because it brings advanced thin-film and multilayer technologies that enable miniaturized, high-Q filters suitable for crowded RF front-ends in space-constrained products. By leveraging materials science, precision manufacturing, and close collaboration with OEMs, AVX supports high-volume integration of notch and complementary filters into modules and chip-scale packages.

-

KYOCERA AVX has recently expanded its high-power and thin-film RF filter lines with new small-form-factor products that can be adapted for band reject functions, supporting higher frequencies, tighter tolerances, and improved power handling for 5G radios, automotive electronics, and compact communication devices.

Bird Technologies Group

Bird Technologies Group is a trusted provider of RF measurement and signal management solutions, including RF filters, combiners, loads, and monitoring equipment used in broadcasting, land mobile radio, military, and industrial applications. The company’s band reject and related filter products are deployed in base stations, repeaters, and critical communication sites to manage interference, protect receivers, and ensure system reliability. Its role in the Band Reject Filters Market is notable, as Bird couples practical field experience with robust product design, offering filters that withstand demanding environmental and power conditions. By integrating filters with testing, monitoring, and system solutions, Bird helps operators diagnose and resolve interference issues while maintaining uptime and compliance.

-

Bird Technologies has broadened its portfolio of cavity and high-power RF filters, including band reject variants optimized for public safety, broadcast, and land mobile radio systems, enabling operators to maintain clean channels and mitigate interference in multi-tenant and spectrum-congested tower environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 1.48 Billion |

| Market Size by 2032 | US$ 2.52 Billion |

| CAGR | CAGR of 6.89 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Notch Filters, Tunable Filters, Fixed Filters) • By Application (Telecommunications, Medical, Military & Defense, Industrial, Others) • By Frequency Range (Low Frequency, Medium Frequency, High Frequency) • By End-User (Consumer Electronics, Automotive, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Anatech Electronics, Inc., API Technologies Corp., AVX Corporation, Bird Technologies Group, CTS Corporation, ECHO Microwave, EPCOS AG, Exodus Dynamics, Filtronetics, Inc., K&L Microwave, Inc., KR Electronics, Inc., Lark Engineering, MtronPTI, Networks International Corporation, Qorvo, Inc., RS Microwave Company, Inc., Skyworks Solutions, Inc., Smiths Interconnect, Wainwright Instruments GmbH, Murata Manufacturing Co., Ltd. |