Bioconjugation Market Report Scope & Overview:

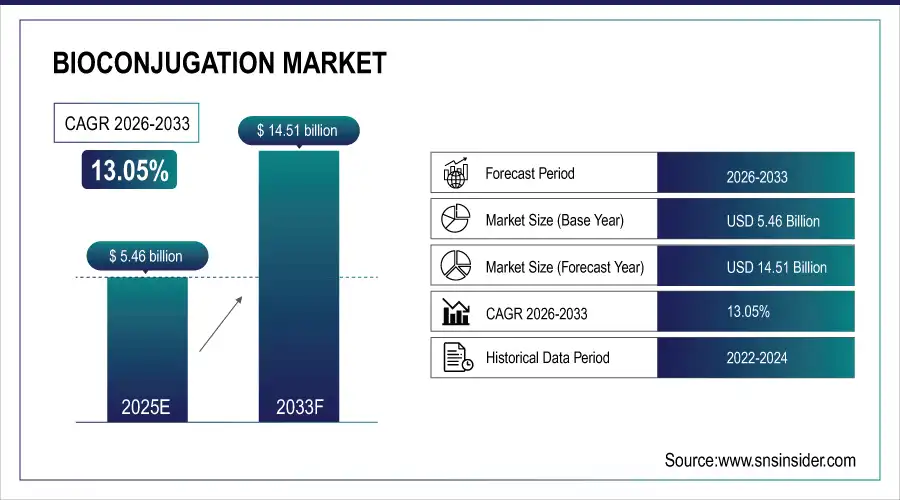

Bioconjugation Market is valued at USD 5.46 billion in 2025E and is expected to reach USD 14.51 billion by 2033, growing at a CAGR of 13.05% from 2026-2033.

The bioconjugation market is experiencing strong growth driven by rising demand for targeted therapeutics, biologics, and advanced drug delivery systems. Increasing adoption of antibody–drug conjugates, vaccines, and molecular diagnostics is accelerating market expansion. Growth in biopharmaceutical R&D, along with advancements in protein engineering and conjugation chemistries, is further supporting adoption. Additionally, rising prevalence of cancer and chronic diseases, increased funding for life science research, and expanding applications in diagnostics and imaging are fueling sustained market growth globally.

85% of life science and biopharma organizations leveraged bioconjugation technologies propelled by demand for antibody–drug conjugates, precision diagnostics, and advanced biologics cementing bioconjugation as a critical enabler of next-generation therapeutics and global market expansion.

Bioconjugation Market Size and Forecast

-

Market Size in 2025E: USD 5.46 Billion

-

Market Size by 2033: USD 14.51 Billion

-

CAGR: 13.05% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Bioconjugation Market - Request Free Sample Report

Bioconjugation Market Trends

-

Rising adoption of antibody-drug conjugates driving demand for advanced bioconjugation technologies in targeted therapies

-

Increasing use of site-specific conjugation techniques to enhance stability, efficacy, and safety of biopharmaceutical products

-

Growing integration of click chemistry and enzyme-mediated methods for efficient and precise bioconjugation reactions

-

Expansion of bioconjugation applications in diagnostics, imaging, and personalized medicine for improved disease management

-

Advancements in polymer and linker technologies to optimize drug delivery and therapeutic index of conjugated molecules

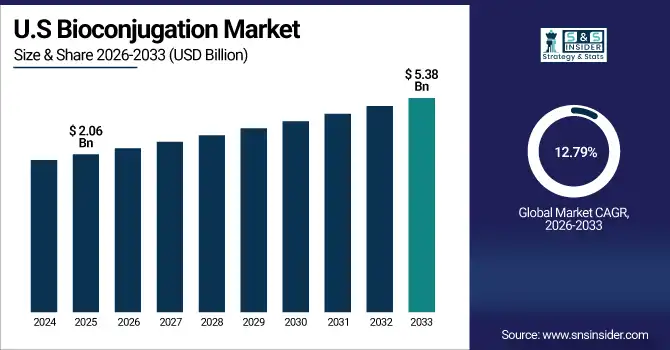

U.S. Bioconjugation Market is valued at USD 2.06 billion in 2025E and is expected to reach USD 5.38 billion by 2033, growing at a CAGR of 12.79% from 2026-2033.

The U.S. bioconjugation market is growing due to strong biopharmaceutical R&D activity, rising adoption of antibody–drug conjugates, and increasing cancer prevalence. Advanced research infrastructure, high healthcare spending, and continuous innovation in targeted therapies and diagnostics further support sustained market expansion.

Bioconjugation Market Growth Drivers:

-

Growing demand for targeted therapies and precision medicine is driving adoption of bioconjugation techniques to enhance drug efficacy and reduce off-target effects globally

The increasing focus on personalized medicine and targeted therapies is fueling the demand for bioconjugation technologies. Bioconjugation enables the attachment of drugs to antibodies, proteins, or other biomolecules, improving specificity and minimizing off-target effects. This approach enhances therapeutic efficacy, reduces side effects, and allows precise treatment of diseases like cancer and autoimmune disorders. As healthcare providers prioritize patient-specific therapies, pharmaceutical and biotech companies are investing in bioconjugation platforms to develop next-generation therapeutics, driving market growth globally, particularly in regions with advanced healthcare infrastructure and strong R&D capabilities.

82% of global therapeutic developers adopted advanced bioconjugation techniques harnessing their precision to enhance drug efficacy, minimize off-target effects, and meet rising demand for targeted therapies and personalized medicine.

-

Increasing investments in biopharmaceutical research and development are fueling bioconjugation applications for antibody-drug conjugates, protein labeling, and diagnostic tool development

Rising funding in biopharmaceutical R&D is expanding the scope of bioconjugation applications, including antibody-drug conjugates (ADCs), protein labeling, and diagnostics. Pharmaceutical companies and research institutions are leveraging bioconjugation to create highly specific therapeutics and advanced diagnostic tools. Government grants, venture capital, and private equity investments in biotech innovation further accelerate development. The increasing prevalence of chronic and complex diseases drives the need for novel therapeutics, which rely on bioconjugation for targeted delivery. This growing financial and research support is significantly boosting adoption of bioconjugation technologies globally, particularly in North America and Europe.

80% of biopharmaceutical R&D programs integrated bioconjugation technologies driving advances in antibody-drug conjugates, precision protein labeling, and next-generation diagnostic tools through heightened investment and innovation.

Bioconjugation Market Restraints:

-

High cost of bioconjugation reagents, complex protocols, and technical expertise requirements limit widespread adoption in smaller laboratories and emerging markets

Bioconjugation involves expensive reagents, sophisticated instruments, and highly specialized techniques, making adoption challenging for smaller laboratories or institutions in developing countries. Technical complexity requires trained personnel and stringent quality control, increasing operational costs. High costs of chemicals, enzymes, and conjugation kits limit accessibility for research teams with budget constraints. Additionally, smaller biopharmaceutical companies may face difficulties scaling bioconjugation processes for commercial production. These factors restrict market penetration, slow adoption in emerging regions, and create barriers for new entrants seeking to leverage bioconjugation technologies for drug development or diagnostic applications.

71% of smaller laboratories and institutions in emerging markets reported limited adoption of bioconjugation technologies due to high reagent costs, technically demanding protocols, and a shortage of specialized expertise hindering broader application in research and diagnostics.

-

Regulatory challenges and stringent approval processes for bioconjugated therapeutics slow commercialization and restrict rapid market growth

Bioconjugated drugs and therapeutics face rigorous regulatory scrutiny due to their complexity and potential safety risks. Obtaining approval from agencies like the FDA or EMA requires extensive clinical trials, quality assessments, and compliance with stringent manufacturing standards. Lengthy approval timelines and evolving regulations increase development costs and delay commercialization. Companies must navigate complex legal and safety requirements to bring bioconjugated therapeutics to market, which can discourage smaller firms from entering the space. These regulatory hurdles slow product launch cycles and restrict rapid expansion of the bioconjugation market, particularly for novel therapeutic applications.

74% of bioconjugated therapeutic developers faced delayed commercialization due to complex regulatory pathways and stringent approval requirements posing significant hurdles to rapid market entry and scalability despite promising clinical data.

Bioconjugation Market Opportunities:

-

Advancements in bioorthogonal chemistry, click chemistry, and site-specific conjugation techniques present opportunities for innovation in drug delivery and diagnostics

Emerging bioconjugation techniques, such as click chemistry and site-specific conjugation, enable precise and efficient attachment of drugs, probes, or imaging agents to biomolecules. These innovations improve stability, reduce off-target effects, and enhance therapeutic performance, creating opportunities for novel drug delivery systems and diagnostic applications. Researchers can develop next-generation antibody-drug conjugates, targeted imaging probes, and personalized therapies. Continuous technological advancements increase efficiency, reduce production costs, and expand the range of potential applications. This innovation-driven approach presents significant growth potential for the bioconjugation market, attracting investment and collaboration across biotechnology and pharmaceutical sectors.

79% of bioconjugation innovators leveraged breakthroughs in bioorthogonal chemistry, click chemistry, and site-specific conjugation enabling precise, stable, and efficient drug delivery and diagnostic platforms with enhanced therapeutic index and reduced off-target effects.

-

Rising collaborations between biotechnology companies, research institutes, and pharmaceutical firms enable development of novel bioconjugated therapeutics and expand market potential globally

Strategic partnerships between biotech companies, academic research institutes, and pharmaceutical firms are accelerating the development of innovative bioconjugated drugs and diagnostic solutions. Collaborative research allows sharing of expertise, technology, and resources, reducing R&D timelines and risks. Such partnerships facilitate access to advanced conjugation techniques and novel therapeutic targets, expanding the portfolio of commercially viable products. Global collaborations also enable market entry into new regions and therapeutic areas. By leveraging joint capabilities, stakeholders can develop high-value, targeted therapies and diagnostics, significantly increasing adoption and growth potential of the bioconjugation market worldwide.

77% of bioconjugated therapeutic developers formed strategic collaborations with biotech firms, research institutes, and pharma partners accelerating innovation, streamlining clinical translation, and unlocking new global market opportunities.

Bioconjugation Market Segment Highlights

-

By Product Type: Crosslinkers & Coupling Reagents led with 34.6% share, while Click Chemistry Reagents is the fastest-growing segment with CAGR of 17.8%.

-

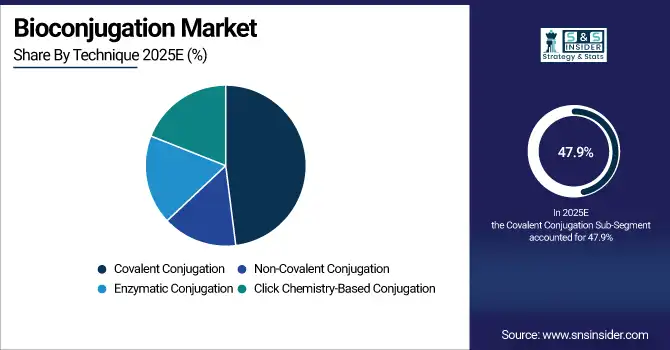

By Technique: Covalent Conjugation led with 47.9% share, while Click Chemistry-Based Conjugation is the fastest-growing segment with CAGR of 18.6%.

-

By Application: Therapeutics & Drug Delivery led with 38.4% share, while Antibody-Drug Conjugates (ADCs) is the fastest-growing segment with CAGR of 19.3%.

-

By End User: Pharmaceutical & Biotechnology Companies led with 44.1% share, while Contract Research Organizations (CROs) are the fastest-growing segment with CAGR of 16.9%.

Bioconjugation Market Segment Analysis

By Product Type: Crosslinkers & Coupling Reagents led, while Click Chemistry Reagents is the fastest-growing segment.

Crosslinkers & Coupling Reagents dominate the bioconjugation market because they form the foundational chemistry enabling stable and reproducible biomolecule conjugation. These reagents are extensively used in antibody labeling, protein modification, and diagnostic assay development due to their high efficiency and broad compatibility. Their widespread adoption across pharmaceutical, biotechnology, and academic research laboratories ensures consistent demand. Strong regulatory acceptance, established protocols, and routine usage in both research and commercial-scale applications reinforce their leading market position within the product type segment.

Click Chemistry Reagents represent the fastest-growing product segment due to their superior selectivity, rapid reaction kinetics, and minimal side reactions. Their ability to produce highly stable conjugates under mild conditions makes them ideal for advanced therapeutics, imaging agents, and biomolecular labeling. Growing use in targeted drug delivery, precision diagnostics, and next-generation biopharmaceutical development is accelerating adoption. Additionally, increasing investment in innovative conjugation platforms and the expansion of ADC pipelines further support the rapid growth of click chemistry reagents globally.

By Technique: Covalent Conjugation led, while Click Chemistry-Based Conjugation is the fastest-growing segment.

Covalent Conjugation remains the dominant technique as it provides strong, irreversible bonds that ensure long-term stability of conjugated biomolecules. This technique is widely preferred in therapeutic development, diagnostics, and research applications where durability and consistency are critical. Its compatibility with a wide range of proteins, peptides, and antibodies makes it highly versatile. Established methodologies, regulatory familiarity, and proven performance across clinical and commercial applications continue to drive its leadership position within the bioconjugation techniques market.

Click Chemistry-Based Conjugation is the fastest-growing technique due to its precision, scalability, and reduced risk of altering biological function. The approach enables site-specific conjugation, which is increasingly required in advanced biologics and ADC development. Its efficiency under mild reaction conditions makes it suitable for sensitive biomolecules. Growing demand for high-purity conjugates, expansion of targeted therapies, and increased R&D investment in next-generation biopharmaceuticals are driving rapid adoption of click chemistry-based conjugation techniques.

By Application: Therapeutics & Drug Delivery led, while Antibody-Drug Conjugates is the fastest-growing segment.

Therapeutics & Drug Delivery dominate the application segment due to the critical role of bioconjugation in enhancing drug efficacy, targeting precision, and safety profiles. Bioconjugation technologies are widely used to improve pharmacokinetics, reduce systemic toxicity, and enable targeted delivery of biologics. The growing prevalence of chronic diseases, rising biologics approvals, and strong pharmaceutical R&D spending support sustained demand. Established use in monoclonal antibodies, vaccines, and peptide-based therapies further strengthens this segment’s leading position.

Antibody-Drug Conjugates represent the fastest-growing application as they combine targeted antibody specificity with potent cytotoxic payloads. Bioconjugation is essential for ensuring linker stability, controlled drug release, and therapeutic efficacy in ADCs. Rapid growth is driven by increasing oncology drug approvals, expanding ADC clinical pipelines, and strong investment from pharmaceutical companies. Advances in linker chemistry and site-specific conjugation techniques are further accelerating adoption, making ADCs a major growth driver within the bioconjugation market.

By End User: Pharmaceutical & Biotechnology Companies led, while Contract Research Organizations are the fastest-growing segment.

Pharmaceutical & Biotechnology Companies dominate the end-user segment due to their extensive use of bioconjugation in drug discovery, biologics development, and clinical research. These organizations leverage conjugation technologies to enhance drug targeting, stability, and therapeutic outcomes. Strong R&D budgets, large-scale production capabilities, and continuous innovation in biologics support sustained demand. Their central role in developing monoclonal antibodies, vaccines, and ADCs ensures that pharmaceutical and biotechnology companies remain the primary consumers of bioconjugation products and technologies.

Contract Research Organizations are the fastest-growing end-user segment as pharmaceutical and biotech firms increasingly outsource bioconjugation-related research to reduce costs and accelerate development timelines. CROs offer specialized expertise, advanced infrastructure, and scalable solutions for complex conjugation projects. Growing outsourcing of preclinical studies, analytical services, and ADC development is driving demand. Expansion of global CRO networks, particularly in Asia, and rising investment in biologics research further contribute to the rapid growth of this segment.

Bioconjugation Market Regional Analysis

North America Bioconjugation Market Insights:

North America dominated the Bioconjugation Market with a 45.50% share in 2025 due to its strong biopharmaceutical industry, high R&D investments, and presence of leading biotech and life science companies. Advanced research infrastructure, early adoption of antibody-drug conjugates, and supportive regulatory frameworks further strengthened regional market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Bioconjugation Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 14.98% from 2026–2033, driven by expanding biopharmaceutical manufacturing, rising investment in biotechnology research, and increasing demand for targeted therapies. Growing clinical trial activity, improving research infrastructure, and government support for life sciences innovation are accelerating regional market growth.

Europe Bioconjugation Market Insights

Europe held a significant share in the Bioconjugation Market in 2025, supported by a strong pharmaceutical and biotechnology base, extensive research collaborations, and rising adoption of advanced drug development technologies. Favorable regulatory support, increasing focus on targeted therapies, and continuous investment in life sciences research further strengthened Europe’s market position.

Middle East & Africa and Latin America Bioconjugation Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Bioconjugation Market in 2025, driven by expanding pharmaceutical manufacturing, improving research infrastructure, and increasing participation in clinical trials. Growing healthcare investments, rising awareness of targeted therapies, and gradual adoption of advanced bioconjugation techniques supported the regions’ emerging market presence.

Bioconjugation Market Competitive Landscape:

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. is a global leader in life sciences, offering a comprehensive portfolio of reagents, instruments, and services supporting bioconjugation applications. The company plays a vital role in antibody–drug conjugates, protein labeling, and biomolecule modification used in research, diagnostics, and therapeutics. With strong R&D capabilities and a broad global footprint alpha, Thermo Fisher enables pharmaceutical and biotechnology companies to accelerate drug discovery, development, and scalable manufacturing of advanced bioconjugated products.

-

March 2024, Thermo Fisher Scientific launched its Bioconjugation Center of Excellence, a dedicated facility offering integrated services for ADC and bioconjugate development from payload synthesis to GMP manufacturing.

Merck KGaA

Merck KGaA is a leading science and technology company with a strong presence in bioconjugation through its life science business. The company provides high-purity reagents, linkers, and conjugation technologies essential for antibody–drug conjugates and targeted therapeutics. Merck focuses on innovation, process optimization, and regulatory-compliant manufacturing solutions. Its extensive expertise supports biopharmaceutical companies in developing safe, effective, and scalable bioconjugated drugs across research, clinical development, and commercial production stages.

-

November 2023, Merck KGaA (operating its life science business as MilliporeSigma) significantly expanded its SAFC Bioconjugation Portfolio, introducing novel cleavable and non-cleavable linkers, topoisomerase I inhibitors (e.g., exatecan derivatives), and site-specific conjugation reagents.

Danaher Corporation

Danaher Corporation is a diversified global science and technology company with significant involvement in bioconjugation through its life sciences subsidiaries. The company offers advanced analytical instruments, bioprocessing tools, and reagents that support conjugation workflows in biologics and targeted therapies. Danaher emphasizes precision, automation, and quality, enabling efficient development and manufacturing of bioconjugated products. Its strong focus on innovation and operational excellence positions it as a key enabler of next-generation biologics and antibody-based therapeutics.

-

January 2025, Danaher through its Cytiva (bioprocessing) and Pall (filtration) operating companies launched an integrated Bioconjugation Solutions Suite for scalable, closed-system ADC manufacturing.

Bioconjugation Market Key Players

Some of the Bioconjugation Market Companies are:

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

Danaher Corporation

-

Lonza Group

-

AbbVie Inc.

-

Sartorius AG

-

AstraZeneca plc

-

Roche / Genentech

-

Seagen Inc.

-

Pfizer Inc.

-

Creative Biolabs

-

Abcam plc

-

Bioconjugate Technologies

-

Agilent Technologies

-

Catalent, Inc.

-

BD (Becton Dickinson)

-

Charles River Laboratories

-

GenScript Biotech Corporation

-

Piramal Pharma Limited

-

WuXi Biologics Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.46 Billion |

| Market Size by 2033 | USD 14.51 Billion |

| CAGR | CAGR of 13.05% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Crosslinkers & Coupling Reagents, Activated Esters & NHS Esters, Click Chemistry Reagents, Linkers & Labels, Biotinylation Kits & Reagents) • By Technique (Covalent Conjugation, Non-Covalent Conjugation, Enzymatic Conjugation, Click Chemistry-Based Conjugation) • By Application (Diagnostics & Imaging, Therapeutics & Drug Delivery, Research & Development, Proteomics & Genomics, Antibody-Drug Conjugates (ADCs)) • By End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs), Diagnostic Laboratories, Healthcare & Clinical Research Centers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, Lonza Group, AbbVie Inc., Sartorius AG, AstraZeneca plc, Roche (Genentech), Seagen Inc., Pfizer Inc., Creative Biolabs, Abcam plc, Bioconjugate Technologies, Agilent Technologies, Catalent, Inc., BD (Becton Dickinson), Charles River Laboratories, GenScript Biotech Corporation, Piramal Pharma Limited, WuXi Biologics Co., Ltd. |