Bus Seat Market Size & Overview

Get More Information on Bus Seat Market - Request Sample Report

The Bus Seat Market Size was valued at USD 13.5 billion in 2023 and is expected to reach USD 21.67 billion by 2032 and grow at a CAGR of 5.4% by 2024-2032.

The growing global population necessitates efficient transportation solutions, making buses a popular choice due to their frequent operation and reliability. This growing demand for bus travel, encompassing coach, school, transfer, and transit options, fuels the bus seat market. The rising desire for comfortable and luxurious bus journeys, prompting increased production of specialized seats for various bus services.

Additional factors propelling the market growth include population surges, government investments in bus transportation, and the expansion of private and tourism sectors due to rising disposable incomes. Public transportation demand, particularly in urban areas, is a primary driver. As cities become more populated, the need for dependable, affordable, and comfortable public transport options intensifies. This has led to more buses on the road, consequently boosting demand for bus seats. Thus, the rise in disposable income and the growing tourism industry contribute to market growth, with tourists favouring buses for their affordability and convenience.

MARKET DYNAMICS:

KEY DRIVERS:

-

AI and IoT Enhance Bus Seat Solutions with Predictive Maintenance, Real-Time Monitoring, and Data-Driven Efficiency

By integrating artificial intelligence (AI) and Internet of Things (IoT) technologies, bus operators can now predict maintenance needs, monitor seats in real-time, and gather valuable data. This allows them to optimize bus performance and efficiency. Imagine seats that signal potential issues before they become problems, or systems that track passenger occupancy for better resource allocation. This tech-driven approach to bus seats is revolutionizing how we manage and optimize public transportation.

-

Development of innovative bus seat products with advanced technology

RESTRAINTS:

-

High initial cost of seats with advanced features like AI and IoT integration can strain bus operator budgets.

-

Potential for complex maintenance and repairs of tech-integrated bus seats could discourage some operators.

OPPORTUNITIES:

-

Development of lighter, more durable, and eco-friendly bus seat materials can reduce weight and improve fuel efficiency.

Bus seats are undergoing a material revolution. Manufacturers are developing next-generation materials that are lighter, more durable, and environmentally friendly. This shift has the potential to significantly impact both comfort and efficiency. Lighter seats translate to lighter buses, which can lead to improved fuel economy and reduced emissions. Additionally, these new materials can be designed to be more comfortable and last longer, boosting passenger satisfaction and reducing replacement costs.

-

Incorporating features like adjustable settings, temperature control, and in-seat entertainment can enhance passenger comfort and satisfaction.

CHALLENGES:

-

Investing in advanced features like AI and ergonomic designs can be expensive for bus operators.

-

Creating spacious seats for passenger comfort can be difficult on buses with limited capacity.

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing Russia-Ukraine war is impacting the bus seat market in several ways. The supply chain disruptions caused by the conflict can lead to shortages of raw materials needed for bus seat production. This could potentially drive up material costs and delay bus seat deliveries. The war has exacerbated the global energy crisis, leading to rising fuel prices. As bus manufacturers struggle with more expensive fuel, they may be forced to cut costs elsewhere, potentially impacting bus seat quality or innovation. Thus, it's important to note the impact might be indirect. A specific value on the impact is difficult to quantify at this stage due to the evolving nature of the conflict. However, there is a potential 5-10% increase in bus seat material costs in the short term, depending on the material and region. This could lead to a slight rise in bus seat prices for operators.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the bus seat market in a few key ways. It can lead to reduced government spending on public transportation infrastructure, potentially stalling bus fleet expansion and limiting demand for new bus seats. This is further compounded by a decline in ridership as people, facing limited budgets, opt for cheaper travel options or carpool more frequently. There is a potential decline of 5-10% in ridership during economic downturns. This translates to lower revenue for bus operators, making them hesitant to invest in upgrades or new buses, which would require additional bus seats. Additionally, with job cuts and reduced disposable income, consumer demand for features like premium seating or enhanced comfort features may decline. Bus seat manufacturers may look towards developing more cost-effective yet durable materials to cater to budget-conscious operators. They may also focus on solutions that improve operational efficiency, such as seats with easier maintenance or longer lifespans, to help companies navigate financial constraints.

KEY MARKET SEGMENTS:

By Components

-

Frame

-

Upholstery

-

Other Accessories

Frame is the dominating sub-segment in the Bus Seat Market by components holding around 40-45% of market share. The frame is the core component of a bus seat, providing structural support and impacting safety, durability, and weight. It represents the largest market share due to its critical role.

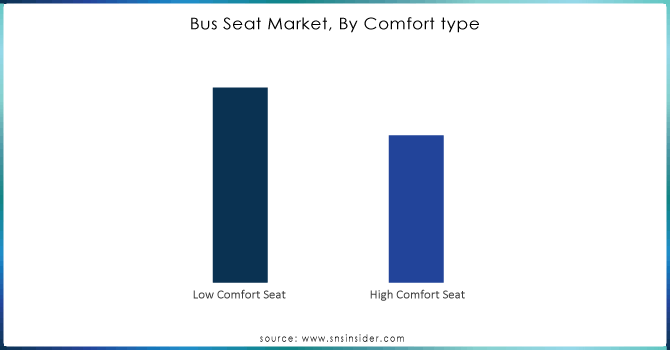

By Comfort type

-

Low Comfort Seat

-

High Comfort Seat

Low Comfort Seat is the dominating sub-segment in the Bus Seat Market by comfort type holding more than 55% of market share. Low-comfort seats are the most common in transit buses and some school buses due to their affordability and space optimization. They cater to shorter trips where basic functionality is prioritized.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Seat Type

-

Regular Passenger Seat

-

Recliner Seat

-

Folding Seat

-

Bus Driver Seat

-

Integrated Child Seat

Regular Passenger Seat is the dominating sub-segment in the Bus Seat Market by seat type holding around 65-70% of market share. Regular passenger seats are the most widely used type across various bus categories (transit, coach, transfer) due to their versatility and ability to accommodate a high number of passengers.

By Bus Type

-

Transit bus

-

Coach bus

-

School Bus

-

Transfer Bus

-

Other

Transit Bus is the dominating sub-segment in the Bus Seat Market by bus type. Transit buses operate with high passenger frequency and require seats that are durable, easy to maintain, and optimize space. Regular passenger seats and low-comfort seats are most common in this segment.

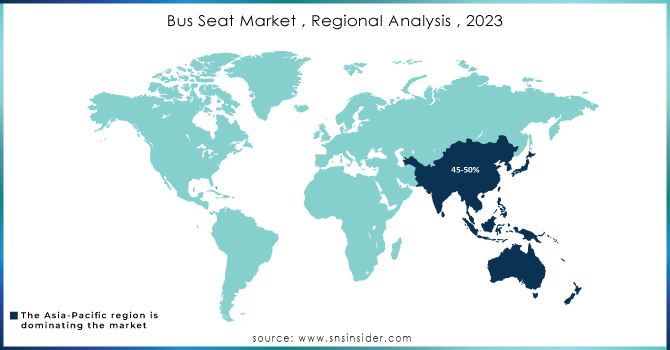

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Bus Seat Market holding 45-50% of market share, fueled by rapid urbanization, a large population base, and government investments in public transportation. This region's growing economies are also creating a demand for more comfortable bus travel experiences, potentially increasing demand for premium bus seats.

Europe is the second highest region in this market due to its established public transportation infrastructure, focus on sustainability and strict safety regulations.

North America is experiencing the fastest growth with the growth rate of 8-10% is due to rising traffic congestion, air pollution concerns, and advancements in smart bus technology that are making buses more attractive to commuters.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are GRAMMER AG (Germany), Magna International Inc. (Canada), Freedman Seating Company (US), Faurecia (France), Franz Keil GmbH (Germany), Adient (US), ISRINGHAUSEN GmbH(Germany), NHK Springs (Japan), Toyota Boshoku (Japan), Lear Corporation(US), Tachi-S (Japan), Minda Industries (India), Commercial Vehicle Group(US), Lazzerini SRL (Italy) and other key players.

RECENT DEVELOPMENTS

-

In March 2022: Toyota Boshoku has reached an agreement with Aisin Corporation and Shiroki Corporation. The deal involves acquiring Shiroki's commercial rights for automotive seat frame components and Aisin's seat frame manufacturing unit. This move strengthens Toyota Boshoku's position in the automotive seat supplier market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.5 Billion |

| Market Size by 2032 | US$ 21.67 Billion |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Frame, Upholstery, Other Accessories) • By Comfort type (Low Comfort Seat, High Comfort Seat) • By Seat Type (Regular Passenger Seat, Recliner Seat, Folding Seat, Bus Driver Seat, Integrated Child Seat) • By Bus TypE (Transit bus, Coach bus, School Bus, Transfer Bus, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | GRAMMER AG (Germany), Magna International Inc. (Canada), Freedman Seating Company (US), Faurecia (France), Franz Keil GmbH (Germany), Adient (US), ISRINGHAUSEN GmbH(Germany), NHK Springs (Japan), Toyota Boshoku (Japan), Lear Corporation(US), Tachi-S (Japan), Minda Industries (India), Commercial Vehicle Group(US), Lazzerini SRL (Italy) |

| Key Drivers | • The use of environmentally friendly and recyclable materials in the creation of seats, as well as recycled metals in the production. • Governments are urging bus seat producers to adopt environmentally friendly biodegradable materials. |

| RESTRAINTS | • Seat replacement in buses is not a realistic solution for long-term company operations. • Many bus fleet firms are wary about taking on contracts to replace seats on older buses. |