Clinical WorkFlow Solutions Market Key Insights:

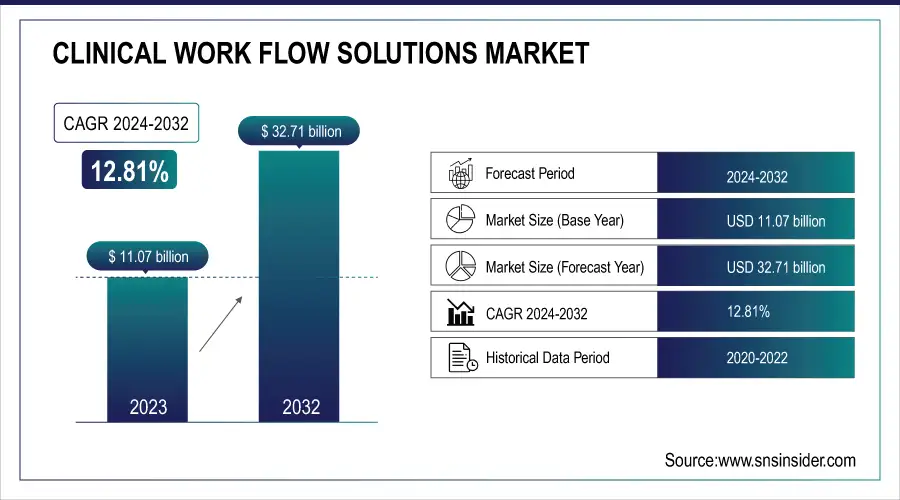

The Clinical Workflow Solutions Market Size was valued at USD 11.07 billion in 2023 and will reach USD 32.71 billion by 2032, growing at a CAGR of 12.81% over the forecast period of 2024-2032. The clinical workflow solutions market is experiencing rapid growth due to the growing efforts of public and private organizations to enhance healthcare delivery. For instance, CenTrak's WorkflowRT platform, introduced in January 2023, showcases how technological progress is enhancing communication and workflow in clinical care. This flexible platform, which is based in the cloud, enhances patient movement, decreases dependence on manual documentation, and detects workflow interruptions, thereby supporting market growth.

According to a survey by Healthcare IT Leaders in 2023, more than 33% of healthcare institutions are incorporating AI solutions, while another 25% are testing AI pilot initiatives. These solutions improve communication between hospital departments, leading to better patient care, increased transparency, and more efficient management of large amounts of medical data. Clinical workflow solutions are crucial for improving patient outcomes and ensuring that healthcare providers can deliver high-quality care by making workflows more adaptable and effective.

Get More Information on Clinical Work Flow Solutions Market - Request Sample Report

It is anticipated that the clinical workflow solutions market will experience consistent growth in the upcoming years. The increase in elderly individuals has led healthcare facilities to focus on incorporating clinical workflow solutions in various departments to improve documentation workflows, manage administrative and healthcare staff more efficiently, and easily access necessary patient data for decision-making, driving market growth. Furthermore, the market growth is propelled by an increase in R&D investments by pharmaceutical companies, expanding healthcare expenditure, and advancements in technology.

Clinical Work Flow Solutions Market Dynamics

Drivers

-

Increasing Demand for Healthcare Digitalization and Automation of clinical workflow

The healthcare industry is quickly integrating digital technologies to enhance efficiency, lower costs, and improve patient care. Clinical workflow solutions play a crucial role in this transition, especially by streamlining daily tasks and incorporating different systems such as Electronic Health Records (EHR) and Health Information Exchange (HIE). According to a recent survey by Becker’s Healthcare, around 30% of hospitals, health systems, and transplant centers are currently utilizing clinical workflow automation, and it is predicted to increase to 61% by 2024. These systems simplify intricate healthcare procedures, allowing for quicker decision-making and better management of patient data accuracy. Consequently, healthcare professionals are progressively utilizing AI-driven workflow automation tools to decrease human errors and enhance overall productivity.

The increasing focus on digital health solutions in the industry is also fueling the need for workflow integration tools that enhance the accessibility of data. The healthcare sector is working towards digitization to handle increasing patient data and boost cooperation between different departments and specialties. This motion is essential for enhancing operational workflows and ultimately improving patient care quality.

-

Increasing emphasis on patient-centered care by clinical workflow

The move from focusing on the volume of healthcare services to focusing on the value of those services is changing the delivery of care, putting more emphasis on patient-centered methods. It can decrease face-to-face patient appointments by as much as 50%. Clinical workflow solutions play a vital role in aiding this transition by promoting improved communication, teamwork, and immediate information exchange within healthcare groups. These solutions aid in enhancing collaboration among doctors, nurses, and other healthcare professionals to deliver individualized care that enhances patient results. Hospitals and long-term care facilities are increasingly using care collaboration tools to enable smooth communication among different teams, guaranteeing thorough care coordination for every patient.

With patient-centered care gaining importance, there is an increasing need for technologies that assist in effective care coordination. It Reduces time dedicated to administrative tasks by as much as 80%. The systems allow healthcare providers to monitor patient advancement, exchange important information promptly, and make educated choices that have a direct effect on patient contentment and recuperation. Incorporating care coordination solutions into clinical processes is crucial for lowering hospital readmissions, boosting care quality, and increasing patient satisfaction.

Restraint

-

High cost of implementation and maintenance of clinical workflow

Utilization of cutting-edge technologies like AI and ML, typically needs a substantial initial investment in both software and infrastructure. Additionally, the continuous expenses linked to updates, integration, and training for employees can contribute to the financial strain, particularly for smaller healthcare providers.

As an example, the typical cost of clinical workflow solutions worldwide can vary from USD100,000 to USD1 million, depending on the healthcare facility's size and the complexity of the solutions that are put in place.

The significant expense may pose a major obstacle, especially in developing countries and smaller medical facilities with restricted funds, hindering efforts to achieve widespread acceptance. Moreover, the requirement for skilled experts to manage these sophisticated systems increases operational costs.

Clinical Work Flow Solutions Market Segmentation Overview

By type

In 2023, the data integration solutions segment dominated the market by over 27%. Healthcare providers prefer data integration systems because they help integrate data to manage the growing costs and volumes of information. Hospitals and other caregivers are increasingly implementing integrated systems that allow patients to access their information while receiving care. This propelled the market expansion for data integration systems in 2023. Regulatory reforms and requirements, interoperability solutions, increased adoption of electronic medical records, and a shift towards value-based services have driven the growth of the sector.

The care collaboration solutions segment has seen the fastest growth in recent years and is projected to experience increasing demand throughout the forecast period. This can be credited to the growing focus on patient-centered services. The increasing amount of patients worldwide is also driving market players to create better and more efficient solutions. Care management solution offers efficient workflow methods and enhances patient care, leading to savings in both cost and time.

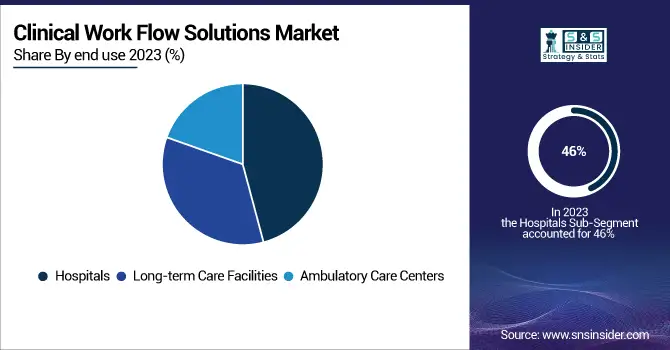

By end use

The hospitals segment dominated the market at 46% of the market share in 2023 Due to the increasing number of healthcare facilities and associated data needing effective management and privacy. Moreover, government efforts in different areas to streamline and improve data management in healthcare are expected to drive growth in the market. Moreover, the West Health Institute (WHI) stated that increased use of interoperability solutions could lead to significant cuts in healthcare costs in the United States.

Furthermore, the market is expected to experience growth during the analysis period due to the increasing prevalence of connected hospitals and efficient management solutions. The increasing need for cohesive critical clinical communications, coordinated care delivery, and efficient call scheduling processes are major factors driving the segment's considerable revenue share.

However, ambulatory care centers are expected to experience the fastest growth during the forecast period. This is primarily because of an increase in the number of out-patient admissions at healthcare facilities. The incorporation of IT solutions in outpatient clinics significantly decreases errors in medical care and improves communication between pharmacies, doctors, nurses, and patients' families.

Clinical Work Flow Solutions Market Regional Analysis

In 2023, North America dominated the clinical workflow solutions market with a 43% revenue share. The increasing amount of research and development projects and admissions of patients to hospitals are causing a significant increase in the amount of data being produced. Furthermore, the rise in government programs promoting the efficient utilization of interoperability, EHR, and other tools, coupled with a strong emphasis on patient care and increasing healthcare investments in digitization for secure data sharing among companies, are factors driving North America's dominant revenue share.

Need Any Customization Research On Clinical Work Flow Solutions Market - Inquiry Now

During the forecast period, the Asia Pacific region is anticipated to experience the fastest growth rate, with a predicted CAGR of 15%. The medical industry is experiencing growth due to the high demand for healthcare information technology solutions. Government efforts that back the adoption of eHealth, enhance healthcare infrastructure, increase medical tourism, and strong demand for quality healthcare services also drive the expansion of the clinical workflow solutions sector in the Asia Pacific region.

Key Players in Clinical Work Flow Solutions Market

-

Cerner Corporation (CareAware Connect, HealtheIntent)

-

Epic Systems Corporation (EpicCare Inpatient Clinical System, MyChart Bedside)

-

Allscripts Healthcare LLC (Sunrise Clinical Manager, Allscripts CareInMotion)

-

NXGN Management LLC (NextGen Office, NextGen Enterprise EHR)

-

McKesson Corporation (Paragon Clinicals, Horizon Clinicals)

-

Koninklijke Philips N.V. (Philips IntelliSpace PACS, Philips Tasy EMR)

-

GE Healthcare (Centricity Clinical Workflow, Mural Virtual Care Solution)

-

Hill-Rom Services, Inc. (NaviCare Clinical Workflow Suite, Voalte Mobile)

-

Vocera Communications (Vocera Platform, Vocera Smartbadge)

-

Stanley Healthcare (AeroScout Real-Time Location System, MobileView Analytics)

-

Cisco Systems, Inc. (Cisco Unified Communications Manager, Webex for Healthcare)

-

Oracle Cerner (PowerChart Ambulatory, Millennium EHR)

-

IBM Watson Health (IBM Micromedex, Watson Health Imaging)

-

Siemens Healthineers (syngo Workflow Solutions, Atellica Diagnostics IT)

-

athenahealth, Inc. (athenaClinicals, athenaCoordinator)

-

eClinicalWorks (eClinicalWorks EHR, Healow Telehealth Solutions)

-

Meditech (Expanse EHR, Expanse Virtual Care)

-

Change Healthcare (InterQual Clinical Decision Support, Workflow Intelligence)

-

Optum, Inc. (Optum Clinical Manager, Optum Physician Advisor Solutions)

-

CenTrak (WorkflowRT, Clinical RTLS Solutions)

Key Suppliers

These suppliers provide the hardware, software, and services necessary for enabling the technologies integrated into clinical workflow systems used by major market players.

-

Intel Corporation

-

Dell Technologies

-

IBM

-

Microsoft Corporation

-

Cisco Systems

-

Honeywell International Inc.

-

SAP SE

-

Salesforce

-

Oracle Corporation

-

3M Health Information Systems

Recent Developments

-

In September 2024, Oracle Cerner, also known as Oracle Health, offers cloud-based EHR software solutions utilized by health organizations across various sizes and specialties. The Cerner system is utilized to improve administrative procedures and deliver high-quality healthcare services to patients.

-

In October 2024, Altera Digital Health, a prominent global health IT company, declared today the availability of Paragon Denali, an electronic health record (EHR) integrated into the Microsoft Azure cloud platform. By utilizing a software-as-a-service (SaaS) approach, Paragon Denali offers cloud-based features and containerized services to rural, critical access, and community hospitals. This enhances system dependability and data availability, leading to organizational expansion and enhanced user satisfaction.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.07 Billion |

| Market Size by 2032 | USD 32.71 Billion |

| CAGR | CAGR of 12.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Data Integration Solutions, Real-time Communication Solutions, Workflow Automation Solutions, Care Collaboration Solutions, Enterprise Reporting & Analytics Solutions) •By End-user (Hospitals, Long-term Care Facilities, Ambulatory Care Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare LLC, NXGN Management LLC, McKesson Corporation, Koninklijke Philips N.V., GE Healthcare, Hill-Rom Services, Inc., Vocera Communications, Stanley Healthcare, Cisco Systems, Inc., Oracle Cerner, IBM Watson Health, Siemens Healthineers, athenahealth, Inc., eClinicalWorks, Meditech, Change Healthcare, Optum, Inc., and CenTrak. |

| Key Drivers | •Increasing Demand for Healthcare Digitalization and Automation of clinical workflow •Increasing emphasis on patient-centered care by clinical workflow |

| Restraints | •High cost of implementation and maintenance of clinical workflow |