Coal Bed Methane Market Report Scope & Overview:

The Coal Bed Methane Market size is valued at USD 19.86 Billion in 2025E and is projected to reach USD 33.53 Billion by 2033, growing at a CAGR of 6.78% during 2026-2033.

The Coal Bed Methane Market analysis highlights the increasing prominence of CBM as a more affordable and sustainable substitute to regular natural gas. New areas of energy consumption and ecological awareness are motivating corporations to invest in exploration and research of CBMs.

Coal Bed Methane emits 30–50% less CO₂ than coal and avoids flaring, making it a transitional fuel in national energy strategies like India’s and the U.S. Methane Action Plan

Market Size and Forecast:

-

Market Size in 2025E: USD 19.86 Billion

-

Market Size by 2033: USD 33.53 Billion

-

CAGR: 6.78% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Coal Bed Methane Market - Request Free Sample Report

Coal Bed Methane Market Trends

-

Horizontal and multilateral drilling significantly improves methane recovery rates and cuts costs.

-

The preference for CBM in power generation will facilitate a cleaner energy switch and minimize demand for traditional fossil fuels.

-

The overall attention to unconventional gas resources fuels CBM development in new markets such as Asia-Pacific and Eastern Europe.

-

Measurement of well performance using IOT sensors and real-time analytics support producers to maximize gas deployment while meeting environmental requirements.

-

Positive legislation and tax breaks for the sector will boost private investment in CBM mining, development, and technology use globally.

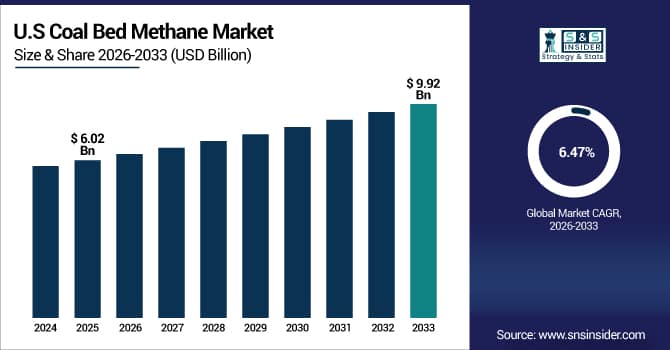

The U.S. Coal Bed Methane Market size is valued at USD 6.02 Billion in 2025E and is projected to reach USD 9.92 Billion by 2033, growing at a CAGR of 6.47% during 2026-2033. Coal Bed Methane Market growth is driven by one of the most mature and technologically advanced in the global arena. The vast feedstock reserves within basins like Powder River and San Juan have resulted in continued production.

Coal Bed Methane Market Growth Drivers:

-

Growing Shift Toward Cleaner Energy Sources and Sustainable Natural Gas Alternatives

The growing global trend of reducing carbon emissions and switching to cleaner, greener energy is driving coal bed methane for power generation applications. As an unconventional source of eco-friendly low-emission natural gas, the CBM power generation facility offers a sustainable alternative to coal and natural gas. Additionally, the natural gas powers industrial machinery while being used for residential heating. The development of drilling technologies and dewatering enhances the system efficiency. The CBM renewables sector could benefit from its fair share in clean energy production in the coming years given the favorable policy environment in most markets globally.

Coal Bed Methane (CBM) emits up to 50% less CO₂ than coal when used for power generation, positioning it as a transitional fuel in national decarbonization strategies

Coal Bed Methane Market Restraints:

-

High Extraction Costs and Environmental Challenges in CBM Production and Water Management

Their high capital and equipment costs as well as the complexity of the extraction technology. The CBM extraction process, given the extensive dewatering, requires a substantial upfront investment in specialized infrastructure and equipment. Producing water, which frequently contains harmful elements, poses environmental and regulatory challenges due to the extraction and handling specifics. The variability of the gas flow rates, difficulties in land acquisition, and stringent environmental regulations reduce the number of feasible projects. These trends may depress the CBM utilization in markets with underdeveloped extraction technologies or unfriendly government policies.

Coal Bed Methane Market Opportunities:

-

Expanding CBM Utilization in Power Generation and Industrial Energy Applications

Power Generation and Industrial Energy Utilization Growth The growing need for cleaner, reliable energy provides a significant opportunity for increasing CBM’s share of energy use. Governments and industrial players are increasingly looking at using CBM to fuel power generation plants, industrial facilities, and replace coal and the carbon-intensive fuels. The growing number of established infrastructure programs, favorable government arrangements, and the development of gas recovery technology increase project feasibility. The Asian and Pacific rotations, and particularly the Indian and Chinese markets, are significantly invested in exploring CBM possibilities, boosting the industry sector’s growth and future.

Global CBM-based power generation capacity reached 7.2 GW in 2025, with China and India accounting for 65% of new installations to replace coal-fired plants

Coal Bed Methane Market Segment Analysis

-

By technology, De-watering led the Coal Bed Methane market with a 55.16% share in 2025, while Fracturing emerged as the fastest-growing segment, registering a CAGR of 8.30%.

-

By application, Power Generation dominated the market, accounting for 50.35% share in 2025, whereas Transportation Fuel is projected to grow at the fastest rate with a CAGR of 9.34%.

-

By end-user, Electricity Generation led with a 45.31% share in 2025, while Chemical Production recorded the highest growth rate at a CAGR of 7.25%.

-

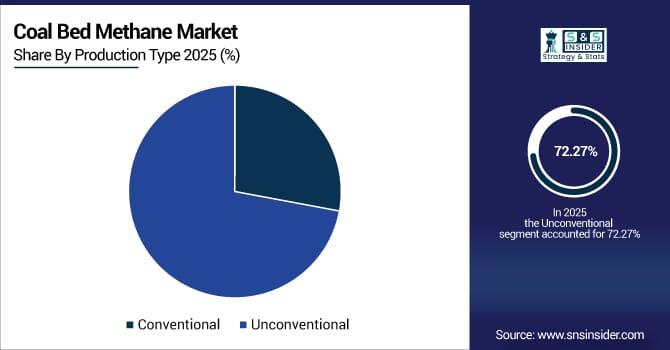

By production type, Unconventional methods held the largest share of 72.27% in 2025 and are expected to remain the fastest-growing segment with a CAGR of 6.58%.

By Technology, De-watering Leads Market While Fracturing Registers Fastest Growth

The de- watering segment dominate the market due to the need for initial gas extraction of the hydrostatic pressure in coal seams and its efficiency in enhancing methane recovery rates and minimizing operational downtime in most major CBM projects, this technology continues to dominate the market. The Fracturing technology shows rapid growth duet to increase in the demand for low-yield reservoir excavation has been improved and increased in gas flow rates. This growth can be attributed to the ongoing development of hydraulic fracturing technologies and use of cleaner extraction fluids.

By Application, Power Generation Dominate While Transportation Fuel Shows Rapid Growth

The power generation has been the leading driver in application due to rising global demand for clean, efficient, and reliable sources of energy. In terms of specifications, the CJM efficiency offers noticeably low carbon emissions compared to conventional coal fuel. This fits well with global sustainability and energy transition ambitions. While, the transformation of CBM into transportation fuel has increased by application over the years. This is due to consistent improvements in gas compression, storage, and ease of distribution across the world. Other rising factors include the global support of the automotive industry that calls for alternative low-emission fuels.

By End-User, Electricity Generation Lead While Chemical Production Registers Fastest Growth

Electricity generation retains its lead position as the dominant end-user in the coal bed methane market. Power plants continue to shift from coal to natural gas and advanced cleaner energy solutions, driving the increased usage of natural gas, the cleanest hydrocarbon compared to oil and coal. Demand for stable, long-lasting, and sustainable power generation technologies drives electricity generation’s strong market share. Meanwhile, chemical production is the fastest-growing segment, with CBM gaining growing usage as a feedstock to produce methanol, ammonia, and hydrogen. This can be traced to industrial decarbonization and rising global demand for greener chemical manufacturing processes.

By Production Type, Unconventional Lead and Grow Fastest

Unconventional production methods lead the coal bed methane market, thanks to their ability to extract gas from complex, low-permeability coal seams. Combined, these methods recover more CMB and produce for longer periods per unit cost. Moreover, growing investment in innovative drilling, horizontal well design, well drilling, and enhanced de-watering technology enhances unconventional production efficiency. As conventional gas supplies dwindle, the importance of unconventional production methods grows rapidly to meet escalating global energy demand. As a result, coal bed methane’s growth is assured, while it continues to grow its strategic importance in the increasingly matured natural gas market.

Coal Bed Methane Market Regional Analysis:

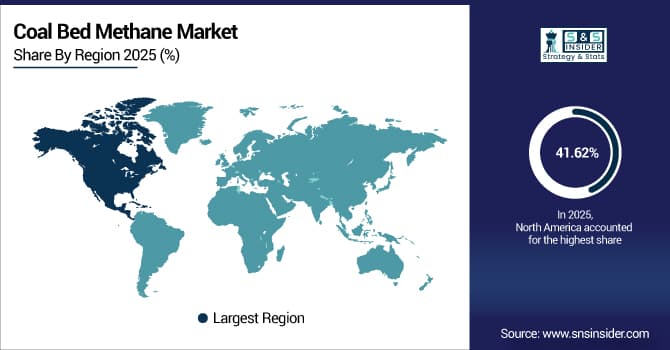

North America Coal Bed Methane Market Insights

In 2025 North America dominated the Coal Bed Methane Market and accounted for 41.62% of revenue share, this leadership is due to the highly technologically innovated, and among the leading producers of CBM the U.S. Major established basins in the U.S. include Powder River and Appalachian. The region is characterized by good leadership and regulation standards, including the strong drilling capacity and already established wells. Increased focus on clean energy premises and less use of coal is driving the CBM search.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Coal Bed Methane Market Insights

U.S. market has grown due to adoption of modern extraction technologies such as horizontal drilling and enhanced de-watering technologies. The country has the capacity to have CBM potential basins such as Powder River and San Juan. Large scale extractions are made possible due to sustainable development methods with the help of stable energy policies like the support given to the unconventional gas source.

Asia-pacific Coal Bed Methane Market Insights

Asia-pacific is expected to witness the fastest growth in the Coal Bed Methane Market over 2026-2033, with a projected CAGR of 7.56% due to abundant coal reserves and government encouragement on unconventional gas production. India, China, and Australia are major investors in exploring the CBM to cope with the increasing energy demand. The gas recovery rate is improving due to advanced drilling and de-watering that are practiced in the region. The commitment to reduce coal consumption is driving CBM faster as alternative energy involution option.

China Coal Bed Methane Market Insights

China is leading in the fastest-growing CBM market, mainly contributed by the abundant coal resources and a particular emphasis on clean energy. The country invested heavily in infrastructure and exploration. Shanxi and Inner Mongolia are among the regions where the country has invested much in CBM mining.

Europe Coal Bed Methane Market Insights

In 2025, Europe emerged as a promising region in the Coal Bed Methane Market, due to growing energy security concerns and efforts to develop local, cleaner energy sources. The United Kingdom, Poland, and Germany are at the forefront of CBM exploration taking actions to revolutionize their national energy policies. Advanced drilling technologies and regulatory policies have created favorable conditions for pilot CBM projects throughout the region.

Germany Coal Bed Methane Market Insights

Germany shows a relatively new and poorly developed CBM market fueled by its aspirations for energy diversification and decarbonization. The country explores its coal-rich resources to calculate potential CBM reserves and test commercial viability.

Latin America (LATAM) and Middle East & Africa (MEA) Coal Bed Methane Market Insights

The Coal Bed Methane Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the vast untapped resources. South Africa, Mozambique, and Brazil are investing in CBM to ensure domestic energy security and decrease reliance on imports. However, these countries have limited infrastructure and investments necessary for large-scale CBM development. Nonetheless, local governments and energy corporations show interest in CBM, signaling potential growth.

Coal Bed Methane Market Competitive Landscape:

Chevron Corporation is major player in the Coal Bed Methane market with a high focus on methane recovery and extraction integrated into the company’s sustainable energy efforts. I believe the use of advanced extraction and drilling technologies allows Chevron Corporation to achieve higher levels of methane recovery and reduce production and processing costs. In addition, the company’s focus on creating low-carbon solutions and sustainable energy results in the growing role of the CBM industry in cleaner energy production and a more diverse supply of natural gas across the globe.

-

In August 2024, Chevron announced a US$1 billion Engineering & Innovation Excellence Center (“ENGINE”) in Bengaluru, India, aimed at leveraging India’s deep technology talent for Chevron’s global operations.

ExxonMobil Corporation pursues large-scale exploration and production projects enhanced by the company’s reservoir modeling and subsurface technologies. CNG Australia indicates the scope of ExxonMobil’s exploration projects over the last two years includes 1.7 million acres. ExxonMobil has continuously invested in technologically enhanced production through horizontal drilling, along with extraction efficiency and decreased de-watering costs.

-

In September 2024, ExxonMobil partnered with Abu Dhabi National Oil Company (ADNOC) to develop a low-carbon hydrogen and ammonia facility in Baytown, Texas, capable of ~1 billion cf/day hydrogen and ~1 million tons/year ammonia.

Royal Dutch Shell plc is one of the entities that are targeted at sustainable extraction of CBM. It mentions the enhanced technologies of gas recovery and CBM extraction. The organization also seeks to diversify its energy sources and applications, aiming to provide enterprises and individuals with cleaner fuels. Moreover, it has established cooperation in the development and exploration spheres, is investing in various projects to increase its global market share and improve its innovative agenda.

-

In September 2025, Shell entered into a multi-year liquefied biomethane supply agreement with Hapag-Lloyd AG, aimed at advancing marine sector decarbonization by providing low-carbon fuel alternatives for shipping operations. This partnership underscores Shell’s strategic focus on cleaner maritime energy solutions and net-zero ambitions.

ConocoPhillips Company is another significant player in the CBM market. From the perspective of its technical experience in developing unconventional gas and efficient reservoir management, the entity seeks to support CBM extraction. Furthermore, this company pays significant attention to the level of CBM unification. Peace that they are exploring different aspects of this resource for successful expansion.

-

In February 2025, ConocoPhillips completed the acquisition of Marathon Oil Corporation, strengthening its portfolio of unconventional gas and shale assets across the United States. This strategic move expanded the company’s resource base and reserve replacement capacity, enhancing its competitiveness in the natural gas and energy transition markets while supporting long-term production growth and operational.

Coal Bed Methane Market Key Players:

Some of the Coal Bed Methane Market Companies are:

-

Chevron Corporation

-

ExxonMobil Corporation

-

Royal Dutch Shell plc

-

ConocoPhillips Company

-

BP plc

-

TotalEnergies SE

-

Santos Ltd.

-

Peabody Energy Corporation

-

China United Coalbed Methane Co., Ltd.

-

Essar Oil Limited

-

Reliance Industries Limited

-

Senex Energy Limited

-

Arrow Energy Pty Ltd

-

Methanex Corporation

-

Metgasco Ltd

-

Fortune Oil PLC

-

PetroChina Company Limited

-

Baker Hughes Company

-

Halliburton Company

-

Blue Energy Ltd

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 16.96 Billion |

| Market Size by 2033 | USD 33.53 Billion |

| CAGR | CAGR of 6.78% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (De-watering, Gas Recovery, Fracturing, and Vertical Drilling) • By Application (Power Generation, Industrial Applications, Residential Heating, and Transportation Fuel) • By End Use (Electricity Generation, Heating, and Chemical Production) • By Production Type (Conventional and Unconventional) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell plc, ConocoPhillips Company, BP plc, TotalEnergies SE, Santos Ltd., Peabody Energy Corporation, China United Coalbed Methane Co., Ltd., Essar Oil Limited, Reliance Industries Limited, Senex Energy Limited, Arrow Energy Pty Ltd, Methanex Corporation, Metgasco Ltd, Fortune Oil PLC, PetroChina Company Limited, Baker Hughes Company, Halliburton Company, and Blue Energy Ltd |