Computer Vision in Healthcare Market Report Scope & Overview:

Get more Information on Computer Vision in Healthcare Market - Request Sample Report

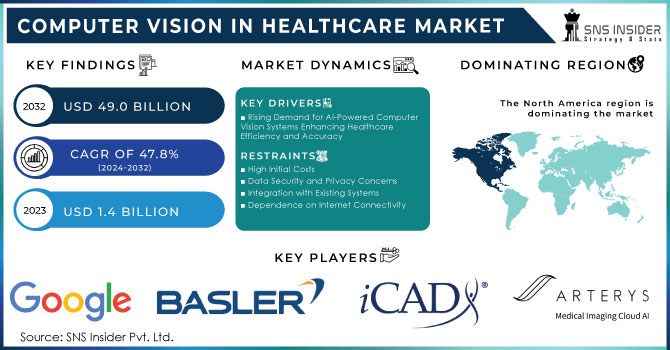

The Computer Vision in Healthcare Market Size was valued at USD 1.4 billion in 2023 and is expected to reach USD 49.0 billion by 2032 and grow at a CAGR of 47.8% over the forecast period 2024-2032.

The Global Computer Vision in Healthcare Market Sees Rapid Growth, Fueled by Technological Advancements

The global Computer Vision in Healthcare Market is experiencing rapid growth, driven by advancements in medical imaging, research, surgical assistance, and early disease detection technologies. Leveraging AI and machine learning, computer vision (CV) enhances diagnostic accuracy and efficiency, particularly in areas like tumor detection, cancer detection, and early disease recognition. Integrating CV with healthcare systems has significantly improved patient outcomes by enabling more precise diagnostics and treatment plans. In 2022, approximately 20 million new cancer cases were recorded globally, with 9.7 million deaths attributed to the disease. The most prevalent cancers included lung, breast, colorectal, prostate, stomach, liver, and cervical cancers. By 2040, the annual incidence of new cancer cases is projected to rise to 29.9 million.

CV algorithms enhance healthcare by improving diagnostic accuracy, with the potential to boost image diagnostics by up to 95%. These algorithms help detect tumors, fractures, and other anomalies in medical images. CV also enhances procedural efficiency by enabling faster diagnoses, such as radiologists using AI-powered solutions to speed up CT scan readings. It aids blood loss monitoring post-surgery by analyzing surgical materials, reducing the need for transfusions. Additionally, CV assists in fall detection, promptly alerting medical teams, and ensures safety by detecting smoke and fire hazards. In surgery, CV supports surgeons in preparing for operations, tracking instruments, and training staff, contributing to better outcomes and operational efficiency. For instance, a study by the National Library of Medicine (2020) found that AI systems could interpret CT scans with an accuracy rate of 90% to 95%, comparable to or exceeding that of human radiologists.

Rising Demand for Computer Vision Solutions in Healthcare

The demand for AI-powered computer vision solutions in healthcare is driven by their widespread use in medical imaging, a critical tool in diagnosing diseases such as cancer. AI-driven imaging analysis systems can detect tumors in early stages, significantly improving the chances of successful treatment. This has spurred demand among healthcare providers, particularly in oncology and radiology departments. Additionally, its applications in surgical assistance, where AI-driven systems guide surgeons during complex procedures, are fueling adoption. On the supply side, companies are increasingly focusing on AI-powered healthcare tools, driven by favorable government initiatives and regulatory support.

Government Regulations Supporting AI Integration in Healthcare

Government regulations are playing a key role in shaping the Computer Vision in Healthcare Market. Several countries have introduced policies to encourage AI usage in healthcare. In the U.S., the FDA has approved an increasing number of AI-driven medical devices, while Europe’s European Medicines Agency (EMA) has streamlined regulatory pathways for AI-based diagnostics and imaging tools. As of 2023, the FDA has cleared over 90 AI/ML-based medical devices, underscoring regulatory support. Meanwhile, the EU’s Medical Device Regulation (MDR) also promotes AI technology adoption in healthcare.

Market Dynamics

Drivers:

-

Rising Demand for AI-Powered Computer Vision Systems Enhancing Healthcare Efficiency and Accuracy

The healthcare sector is witnessing increased demand for AI-driven computer vision systems, driven by their transformative potential across various domains. The adoption of AI-powered CV solutions has surged due to their ability to offer improved patient care, faster and more accurate diagnostic image analysis, better medication adherence, and cost savings. AI-driven CV systems are highly appealing to stakeholders within the industry.

The integration of computer vision technology streamlines decision-making, minimizes human error, and enhances healthcare services' efficiency and effectiveness. Academic institutions and healthcare providers are increasingly adopting AI-based CV solutions. For example, in April 2024, CAD partnered with RAD-AID to advance breast cancer detection using AI in underserved regions. Additionally, in November 2023, ICAD’s AI technologies, in collaboration with GE Healthcare, facilitated faster breast cancer detection. These partnerships highlight computer vision’s expanding role in healthcare and are expected to drive market growth shortly.

Restraints:

-

High Initial Costs

-

Data Security and Privacy Concerns

-

Integration with Existing Systems

-

Dependence on Internet Connectivity

Key Segmentation

By Component:

In 2023, the hardware segment dominated the market, representing over 45.0% of global revenue. Key hardware components, including advanced imaging devices and sensors, are essential for the healthcare computer vision sector. Innovations in hardware technology continue to improve image quality and diagnostic accuracy. Medical imaging systems like MRI, CT scans, and X-rays rely on these components for capturing and processing critical diagnostic images. Additionally, wearable devices with CV capabilities are being increasingly used for patient monitoring, which depend on specialized hardware for visual data interpretation.

The software segment is expected to experience significant growth in the coming years. Software solutions integrated with AI are crucial to healthcare digitalization, addressing challenges like staff shortages and the rising volume of imaging scans. AI-enhanced software improves operational efficiency, providing healthcare providers with a competitive edge and driving strong market growth.

By Product Type:

In 2023, PC-based computer vision systems accounted for over 50.0% of revenue. These systems are primarily designed for image processing but require peripheral devices like data transfer and storage. Their affordability, upgradability, and ease of replacement drive market share. For instance, in August 2020, Omron Corporation launched the FJ2 PC-based camera system, offering advanced resolutions for color and monochrome visions.

The smart camera-based computer vision systems segment is projected to see significant demand growth. Built with embedded processing technology, these systems eliminate the need for external components, offering cost-effectiveness, compact design, and simplified integration.

By Application:

In 2023, the medical imaging and diagnostics segment led the market, contributing over 50.0% of global revenue. Integrating computer vision with AI has greatly improved medical imaging, enabling exceptional accuracy in image analysis and assisting healthcare professionals in detecting conditions more effectively. This has driven growth in this segment.

The surgeries segment is expected to grow significantly as complex surgical procedures increasingly rely on CV technologies for precise navigation and visualization. In particular, robot-assisted surgery is benefiting from CV’s ability to enhance the precision of minimally invasive procedures.

By End-User:

In 2023, healthcare providers accounted for over 55.0% of market revenue. Hospitals and clinics are increasingly adopting computer vision technologies to integrate with their healthcare systems, improving diagnostic accuracy, patient care, and workflow efficiency. Computer vision aids early detection, personalized treatment, and continuous patient monitoring, leading to better outcomes.

The diagnostic centers segment is projected to grow as these centers rely heavily on imaging technologies. Integrating computer vision enhances image interpretation accuracy and efficiency, improving disease detection and contributing to early diagnoses.

Regional Analysis

In 2023, North America led the market, accounting for over 35.0% of global revenue. The region’s robust healthcare, IT, and telecommunications infrastructure supports digital technology adoption, including AI in healthcare. Favorable government policies, chronic disease prevalence, and healthcare data management regulations are key factors driving CV demand in healthcare across North America.

The Asia Pacific region is expected to record the fastest CAGR during the forecast period, driven by heavy investments in healthcare infrastructure and a rising prevalence of chronic diseases. The region offers growth opportunities for CV integration in diagnostics, treatment, and patient management.

Need any customization research on Computer Vision in Healthcare Market - Enquiry Now

Key Players

Major players in the market include Arterys, iCAD Inc., Basler AG, AiCure, Google, IBM, Intel Corporation, Microsoft, NVIDIA Corporation, Xilinx Inc., and others.

Recent Developments

-

In Aug 2024, Caregility Corporation introduced edge-based computer vision AI for healthcare, eliminating the need for costly cloud processing.

-

In Nov 2023, Philips launched its cloud-based AI platform, HealthSuite, featuring advanced computer vision algorithms.

-

In March 2022, NVIDIA unveiled its upgraded Clara Imaging platform with enhanced cloud-based CV capabilities, aimed at accelerating diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.4 Billion |

| Market Size by 2032 | US$ 49.0 Billion |

| CAGR | CAGR of 47.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services)

• By Product Type (Smart Cameras-based Computer Vision Systems, PC-based Computer Vision Systems) • By Application (Medical Imaging & Diagnostics, Surgeries, Patient Management & Research, Others) • By End-users (Healthcare Providers, Diagnostic Centers, Academic Research Institutes, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arterys, iCAD Inc., Basler AG, AiCure, Google, IBM, Intel Corporation, Microsoft, NVIDIA Corporation, Xilinx Inc. |

| DRIVERS | • Rising Demand for AI-Powered Computer Vision Systems Enhancing Healthcare Efficiency and Accuracy |

| RESTRAINTS |

• High Initial Costs • Data Security and Privacy Concerns • Integration with Existing Systems • Dependence on Internet Connectivity |