Concrete Blocks and Bricks Market Report Scope & Overview

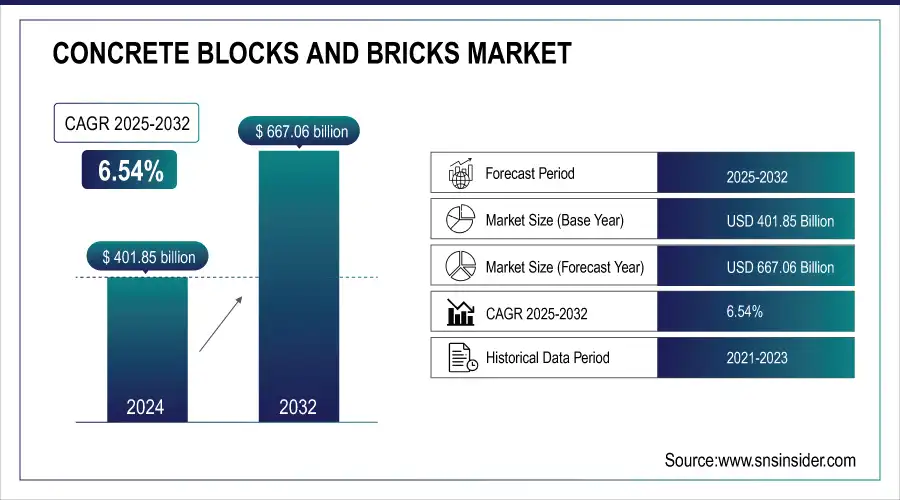

The Concrete blocks and bricks Market was valued at USD 401.85 billion in 2024 and is expected to reach USD 667.06 billion by 2032, growing at a CAGR of 6.54% from 2025-2032.

Get E-PDF Sample Report on Concrete Blocks and Bricks Market - Request Sample Report

The concrete blocks and bricks market has witnessed steady growth in recent years, driven by the demand for durable, cost-effective building materials in the construction industry. These products are favored for their strength, versatility, and environmental sustainability, making them a popular choice for both residential and commercial projects. A key trend in the market is the increasing preference for eco-friendly materials, such as recycled concrete blocks, as the construction industry adopts more sustainable practices. This shift aligns with growing regulatory pressures to reduce carbon footprints, as well as consumer demand for greener, energy-efficient buildings.

Market Size and Forecast

-

Market Size in 2024: USD 401.85 Billion

-

Market Size by 2032: USD 667.06 Billion

-

CAGR: 6.54% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Concrete blocks and bricks Market Trends

-

Rising construction and infrastructure development is driving demand for concrete blocks and bricks.

-

Increasing adoption of sustainable, durable, and cost-effective building materials is boosting market growth.

-

Expansion of residential, commercial, and industrial projects is fueling material consumption.

-

Advancements in lightweight, hollow, and interlocking blocks are improving efficiency and construction speed.

-

Growing focus on energy-efficient and environmentally friendly building practices is shaping market trends.

-

Integration of automation and mechanized production techniques is enhancing quality and scalability.

-

Collaborations between manufacturers, contractors, and real estate developers are accelerating innovation and adoption.

Concrete blocks and bricks Market Growth Drivers:

-

Concrete blocks and bricks are cost-effective, durable, and eco-friendly construction materials, driving market growth, particularly in emerging economies focused on affordable housing and infrastructure development.

Concrete blocks and bricks have long been regarded as cost-effective construction materials, which significantly contribute to their widespread use in both residential and commercial construction. Compared to alternatives such as steel or wood, concrete blocks offer an affordable solution, making them an attractive choice, particularly in emerging markets where budget constraints are a priority. The materials are readily available, and their production processes are relatively simple, driving down costs and ensuring a steady supply. Additionally, the long-term durability and minimal maintenance requirements of concrete blocks and bricks further enhance their cost-effectiveness, as they reduce the need for repairs and replacements over time.

The global concrete blocks and bricks market has experienced steady growth, primarily driven by rapid urbanization, infrastructure development, and population expansion. This trend is especially prominent in emerging economies, where construction activities are booming. As governments focus on affordable housing and infrastructure projects, the demand for concrete blocks and bricks is expected to rise significantly. Furthermore, with the increasing emphasis on sustainability, there is a growing trend toward producing eco-friendly concrete blocks made from recycled materials, which supports both cost savings and environmental goals. This market is poised for continued growth, with innovations in manufacturing and material properties further driving market expansion.

Concrete blocks and bricks Market Restraints:

-

Fluctuating raw material costs, including cement, sand, and aggregates, drive up production costs and reduce the affordability of concrete blocks and bricks, challenging market growth.

High raw material costs pose a significant challenge to the concrete blocks and bricks market. The production of concrete involves essential raw materials such as cement, sand, and aggregates, which are subject to price fluctuations based on factors like supply chain disruptions, demand surges, and environmental regulations. When the prices of these materials increase, manufacturers face higher production costs, which often result in increased prices for concrete blocks and bricks. This volatility can strain profit margins and reduce the affordability of these construction materials, especially for large-scale projects. Additionally, manufacturers may struggle to maintain competitive pricing if the cost of raw materials continues to rise. The unpredictability of raw material costs is particularly impactful in regions with limited access to local resources or volatile market conditions, further complicating the cost structure of concrete production and potentially slowing down market growth.

Concrete blocks and bricks Market Segment Analysis

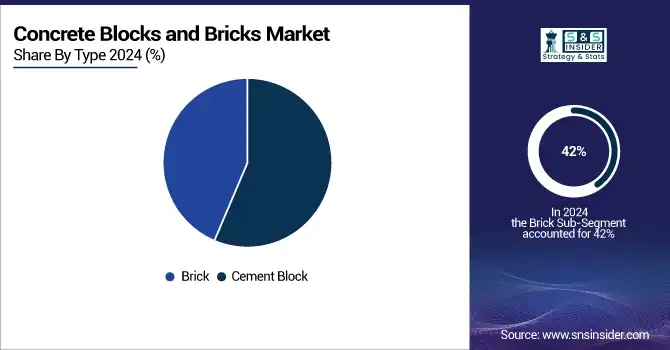

By Type, Brick dominated the market in 2024 with over 42% share, driven by durability, insulation, fire resistance, and aesthetic appeal.

The Brick segment dominated with the market share over 42% in 2024, due to its long-established presence and widespread use in construction. Brick products, particularly clay bricks, offer significant advantages such as durability, thermal insulation, fire resistance, and aesthetic appeal, making them a preferred choice in residential, commercial, and industrial projects. Additionally, the versatility of bricks in different architectural styles, along with their ability to withstand varying environmental conditions, has contributed to their dominance. The strong demand for traditional brick materials continues to lead the market despite the growing popularity of cement blocks.

By Application, Residential applications held the largest market share in 2024 at over 48%, fueled by the demand for durable, energy-efficient, and cost-effective construction materials.

The Residential segment dominated with the market share over 48% in 2023, primarily due to the material's advantages in home construction. Concrete blocks and bricks offer excellent durability, providing long-lasting strength against external elements, making them ideal for residential buildings. Additionally, they provide superior insulation, helping to regulate indoor temperatures and reduce energy costs. These properties make concrete blocks and bricks an attractive and cost-effective choice for homeowners and builders alike. As a result, this segment remains a key driver of demand, especially in regions experiencing growth in housing construction and residential developments.

Concrete blocks and bricks Market Regional Analysis

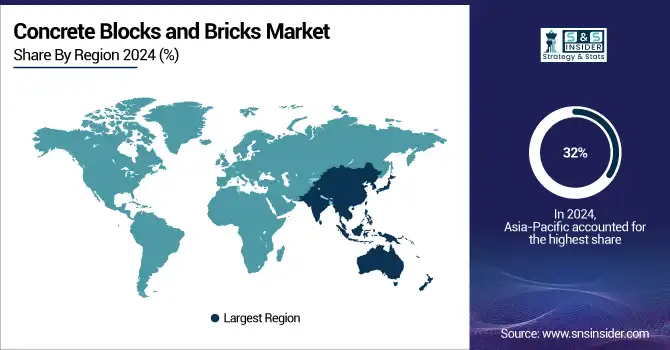

Asia Pacific Concrete blocks and bricks Market Insights

The Asia-Pacific region dominated with the market share over 32% in 2024, due to its rapid urbanization, large-scale construction projects, and expanding infrastructure development in countries like China, India, and Japan. The demand for concrete blocks and bricks is primarily driven by residential, commercial, and industrial construction activities. The region benefits from abundant low-cost labor and readily available raw materials, making production more cost-effective. These factors, along with the growing need for sustainable building solutions, have fueled significant market growth, positioning Asia-Pacific as the leader in the global concrete blocks and bricks market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

North America Concrete blocks and bricks Market Insights

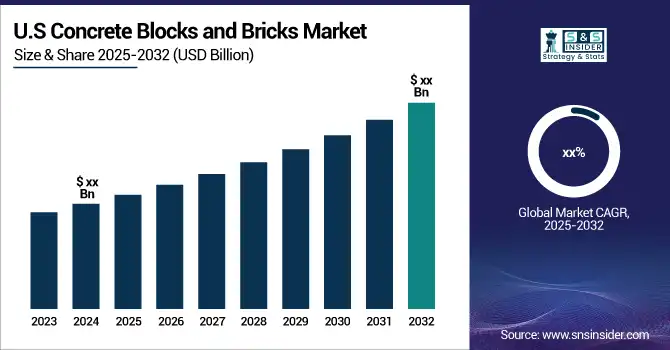

North America, especially the United States and Canada, is witnessing the fastest growth in the Concrete Blocks and Bricks Market. This growth is driven by rising demand for residential and commercial buildings, as well as a shift towards sustainable construction practices that prioritize eco-friendly materials like concrete blocks and bricks. Additionally, ongoing renovation and remodelling projects in both urban and suburban areas are further boosting market demand. The region's commitment to green building standards, energy-efficient construction, and the use of durable materials contributes significantly to the expanding market for concrete blocks and bricks.

Europe Concrete blocks and bricks Market Insights

Europe’s concrete blocks and bricks market is driven by rapid urbanization, infrastructure expansion, and demand for sustainable construction materials. Countries like Germany, France, and the UK lead adoption, supported by stringent building regulations and green construction initiatives. Increasing investments in residential, commercial, and industrial projects, coupled with technological advancements in precast and aerated concrete products, are boosting market growth. Rising awareness of energy-efficient and durable building materials further enhances regional demand.

Middle East & Africa and Latin America Concrete blocks and bricks Market Insights

The Concrete Blocks and Bricks market in the Middle East & Africa and Latin America is experiencing growth due to rapid urbanization, infrastructure development, and rising construction activities. Governments are promoting affordable and sustainable housing projects, while investments in commercial and industrial buildings increase demand. Adoption of durable, energy-efficient, and cost-effective concrete materials is accelerating. Technological advancements in precast and modular construction solutions further support market expansion across these regions.

Concrete blocks and bricks Market Competitive Landscape:

Cemex S.A.B. de C.V.

Cemex, founded in 1906 and headquartered in Monterrey, Mexico, is a global leader in building materials, including cement, concrete, and aggregates. The company provides sustainable construction solutions for residential, commercial, and infrastructure projects worldwide. Cemex focuses on innovation, quality, and environmental responsibility, delivering high-performance materials that enhance durability, safety, and efficiency in construction while supporting urban development and large-scale infrastructure initiatives.

-

December 9, 2024: Cemex is supplying 141,000 cubic yards of concrete for the USD 865 million Howard Frankland Bridge project in Tampa, Florida, which will be the largest bridge by surface area in the state, designed to enhance hurricane evacuation preparedness and regional connectivity.

Wienerberger India

Wienerberger India, part of the global Wienerberger Group founded in 1819 and headquartered in Vienna, Austria, is a leading manufacturer of clay-based building materials, including bricks, blocks, and tiles. The company focuses on sustainable, high-performance construction solutions with low environmental impact. Wienerberger emphasizes energy efficiency, longevity, and eco-friendly materials to support green building practices and reduce the carbon footprint of residential and commercial construction projects

-

January 8, 2025: Wienerberger India's Porotherm Smart Bricks achieved the lowest carbon footprint in a recent Life Cycle Analysis (LCA), demonstrating a Global Warming Potential (GWP) of just 97.103 Kg CO2e per ton and a lifespan of 150 years.

Boral Limited

Boral Limited, founded in 1946 and headquartered in Sydney, Australia, is a leading supplier of building and construction materials, including cement, concrete, and aggregates. The company focuses on sustainable innovation to reduce the environmental impact of construction materials while maintaining high performance. Boral collaborates with researchers and industry partners to develop lower-carbon solutions, enhance material efficiency, and support infrastructure projects that meet the growing demand for environmentally responsible building practices.

-

August 8, 2024: Boral is developing next-generation lower-carbon concrete using Australian calcined clay as an alternative to traditional cement. Co-funded by the Commonwealth’s CRC Program, the project aims to reduce the carbon intensity of concrete while ensuring a sustainable supply of supplementary cementitious materials for Australian buildings and infrastructure.

Key Players

Some of the major key players of the Concrete blocks and bricks Market

-

Acme Brick Company (Brick products, masonry supplies)

-

Boral (Concrete bricks, masonry products, pavers)

-

Wienerberger AG (Clay bricks, concrete blocks, paving stones)

-

Midwest Block & Brick (Concrete blocks, retaining wall systems)

-

Concrete Products (Concrete block, paving stones, retaining walls)

-

Tristar Brick & Block LTD (Concrete blocks, bricks, decorative wall systems)

-

Ideal Concrete Block (Concrete blocks, retaining walls, custom masonry)

-

CEMEX (Concrete blocks, pavers, ready-mix concrete)

-

Lignacite Ltd. (Concrete blocks, sustainable building materials)

-

Bauroc AS (Aerated concrete blocks, walling systems)

-

Hi-Way Concrete (Concrete blocks, precast products, paving)

-

Brampton Brick (Concrete bricks, masonry units, landscaping products)

-

Oldcastle (Concrete blocks, paving stones, wall systems)

-

Forterra (Concrete blocks, bricks, retaining wall products)

-

Rocla (Precast concrete blocks, pipes, and drainage systems)

-

Hanson UK (Concrete blocks, bricks, ready-mix concrete)

-

Kingspan (Aerated concrete blocks, insulation blocks)

-

Fendt (Concrete paving blocks, stone blocks)

-

Teifoc (Concrete bricks, modular building sets)

-

Cemex USA (Masonry blocks, paving blocks, aggregates)

Suppliers for (Concrete blocks, bricks, cement, ready-mix concrete) on Concrete blocks and bricks Market

-

Cemex

-

LafargeHolcim

-

CRH plc

-

Forterra

-

Boral Limited

-

Northeast Precast

-

Foley Products Company

-

Hanson Building Products

-

Oldcastle APG

-

Redland

| Report Attributes | Details |

| Market Size in 2024 | USD 401.85 billion |

| Market Size by 2032 | USD 667.06 billion |

| CAGR | CAGR of 6.54% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cement Block (Hollow, Fully Solid, Cellular), Brick (Clay, Fly Ash Clay, Sand Lime, Others) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acme Brick Company, Boral, Wienerberger AG, Midwest Block & Brick, Concrete Products, Tristar Brick & Block LTD, Ideal Concrete Block, CEMEX, Lignacite Ltd., Bauroc AS, Hi-Way Concrete, Brampton Brick, Oldcastle, Forterra, Rocla, Hanson UK, Kingspan, Fendt, Teifoc, Cemex USA |

| Key Drivers | • Concrete blocks and bricks are cost-effective, durable, and eco-friendly construction materials, driving market growth, particularly in emerging economies focused on affordable housing and infrastructure development. |

| RESTRAINTS | • Fluctuating raw material costs, including cement, sand, and aggregates, drive up production costs and reduce the affordability of concrete blocks and bricks, challenging market growth. |