CubeSat Market Report Scope & Overview:

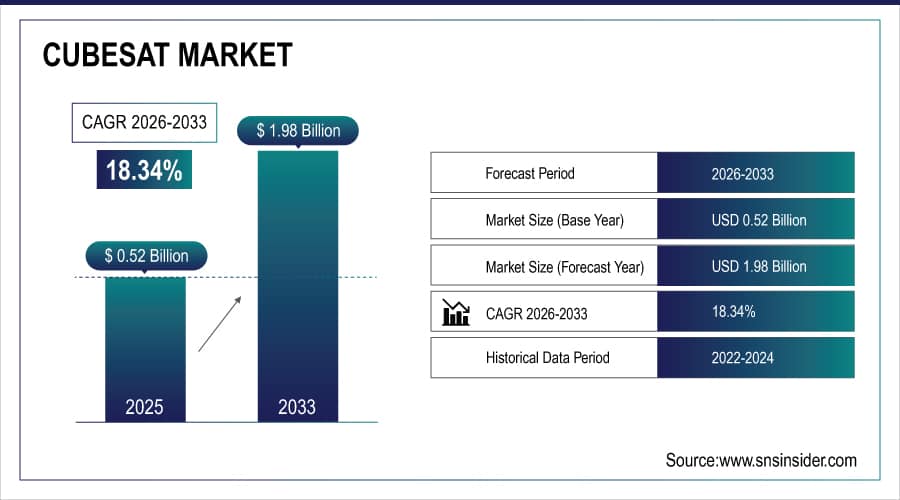

The CubeSat Market was valued at USD 0.52 billion in 2025E and is expected to reach USD 1.98 billion by 2032, growing at a CAGR of 18.34% from 2026-2033.

CubeSat Market is growing rapidly due to increasing demand for low-cost, small-satellite solutions for earth observation, communication, and scientific research. Advancements in miniaturized components, standardized architectures, and faster development cycles are making CubeSats attractive for commercial, academic, and defense applications. Rising investments in satellite constellations, space exploration programs, and launch service innovations are further accelerating adoption. Additionally, growing interest from startups and universities is expanding overall market activity.

Over 3,000 CubeSats launched in the past decade; annual deployments now exceed 300 units, with more than 60% used for Earth observation and communication, driven by cost efficiency and rapid development cycles.

CubeSat Market Size and Forecast

-

CubeSat Market Size in 2025E: USD 0.52 Billion

-

CubeSat Market Size by 2033: USD 1.98 Billion

-

CAGR: 18.34% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On CubeSat Market - Request Free Sample Report

CubeSat Market Trends

-

Growing demand for low-cost satellite missions as universities, startups, and agencies expand space research initiatives

-

Rising adoption of CubeSats for Earth observation, communication, and remote sensing across commercial and defense sectors

-

Increasing use of standardized components enabling faster development cycles and reduced satellite manufacturing complexity

-

Expansion of rideshare launch services providing affordable access to orbit for small satellite operators globally

-

Advancements in miniaturized propulsion, power systems, and sensors enhancing CubeSat mission capability and overall performance

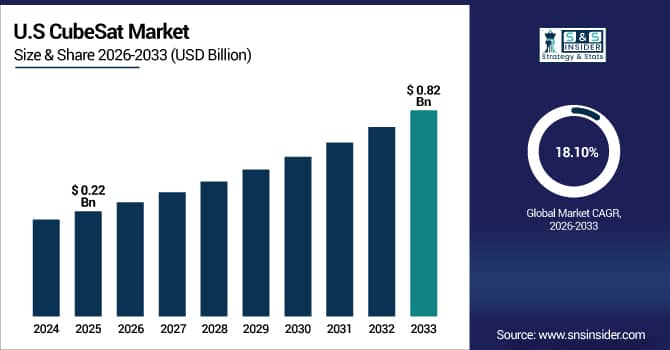

The U.S. CubeSat Market was valued at USD 0.22 billion in 2025E and is expected to reach USD 0.82 billion by 2032, growing at a CAGR of 18.10% from 2026-2033.

Growth in the U.S. CubeSat Market is driven by rising demand for low-cost satellite missions, increased government and defense investments, and expanding commercial applications in communication and earth observation. Advancements in miniaturized technologies and reliable launch services are further boosting deployment across research institutions, startups, and private space companies.

CubeSat Market Growth Drivers:

-

Increasing demand for low-cost satellite missions is boosting adoption of CubeSats due to their affordable development, launch flexibility, and operational efficiency

The global shift toward cost-efficient space missions is driving strong adoption of CubeSats, which offer significantly lower development and launch expenses compared to traditional satellites. Their compact size and modular design allow multiple CubeSats to be launched together, increasing mission flexibility and reducing overall deployment time. Government agencies, private companies, and research institutions are increasingly relying on CubeSats for rapid testing, technology demonstration, and short-duration space missions. This affordability and operational efficiency make CubeSats an attractive option for expanding space-based capabilities across various industries.

Over 70% of new satellite missions in 2024 were CubeSats, driven by 80% lower development costs and shared launch opportunities, enabling universities and startups to deploy affordable, efficient Earth observation and communication systems globally.

-

Rising investments in Earth observation and remote sensing applications are driving CubeSat deployment for agriculture, climate monitoring, and disaster management

Growing demand for real-time environmental data is encouraging greater deployment of CubeSats for Earth observation and remote sensing missions. Governments, startups, and research bodies are investing in CubeSat constellations to monitor crop health, track climate patterns, assess natural resources, and support disaster preparedness. Their ability to deliver frequent, high-resolution imagery at a fraction of traditional satellite costs enhances decision-making in agriculture, urban planning, and emergency response. As global focus on sustainability and environmental intelligence increases, CubeSats are becoming essential tools for cost-effective, continuous Earth monitoring.

Over 300 Earth observation CubeSats were launched, with 60% supporting agriculture, climate, and disaster management; annual deployments growing by 25%, reflecting increased investment in scalable, cost-effective remote sensing solutions.

CubeSat Market Restraints:

-

Limited payload capacity and power constraints restrict CubeSat functionality, reducing mission complexity and limiting adoption for high-performance space applications

CubeSats are inherently small and lightweight, which significantly limits the size, weight, and capability of onboard instruments. Their restricted power generation capacity further reduces their ability to support advanced sensors, high-bandwidth communication systems, and long-duration missions. These constraints make CubeSats unsuitable for many high-performance scientific, commercial, or defense applications requiring robust payloads. As a result, organizations with demanding mission requirements often prefer larger satellites, slowing broader CubeSat adoption for complex tasks despite their low-cost advantages.

Most CubeSats have power budgets under 50W and payload capacity below 2kg, restricting sensor size and data transmission rates, limiting use in high-performance missions requiring advanced instruments or real-time processing.

-

High launch costs and limited availability of dedicated launch opportunities hinder timely CubeSat deployment and increase overall project expenses

Although CubeSats offer lower development costs, securing an affordable and timely launch remains a major challenge. Most CubeSats rely on rideshare missions, where launch schedules depend on larger primary payloads, often causing delays. Dedicated launch vehicles are costly and remain limited in availability, further increasing project timelines and budgets. These constraints create deployment bottlenecks for universities, startups, and small organizations. As demand grows, competition for launch slots intensifies, making it difficult for CubeSat missions to achieve timely deployment and efficient operational planning.

Over 60% of CubeSat missions face delays due to scarce launch opportunities, with average deployment costs exceeding USD300,000 per satellite, significantly impacting small satellite project timelines and budget allocations.

CubeSat Market Opportunities:

-

Rising demand for Earth observation and remote sensing creates opportunities for CubeSats to deliver affordable, high-resolution imaging for multiple industries

Growing global demand for real-time Earth monitoring, environmental assessment, agricultural insights, and urban development planning is accelerating the use of CubeSats. Their low manufacturing and launch costs make them ideal for organizations seeking high-resolution imaging without the expense of traditional satellites. Industries such as agriculture, oil & gas, forestry, disaster management, and defense increasingly rely on CubeSat data to improve decision-making. As climate monitoring and weather forecasting needs intensify, CubeSats offer scalable, cost-effective imaging capabilities, creating significant commercial opportunities across both emerging and established markets.

-

Growing interest in space research and scientific experimentation supports increased CubeSat deployments by universities, startups, and government space agencies

CubeSats have become a preferred platform for conducting low-cost scientific missions, enabling rapid experimentation and innovation. Academic institutions use them for educational projects, technology demonstrations, atmospheric studies, and microgravity experiments. Startups and research organizations deploy CubeSats to test new space technologies, sensors, and propulsion systems at a fraction of traditional costs. Government space agencies also support CubeSat missions to advance research objectives and encourage STEM participation. The rising accessibility of launch services and supportive space policies further expands opportunities for scientific exploration through CubeSat-based missions.

Over 300 CubeSats were launched annually, with universities and startups accounting for 40% of deployments, driven by low cost, rapid development, and expanding use in Earth observation, education, and deep space missions.

CubeSat Market Segment Highlights

-

By Size In 2025, 1U to 3U led the market with 35% share while 6U to 12U is the fastest-growing segment (2026–2033)

-

By Application In 2025, Earth Observation led the market with 45% share while Communication is the fastest-growing segment (2026–2033)

-

By Subsystem In 2025, Payloads led the market with 28% share while ADCS is the fastest-growing segment (2026–2033)

-

By End Use In 2025, Government & Defense led the market with 50% share while Commercial is the fastest-growing segment (2026–2033)

CubeSat Market Segment Analysis

By Size, 1U to 3U segment led in 2025; 6U to 12U segment expected fastest growth 2026–2033

1U to 3U dominated the CubeSat Market in 2025 due to their optimal balance of size, cost, and mission capability. Their versatility across academic, commercial, and government missions, along with lower launch costs and widespread standardization, strengthened their adoption for Earth observation, technology demonstration, and scientific applications, supporting their leading position.

6U to 12U is expected to grow fastest from 2026–2033 as demand increases for higher-performance CubeSats capable of carrying advanced sensors, larger payloads, and more powerful communication systems. Their ability to support complex missions in remote sensing, connectivity, and defense applications drives rapid adoption across expanding small satellite constellations.

By Application, Earth Observation segment led in 2025; Communication segment expected fastest growth 2026–2033

Earth Observation dominated the CubeSat Market in 2025 because of strong global demand for affordable, high-resolution imaging for climate monitoring, disaster management, agriculture, defense, and commercial analytics. CubeSats offer rapid deployment, frequent revisit rates, and cost-effective data acquisition, making them a preferred solution for Earth monitoring missions.

Communication is expected to grow fastest from 2026–2033 due to rising demand for low-cost satellite connectivity, IoT networks, global data relay, and broadband services. Expanding constellations focused on narrowband and low-latency communication drive the adoption of CubeSats as scalable, flexible platforms for modern communication infrastructure.

By Subsystem, Payloads segment led in 2025; ADCS segment expected fastest growth 2026–2033

Payloads dominated the CubeSat Market in 2025 because mission effectiveness depends heavily on sensor, imaging, and communication payload capabilities. Increasing investments in advanced miniaturized payloads for imaging, spectroscopy, and telemetry enhanced this segment’s importance, as they directly determine data quality and mission value.

ADCS is expected to grow fastest from 2026–2033 as missions require higher pointing accuracy, stabilization, and attitude control for imaging, communication, and scientific experiments. Advancements in miniaturized actuators, star trackers, and gyros enable more complex operations, increasing demand for sophisticated ADCS solutions.

By End Use, Government & Defense segment led in 2025; Commercial segment expected fastest growth 2026–2033

Government & Defense dominated the CubeSat Market in 2025 due to strong adoption for surveillance, reconnaissance, space situational awareness, scientific missions, and technology testing. Their cost efficiency, rapid deployment, and suitability for constellation-based monitoring made CubeSats a strategic tool for national security and governmental research programs.

Commercial is expected to grow fastest from 2026–2033 as private companies increasingly deploy CubeSats for imaging services, communication networks, asset tracking, and IoT connectivity. Falling launch costs, expanding commercial space investment, and new business models accelerate CubeSat adoption across diverse commercial sectors.

CubeSat Market Regional Analysis

North America CubeSat Market Insights

North America dominated the CubeSat Market with a 50% share in 2025 due to the presence of leading aerospace companies, advanced space research infrastructure, and strong government and private investments in satellite technology. High adoption of small satellite missions for communication, earth observation, and defense applications further reinforced the region’s market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific CubeSat Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 20.79% from 2026–2033, driven by increasing government space initiatives, rising private sector participation, and expanding demand for low-cost satellite solutions. Growing investments in satellite-based communication, earth monitoring, and research programs, along with technological advancements in miniaturized satellites, are accelerating market growth in the region.

Europe CubeSat Market Insights

Europe held a significant share in the CubeSat Market in 2025, supported by its strong aerospace ecosystem, active space research programs, and presence of leading satellite manufacturers. Increasing government and commercial investments in small satellite missions for earth observation, scientific research, and communication applications further strengthened Europe’s position in the CubeSat market.

Middle East & Africa and Latin America CubeSat Market Insights

The Middle East & Africa and Latin America together showed steady growth in the CubeSat Market in 2025, driven by rising government space initiatives, increasing private sector involvement, and growing demand for cost-effective satellite solutions. Expanding investments in earth observation, communication, and scientific research programs further supported the regions’ emerging presence in the CubeSat market.

CubeSat Market Competitive Landscape:

Planet Labs PBC

Planet Labs PBC is a leading Earth-imaging company that operates large CubeSat constellations, including Flock and SkySat. The company provides high-resolution, frequent imaging for agriculture, environmental monitoring, disaster response, and urban planning. With a robust satellite fleet, advanced data analytics, and cloud-based platforms, Planet enables clients to access near real-time Earth observation. Its innovation, scalability, and commercial focus make it a pioneer in the CubeSat and small-satellite Earth observation market.

-

2025, Planet Labs Germany secured a €240 million multi-year deal with the German government for dedicated Pelican‑satellite capacity, PlanetScope, SkySat, and AI-enabled imagery services

Spire Global Inc

Spire Global Inc operates one of the world’s largest CubeSat fleets, providing weather, maritime, and aviation data from low Earth orbit. Its nanosatellites gather critical tracking and atmospheric information for commercial and government customers. By combining satellite-based observations with advanced analytics and AI, Spire offers actionable insights for shipping, aviation, climate monitoring, and forecasting. Its extensive CubeSat network ensures global coverage, making it a key player in the small-satellite data market.

-

2024, Spire launched seven LEMUR satellites (3U–16U) on SpaceX’s Transporter-11 mission. These support weather forecasting, soil moisture, and maritime tracking.

AAC Clyde Space

AAC Clyde Space, headquartered in Europe, designs and manufactures small satellites and CubeSat platforms for commercial, academic, and government applications. The company offers end-to-end solutions, including satellite buses, subsystems, and mission integration. Its CubeSats are used for Earth observation, scientific research, and communication. With modular designs, flexible payload options, and strategic partnerships, AAC Clyde Space strengthens Europe’s presence in the nanosatellite and small-satellite industry, supporting cost-effective, scalable space missions.

-

2023, AAC Clyde Space successfully launched its 6U EPIC VIEW satellite (EPICHyper‑1) aboard SpaceX’s Transporter‑7 mission. The CubeSat aims to support Earth observation and technology demonstration, marking a significant milestone for the company’s small-satellite program.

GomSpace A/S

GomSpace A/S is a Danish company specializing in nanosatellite and CubeSat development. The company provides complete satellite platforms, subsystems, and mission solutions for commercial, academic, and defense clients. GomSpace CubeSats are deployed for Earth observation, communications, and technology demonstration missions. Its expertise in miniaturized components, propulsion, and communication systems allows rapid development and deployment of scalable satellite constellations, positioning GomSpace as a leading innovator in the CubeSat and small-satellite market.

-

2025: GomSpace secured product orders totaling 64 million SEK for its power and communication subsystems. This order highlights the company’s growing demand and continued expansion in the small-satellite and CubeSat components market.

CubeSat Market Key Players

Some of the CubeSat Market Companies are:

-

Planet Labs PBC

-

Spire Global Inc

-

AAC Clyde Space

-

GomSpace A/S

-

Blue Canyon Technologies (BCT) Raytheon Technologies

-

Terran Orbital Corporation (Tyvak Nano-Satellite Systems)

-

NanoAvionics (Kongsberg NanoAvionics)

-

EnduroSat

-

Lockheed Martin Corporation

-

Northrop Grumman Corporation

-

Aerospace Corporation

-

SpaceX

-

Rocket Lab USA Inc

-

D-Orbit S.p.A

-

ISISPACE (Innovative Solutions In Space)

-

Surrey Satellite Technology Ltd (SSTL)

-

Millennium Space Systems (Boeing)

-

L3Harris Technologies Inc

-

ExoLaunch GmbH

-

York Space Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 0.52 Billion |

| Market Size by 2033 | USD 1.98 Billion |

| CAGR | CAGR of 18.34% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Size (0.25U to 1U, 1U to 3U, 3U to 6U, 6U to 12U, 12U & Above) • By Application (Earth Observation, Meteorology, Space Observation, Communication, Scientific Research) • By Subsystem (Structures, Payloads, Power Systems, C&DH, ADCS, Propulsion Systems, Others) • By End-use (Government & Defense, Commercial, Research Institutions & Non-Profit Organizations) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Planet Labs PBC, Spire Global Inc., AAC Clyde Space, GomSpace A/S, Blue Canyon Technologies (Raytheon), Terran Orbital Corporation (Tyvak Nano-Satellite Systems), NanoAvionics (Kongsberg NanoAvionics), EnduroSat, Lockheed Martin Corporation, Northrop Grumman Corporation, The Aerospace Corporation, SpaceX, Rocket Lab USA Inc., D-Orbit S.p.A., ISISPACE (Innovative Solutions In Space), Surrey Satellite Technology Ltd. (SSTL), Millennium Space Systems (Boeing), L3Harris Technologies Inc., ExoLaunch GmbH, York Space Systems |