Diethylenetriamine Market Report Scope & Overview:

The Diethylenetriamine Market size is valued at USD 188.35 Billion in 2025E and is projected to reach USD 269.16 Billion by 2033, growing at a CAGR of 4.59% during 2026-2033.

The Diethylenetriamine Market analysis highlights the demand across coating, resins, lubricants and corrosion inhibitors. Growing industrialization and construction sector is anticipated to foster demand for adhesives and curing agents. Amines based formulations performance and sustainability is improved by technological development.

DETA-based corrosion inhibitors grew by 12% in 2024, widely used in oil & gas pipelines, marine coatings, and automotive underbody treatments to extend asset life.

Market Size and Forecast:

-

Market Size in 2025E: USD 188.35 Billion

-

Market Size by 2033: USD 269.16 Billion

-

CAGR: 4.59% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Diethylenetriamine Market - Request Free Sample Report

Diethylenetriamine Market Trends

-

Growing use of DETA in epoxy resins and paints due to growing construction & infrastructure development globally.

-

Increasing demand for DETA corrosion inhibitors in the oil & gas and marine sector to improve equipment life.

-

Growing need for bio-based and low-VOC amine formulations to comply with the environmental and sustainability regulations.

-

Increasing applications of DETA as a sequestering agent in water treatment and cleaning formulations of various industries.

-

The new development of technology promotes DETA production efficiency, energy saving and low pollution.

The U.S. Diethylenetriamine Market size is valued at USD 52.30 Billion in 2025E and is projected to reach USD 73.21 Billion by 2033, growing at a CAGR of 4.32% during 2026-2033. Diethylenetriamine Market growth is driven by raising application base in resins, adhesives, and corrosion inhibitors. Positive momentum in construction, automotive and oil & gas industries maintain steady use. Marketers are prioritizing High purity, green amine formulas.

Diethylenetriamine Market Growth Drivers:

-

Rising Demand from Resin, Adhesive, and Lubricant Industries Driving Diethylenetriamine Consumption Globally

Increasing applications of Diethylenetriamine in epoxy resins, adhesives, and lubricant additives are expected to drive market growth. The high curing, chelating and surfactant characteristics of the composition are necessary for industrial coatings and sealants. Thanks to rapid infrastructure expansion and increasing automotive fabrications globally, the market for high-performance adhesives is additionally growing, especially in Asia-Pacific and North America fueling DETA’s indispensable role in several downstream chemicals sectors. In 2025, global DETA consumption reached approximately 215 kilotons, with resin applications accounting for over 38% of total demand.

In 2025, over 65% of global diethylenetriamine (DETA) consumption was used as a curing agent in epoxy resins for adhesives, composites, and industrial flooring

Diethylenetriamine Market Restraints:

-

Stringent Environmental Regulations and Toxicity Concerns Restricting Market Expansion for Diethylenetriamine

Rigorous environmental legislation in relation to handling, emissions and disposal of Diethylenetriamine has inhibited its global use. Due to its corrosive characteristics, possible health risks and strict occupational exposure limits, industries have sought safer substitutes. Furthermore, increasing compliance costs and the requirement for superior protective wear drive up manufacturers’ operating costs. These factors are holding back growth especially in areas where environmental enforcement is strong (Europe, USA) preventing market scaling. As of 2025, compliance costs and environmental control expenditures accounted for nearly 12% of total production expenses.

Diethylenetriamine Market Opportunities:

-

Growing Adoption of Bio-Based and Sustainable Amines Creating New Market Growth Pathways

Growing emphasis on green chemistry and bio-based chemical manufacturing are creating prospects in the Diethylenetriamine market. Renewable or CO 2-neutral feedstock and EMR are currently attracting corporate investment in renewable raw material sourcing, low-emission synthesis routes to meet sustainability goals. The growing trend towards environmentally benign curing and corrosion inhibiting products for coatings, water treatment, oilfields etc., offers opportunities to new formulations and partnership alliances. The increasing investment in clean industrial process by developing economies is also believed to be on accelerating the growth of the bio-based Diethylenetriamine market over the long run. In 2025, bio-based amine production accounted for 7.5% of total DETA output, with rapid growth expected through 2030.

In 2025, over $1.2 billion was invested globally in bio-based amine production, with DETA alternatives derived from renewable feedstocks like glycerol and biomass gaining traction.

Diethylenetriamine Market Segment Analysis

-

By Grade, the Industrial Grade segment led the Diethylenetriamine market in 2025 with a 52.60% share, while the High-Purity Grade segment is projected to grow fastest at a CAGR of 7.54%.

-

By Application, Resins & Adhesives dominated the market with a 47.85% share in 2025, whereas Lubricant Additives are expected to record the highest growth at a CAGR of 7.95%.

-

By End-User, the Oil & Gas sector led the market with a 43.10% share in 2025, while the Chemicals segment is anticipated to grow at the fastest CAGR of 8.12%.

-

By Function, the Curing Agent category held a 49.25% market share in 2025, with the Chelating Agent segment projected to expand most rapidly at a CAGR of 7.68%.

By Grade, Industrial Grade Leads Market While High-Purity Grade Registers Fastest Growth

Industrial Grade Diethylenetriamine was the leading market with wide application in epoxy resins, coatings and lubricants. In addition, it is cost-effective and can be formulated in a vast range of large- scale chemical applications, making it a choice for diverse industrial applications. Meanwhile, the High-Purity Grade segment is growing fastest due to its increased use in pharmaceutical and electronics applications that demand low impurity contents and higher efficiency. This trend is further driven by investment in chemical precision manufacturing and quality-based industries. In 2025, global industrial-grade DETA production surpassed 125 kilotons, indicating strong consumption across core industrial sectors.

By Application, Resins & Adhesives Dominate While Lubricant Additives Shows Rapid Growth

Resins & Adhesives is the leading market application for Diethylenetriamine market in 2025 due to excellent curing and adhesion boosting properties of DETA in epoxy systems. Served as coatings, sealants and composites has been driving the demand across construction, automobile and marine applications. While, the Lubricant Additives segment is growing quickly as it enhances anti-corrosion performance and long-term storage stability of synthetic lubricants. The continued migration to high performance and environmentally friendly lubricants bodes well for this trend. In 2025, the resins and adhesives sector consumed approximately 40% of total global DETA output.

By End-User, Oil & Gas Lead While Chemicals Registers Fastest Growth

The Oil & Gas application segment is the major consumer of Diethylenetriamine and utilized it in corrosion inhibitors, demulsifies, and surfactant formulations in 2025. Its importance to pipeline care and refining maintains it at a constant level of demand within that sector. The Chemicals industry is expanding rapidly as demand for DETA increases in specialty amines and chelating agents- the expansions of fine chemical and polymer manufacturing provide momentum. By 2025, the oil and gas sector accounted for over 33% of global DETA consumption volume.

By Function, Curing Agent Lead While Chelating Agent Grow Fastest

Curing Agent function led the Diethylenetriamine market in 2025, for epoxy resins used in coatings, adhesives and composites. It is highly reactive and the pure material bonds well in high strength materials. Meantime, chelating agent function is expanding because of increased application in water treatment, detergents and agricultural formulations. Growing emphasis on effective metal ion control and environment protection solution is driving the market growth. In 2025, curing agent applications represented around 42% of total Diethylenetriamine utilization globally.

Diethylenetriamine Market Regional Analysis:

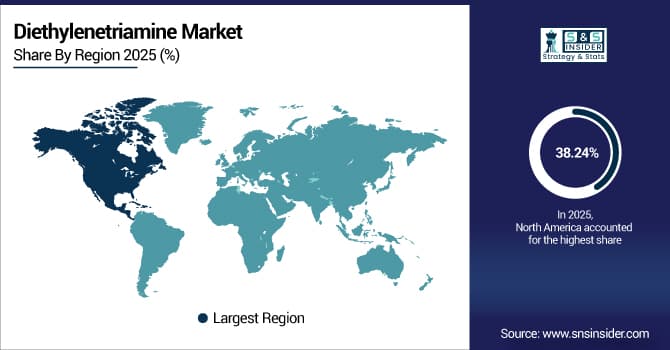

North America Diethylenetriamine Market Insights

In 2025 North America dominated the Diethylenetriamine Market and accounted for 38.24% of revenue share, this leadership is due to the growing consistently applications across oilfield chemicals, lubricants and polymers manufacturing. The existence of domestic significant producers in the US and Canada will continue to contribute to a robust supply and innovation for high-purity DETA uses. An increase in automotive coatings and adhesives also helped expansion in the region. The sustainability strides in the region are spurring the adoption of eco-friendly amine-based chemistries. North America accounted for 21% of global DETA demand in 2025.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Diethylenetriamine Market Insights

Strong presence in oil & gas and construction industry in U.S. Stable growth of construction investment and the improvement of technology in epoxy resins promote the rise in domestic consumption. U.S.-based producers are also adding exporting capability to Latin Americans and Asian buyers. The U.S. accounted for over 17% of global Diethylenetriamine consumption in 2025.

Europe Diethylenetriamine Market Insights

Europe is expected to witness the fastest growth in the Diethylenetriamine Market over 2026-2033, with a projected CAGR of 5.14% due to huge usage in coatings, adhesives and water treatment. Further, persistent ecological rules and regulations concerning sustainable chemicals have strengthened the popularity of DETA containing eco-friendly formulations. The lightweight automotive composites continued to be more powerfully exploited by product developers. Europe contributed about 26% of global DETA revenue in 2025.

Germany Diethylenetriamine Market Insights

Germany dominated the Diethylenetriamine consumption in Europe with high industrial manufacturing, automotive and specialty chemical production. The developed epoxy resin and adhesive technology of the country have widely used DETA as a curing agent or crosslinking agent. Germany represented around 8% of global DETA consumption in 2025.

Asia-Pacific Diethylenetriamine Market Insights

In 2025, Asia-Pacific emerged as a promising region in the Diethylenetriamine Market, due to demand from resin, adhesive and lubricant additive applications. Rising construction and automotive sectors in China, India, South Korea as well Japan led regional consumption higher. Local producers of chemicals are enhancing production capacity to ensure supply for both domestic and foreign markets. Market growth is further driven by increasing industrialization and urbanization in the region.

China Diethylenetriamine Market Insights

China continued to lead Asia-Pacific in 2025, due to its strong chemical, automotive and electronics industries. The adoption of corrosion inhibitors and surfactants such as DETA-based in the industrial sector has gained momentum owing to government efforts on industrial efficiency and environmental regulations.

Latin America (LATAM) and Middle East & Africa (MEA) Diethylenetriamine Market Insights

The Diethylenetriamine Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing oil & gas, construction and agriculture sector. A rise in construction activity in Brazil, Saudi Arabia and the UAE buttressed regional requirements. There is still modest production but most requirements are imported from North America and Asia. Steady industry diversification and downstream chemical expansion are improving long term fundamentals. LATAM and MEA collectively accounted for 11% of global DETA demand in 2025.

Diethylenetriamine Market Competitive Landscape:

BASF SE is a world leading manufacturer of Diethylenetriamine. High purity and industrial grade product forms ideal for coatings, adhesives or water treatment end use. The company focuses on sustainable and efficient amine production technologies. Its investment in R&D focuses on increased performance and environmental compatibility. BASF’s worldwide network of sales offices guarantees professional local assistance in Europe, Asia and in North America. In 2025, BASF accounted for over 11% of global DETA production capacity.

-

In April 2025, BASF SE introduced three natural-based ingredients Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA at the in-cosmetics Global event, strengthening its sustainable personal-care portfolio and reinforcing its focus on eco-friendly innovation and renewable ingredient solutions for cosmetic applications.

Huntsman Corporation is a significant participant in the world market for DETA, offering these products from captive production facilities and through an extensive product line. The firm specializes in the research and development of amine-based formulations for resin, lubricants and corrosion inhibitor purposes. Ongoing developments in Polyurethane and Epoxy chemistries ensure high standards are maintained. Huntsman’s downstream alliances with suppliers in North America and Europe are enhancing the company’s customer bases. In 2025, Huntsman contributed around 9% of worldwide DETA output.

-

In May 2025, Huntsman Corporation expanded its Conroe, Texas facility with the addition of its E-GRADE unit, enhancing semiconductor-grade high-purity amine production and improving global supply reliability for advanced electronics, coatings, and specialty chemical markets across North America and Asia.

AkzoNobel N.V. is a producer of specialty chemicals; DETA is used in coatings, adhesives and for manufacturing various types of plastics. The firm’s strategy for innovation is one that focuses heavily on sustainability and environmental impact minimization. Its European production facilities guarantee a local reliable supply and compliance with REACH. AkzoNobel’s commitment to next generation amines reflects the accelerating growth in the market.

-

In August 2025, AkzoNobel N.V. launched its Interpon D2525 Structura powder coatings line in South Asia, designed to deliver superior durability and aesthetic appeal for architectural applications, strengthening its regional presence and meeting the rising demand for sustainable, high-performance surface finishes.

Diethylenetriamine Market Key Players:

Some of the Diethylenetriamine Market Companies are:

-

BASF SE

-

Huntsman Corporation

-

Diamines and Chemicals Ltd.

-

The Dow Chemical Company

-

AkzoNobel N.V.

-

Tosoh Corporation

-

Nouryon

-

Afton Chemical Corporation

-

Lanxess AG

-

Lubrizol Corporation

-

Delamine B.V.

-

Arabian Amines Company

-

Shin-Akka Chemical Co. Ltd.

-

Toray Fine Chemicals

-

Avantor Inc.

-

SABIC

-

Mitsubishi Gas Chemical Company

-

Solvay S.A.

-

Eastman Chemical Company

-

Amines & Plasticizers Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 188.35 Billion |

| Market Size by 2033 | USD 269.16 Billion |

| CAGR | CAGR of 4.59% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Industrial Grade, Technical Grade, Pharmaceutical Grade, High-Purity Grade, and Others) • By Application (Resins & Adhesives, Lubricant Additives, Corrosion Inhibitors, Pharmaceuticals, and Others) • By End-User (Construction, Automotive, Oil & Gas, Chemicals, and Others) • By Function (Curing Agent, Chelating Agent, Surfactant, Intermediate, and Additive) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BASF SE, Huntsman Corporation, Diamines and Chemicals Ltd., The Dow Chemical Company, AkzoNobel N.V., Tosoh Corporation, Nouryon, Afton Chemical Corporation, Lanxess AG, Lubrizol Corporation, Delamine B.V., Arabian Amines Company, Shin-Akka Chemical Co. Ltd., Toray Fine Chemicals, Avantor Inc., SABIC, Mitsubishi Gas Chemical Company, Solvay S.A., Eastman Chemical Company, and Amines & Plasticizers Ltd. |