Digital Isolator Market Report Scope & Overview:

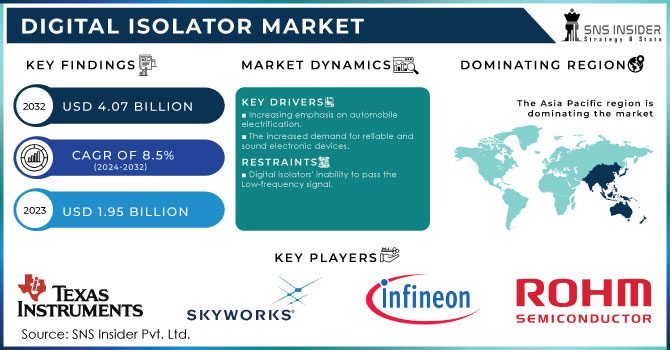

The Digital Isolator Market Size was valued at USD 1.93 Billion in 2023 and is expected to reach USD 3.55 Billion by 2032 and grow at a CAGR of 7.03% over the forecast period 2024-2032. Rising demand for digital isolators in industrial automation, electric vehicles (EVs), and high-speed communication fuels the growth of the digital isolator market. Organizations are emphasizing technology upgradation, product performance, and channeling functional fields within the healthcare, telecom, and energy industries. Digital isolators are rapidly replacing traditional optocouplers with impressive improvements in switching speed, power efficiency, and reliability. On one hand, customer behavior points to the trend towards more miniaturized, more efficient, and more secured isolation solutions, and on the other hand regulatory requirements, supply chain evolution, and increasing demand for miniaturization of electronics dictate the market.

Get more information on Digital Isolator Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Rising Demand for Digital Isolators Driven by EVs, Industrial Automation, and High-Speed Electronics

The digital isolator market is primarily driven by the adoption of high-speed and energy-efficient electronic systems across different industries including automotive, industrial automation, and telecommunications. One of the main driving forces behind market growth is the increasing need for galvanic isolation in power electronics including gate drivers and DC/DC converters. The trend towards electric vehicles (EVs), as well as renewable energy solutions, has increased the digital isolator demand as the performance of digital isolators is higher compared to the constational optocouplers, in terms of speed as well as reliability and power efficiency. Moreover, industrial automation and Industry 4.0 trends have strengthened the usage of digital isolators in motor drives, sensors as well as PLC to ensure safer and more reliable operations.

Restrain:

-

Challenges in Digital Isolator Integration Due to Design Complexity High-Voltage Stability and Stringent Regulations

Integration is a key restraint for the digital isolator market – their integration into existing electronic systems is complicated. Digital isolators have several design considerations that should be taken into account to ensure good signal integrity and electromagnetic compatibility which often represents a challenge for manufacturers. However, especially for high voltage applications, achieving the functional long-term stability and the environmental endurance of insulators particularly in the case of effective electric field conditions, is challenging. Also, specific sectors like aerospace and healthcare impose a more robust regulatory and safety standard that digital isolators must conform to, thereby prolonging validation, and should be checked thoroughly before getting approved.

Opportunity:

-

Advancements in Semiconductor Materials and Growing Healthcare Demand Boost Digital Isolator Market Expansion

The digital isolator market is gaining from continuous research growth in semiconductor materials including silicon carbide (SiC) and gallium nitride (GaN) which further improve the performance and robustness of the isolator. Moreover, the healthcare industry is also becoming a significant expansion channel for digital isolators owing to their increasing utilization in medical imaging, patient monitoring systems, and implantable devices. In addition, there are great opportunities for players as there is rising demand for high-speed, noise-immune isolation solutions for data centers and IoT applications. Investments in smart grids and energy-efficient power systems provide some additional growth opportunities as digital isolators are key to ensuring that data can be reliably transferred and power can be managed.

Challenges:

-

Lack of Awareness of Legacy Compatibility and Signal Integrity Challenges Hinder Digital Isolator Adoption

The big challenge is the lack of awareness and technical skills to implement it in the best way. Traditional isolation has been a time-tested solution in several industries however, migrating to digital isolators requires engineering expertise and a redesign of the circuit. Transitioning to digital isolators may not always be feasible because of compatibility issues with legacy systems, especially in industries where upgrading infrastructures is expensive and is a time-consuming process. In addition, there are other technical challenges related to the possible distortion or failure of the signal in applications using high-speed data transmission. Addressing these challenges will necessitate ongoing innovation, strong testing regimes, and more collaboration between semiconductor makers and customers to help ease integration and ensure reliability in critical-end applications.

Segment Analysis

By Type

The market for digital isolators was led by capacitive coupling with a 43.3% market share in 2023. This dominance is mainly attributed to its ability to transmit data at high speed while consuming less power and providing better Electromagnetic Interference (EMI) immunity. Capacitive coupling isolators are used commonly in industrial Automation, Automotive Electronics, and Telecommunications, as they provide good signal isolation while maintaining the integrity of data. This drives their extensive application in gate drivers, DC/DC converters, and high-frequency switching power supplies due to their advantages.

Magnetic coupling is anticipated to witness the highest CAGR during the forecast period of 2024 to 2032 on account of various benefits such as excellent noise immunity, high reliability, and operation in a high-temperature environment. Customary patterns for isolators during this procedure rely upon sneak and vitality board illustrative advances, which give scientifically relevant portrayals of isolator execution in the quick and reasonableness scope. High-power applications witness the use of magnetic coupling isolators for increased efficiency and the increasing penetration of electric vehicles (EVs) and renewable energy systems is anticipated to initiate a new wave with enhanced demand for magnetic coupling isolators.

By Data Rate

The 25 Mbps to 75 Mbps segment accounted for 42.7% of the market share. It dominates due to the large number of applications (industrial automation, automotive systems, and power electronics) that require moderate-speed data transmission for effective signal processing and isolation. In this performance, power, and cost range, digital isolators are primarily used for gate drivers, DC/DC converters, and motor control applications. Even with communication interfaces, microcontrollers, and sensors, they are preferred to be used with these as they provide isolation reliability but very little faster/Pace levels & stability.

The above 75 Mbps segment is anticipated to register the fastest CAGR during the forecast period 2024 to 2032, owing to the rising need for high-speed data transmission in telecom, data centers, and sophisticated industrial applications. The necessity of isolators that enable ultra-low latency transmission such as a few nanoseconds of the signal is driven by the rapid growth of 5G networks, high-speed communication systems, and real-time data processing. Furthermore, faster digital isolators are essential for new technologies like autonomous vehicles, AI-based industrial automation, and IoT-based smart systems for data persistence and to avoid signal degradation.

By Channel

In 2023, the digital isolator Market share of the Channel Four segment has crossed 38.3% of the market. Such dominance is due to its extensive use in industrial automation, automotive electronics, and power management applications that must provide a tradeoff between isolation performance and cost. Four-channel digital isolators are a great fit for mid-range systems like motor drives, PLCs, and communication interfaces since they provide robustness in data transmission and electrical isolation. The efficiency in multi-signal management with a low footprint has also cemented their place in the market.

Channel Eight is projected to grow at the fastest CAGR during the forecast period from 2024 to 2032 due to the increasing requirement of high-density isolation versatility across many high-performance industrial and telecommunication systems. Advancements in communication and automation like high-speed data communication and complex automation networks, combined with the growth in electric vehicle power systems are driving the need for eight-channel isolators enabling higher integration and smaller PCB footprints. This segment is expected to grow at a rapid pace due to the increasing demand for multi-channel digital isolators as industries are moving towards miniaturized, high-performance electronics.

By Application

In 2023, the digital isolator market was dominated by the Gate Drivers segment, which had a 41.7% market share. The main factor responsible for this dominance is the rapid adoption of power electronics in industrial automation, electric vehicles (EVs), and renewable energy systems. Simply put, there is always a need for gate drivers in applications such as motor control, inverters, and power converters that deliver isolation, high-speed switching, and provide high gate current for the high voltage MOSFETs and IGBTs to operate. Due to the requirement of high efficiency, miniaturization, and reliable isolation performance, the application of digital isolators has greatly promoted the gate driver under a high-voltage environment.

The DC/DC Converter segment is expected to have the highest CAGR during the period from 2024 to 2032 as the need for efficient power management solutions across industries such as automotive, telecommunications, and industrial automation is expected to drive the growth of the segment. The continued push for more energy-efficient systems and miniaturized power supplies continues to drive the demand for digital isolators, as they offer great performance within DC/DC converters with their higher voltage regulation and noise immunity properties, putting them front and center in battery management systems (BMS) in EVs, IoT devices, and 5G infrastructure.

By Vertical

In 2023, the Industrial segment accounted for the largest share of 27.8% of the digital isolator market. This domination is due to growing implementations of automation, robotics, and Industry 4.0 technologies in manufacturing and process industries. Digital isolators have a wide range of applications in the fields of motor drives, factory automation systems, PLCs, and industrial power supplies where they provide reliable signal transmission and electrical isolation in demanding operating conditions. The increasing shift toward smart factories and IIoT (Industrial Internet of Things) interfaces has propelled the demand for performance-oriented isolation solutions, thus further consolidating the share of the industrial sector in the global market.

The automotive segment is projected to exhibit the fastest CAGR during the forecast period 2024-2032, owing to the swift growth of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and battery management systems (BMS). Digital isolators are vital for safe and effective power management, data communication, and noise immunity automakers are not moving toward electrification and autonomous driving technologies without them. Automotive will be the fastest-growing segment in the upcoming years, with the rising integration of high-voltage power electronics, onboard chargers, and infotainment systems further driving the demand.

Regional Analysis

The North American region accounted for 34.4% of market share. Such dominance is due to a vast concentration of semiconductor giants, robust industrial automation, and swift penetration of EVs and renewable energy solutions. For decades, the high-speed communication infrastructure, industrial robotics, and aerospace & defense applications across the U.S. and Canada have motivated the demand for digital isolators that can ensure signal integrity and electrical isolation. Concrete use cases can be found in Texas Instruments and Analog Devices as well as Skyworks Solution providing state-of-the-art digital isolator solutions for EV powertrains, industrial motor drives as well and medical imaging equipment.

Asia Pacific is projected to be the fastest-growing region with the highest CAGR from 2024 to 2032, owing to the strong Consumer Electronics, Automotive electrification & Smart Grid infrastructure. The data about countries such as China, Japan, South Korea, and India, which are heavily investing in 5G, electric mobility, and industrial automation, opens new potential needs for high-performance isolation solutions. In EV platforms and autonomous driving systems, digital isolators are being integrated by BYD and Hyundai, while in 5G base stations and high-speed data transmission equipment, Huawei and Samsung have adopted digital isolators.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the Digital Isolator Market are:

-

Texas Instruments (ISO6163, ISO6520)

-

Analog Devices (ADuM362N, ADuM321N)

-

Infineon Technologies (ISOFACE Dual-Channel, ISOFACE Quad-Channel)

-

STMicroelectronics (STISO621, STISO621W)

-

Vicor Corporation (PI3586-00-LGIZ, PI3740-00-LGIZ)

-

Silicon Labs (Si86xx, Si88xx)

-

Broadcom (ACPL-C87B, ACPL-K73L)

-

NXP Semiconductors (NX3DV42GU10, NX3L1T53GU10)

-

Maxim Integrated (MAX22441, MAX22666)

-

Rohm Semiconductor (BD7F100HFN-LB, BD7F200HFN-LB)

-

Murata Manufacturing (MGJ2D121505SC, MGJ6D121505SC)

-

ON Semiconductor (NCS21xR, NCS21xR2)

-

Renesas Electronics (ISL32704E, ISL32705E)

-

Toshiba Electronic Devices & Storage (TLP2361, TLP2363)

-

Broadcom (ACPL-P480, ACPL-W480)

Recent Trends

-

In November 2024, Texas Instruments (TI) launched new MCUs with edge AI and enhanced real-time control, boosting efficiency, safety, and sustainability in automotive and industrial applications.

-

In February 2024, Infineon launched new Solid-State Isolators with coreless transformer technology, enabling faster switching with up to 70% lower power dissipation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.93 Billion |

| Market Size by 2032 | USD 3.55 Billion |

| CAGR | CAGR of 7.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Capacitive Coupling, GMR, Magnetic Coupling) • By Data Rate (Less Than 25 Mbps, 25 Mbps to 75 Mbps, above 75 Mbps) • By Channel (Channel Two, Channel Four, Channel Six, Channel Eight) • By Application (Gate Drivers, DC/DC Converter, ADC) • By Vertical (Industrial, Healthcare, Automotive, Telecommunication, Aerospace & Defense, Energy & Power) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Texas Instruments, Analog Devices, Infineon Technologies, STMicroelectronics, Vicor Corporation, Silicon Labs, Broadcom, NXP Semiconductors, Maxim Integrated, Rohm Semiconductor, Murata Manufacturing, ON Semiconductor, Renesas Electronics, Toshiba Electronic Devices & Storage, Broadcom. |