Drip Irrigation Market Report & Overview:

The Drip Irrigation Market size was valued at USD 6.40 billion in 2023 and is expected to grow to USD 16.08 billion by 2032 and grow at a CAGR of 10.78% over the forecast period of 2024-2032. This growth is attributed to various factors such as the increasing adoption of advanced irrigation technologies, massive investments being made in sustainable agriculture, and the growing awareness of the environmental impacts of water conservation. Also, there is a surge in consumer knowledge about the advantages of efficient irrigation systems, which is also keeping the market demand on an up-handed note. The aforementioned factors together drive the growth of the drip irrigation market.

Get E-PDF Sample Report on Drip Irrigation Market - Request Sample Report

Drip Irrigation Market Dynamics:

Drivers:

-

Enhancing Agricultural Sustainability through Efficient Irrigation Technologies

Increasing Global food demand Due to Population Explosion is making it imperative that irrigation systems should be as efficient as viable. Drip irrigation systems supply water directly to the plant root, utilizing the water more efficiently and reducing wastage, and the latest technologies to support productivity. FNF's Rocket 2.0 Smart Irrigation Platform employs artificial intelligence and built-in sensors to ensure irrigation efficiency and to reduce water waste. Since 70 percent of the world’s freshwater is being used for farming — and almost 40 percent of this water is wasted — this platform can reduce water costs by 30 percent, and increase crops’ yield. By promoting agricultural water productivity, it addresses the urgent need for effective water management policies in water-scarce regions.

Restraints:

-

Drip irrigation systems require consistent maintenance to prevent clogging and ensure efficiency, creating challenges for farmers due to the need for regular upkeep and technical knowledge.

Drip irrigation systems require consistent maintenance to operate effectively, as the emitters can easily become clogged with debris, sediment, or mineral deposits. This requires frequent inspection and purging, which can be a huge burden for farmers, especially those with little cash or know-how. Maintenance tasks typically include checking the system for leaks, flushing emitters and … verifying filters are clean and functioning properly. For many smallholder farmers, the labor and time incurred in maintaining these systems can be significant, which may in turn reduce system efficiency and crop yields. Additionally, the lack of access to trained personnel for maintenance further complicates the issue, making it a critical restraint in the widespread adoption of drip irrigation technologies.

Opportunities:

-

Advancing Precision Agriculture through Drip Irrigation for Enhanced Sustainability and Resource Efficiency.

The growing emphasis on precision agriculture fosters the integration of drip irrigation within comprehensive crop management strategies, enhancing productivity and resource efficiency. With rapidly decreasing water availability, compounded by climate change impacts, appropriate water management is paramount to sustainable agriculture. Using advanced water tracking technology, this approach uses precision irrigation, soil moisture sensors, and real-time data analytics to increase water efficiency. By delivering water directly to the root zones of the crops, it prevents evaporation and runoff, allowing for an irrigation efficiency of up to 92% and cuts water consumption by 50%. Its 30% increase in crop yields illustrates support for sustainable farming. Utilizing IoT and machine learning, it presents a viable, eco-friendly alternative to traditional irrigation, balancing resource conservation with agricultural productivity.

Challenges:

-

Climate variability poses significant challenges for the drip irrigation market by impacting water availability and system effectiveness.

Climate variability has a strong and direct impact on agricultural practices, particularly for farmers employing drip irrigation systems. Changes in weather patterns, such as long periods of drought or unexpected heavy rainfall, can affect water availability and the feasibility/efficiency of these systems. For instance, as drought periods increase, the water demand is higher but the irrigation becomes less effective due to lower water availability. On the other hand, too much rain can cause waterlogging, reducing the efficacy of drip systems built for targeted application. Furthermore, variable temperatures can influence crop development and water requirements making irrigation scheduling and management more complex. As a result, farmers may face difficulties in optimizing water use, leading to decreased crop yields and increased operational costs. This challenge emphasizes the need for adaptable irrigation solutions and highlights the importance of integrating climate-resilient practices in the drip irrigation market to enhance sustainability and productivity in agriculture.

Drip Irrigation Market Segment Analysis:

By Component

In 2023, the Drip Tubing/Drip Lines segment led the drip irrigation market, capturing approximately 41% of the revenue share. This is due to the high proliferation of drip tubing systems, which efficiently deliver water directly to the plant's roots, minimizing waste and maximizing crop yield. These systems are popular due to their versatility for different agricultural types like row crops, orchards or even greenhouses. In addition, improvements in materials and production processes have been refined and drip tubing has become more durable and efficient, making the equipment more appealing to the producers looking for an effective and inexpensive irrigation solution. As water scarcity becomes a more pressing issue globally, the demand for efficient irrigation components like drip tubing is expected to continue growing, reinforcing its significant market share.

The Emitters/Drippers segment is expected to experience the fastest growth in the drip irrigation market during the forecast period from 2024 to 2032. This growth can be the growing demand for precision agriculture, which demands highly efficient water delivery systems to maximize the amount of crops and the efficient use of resources. To ensure this efficiency, emitters and drippers are used, as they deliver the water as close to the roots as possible, reducing evaporation and runoff. Furthermore, industry evolution has given rise to equipment by using sensors and automation, smart emitters are also emerging, and they are increasingly favorable by farmers.. As agricultural practices evolve to prioritize sustainability and efficiency, the demand for innovative emitter solutions is anticipated to rise significantly, driving the segment's growth.

By Method

The Surface segment dominated the largest share of revenue in the drip irrigation market, accounting for approximately 69% in 2023. Surface drip irrigation systems are already widely adopted for many agricultural applications such as field crops and orchards, which explains their prevalent market share. Surface drip irrigation is the most commonly used method around the world because it is inexpensive, easy to install, and enables water delivery precisely to the plant root zone, which reduces evaporation losses and ensures efficient water utilization. Moreover, rising attention towards water conservation and sustainable agriculture practices have additionally propelled the adoption of surface-based systems, thus facilitating the market expansion. As demand for resource-efficient irrigation systems rises, the surface segment is expected to maintain its strong position in the coming years.

The Subsurface segment is the fastest-growing segment in the drip irrigation market during the forecast period from 2024 to 2032. This growth can be attributed to the increasing awareness of water conservation and the need for efficient irrigation methods that minimize evaporation and runoff. Subsurface drip irrigation systems can optimize water application by directly applying water to the root zone of crops buried below the soil surface, which can also improve crop growth and yield. The integration of subsurface systems also benefits from technological advancements, such as enhanced emitter designs and soil moisture sensors, which enable accurate water management. As farmers strive to increase productivity and minimize water usage, the subsurface segment is projected to witness substantial growth over the next few years.

By Crop

The Field Crops segment dominated the drip irrigation market, accounting for approximately 59% of the revenue in 2023. The growing use of drip irrigation systems in bunk larger production crops, where efficiency and maxing yield are vital. Drip irrigation is extremely effective on field crops including corn, soybeans, and cotton, as it provides direct water to the roots of the plants reducing water wastage and increasing growth. On the other hand, the increasing global population coupled with the growing demand for food are also promoting the need for efficient irrigation solutions in field agriculture. Moreover, automated and precision irrigation are likely to make drip systems more attractive to farmers, supporting sustainable practices and driving robust growth of segment in the global drip irrigation system market.

The Fruits and Nuts segment is poised to be the fastest-growing sector in the drip irrigation market over the forecast period from 2024 to 2032. This growth is primarily due to surging global demand for high-quality fruits and nuts, fueled by shifting consumer preferences towards healthier diets and organic food items. Overall, these systems improve water efficiency, increase crop yield and produce higher-quality fruit and nut by delivering water more precisely to the roots. In addition, new irrigation technologies (eg. soil moisture monitoring, automation of irrigation systems) are making drip irrigation more affordable and efficient for fruit and nut growers. Increasing emphasis on sustainability and resource conservation in the agricultural sector propels the Fruits and Nuts segment to register significant growth over the next few years.

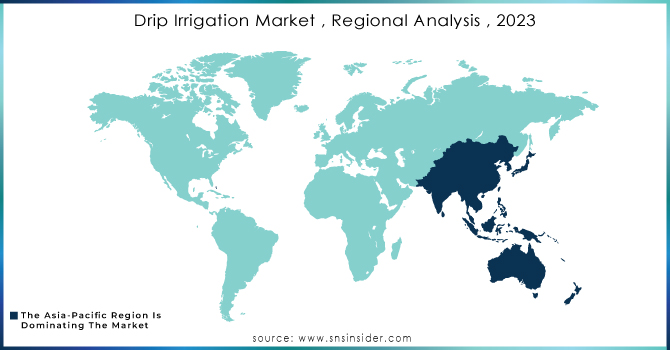

Drip Irrigation Market Regional Analysis:

The Asia-Pacific region holds the largest share of revenue in the drip irrigation market, accounting for approximately 44% in 2023. This dominance is driven by several factors, including the increasing adoption of advanced agricultural practices, an increasing emphasis on water conservation due to growing water scarcity, and dire demand for efficient irrigation techniques to increase crop yields. Countries in this area including India and China are investing significant amounts to modernize their agriculture infrastructure which in turn leading to huge demand in Drip Irrigation System. In addition, government initiatives and support for sustainable farming practices drive the adoption of drip irrigation technologies, making the Asia-Pacific market a key player in the global agricultural irrigation landscape.

The North America region is the fastest-growing market for drip irrigation, projected to experience significant expansion during the forecast period from 2024 to 2032. This growth is driven by several factors driving this growth, including increased awareness of water conservation practices, technological advancements in irrigation, and a greater emphasis on sustainable agricultural practices. The advantage of drip irrigation systems has gained momentum among farmers to achieve optimal use of water in addition to enhancing crop yield. The use of premium irrigation solutions has also been promoted in the developing markets, either due to government initiatives or funding programs.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Drip Irrigation Market Key Players:

Some of the major key Players in Drip Irrigation Market along with along with product:

-

NETAFIM (Israel) - Drip Irrigation Solutions

-

Jain Irrigation Systems Ltd. (India) - Drip Irrigation Systems, Sprinklers, and Pipes

-

Lindsay Corporation (USA) - Center Pivot Irrigation Systems

-

The Toro Company (USA) - Irrigation Systems, Drip Irrigation Products

-

Rivulis (Israel) - Drip Irrigation and Micro Irrigation Solutions

-

Rain Bird Corporation (USA) - Irrigation Products, Controllers, and Sprinklers

-

HUNTER INDUSTRIES INC. (USA) - Sprinkler Systems, Drip Irrigation Products

-

T-L Irrigation (USA) - Center Pivot Irrigation Systems

-

Antelco (Australia) - Drip Irrigation Solutions

-

AZUD (Spain) - Filtration and Drip Irrigation Systems

-

T-L Irrigation Company (USA) - Center Pivot and Lateral Move Irrigation Systems

-

EPC Industries (France) - Irrigation Systems and Equipment

-

Nelson Irrigation Corporation (USA) - Sprinkler and Drip Irrigation Products

-

DripWorks Inc (USA) - Drip Irrigation Kits and Supplies

-

Microjet Irrigation Systems (USA) - Micro Irrigation Solutions

-

Rivulis Irrigation Limited (Israel) - Drip and Micro Irrigation Solutions

-

Harvel Agua (USA) - PVC Piping for Irrigation

-

Antelco Pty Ltd (Australia) - Drip Irrigation Solutions

-

Irritec S.P.A (Italy) - Drip Irrigation Systems and Components

List of suppliers who provide raw materials and components for the drip irrigation market:

-

Netafim

-

Toro Company

-

Rain Bird Corporation

-

Jain Irrigation Systems Ltd.

-

Hunter Industries

-

M. Irrigation

-

Blick Industries

-

Ceres Global Ag Corp

-

Dura-Line Corporation

-

Elgo Irrigation Ltd.

Recent Development

-

On February 19, 2025, Netafim USA is now rolling out FlexNet Medium Pressure Pipes to improve water distribution efficiency and reduce labour costs by 20-30% as of These pipes, imported from their Fresno facility, make life easier for the Sustainable Groundwater Management Act, which has resulted in reduced water production for certain users.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.40 Billion |

| Market Size by 2032 | USD 16.08 Billion |

| CAGR | CAGR of 10.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Drip Tubing/Drip Lines, Emitters/Drippers, Valves, Pumps, Filters, Others) • By Method (Surface, Subsurface) • By Crop (Field Crops, Fruits and Nuts, Vegetable Crops, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NETAFIM (Israel), Jain Irrigation Systems Ltd. (India), Lindsay Corporation (USA), The Toro Company (USA), Rivulis (Israel), Rain Bird Corporation (USA), HUNTER INDUSTRIES INC. (USA), T-L Irrigation (USA), Antelco (Australia), AZUD (Spain), T-L Irrigation Company (USA), EPC Industries (France), Nelson Irrigation Corporation (USA), DripWorks Inc (USA), Microjet Irrigation Systems (USA), Rivulis Irrigation Limited (Israel), Harvel Agua (USA), Antelco Pty Ltd (Australia), Irritec S.P.A (Italy). |