Driverless Car Sensors Market Report Scope & Overview:

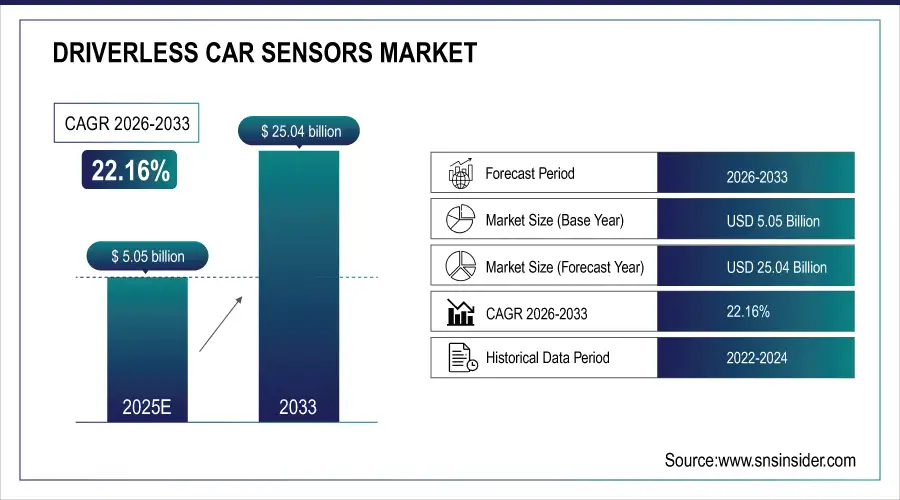

The Driverless Car Sensors Market size was valued at USD 5.05 Billion in 2025E and is projected to reach USD 25.04Billion by 2033, growing at a CAGR of 22.16% during 2026–2033.

The Driverless Car Sensors market is evolving rapidly, driven by advances in autonomous driving technologies and increasing demand for safer, more efficient transport. Key sensor types include LiDAR, radar, and high-resolution cameras, often integrated with AI and advanced driver-assistance systems (ADAS). While LiDAR has been promoted for fully autonomous vehicles, its adoption remains limited outside China due to high costs and growing performance of cameras and radar, which now meet many OEM requirements. Advances in processing power and system-on-chip (SoC) technologies further enable real-time data interpretation, making sensor fusion solutions critical for next-generation driverless cars and robotaxis.

On January 24, 2025, LiDAR adoption in automotive markets faces slow uptake outside China, as advanced cameras, AI, and radar increasingly meet OEMs’ autonomous driving needs.

Driverless Car Sensors Market Size and Forecast:

-

Market Size in 2025E: USD 5.05 Billion

-

Market Size by 2033: USD 25.04 Billion

-

CAGR: 22.16% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Driverless Car Sensors market - Request Free Sample Report

Driverless Car Sensors Market Highlights:

-

Growing AI integration in vehicles is driving demand for advanced driverless car sensors, emphasizing connectivity, automation, and safety over traditional car features.

-

Automakers are adopting sophisticated sensor suites including LiDAR, radar, and high-resolution cameras for real-time decision-making and autonomous navigation.

-

High costs and technical complexity of advanced sensors limit large-scale adoption, posing challenges for smaller automakers and global deployment.

-

Integration requires precise calibration, robust AI algorithms, and compliance with varying regional safety standards, adding development time and cost.

-

Falling LiDAR costs and improved sensor designs are enabling mass adoption in passenger vehicles and expanding application possibilities.

-

Enhanced LiDAR performance, including long-range detection and environmental resilience, supports innovation, collaborations, and scaling opportunities in autonomous driving.

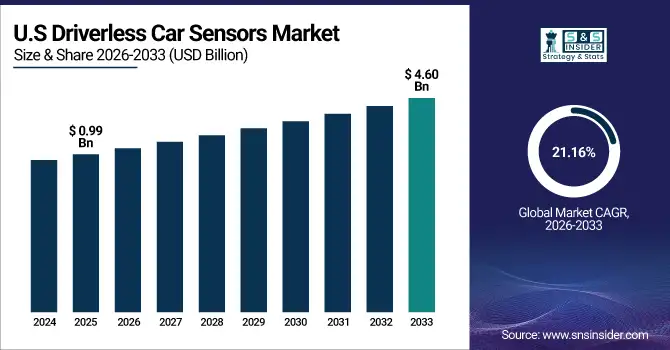

The U.S. Driverless Car Sensors Market size was valued at USD 0.99 Billion in 2025E and is projected to reach USD 4.60 Billion by 2033, growing at a CAGR of 21.16% during 2026–2033. This growth is fueled by rapid advancements in autonomous driving technologies, increasing deployment of ADAS systems, and rising investments from automotive OEMs and tech firms. Growing demand for real-time object detection, LiDAR, radar, and camera-based sensing solutions is accelerating market expansion.

Driverless Car Sensors Market Drivers:

-

Growing AI Integration in Vehicles Boosts Demand for Advanced Driverless Car Sensors

The growing integration of AI and quasi-autonomous systems in vehicles is driving demand for advanced driverless car sensors. Automakers are prioritizing intelligent driving technologies over traditional car features, reflecting a shift in consumer and industry focus toward connectivity, automation, and safety. This trend compels manufacturers to adopt sophisticated sensor suites including LiDAR, radar, and high-resolution cameras to enable real-time decision-making, obstacle detection, and autonomous navigation. The push for AI-enabled vehicles accelerates sensor innovation, expands market opportunities, and fosters competition among automotive technology providers globally.

On April 2025, the Shanghai Auto Show highlighted AI-powered and quasi-autonomous vehicles, emphasizing advanced driverless technologies over traditional car models.

Driverless Car Sensors Market Restraints:

-

High Costs and Technical Complexity Cause Limited Adoption of Driverless Car Sensors

The adoption of driverless car sensors faces significant challenges due to high costs and technological complexity. Advanced LiDAR, radar, and camera systems require substantial investment in both hardware and software, making mass-market deployment expensive. Integration into vehicles demands precise calibration, robust AI algorithms, and seamless communication with onboard systems, which increases development time and cost. Regulatory hurdles, varying safety standards across regions, and concerns about reliability in extreme weather or complex urban environments further constrain adoption. These factors slow large-scale commercialization, limit accessibility for smaller automakers, and create barriers for rapid global deployment of autonomous vehicles.

Driverless Car Sensors Market Opportunities:

-

Falling Costs and Improved LiDAR Designs Drive Mass Adoption in Driverless Vehicles

The declining cost and enhanced durability of LiDAR sensors are creating significant growth potential in the driverless car sensor market. More compact, robust designs enable integration into a wider range of passenger vehicles, while improved performance, including long-range detection and resistance to environmental factors, expands application possibilities. Automakers and technology providers can leverage these advancements to enhance autonomous driving features, improve vehicle safety, and accelerate market penetration. This shift supports new collaborations, product innovations, and scaling opportunities, making the LiDAR segment a key driver of growth in the broader autonomous vehicle ecosystem.

On July 22, 2025, IDTechEx reported that LiDAR adoption is accelerating with lower costs, compact designs, and mass deployment in Level 2+ passenger vehicles.

Driverless Car Sensors Market Segment Highlights:

-

By Sensor Type: Dominant – LiDAR (53.13% in 2025 → 41.88% in 2033); Fastest-Growing –Camera (CAGR 28.58%)

-

By Application: Dominant – Collision Detection (34.38% in 2025 → 30.63% in 2033); Fastest-Growing – Traffic Sign Recognition (CAGR 25.99%)

-

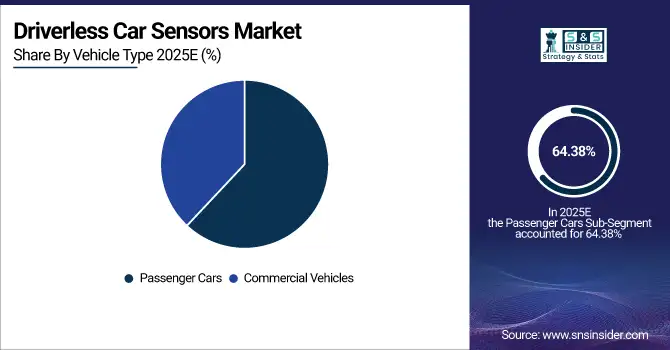

By Vehicle Type: Dominant – Passenger Cars (64.38% in 2025 → 60.63% in 2033); Fastest-Growing – Commercial Vehicles (CAGR 23.69%)

-

By End-User: Dominant – OEMs (74.38% in 2025 → 70.63% in 2033); Fastest-Growing – Aftermarket (CAGR 24.24%)

Driverless Car Sensors Market Segment Analysis:

By Vehicle Type, Passenger Cars Dominating and Commercial Vehicles Fastest-Growing

Passenger cars continue to dominate the market due to their high adoption of advanced sensors for safety, navigation, and driver-assistance features. Commercial vehicles, however, represent the fastest-growing segment, fueled by rising demand for fleet automation, logistics efficiency, and enhanced safety systems across transportation and delivery industries.

By Sensor Type, LiDAR Dominating and Camera Fastest-Growing

LiDAR remains the dominant sensor type in the automotive and smart mobility market, widely used for navigation, collision detection, and autonomous driving due to its high accuracy, reliability, and long-range detection capabilities. Camera sensors, on the other hand, are the fastest-growing segment, driven by increasing adoption in advanced driver-assistance systems, traffic monitoring, and vehicle perception applications, offering cost-effective, versatile, and compact solutions to meet evolving safety and automation requirements.

By Application, Collision Detection Dominating and Traffic Sign Recognition Fastest-Growing

Collision detection remains the dominant application in the automotive sensor market, widely deployed for enhancing vehicle safety, preventing accidents, and supporting autonomous driving systems. Traffic sign recognition is the fastest-growing application, driven by increasing regulatory requirements, adoption of advanced driver-assistance systems, and the need for intelligent traffic monitoring, enabling vehicles to detect, interpret, and respond to road signs effectively.

By End-User, OEMs Dominating and Aftermarket Fastest-Growing

OEMs remain the dominant end-user segment, integrating advanced sensors during vehicle manufacturing to meet safety and regulatory standards. The aftermarket segment is the fastest-growing, driven by increasing retrofitting of advanced sensors, upgrades for autonomous features, and rising demand for enhanced vehicle safety and performance solutions post-purchase.

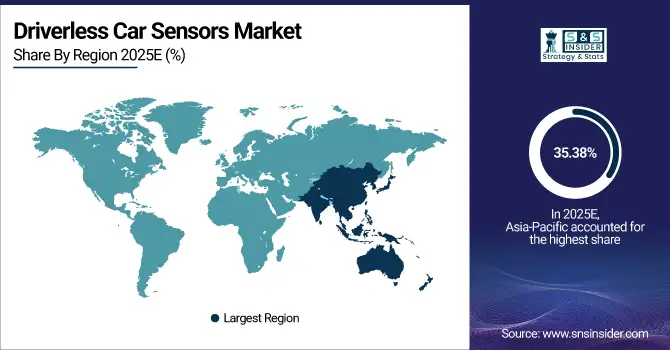

Driverless Car Sensors Market Regional Highlights:

-

Asia-Pacific: In 2025E 35.38% → 37.63%, Dominating Region (CAGR 23.10%)

-

North America: In 2025E 29.75% → 28.25%, Significant Market (CAGR 21.37%)

-

Europe: In 2025E 24.63% → 22.38%, Moderate Growth (CAGR 20.70%)

-

Latin America: In 2025E 5.13% → 5.88%, Steady Growth (CAGR 24.24%)

-

Middle East & Africa: In 2025E 5.13% → 5.88%, Stable Share (CAGR 24.24%)

Driverless Car Sensors Market Regional Analysis:

Asia-Pacific Driverless Car Sensors Market Insights:

Asia-Pacific dominates the Driverless Car Sensors Market due to rapid technological adoption, supportive government policies, and extensive investments in autonomous vehicle infrastructure. The region benefits from strong automotive manufacturing hubs, growing urbanization, and rising consumer interest in advanced mobility solutions. These factors collectively drive demand for LiDAR, radar, and camera sensors, positioning Asia-Pacific as the leading market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Driverless Car Sensors Market Insights:

China leads the Driverless Car Sensors market, driven by advanced automotive technology adoption, government support for autonomous vehicles, rapid urbanization, and significant investments in LiDAR, radar, and camera sensor technologies.

North America Driverless Car Sensors Market Insights:

North America is the fastest-growing region in the Driverless Car Sensors market, fueled by robust R&D initiatives, early adoption of autonomous vehicle technologies, supportive regulatory frameworks, and strong presence of key automotive and technology players. High investments in LiDAR, radar, and camera sensors, along with increasing consumer interest in connected and autonomous vehicles, are accelerating regional market growth.

U.S. Driverless Car Sensors Market Insights:

The U.S. dominates the Driverless Car Sensors market, driven by advanced automotive technology, strong R&D infrastructure, major sensor manufacturers, and supportive policies promoting autonomous vehicle adoption and innovation.

Europe Driverless Car Sensors Market Insights:

The Europe Driverless Car Sensors Market is witnessing emerging trends such as increased adoption of advanced LiDAR, radar, and camera systems, integration of AI-driven perception technologies, and growing investments in smart mobility infrastructure. Collaborations between automotive manufacturers and tech companies, along with supportive government regulations, are further driving innovation, enhancing sensor accuracy, and accelerating the deployment of autonomous vehicles across the region.

Germany Driverless Car Sensors Market Insights:

Germany dominates the European market due to its strong automotive industry, advanced R&D in autonomous vehicle technologies, and significant investments in sensor development and deployment. Other key contributors include France and the U.K., but Germany leads in market share and innovation.

Latin America Driverless Car Sensors Market Insights:

The Latin America Driverless Car Sensors Market is steadily expanding, driven by increasing automotive production, growing urbanization, and rising interest in connected and autonomous vehicles. Investments in sensor technologies and supportive government initiatives are gradually enhancing regional adoption and market growth.

Brazil Driverless Car Sensors Market Insights:

Brazil dominates the Driverless Car Sensors market due to its large automotive industry, growing investments in autonomous vehicle technologies, and increasing adoption of advanced sensor systems. Other notable contributors include Mexico and Argentina, but Brazil remains the leading country in market share and technological development.

Middle East & Africa Driverless Car Sensors Market Insights:

The Middle East and Africa Driverless Car Sensors Market is witnessing moderate growth, driven by gradual adoption of autonomous vehicle technologies, government initiatives supporting smart mobility, and investments in advanced LiDAR, radar, and camera sensors. Countries like the UAE and Saudi Arabia are leading regional development, while infrastructure expansion and technology partnerships are steadily enhancing market presence across the region.

UAE & Saudi Arabia Driverless Car Sensors Market Insights:

The UAE and Saudi Arabia dominate the Driverless Car Sensors market. These countries lead due to strong government support for autonomous vehicle initiatives, smart mobility projects, and investments in advanced sensor technologies. Other countries in the region are gradually adopting, but the UAE and Saudi Arabia hold the largest market share and influence.

Driverless Car Sensors Market Competitive Landscape:

NVIDIA Corporation – Established in 1993, NVIDIA is a global leader in accelerated computing, AI, and autonomous vehicle technologies. The company develops high-performance GPUs, AI software platforms, and the NVIDIA DRIVE ecosystem, enabling next-generation driverless systems, robotics, and smart mobility solutions for automotive, industrial, and enterprise applications worldwide.

-

In October 2025, NVIDIA Corporation– NVIDIA partnered with Uber to scale the world’s largest Level 4-ready robotaxi and autonomous delivery fleets using its DRIVE AGX Hyperion 10 platform, enabling Uber’s global rollout of 100,000 autonomous vehicles starting in 2027 and advancing the AI-driven mobility ecosystem.

FORVIA HELLA Established in 1899 is a global automotive technology leader specializing in lighting, electronics, and sensor systems. The company focuses on advanced driver assistance, steer-by-wire, and autonomous vehicle technologies, delivering innovative, high-precision solutions for safety, efficiency, and electrification across global automotive markets.

-

In August 2025, FORVIA HELLA launched its fifth-generation steer-by-wire sensors, enhancing electric steering precision for premium automakers in Germany and China, marking a major step toward fully electric steering systems.

Driverless Car Sensors Market Key Players:

-

Bosch

-

Continental AG

-

Denso Corporation

-

Veoneer Inc.

-

Hella GmbH

-

Aptiv PLC

-

Valeo SA

-

ZF Friedrichshafen AG

-

Velodyne Lidar

-

Innovusion

-

Hesai Technology

-

Ibeo Automotive Systems

-

Ouster Inc.

-

RoboSense

-

Luminar Technologies

-

AEye Inc.

-

Waymo LLC

-

Mobileye

-

Quanergy Systems

-

NVIDIA Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.05 Billion |

| Market Size by 2033 | USD 25.04 Billion |

| CAGR | CAGR of 22.16% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type(LiDAR, Radar, Ultrasonic, Camera and Others) • By Application(Navigation, Collision Detection, Lane Departure Warning, Traffic Sign Recognition and Others) • By Vehicle Type(Passenger Cars and Commercial Vehicles) • By End-User(OEMs and Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Bosch, Continental AG, Denso Corporation, Veoneer Inc., Hella GmbH, Aptiv PLC, Valeo SA, ZF Friedrichshafen AG, Velodyne Lidar, Innovusion, Hesai Technology, Ibeo Automotive Systems, Ouster Inc., RoboSense, Luminar Technologies, AEye Inc., Waymo LLC, Mobileye, Quanergy Systems, NVIDIA Corporation. |