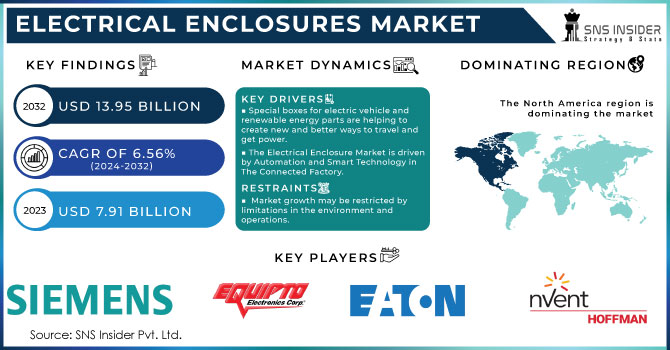

Electrical Enclosure Market Size Analysis:

The Electrical Enclosures Market size was $ 7.91 Billion in 2023 and is estimated to Reach USD 13.95 billion by 2032 and grow at a CAGR of 6.56% over the forecast period of 2024-2032.

Generic enclosures frequently do not fulfill the particular requirements of individual projects. Customized enclosures provide personalized answers for difficult environments and applications.

These tailored solutions offer ideal suitability and functionality for users. They are carefully crafted to fit certain wiring setups and seamlessly work with current systems. This results in advantages such as improved airflow, boosted efficiency, and better defense against external dangers. Clients are also able to customize the enclosures by selecting the size, shape, material, and surface finishes to meet industry guidelines and incorporate unique elements. Many end-users choose customized enclosures because they are able to meet a wide range of needs.

Electrical Enclosures Market Size and Forecast

-

Market Size in 2023: USD 7.91 Billion

-

Market Size by 2032: USD 13.95 Billion

-

CAGR: 6.56% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020-2022

Get More Information on Electrical Enclosure Market - Request Sample Report

Key market trends for the Electrical Enclosures Market

-

Rising industrial automation and smart infrastructure is increasing enclosure demand, with the market projected to grow at ~5% CAGR over the next decade.

-

Expansion of renewable energy and smart grid projects is boosting adoption, as over 20% of new installations require weather-proof and outdoor-rated enclosures.

-

Growing use of smart, sensor-enabled enclosures is emerging, with around 25% of new deployments supporting temperature and humidity monitoring.

-

Metallic enclosures dominate with ~70% market share, while non-metallic enclosures are growing at ~8% CAGR due to corrosion resistance and lightweight design.

-

Asia-Pacific leads the market with around 40% share, driven by rapid industrialization, infrastructure expansion, and manufacturing growth.

Market participants are acknowledging this trend and proactively meeting user customization needs. In March 2023, RS formed a partnership with Hammond Manufacturing to provide industrial and commercial customers with a wide range of over 4,900 customizable electrical and electronic enclosures, as well as over 2,900 accompanying products. The emphasis on tailor-made solutions that provide top performance, safety, and functionality to meet industry-specific requirements is a major factor driving growth in the enclosures market.

|

Report Attributes |

Details |

|---|---|

|

Key Segments |

• By Type (Wall-Mounted, Floor-Mounted/Freestanding, Others) |

|

Regional Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

nVent (Eldon Holdings) (U.K.), Eaton (U.S.), Equipto Electronics, Corp. (U.S.), Siemens (Germany), Rittal GmbH & Co. KG (Germany), Schneider Electric (France), Hammond Manufacturing Ltd (Canada), Hubbell (U.S.), Fibox (Finland), Saipwell Electric Co., Ltd. (China). |

Electrical Enclosures Market Drivers

Special boxes for electric vehicle and renewable energy parts are helping to create new and better ways to travel and get power.

These progressions depend greatly on fragile electrical parts that are susceptible to weather conditions. This is where electrical enclosures come in as quiet protectors, playing a crucial role in guaranteeing the safety and operation of these innovative technologies. Special boxes keep electric car batteries and other important parts safe from bumps, hot or cold weather, and getting dirty. These boxes also protect equipment in solar and wind farms so we can keep getting clean power from the sun and wind.

The Electrical Enclosure Market is driven by Automation and Smart Technology in The Connected Factory.

The industrial scenery is changing due to automation and the Internet of Things (IoT). In this integrated ecosystem, machines and devices work together and communicate, requiring a strong and secure electrical infrastructure, with electrical enclosures playing a key role in this industrial advancement. The growth of industrial automation results in a substantial rise in the need to safeguard electrical and electronic devices. These cages protect sensitive control systems, sensors, and robots from dust, debris, and potential physical harm in factories. The increasing popularity of interconnected technologies in different industries has a domino effect. With the increase in online devices generating data, the importance of secure and dependable electrical enclosures is becoming crucial. Electrical enclosures guarantee the efficient functioning and communication of this connected system, averting interruptions and safeguarding delicate parts from possible electrical risks.

Electrical Enclosures Market Restraints

Market growth may be restricted by limitations in the environment and operations.

Electric boxes are made to safeguard fragile machinery, yet they encounter a concealed adversary which is heat. Unregulated heat accumulation in a container can greatly reduce the longevity of the contained parts. This sudden increase in temperature can also trigger a risky chain reaction. Warm air has the ability to trap moisture, which can lead to the development of rust and may result in electrical shorts. Additionally, enclosures may need certain coatings or materials to endure varying environmental conditions. Inadequate material selection or improper coatings make enclosures susceptible to moisture, corrosion, and degradation of the protected equipment. It is important to handle these environmental restrictions properly, as not doing so can result in expensive damage to equipment and obstruct the overall development of the electrical enclosure industry.

Navigating the complex world of safety standards in electrical enclosures can be challenging due to the regulatory maze.

Navigating the constantly shifting safety regulations can seem like a complex maze for makers of electrical enclosures. Staying updated on these changing standards, which differ depending on the industry and location, brings complexity to the production process. Making sure to comply often demands extra testing and possible redesign of enclosures to achieve the most up-to-date standards. These crucial measures may result in higher expenses and longer project durations for manufacturers. It is vital to navigate through this "regulatory maze." Stringent safety regulations are implemented to safeguard workers and maintain the effective operation of electrical systems. Prioritizing adherence to regulations enables manufacturers to enhance workplace safety and prevent potential legal consequences related to non-compliant enclosures.

Segment Analysis

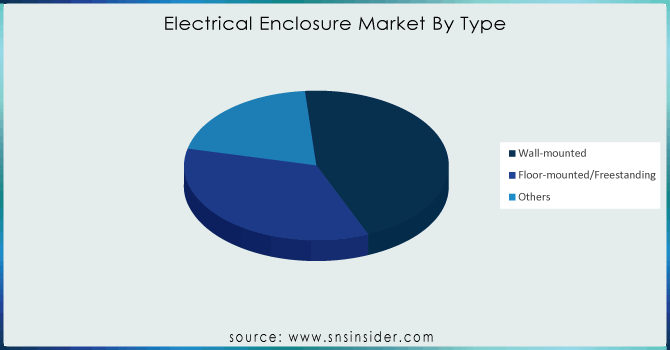

By Type

-

Wall-mounted

-

Floor-mounted/Freestanding

-

Others

Wall-mounted electrical enclosures hold 45% of the market share and are projected to maintain their dominance in 2023. These small but powerful devices provide multiple benefits that secure their place. Their compact nature makes them perfect for many different uses, and the low production of heat guarantees that the enclosed devices remain at a cool temperature. Their ease of installation may be the greatest benefit, as it can save both time and resources when setting up. The advantages of wall-mounted enclosures have made them popular in various industries, prompting manufacturers to continually improve their features. The continuous emphasis on enhancement ensures that the wall-mounted segment remains dominant in the electrical enclosures market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Material

-

Non-metallic

-

Metallic

Non-metallic enclosures, in terms of material, dominate the electrical enclosures market with a majority share of 55% in 2023. Metal boxes are great for electrical enclosures because they don't catch fire easily and can stop shocks. But companies that make cars and other machines are starting to use more and more non-metallic boxes instead. These new boxes are lighter and cheaper, which is perfect for smaller vehicles.

By Application

-

Energy and Power

-

Industrial Control Systems

-

Telecommunications

-

Oil and Gas

-

Others

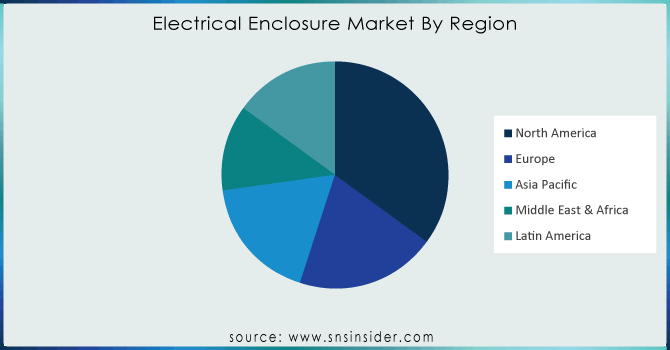

REGIONAL ANALYSES

In 2023 North America dominates the electrical enclosures market with a significant 40% share. This control arises from the strong industrial base in the area and increasing focus on automation. Booming sectors depend greatly on protecting their electrical machinery, leading to increased need for top-notch enclosures. Strict safety rules require the utilization of these barriers, solidifying North America's leading position in the market. The combination of a robust industrial foundation and a prioritization of safety creates a flourishing atmosphere for electrical enclosures in North America.

The Asia Pacific region is driving growth in the electrical enclosures market with a rapidly increasing 27% market share in 2023. The increase is driven by the quick industrial and urban growth in the area. As urban areas and industrial plants rapidly grow, there is a soaring need for dependable electrical machinery to fuel them. As a result, there is a requirement for a large number of electrical enclosures to store and safeguard this essential equipment. The meeting of industrial expansion and urban advancement places the Asia Pacific region as an emerging player in the electrical enclosures market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

-

-

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

The major key players are nVent (Eldon Holdings) (U.K.), Eaton (U.S.), Equipto Electronics, Corp. (U.S.), Siemens (Germany), Rittal GmbH & Co. KG (Germany), Schneider Electric (France), Hammond Manufacturing Ltd (Canada), Hubbell (U.S.), Fibox (Finland), Saipwell Electric Co., Ltd. (China).

RECENT DEVELOPMENT

-

In March 2024 - Eaton (Ireland) acquired a company specializing in electrical vehicle charging solutions, expanding their presence in the clean energy sector.

-

In February 2024 - ABB (Switzerland) announced a collaboration with a leading AI company to develop AI-powered solutions for optimizing energy management in electrical enclosures.

-

January 2024 - Siemens (Germany) announced a partnership with a wind turbine manufacturer to develop next-generation electrical enclosures for offshore wind farms.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.91 Billion |

| Market Size by 2032 | US$ 13.95 Billion |

| CAGR | CAGR of 6.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers |

|

| Restraints |

|