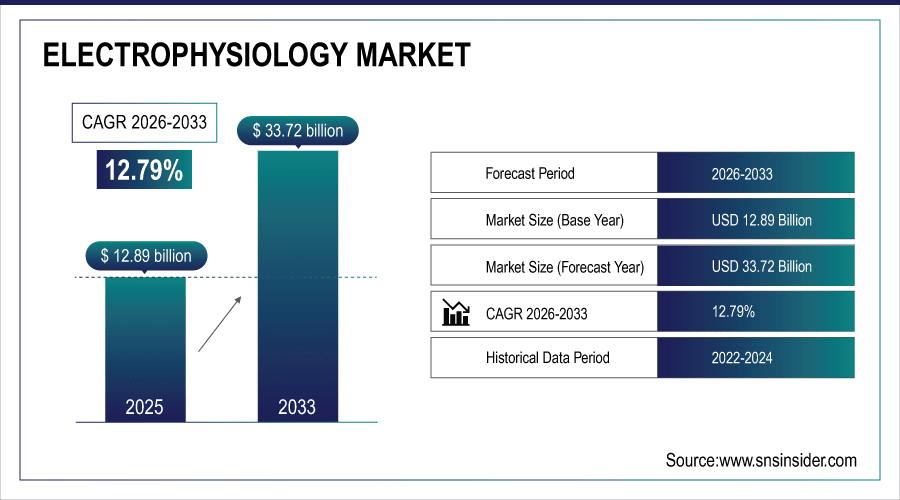

Electrophysiology Market Size Analysis:

The global electrophysiology market is estimated to be valued at USD 12.89 billion in 2025 and is projected to reach USD 33.72 billion by 2033, growing at a CAGR of 12.79% during the forecast period 2026–2033.

Over the last decade, electrophysiology has emerged in response to the growing incidence of arrhythmias. In 2025, over 3.5 million EP procedures were performed worldwide and ablation accounted for 55%. Electrophysiology (EP) catheters and mapping systems contribute 60% of sales. Rising prevalence of cardiovascular diseases, rising number of cardiac care collaborative settings and increasing utilization in clinical trials and research are a few factors propelling robust demand in hospitals, cardiology clinics, ambulatory surgical centers globally.

Over 3.5 million electrophysiology procedures were performed globally in 2025, with cardiac ablation and mapping driving growth.

'

'

To Get More Information On Electrophysiology Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 12.89 Billion

-

Market Size by 2033: USD 33.72 Billion

-

CAGR: 12.79% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Electrophysiology Market Trends:

-

More than 960,000 electrophysiology ablation procedures are projected to be done in the U.S. during 2025, and over 1.02 million transseptal procedures are expected to be performed worldwide annually.

-

There are about 60,000 catheter ablation procedures per year in Germany with rising demand.

-

The region is home to 800 ablation procedures and over 1,200 EP studies performed each year revealing an increasing adoption of such therapy in Latin America.

-

The intermediate skills range held the highest number of practitioners (34.9%) who performed 50-149 procedures per year and the second-largest percentage (43.8%) with 150-399 procedures.

-

Over 1,900 open-heart cases are performed annually at the University of Ottawa Heart Institute, including pacemaker and ICD surgery.

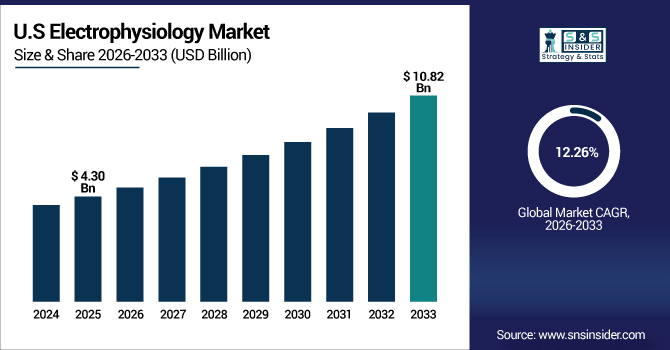

U.S. Electrophysiology Insights:

The U.S. Electrophysiology Market was valued at USD 4.30 billion in 2025E and is projected to reach USD 10.82 billion with CAGR of 12.26% by 2033. With over 1,200 EP labs, adoption of ablation catheters and 3D mapping systems, rising arrhythmia awareness, and investments in minimally invasive technologies drive strong market growth.

Electrophysiology Market Growth Drivers:

-

Advancements in Ablation and 3D Mapping Technologies Drive Adoption of Electrophysiology Procedures Across Hospitals and Cardiac Centers Globally.

Ablation and 3D mapping innovations are adding precision and safety to EP work Player for the A team. Over 850,000 electrophysiology ablation procedures and over 900,000 transseptal procedures are performed annually in the U.S. and worldwide, respectively. All these trends are driving an increasing number of hospitals and cardiology centers abroad to use electrophysiology (EP) procedures, which is increasingly beneficial to patients and expanding the market.

3D cardiac mapping systems accounted for the majority of EP procedures in leading hospitals, and adoption is increasing in ambulatory surgical centers.

Electrophysiology Market Restraints:

-

High Costs of Electrophysiology Devices and Procedures Restrict Adoption Among Smaller Hospitals and Clinics in Developing Regions.

High device and procedural costs limit the acceptance of electrophysiology procedures. As recently as 2025 EP labs with adequately trained and equipped personnel for complex ablation and mapping systems would have existed in less than 55% of hospitals, globally translated. Many smaller cardiac centers and clinics simply do not have the necessary facilities to perform complicated procedures safely. Re-do or repeated ablations (average of 1–2 per patient per year) consume even more resources. These limitations hinder EP penetration, especially in developing and under resourced areas, even as cardiac arrhythmia prevalence continues to rise.

Electrophysiology Market Opportunities:

-

Increasing Incidence of Cardiac Arrhythmias and Demand for Outpatient Ablation Procedures Drives Electrophysiology Market Expansion Globally.

Growing incidence of cardiac arrhythmias is expected to boost acceptance for electrophysiology procedures across the globe. In 2025, approximately 850,000 ablation procedures were performed worldwide with follow-up procedures ranging from 1 to 2 per patient annually. By 2033, expected to exceed 1.5 million EP procedures are anticipated annually, driven by the uptake of minimally invasive ablation, and advanced 3D mapping modalities. Outpatient Centres and Clinical Research are adding to market opportunities in an expanded market worldwide.

Outpatient and ambulatory surgical centers are expected to perform an increasing share of EP procedures by 2033.

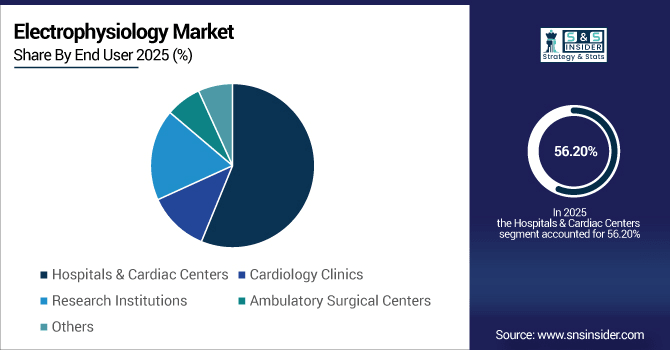

Electrophysiology Market Segmentation Analysis:

-

By Product Type, Electrophysiology Catheters held the largest market share of 45.65% in 2025, while Mapping Systems are expected to grow at the highest CAGR of 16.10%.

-

By Application, Cardiac Arrhythmia Diagnosis contributed the highest market share of 51.80% in 2025, while Cardiac Ablation Procedures are anticipated to expand at the fastest CAGR of 15.35%.

-

By End User, Hospitals & Cardiac Centers comprised 56.20% in 2025, while Ambulatory Surgical Centers are projected to grow at the fastest CAGR of 13.80%.

By End User, Hospitals & Cardiac Centers Dominate While Ambulatory Surgical Centers Grow Rapidly:

In 2025, hospitals and cardiac centers controlled the EP procedures market driven by infrastructure, manpower as well as capability to handle critical surgeries. Ambulatory surgical centers performed 2.4 million procedures and are on the rise, as outpatient facilities become an increasingly cost-effective and accessible option for patients. Cardiovascular care facility growth and patient demand for less invasive treatments explain the predominance of hospitals and rapid expansion of ambulatory facilities.

By Product Type, Electrophysiology Catheters Dominate While Mapping Systems Grow Rapidly:

Usage of electrophysiology catheters was highest and it was performed more than 5.9 million procedures globally in 2025, because they are required for diagnosis as well as ablation. The systems supported 2.4 million procedures, and it expanded quickly due to demand for accurate 3D cardiac mapping, especially in complex arrhythmia cases. The trend towards minimally invasive procedures and increased penetration in advanced hospitals explains both domination of catheters and high growth rates of mapping systems on the global market.

By Application, Cardiac Arrhythmia Diagnosis Dominates While Ablation Procedures Expand Rapidly:

More than 4.2 million cardiac arrhythmia diagnosis procedures were performed worldwide in 2025, primarily due to early diagnostic requirements to avoid complications. Ablation procedure volumes were 2.8 million and are increasing quickly with more atrial fibrillation and new ablation technologies. Growing patient knowledge, expanding outpatient procedure utilization and enhanced treatment accuracy support accelerated ablation procedures world-market expansion in parallel with the prevailing diagnostic category.

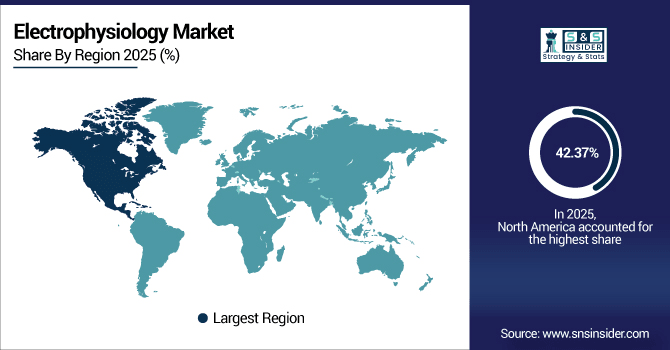

Electrophysiology Market Regional Insights:

North America Electrophysiology Market Insights:

North America leads the global electrophysiology market with a 42.37% share in 2025, supported by advanced cardiac care infrastructure and extensive R&D investments. It was home to more than 1,200 fully equipped EP labs by 2025 for hospitals, heart centers and research institutions. Increasing utilization of 3D mapping systems and ablation technologies along with increasing awareness of arrhythmia management is the major driver for market expansion. The development of new technologies and infrastructure will continue to propel the market momentum until 2033.

Over 120 leading cardiac research centres across the USA were performing EP in 2025 using state-of-the-art 3D mapping and ablation technologies. Increasing spending on R&D, clinical trials and technology validation are promoting the markets growth, enabling further penetration of next-gen electrophysiology solutions across the country.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Electrophysiology Market Insights:

The Asia-Pacific electrophysiology market is projected to grow at a CAGR of 14.44% during 2026–2033, making it the fastest-growing region globally. In 2025, more than 3.2 million arrhythmia diagnoses and ablation procedures were performed across the region in over 950 EP labs. Positive traction is influenced by growing incidence of cardiac diseases, high healthcare spending, demand for innovative ablation catheters and 3D mapping technology and accessibility for minimally invasive cardiac treatment.

China Market Insights:

China is the APAC region’s biggest electrophysiology market, with more than 1,150 EP labs to support 1.8 million arrhythmia diagnoses and ablations in 2025. Increased focus on development of healthcare infrastructure, increasing incidence of cardiac diseases, growing uptake of ablation catheters & 3D mapping systems and expanding aspiration to develop minimally invasive cardiac treatment capabilities are contributing to the robust growth.

Europe Market Insights:

In 2025, Europe had over 1,300 specialized cardiac facilities performing around 3.1 million advanced heart monitoring and intervention procedures across Germany, France, and the UK. The market is powered by the uptake of advanced cardiac imaging, catheter-based treatments and digital monitoring solutions. Growing CVD awareness, healthcare government initiatives and investments in clinical research infrastructure are promoting access, making Europe a center for innovative technologies for cardiac treatment.

Germany Market Insights:

Germany is the largest electrophysiology market in Europe, and over 1,000 cardiac centers will conduct approximately 1.2 million advanced monitoring and intervention procedures in 2025. Market growth is fuelled by robust healthcare resources, a high penetration of catheter-based therapies, next-generation cardiac imaging and significant investments in digital monitoring tools, supporting Germany's position as the leader within Europe.

Latin America Market Insights:

The Latin America electrophysiology market is expanding steadily, led by Brazil with over 220 specialized cardiac centers in 2025. In Mexico and Argentina, the trend is similar as there is a progressive use of minimally invasive treatment for cardiac procedures and high-tech mapping systems. Increasing healthcare infrastructure, increasing the awareness of cardiovascular disease, and investment in digital cardiac monitoring and interventional devices in the region will drive growth.

Middle East and Africa Market Insights:

The Middle East & Africa electrophysiology market is growing steadily, with over 180 specialized cardiac centers in 2025. Most advanced cardiac care infrastructure is being adopted in Saudi Arabia followed by South Africa. Growth is due to a growing healthcare sector, robust high awareness for cardiovascular diseases and the advancements in minimally invasive therapies and guided advanced mapping systems.

Competitive Landscape:

Boston Scientific is recognized for pioneering innovative ablation catheters and the CARTO 3D mapping system, which was used in over 2.3 million procedures globally in 2025. Its market leadership results from a focus on minimally invasive interventions and advanced arrhythmia treatments. With ii3’s robust clinical collaboration, proprietary physician training programs and its footprint in more than 50+ countries, the company continues to bring breakthrough products to market that lead procedural efficiencies and improve drug delivery.

-

In April 2025, Boston Scientific announced that its FARAPULSE™ Pulsed Field Ablation system achieved key endpoints in the ADVANTAGE AF trial, reinforcing its leadership in pulsed field ablation.

Medtronic’s dominance arises from its broad electrophysiology portfolio, including the Arctic Front cry balloon system and EnSite Precision mapping technology, applied in over 1.9 million procedures globally in 2025. Its competitive advantage is due to long-term experience in energy-based ablations, integration of wearable monitoring, and real-world clinical evidence. Working in 60+ countries, Medtronic focuses on helping physicians and bringing unique device therapy solutions to the world that have been cared for by more people.

-

In April 2025, Medtronic received FDA approval for its OmniaSecure™ defibrillation lead, the world’s smallest lumenless defibrillation lead, enhancing next-generation cardiac rhythm management solutions.

Abbott’s strength lies in its high-resolution Advisor HD Grid mapping catheter and integrated cardiac monitoring platforms, used in more than 1.6 million procedures in 2025. The company specializes in targeted arrhythmia detection, AI guided mapping and simplified ablation procedure. Operating in more than 55+ countries, Abbott is investing in digital cardiac care devices to help transform care and enable better outcomes across a broader range of cardiovascular diseases, further solidifying the company’s leadership in electrophysiology innovation.

-

In March 2025, Abbott received CE Mark approval for its Volt™ Pulsed Field Ablation system, enabling its entry into the European electrophysiology market.

Electrophysiology Market Key Players:

Some of the Electrophysiology Market Companies are:

-

Biosense Webster (Johnson & Johnson Services, Inc.)

-

Biotronik SE & Co. KG

-

GE HealthCare Technologies Inc.

-

Siemens Healthineers

-

MicroPort Scientific Corporation

-

Koninklijke Philips N.V.

-

LivaNova PLC

-

Penumbra, Inc.

-

Stereotaxis, Inc.

-

Advanced Cardiac Therapeutics, Inc.

-

CathRx Ltd.

-

Osypka Medical GmbH

-

AngioDynamics, Inc.

-

H2O.ai Inc.

-

DataRobot, Inc.

-

Clarifai, Inc.

-

Darktrace plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 12.89 Billion |

| Market Size by 2033 | USD 33.72 Billion |

| CAGR | CAGR of 12.79% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Electrophysiology Catheters, Mapping Systems, Ablation Systems, Recording Systems, Accessories, Others) • By Application (Cardiac Arrhythmia Diagnosis, Cardiac Ablation Procedures, Research & Academic, Pharmaceutical & Biotech, Others) • By End User (Hospitals & Cardiac Centers, Cardiology Clinics, Research Institutions, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Biosense Webster (Johnson & Johnson Services, Inc.), Biotronik SE & Co. KG, GE HealthCare Technologies Inc., Siemens Healthineers, MicroPort Scientific Corporation, Koninklijke Philips N.V., LivaNova PLC, Penumbra, Inc., Stereotaxis, Inc., Advanced Cardiac Therapeutics, Inc., CathRx Ltd., Osypka Medical GmbH, AngioDynamics, Inc., H2O.ai Inc., DataRobot, Inc., Clarifai, Inc., Darktrace plc |