Enhancement MOSFET Transistor Market Report Scope & Overview:

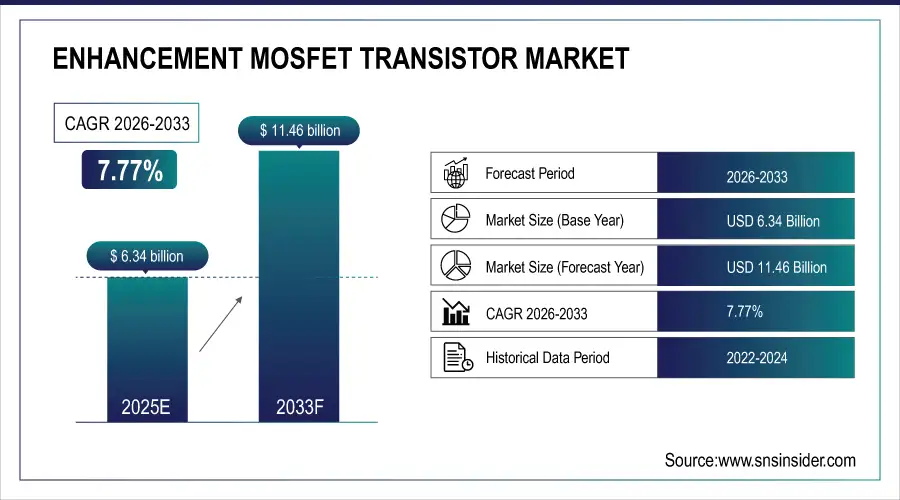

The Enhancement MOSFET Transistor Market was valued at USD 6.34 billion in 2025E and is expected to reach USD 11.46 billion by 2033, growing at a CAGR of 7.77% from 2026-2033.

The Enhancement MOSFET Transistor Market is growing due to rising demand for energy-efficient electronics, increasing electric vehicle production, and expanding industrial automation. Rapid adoption of consumer electronics, renewable energy systems, and smart devices drives the need for high-performance MOSFETs. Technological advancements, miniaturization trends, and supportive government policies further contribute to market expansion and sustained revenue growth.

Texas Instruments Incorporated announced a collaboration with Delta Electronics in June 2024 to develop next‑generation EV onboard charging and power systems, leveraging TI’s power/semiconductor technologies for higher power density, smaller size, and improved efficiency.

Market Size and Forecast

-

Market Size in 2025: USD 6.34 Billion

-

Market Size by 2033: USD 11.46 Billion

-

CAGR: 7.77% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Enhancement MOSFET Transistor Market - Request Free Sample Report

Enhancement MOSFET Transistor Market Trends

-

Rising demand for energy-efficient and high-performance power electronics is driving the enhancement MOSFET transistor market.

-

Growing adoption in automotive, consumer electronics, industrial automation, and renewable energy applications is boosting growth.

-

Expansion of electric vehicles (EVs) and power management systems is fueling market demand.

-

Advancements in low on-resistance, fast switching, and high-voltage MOSFET designs are enhancing performance and reliability.

-

Increasing focus on miniaturization, thermal management, and low power consumption is shaping market trends.

-

Collaborations between semiconductor manufacturers, automotive OEMs, and electronics companies are accelerating innovation and commercialization.

-

Technological developments in SiC and GaN MOSFETs are supporting next-generation applications and global market expansion.

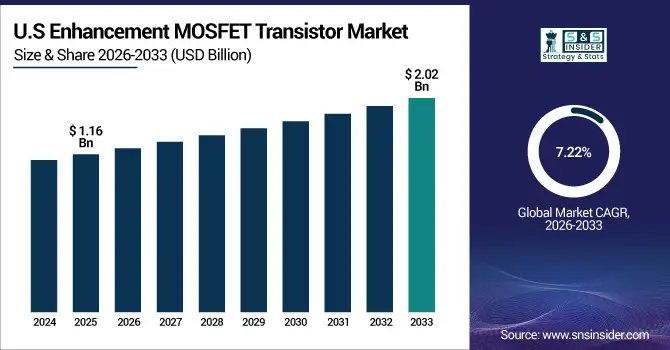

U.S. Enhancement MOSFET Transistor Market was valued at USD 1.16 billion in 2025E and is expected to reach USD 2.02 billion by 2033, growing at a CAGR of 7.22% from 2026-2033.

The U.S. Enhancement MOSFET Transistor Market growth is driven by increasing electric vehicle adoption, advanced consumer electronics demand, industrial automation expansion, and continuous technological innovations in power management, energy efficiency, and high-performance semiconductor applications across multiple sectors.

Enhancement MOSFET Transistor Market Growth Drivers:

-

Rapid adoption of electric vehicles and renewable energy systems is increasing demand for high-efficiency MOSFET transistors globally

The growth in electric vehicles (EVs) and renewable energy installations is driving the need for highly efficient and reliable power management components. Enhancement MOSFET transistors provide low on-resistance, high switching speeds, and thermal stability, making them ideal for EV powertrains, battery management systems, and solar inverters. As governments incentivize green energy and automakers expand EV production, the demand for these transistors rises sharply. Moreover, industrial automation and smart electronics further increase their adoption due to improved energy efficiency, reduced power loss, and compact designs, reinforcing their essential role in modern electronic systems across multiple sectors worldwide.

Enhancement MOSFET Transistor Market Restraints:

-

High production and R&D costs for advanced enhancement MOSFET transistors limit widespread adoption globally

The production of high-performance enhancement MOSFETs requires advanced fabrication processes, high-purity materials, and substantial R&D investments, which significantly increase overall costs. Small and medium-sized enterprises may find it challenging to afford these components, limiting their use in cost-sensitive applications. Additionally, the integration of these transistors into complex electronics often requires specialized design expertise, further adding to development expenses. High costs can delay adoption in emerging markets where price sensitivity is critical. This financial barrier restrains market expansion, as only well-funded manufacturers or large-scale electronics producers can consistently invest in and utilize these advanced MOSFET solutions.

Enhancement MOSFET Transistor Market Opportunities:

-

Expansion in electric mobility and renewable energy infrastructure offers long-term growth potential for enhancement MOSFETs globally

The transition toward electric vehicles, solar power, and wind energy infrastructure drives significant demand for high-performance MOSFETs. Power converters, inverters, and battery management systems rely heavily on efficient transistors for energy optimization. Increasing investments in EV charging networks, solar inverters, and industrial energy storage systems provide continuous opportunities for manufacturers. Additionally, government policies supporting green energy adoption further boost market potential. By developing MOSFETs capable of handling higher currents, faster switching, and improved thermal management, companies can capture these emerging applications. Long-term growth is thus fueled by global sustainability trends, electrification of transportation, and expansion of renewable energy generation infrastructure.

Enhancement MOSFET Transistor Market Segment Highlights

-

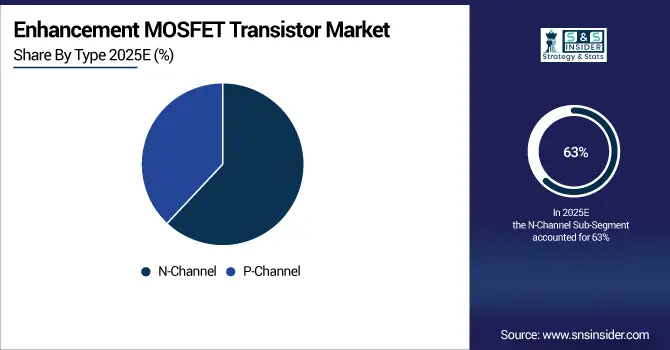

By Type, N-Channel dominated with ~63% share in 2025; P-Channel fastest growing (CAGR).

-

By Application, Consumer Electronics dominated with ~44% share in 2025; Automotive fastest growing (CAGR).

-

By End-User, Residential dominated with ~43% share in 2025; Industrial fastest growing (CAGR).

Enhancement MOSFET Transistor Market Segment Analysis

By Type, N-Channel dominates the market, P-Channel is expected to grow fastest

N-Channel segment dominated the Enhancement MOSFET Transistor Market in 2025 due to its high efficiency, low on-resistance, and suitability for high-speed switching applications in consumer electronics and industrial devices. Its reliability and cost-effectiveness make it the preferred choice for power management systems, ensuring widespread adoption across multiple sectors.

P-Channel segment is expected to grow at the fastest CAGR from 2026-2033 because of increasing demand in complementary MOSFET circuits, low-voltage applications, and power-efficient designs. Its role in integrated circuits for portable electronics and automotive systems drives rapid adoption, supported by miniaturization trends and rising requirements for compact, energy-saving transistor solutions.

By Application, Consumer Electronics dominates the market, Automotive is expected to grow fastest

Consumer Electronics segment dominated the Enhancement MOSFET Transistor Market in 2025 owing to growing adoption of smartphones, laptops, wearable devices, and IoT applications. These devices require compact, energy-efficient, and high-speed transistors, making enhancement MOSFETs ideal. Rising consumer electronics penetration worldwide continues to sustain high demand for these transistors across markets.

Automotive segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing electric vehicle production, advanced driver-assistance systems, and battery management requirements. Enhancement MOSFETs provide efficient power conversion, thermal stability, and reliability needed for modern automotive electronics, supporting the rapid adoption of EVs and connected vehicle technologies globally.

By End-User, Residential dominates the Market, Industrial is expected to grow fastest

Residential segment dominated the Enhancement MOSFET Transistor Market in 2025 because of high adoption in home appliances, smart home devices, and energy-efficient systems. Enhancement MOSFETs enable low power consumption, compact designs, and reliable operation, driving their preference in residential electronics and ensuring steady demand across consumer households worldwide.

Industrial segment is expected to grow at the fastest CAGR from 2026-2033 owing to expansion of automation, robotics, and industrial power management systems. Enhancement MOSFETs support high-current handling, fast switching, and reliable performance in industrial applications, driving rapid adoption in manufacturing plants, process control systems, and large-scale industrial energy solutions.

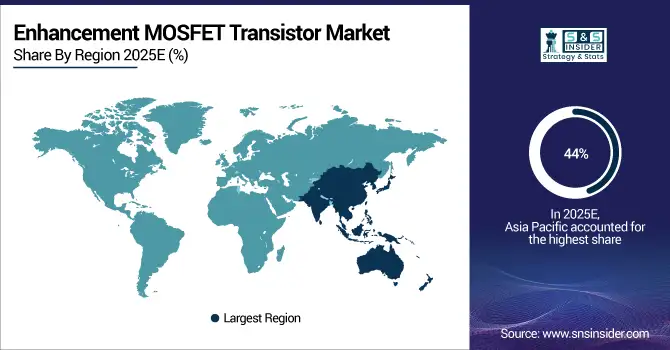

Enhancement MOSFET Transistor Market Regional Analysis

Asia Pacific Enhancement MOSFET Transistor Market Insights

Asia Pacific dominated the Enhancement MOSFET Transistor Market in 2025 with the highest revenue share of about 44% due to rapid industrialization, growing consumer electronics demand, and increasing electric vehicle adoption. The presence of major semiconductor manufacturers, supportive government policies, and expanding manufacturing infrastructure contribute to high production and consumption. Rising investments in smart devices, renewable energy, and automotive electronics further strengthen the region’s market leadership and sustained growth potential.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Enhancement MOSFET Transistor Market Insights

North America held a significant position in the Enhancement MOSFET Transistor Market due to advanced automotive and consumer electronics industries, widespread adoption of electric vehicles, and strong R&D activities. Presence of key semiconductor manufacturers and technological innovations in power management and industrial automation drive steady demand. Supportive policies and high disposable income further contribute to market growth.

Europe Enhancement MOSFET Transistor Market Insights

Europe holds a notable position in the Enhancement MOSFET Transistor Market due to growing adoption of electric vehicles, renewable energy systems, and industrial automation. Strong presence of semiconductor manufacturers, advanced technological infrastructure, and government incentives for energy-efficient solutions drive market demand. Increasing focus on smart electronics and sustainable industrial applications further supports steady growth in the region.

Middle East & Africa and Latin America Enhancement MOSFET Transistor Market Insights

Middle East & Africa and Latin America are emerging markets in the Enhancement MOSFET Transistor Market, driven by growing industrialization, rising demand for consumer electronics, and gradual adoption of electric vehicles. Investments in renewable energy, infrastructure development, and increasing electronics manufacturing activities support market growth. However, slower technological adoption and price sensitivity may limit rapid expansion compared to developed regions.

Enhancement MOSFET Transistor Market Competitive Landscape:

Infineon Technologies AG

Infineon Technologies AG is a global leader in power semiconductor solutions, delivering advanced MOSFETs, IGBTs, and SiC devices for automotive, industrial, renewable energy, and data-center applications. The company focuses on improving energy efficiency, power density, and reliability, while supporting electrification and sustainable energy transitions. Infineon’s innovations include high-voltage SiC, low-resistance MOSFETs, and compact packages for EVs, AI servers, and PV systems.

-

2025: Introduced the new CoolSiC MOSFET 2000 V (TO‑247PLUS‑4‑HCC) for high-voltage applications like solar string inverters and energy storage.

-

2024: Released CoolSiC MOSFET G2 series (650 V & 1200 V) with up to 20% better efficiency for EVs, solar, and storage systems.

-

2024: Launched OptiMOS 7 80 V MOSFET (IAUCN08S7N013) with R₍DS(on)₎ ≤ 1.3 mΩ in a compact 5×6 mm² package for 48 V automotive board-net applications.

-

2024: Introduced CoolSiC MOSFET 400 V portfolio (Kelvin-source TOLL & D²PAK‑7) for 2- and 3-level converters and synchronous rectification in AI PSUs.

STMicroelectronics N.V.

STMicroelectronics is a multinational semiconductor company offering SiC and silicon power devices, MEMS, and automotive solutions. Its fourth-generation SiC MOSFETs improve inverter efficiency, reduce system size, and enhance performance for EV traction and industrial drives. ST emphasizes high reliability, low on-resistance, and low gate charge, delivering energy-efficient solutions for automotive, industrial, and renewable energy markets.

-

2024: Unveiled 4th-generation SiC MOSFETs (750 V & 1200 V) improving efficiency, size, and performance for 400 V and 800 V EV traction inverters and industrial drives.

-

2022: Introduced MDmesh M9 & DM9 power MOSFET series (650 V & 600 V) with low on-resistance and gate charge, improving power density and switching performance.

Renesas Electronics Corporation

Renesas Electronics Corporation is a leading provider of semiconductor solutions, including MOSFETs, microcontrollers, and power devices for automotive and industrial applications. The company focuses on high-efficiency, compact, and reliable power components, enabling smaller system designs and improved energy efficiency in EVs, AI servers, and renewable energy systems.

-

2025: Introduced new 100 V high-power N-Channel MOSFETs based on the REXFET‑1 wafer process, achieving 30% lower on-resistance, 40% reduction in gate-drain charge, and 50% smaller package size.

Texas Instruments Incorporated

Texas Instruments develops power MOSFETs, GaN semiconductors, and analog solutions for automotive, industrial, and data-center applications. Its innovations enhance current handling, thermal management, and compactness, supporting high-voltage DC/DC conversion and high-efficiency EV powertrain designs. TI emphasizes advanced packaging and scalable manufacturing to meet increasing demand for electrification and AI applications.

-

2024: Released power MOSFETs with DualCool NexFET top-side thermal management, enabling up to 50% more current in standard footprint packages for high-current DC/DC applications.

-

2024: Expanded GaN-based power semiconductor manufacturing capacity in Japan, supporting high-voltage power solutions with 300 mm wafer upgrades.

NXP Semiconductors

NXP Semiconductors provides high-voltage SiC and power management solutions for automotive and industrial markets. Its focus on isolated gate drivers and EV traction inverter solutions accelerates the adoption of efficient, high-performance electrified powertrains and energy systems.

-

2024: Collaborated with ZF Friedrichshafen AG to co-develop 800 V SiC-based traction inverter solutions using NXP’s GD316x high-voltage isolated gate drivers for EV powertrain control.

ROHM Co., Ltd.

ROHM Co., Ltd. develops high-performance MOSFETs and power semiconductors for automotive, industrial, AI server, and consumer applications. The company emphasizes low on-resistance, compact packages, and wide safe operating areas to enhance energy efficiency, reduce power losses, and support miniaturization in high-density systems.

-

2025: Unveiled a MOSFET lineup for enterprise and AI servers, featuring low ON-resistance and wide SOA in DFN5060‑8S packages for 12 V/48 V and hot-swap circuits.

-

2024: Developed ultra-compact 30 V N-channel MOSFET (AW2K21) in 2.0×2.0 mm² WLCSP with 2 mΩ ON-resistance, targeting fast-charging and compact power designs.

Key Players

Some of the Enhancement MOSFET Transistor Market Companies

-

Infineon Technologies AG

-

Toshiba Corporation

-

STMicroelectronics N.V.

-

ON Semiconductor Corporation

-

Vishay Intertechnology, Inc.

-

Renesas Electronics Corporation

-

NXP Semiconductors N.V.

-

Texas Instruments Incorporated

-

Mitsubishi Electric Corporation

-

ROHM Co., Ltd.

-

Fairchild Semiconductor International, Inc.

-

Diodes Incorporated

-

IXYS Corporation

-

Alpha & Omega Semiconductor Limited

-

Microchip Technology Inc.

-

Fuji Electric Co., Ltd.

-

Hitachi Power Semiconductor Device, Ltd.

-

Littelfuse, Inc.

-

Panasonic Corporation

-

Semikron International GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.34 Billion |

| Market Size by 2033 | USD 11.46 Billion |

| CAGR | CAGR of 7.77% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (N-Channel, P-Channel) • By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, Others) • By End-User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Infineon Technologies AG, Toshiba Corporation, STMicroelectronics N.V., ON Semiconductor Corporation, Vishay Intertechnology, Inc., Renesas Electronics Corporation, NXP Semiconductors N.V., Texas Instruments Incorporated, Mitsubishi Electric Corporation, ROHM Co., Ltd., Fairchild Semiconductor International, Inc., Diodes Incorporated, IXYS Corporation, Alpha & Omega Semiconductor Limited, Microchip Technology Inc., Fuji Electric Co., Ltd., Hitachi Power Semiconductor Device, Ltd., Littelfuse, Inc., Panasonic Corporation, Semikron International GmbH |