Erectile Dysfunction Treatment Devices Market Overview & Scope:

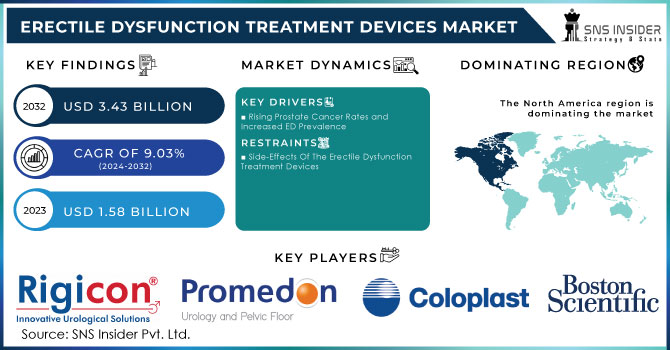

The Erectile Dysfunction Treatment Devices Market is expected to grow from USD 1.58 billion in 2023 to USD 3.43 billion by 2032, at a compound annual growth rate of 9.03% during the forecast period 2024-2032.

The Erectile Dysfunction Treatment Devices Market is expected to grow due to more men experiencing erectile dysfunction. This rise is likely connected to an increase in conditions like prostate cancer, vascular diseases, and neurological disorders, all known risk factors for erectile dysfunction. On the other hand, high device costs may slow down Erectile Dysfunction Treatment Devices Market growth.

Erectile dysfunction can be caused by various underlying health conditions. Prostate cancer is one well-documented risk factor. As an example, about 1 in 8 men will be diagnosed with prostate cancer in their lifetime, and treatment for prostate cancer can sometimes lead to ED, according to the study of American Cancer Society, which can accelerate the rate of growth in the Erectile Dysfunction Treatment Devices Market.

Erectile dysfunction devices have become a game-changer for many men, offering a safe and effective way to manage ED. These non-invasive solutions promote blood flow to the penis, enabling users to achieve and maintain erections. This translates to a significant improvement in sexual experiences and overall relationship satisfaction. As a result, the Erectile Dysfunction Treatment Devices Market is expected to experience steady growth in the coming years.

Get More Information on Erectile Dysfunction Treatment Devices Market - Request Sample Report

While advancements in technology are leading to more user-friendly and effective erectile dysfunction devices, like improved vacuum pumps and penile implants, a significant challenge remains that is low awareness about prostate health among men. New treatments like low-intensity shockwave therapy (LIST) are under development, offering promise for improved blood flow and potentially treating ED. However, this highlights an even greater need for education. Studies, like the one commissioned by the European Association of Urology, show a concerning lack of awareness, especially among men over 50. This is despite the fact that prostate cancer is a common cause of death in older men, and a significant portion (40%) of men over 60 experience prostate enlargement.

By increasing awareness about prostate health and the potential for ED as a side effect, men can have more informed discussions with their doctors about both prevention and treatment options. This can lead to earlier detection of prostate issues and the exploration of solutions like ED devices or other treatments when needed which propels the demand for the Erectile Dysfunction Treatment Devices Market in forecast period.

MARKET DYNAMICS

Drivers

-

Rising Prostate Cancer Rates and Increased ED Prevalence

According to the World Health Organization (WHO), over 209,000 men in the US alone were living with prostate cancer in 2020, with projections estimating a rise to over 257,000 by 2040. Prostate cancer treatment is a major contributor to erectile dysfunction treatment devices, often causing nerve damage or hormonal changes that impact erections.

Several factors are driving a global rise in Erectile Dysfunction Treatment Devices Market, including lifestyle changes (stress, obesity), and chronic health conditions like diabetes and cardiovascular disease. As the global population ages, this trend is likely to continue as older individuals are more susceptible to age-related physiological changes impacting erectile function. The Erectile Dysfunction Treatment Devices Market benefits from ongoing medical technology innovation. New, more sophisticated ED devices like penile implants, improved vacuum erection devices, and even shockwave therapy offer effective treatment options for men struggling with ED. Men are becoming more open about ED and its treatment options. The stigma associated with seeking help is diminishing, leading more individuals to explore solutions like ED devices. The integration of telemedicine platforms and remote monitoring technologies allows healthcare professionals to offer virtual consultations and monitor ED patients remotely. This improves access to care, especially for those in remote areas, and potentially promotes the adoption of ED devices as part of remote treatment plans which fuels the erectile dysfunction treatment devices market. The growing patient preference for minimally invasive treatments, coupled with advancements in surgical techniques and materials, fuels demand for ED devices like inflatable penile implants that offer less invasive solutions compared to traditional surgeries and accelerate the expansion for the erectile dysfunction treatment devices market.

Restraints

-

Side-Effects Of The Erectile Dysfunction Treatment Devices

Shockwave therapy presents a novel, non-invasive option for treating erectile dysfunction. However, it's crucial to be aware of potential drawbacks like discomfort, urinary issues because there's a chance that shockwave therapy might worsen existing lower urinary tract symptoms (LUTS).

Key Segmentation

By Product Type

-

Vacuum Constriction Devices

-

Penile Implants

-

Shockwave Therapy

-

Other Device Types

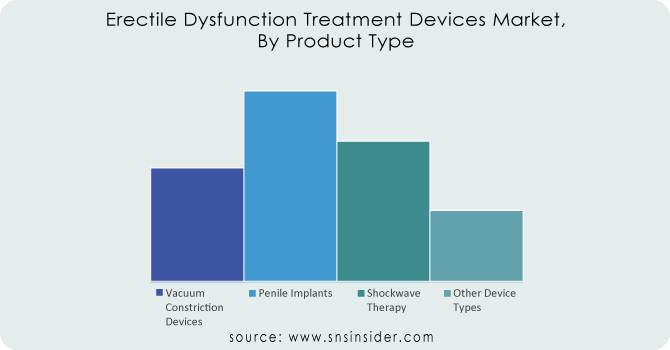

The Erectile Dysfunction Treatment Devices Market is segmented by product type. In 2023, penile implants held the largest market share 36.99%, because implants offer a long-term solution for ED, unlike temporary fixes like medication or pumps, but the future is trending towards non-invasive solutions. Shockwave therapy, which uses acoustic waves to potentially improve blood flow, is expected to see the fastest growth. This surge is likely due to its non-invasive nature, eliminating the need for medication, and the increasing number of manufacturers and research efforts focused on this promising treatment.

Need any customization research on Erectile Dysfunction Treatment Devices Market - Enquiry Now

By Age Group

-

Less than 40 years

-

40-60 years

-

More than 60 years

The Erectile Dysfunction Treatment Devices Market caters to various age groups, those over 60 are expected to be the dominant user base with 52.41% in 2023. This is due to two key factors such as the prevalence of ED naturally increases with age and the older men are more likely to experience conditions like prostate cancer and cardiovascular diseases, both of which can contribute to Erectile Dysfunction. As awareness and treatment options for ED grow, this segment is likely to see a rise in individuals seeking solutions like vacuum pumps, implants, or shockwave therapy to manage their condition.

By Cause

-

Vascular Disorders and Diabetes

-

Neurological Disorders

-

Other Causes

The Erectile Dysfunction Treatment Devices Market is segment by cause, in which Vascular Disorders and Diabetes category likely holds the largest market share 47.06% in 2023 due to the high prevalence of both conditions and their strong association with ED. Diabetes can damage nerves and blood vessels crucial for erections, while vascular disorders directly affect blood flow.

By End User

- Hospitals and ASCs

- Clinics

The Erectile Dysfunction Treatment Devices Market caters to patients through two main channels: hospitals and ambulatory surgery centers/clinics. While hospitals currently hold the larger market share 55.25% in 2023, this might shift in the future. Hospitals benefit from a higher level of awareness surrounding ED devices among healthcare professionals, leading to more frequent discussions with patients. Additionally, hospitals are typically equipped to handle complex procedures, like those required for penile implants.

However, the market might see a rise in ambulatory settings offering ED devices. As awareness increases and technology advances, these centers may become better equipped to provide solutions like vacuum pumps or less invasive procedures using shockwave therapy. This could potentially lead to a more convenient and accessible experience for some patients.

Regional Analysis

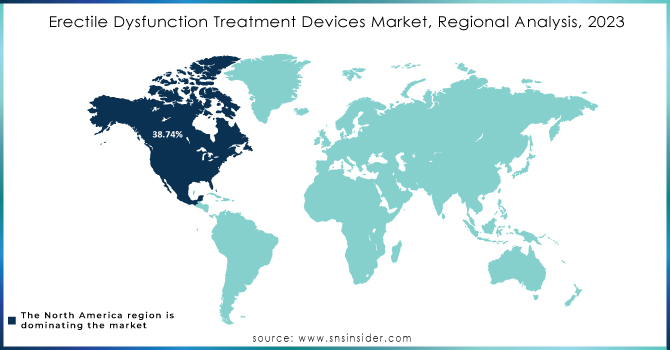

North America is the dominating region in the Erectile Dysfunction Treatment Devices Market with 38.74% in 2023. This dominance can be attributed to several factors such as the aging population creates a significant market segment. Studies suggest that around half of American men between 40 and 70 experience some level of ED, with this prevalence rising sharply with age. This translates to a larger pool of potential users for ED devices in North America.

The region boasts a well-established healthcare infrastructure and this grants patient access to the latest advancements in ED devices and treatment options, making North America a hub for innovation and adoption of these solutions. There's a growing openness towards ED as a medical condition with both men and healthcare providers are shedding stigmas, leading to more men seeking help. This increased awareness fuels demand for ED devices as part of comprehensive treatment plans.

Finally, prevalent lifestyle factors and chronic diseases in North America contribute to a higher rate of ED. Conditions like diabetes, cardiovascular disease, and lack of physical activity are all known risk factors. This further strengthens the market for ED devices in the region. With this number of factors driving market growth, North America, particularly the US market projected for a CAGR of 9.7% by 2034, is poised to remain the frontrunner in the Erectile Dysfunction Treatment Devices Market.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major key players of the Erectile Dysfunction Treatment Devices Market are: Rigicon, Inc., Promedon GmbH, Coloplast Group, Zephyr Surgical Implants, Boston Scientific Corporation, Owen Mumford Ltd., Alma Lasers, Augusta Medical Systems, Giddy, Storz medical AG, Silimed, Promedon, Timm Medical, The Elator and other players.

Recent Developments Of The Erectile Dysfunction Treatment Devices Market

2023: Rigicon Unveils Innovative Surgical Tool

Rigicon, Inc. (US) made a significant contribution to the ED device market in 2023 with the launch of the HL-LEVINE Combo Prosthesis Tool. This innovative tool combines the functionalities of two existing instruments used in penile implant surgery, potentially streamlining the surgical process.

2022: Market Expansion in China

Advanced MedTech Holdings (Singapore) marked a strategic move in 2022 by acquiring Shenzhen Huikang Medical Apparatus Co., Ltd. (China). This acquisition broadens Advanced MedTech's reach in the Chinese urological market by leveraging Huikang's established sales network, local R&D capabilities, and manufacturing infrastructure.

2022: Shockwave Therapy Gains Ground

The successful installation of Wikkon's extracorporeal shock wave lithotripter model HK.ESWL-108A at Maria Clinic, Dili, East Timor in 2022 highlights the growing adoption of shockwave therapy as a potential treatment for ED.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.58 Billion |

| Market Size by 2031 | US$ 3.43 Billion |

| CAGR | CAGR of 9.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Vacuum Constriction Devices, Penile Implants, Shockwave Therapy, Other Device Types) • By Age Group (Less than 40 years, 40-60 years, More than 60 years) • By Cause (Vascular Disorders and Diabetes, Neurological Disorders, Other Causes) • By End User (Hospitals and ASCs, Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rigicon, Inc., Promedon GmbH, Coloplast Group, Zephyr Surgical Implants, Boston Scientific Corporation, Owen Mumford Ltd., Alma Lasers, Augusta Medical Systems, Giddy, Storz medical AG, Silimed, Promedon, Timm Medical, The Elator |

| Key Drivers | • Rising Prostate Cancer Rates and Increased ED Prevalence |

| RESTRAINTS | • Side-Effects Of The Erectile Dysfunction Treatment Devices |