External Urine Management Products Market Report Scope & Overview:

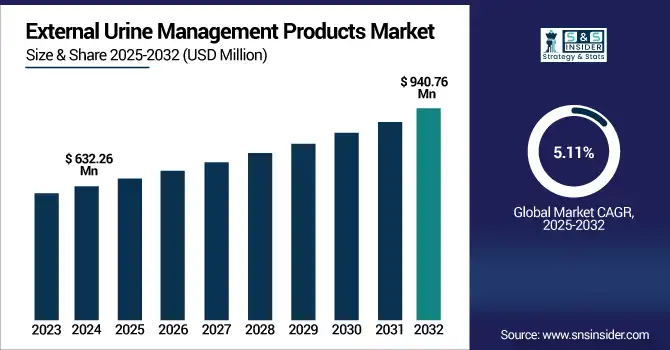

The external urine management products market size was valued at USD 632.26 million in 2024 and is expected to reach USD 940.76 million by 2032, growing at a CAGR of 5.11% over 2025-2032.

To Get more information on Urine Management Products Market - Request Free Sample Report

The global external urine management products market is undergoing a significant transformation due to the increasing needs of an expanding elderly demographic, a mounting occurrence of urinary incontinence, and a preference toward non-invasive, catheter-free options. The global external urine management products market is rapidly growing due to increased comfort, less risk of catheter-associated urinary tract infections (CAUTIs), and greater patient mobility for both hospital and homecare facilities. There is increasing utilization of male and female external catheters, urine collection systems, and absorbent skin-friendly devices in the U.S. external urine management products market, particularly from post-acute and long-term care facilities.

In May 2024, TillaCare Ltd. announced that it received clearance from the FDA for UriCap Female, an advanced female external urine collection device that aims to reduce skin contact and incidence of infections, and provides impetus to the U.S. external urine management products market.

Technological innovation in skin-safe adhesives, hydrocolloid materials, and wearable urine sensors is spurring from the substantial growth in R&D investments by leading external urine management products companies that include Hollister Incorporated, Sage Products (Stryker), and TillaCare Ltd. Moreover, increasing investment in healthcare and favorable reimbursement coverage favor the expansion of the external urine management products market, while the development of wide supply chains facilitates better availability of advanced and disposable solutions in the regions.

The external urine management products market analysis in recent years emphasizes the role played by regulatory authorities, including the U.S. FDA and EMA, working to streamline approvals, especially for patient-friendly devices that serve to decrease infection risks and hospitalization. The global external urine management products market is supported by clinical data and pilot studies in nursing facilities, which promote wider use of CAUTI prevention bundles.

As per 2024 trends, health expenditure on products for incontinence care surged over 10% y-o-y in North America, with advancements in antimicrobial linings and urine diversion technology making products more user-friendly. The EEZS are based on the urinary incontinence kits of the US military and can be reused. Other companies, such as Consure Medical and Teleflex, have recently widened distribution in response to rising worldwide demand. Augmented promotional activities and online devices for managing incontinence are further contributing to the market’s future direction.

In March of 2024, Sage Products, a Stryker company, introduced next-generation male external urine devices with hydrogel adhesives for a secure fit, which exemplifies significant external urine management products market trends related to patient comfort and infection control.

Table: Regulatory Approvals and R&D Investments (2023–2025)

|

Company |

Year |

Product Approved |

Region |

R&D Focus Area |

|

Bright Uro |

2025 |

Glean Urodynamics System (FDA) |

U.S. |

Wireless, catheter-free diagnostics |

|

Medline & Consure |

2024 |

QiVi MEC Distribution Partnership |

North America |

Suction-based male urine devices |

|

TillaCare |

2023 |

UriCap Female (FDA Cleared) |

U.S. |

Female urine collection system |

Market Dynamics:

Drivers:

-

Technological Advancements and Demand for Non-Invasive Solutions Driving Adoption Fuel Market Growth

Increasing demand for non-invasive and patient-friendly urinary incontinence products, including the aging population, after operations, is driving the external urine management product market growth. Recent awareness of the complications of indwelling catheters, including catheter-associated urinary tract infections (CAUTIs), has led to a move towards external devices. Devices designed to wick away moisture externally, real-time sensors to monitor for urine, and wearable technology that includes an ergonomic design have led to significantly more comfort, less risk of infection, and better compliance in these more recent innovations.

BioDerm Inc. and Men’s Liberty are among those companies that have diversified their offerings with gender-specific solutions that are made to be worn all day or night, with the maintenance of skin integrity. The increase in R&D investment is undeniable; BioDerm, for instance, grew its R&D expenditure by 18% in 2023 to underpin product development in secure, skin-friendly adhesive technology. In the meantime, regulatory incentives such as the CDC’s CAUTI reduction guidelines and the FDA’s 510(k) clearances have led to expedited market entry of innovative devices. In addition, hospital purchasing trends are moving towards value-based care, which supports the external urine management products market growth as a result of the decreased risk of hospitalization and fewer quality of life effects. With clinical preference and caretaker acceptance on the rise, the demand for external urine management products is growing, with strong product penetration in the global healthcare domain.

Restraints:

-

Product Limitations and Reimbursement Challenges Hindering Market Adoption

Despite increasing need, critical challenges exist in the external urine management products market in terms of product efficacy, skin issues, and lack of insurance coverage. A large group of patients complain of soiling, poor adhesion, and discomfort with long-term use, particularly with female-specific external solutions. These barriers impede caregiver reliance and repeated use. Moreover, Product availability, especially in remote and underdeveloped areas, is a challenge that can influence the external urine management products market share of hospitals and homecare providers.

An industry survey in 2024 showed that 32% of the caregivers consider external urine devices inappropriate for highly mobile or obese incontinent patients, suggesting a demand for a better form factor. In addition, reimbursement guidelines and coverage consistencies are still not ubiquitous globally. Most payers do not consider external devices as standard incontinence management options, resulting in higher out-of-pocket costs for patients. In the U.S., not all external urine devices are categorized as DME by CMS, which has hindered market adoption. While enhanced, regulatory pathways are still slow in approving labels for children or other high-risk populations. Furthermore, a lack of strong real-world evidence in certain patient segments also discourages the appetite for investment and development in niche segments, proving to be a major restraint on the external urine management products market analysis and longer-term expansion.

Segmentation Analysis:

By Products

The male external catheters were the largest product type segment in 2024 and accounted for a share of more than 65.12% of the global external urine management products market. This market share is in no small part due to ready access to men’s comfortable and skin-safe urine collection systems, which have been in use in hospitals and long-term care facilities for decades. These products are easier to fit, improve urine containment, and offer strong clinical evidence of their effectiveness in preventing CAUTIs. Furthermore, there has been a steady rise in innovation in adhesive technology and moisture management dedicated to male sufferers in the marketplace, which has fuelled demand.

The female external catheter segment is projected to register the highest growth in the forecast period, primarily due to growing emphasis on gender-inclusive devices and better device design for fitting every individual’s anatomy. There is growing investment by manufacturers in custom-fit products that will feature improved skin barriers and vacuum-based collection systems, thus overcoming historical issues in terms of leakage and comfort for female users.

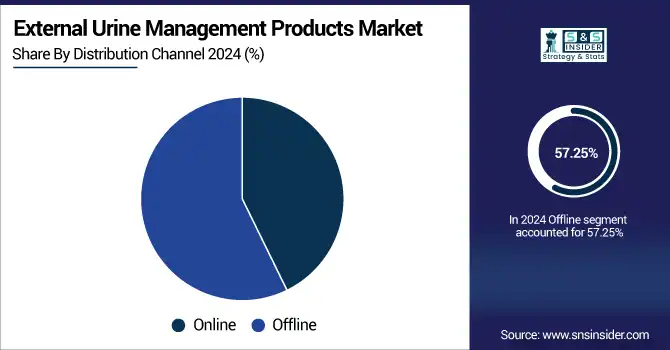

By Distribution Channel

Offline was the dominant distribution channel with a share of over 57.25% of the global external urine management products market revenue in 2024. Hospitals, clinics, and medical supply outlets, however, still prefer to purchase in bulk through offline channels as they require immediate availability, product quality verification, and institutional contracts. This is where offline retail can offer consumers the ability to directly interact with healthcare professionals and receive more nuanced guidance on products and create trust, and, in turn, repeat purchase.

Nevertheless, the segment online is the fastest growing, with patients and caregivers fueled by quick and cheap online purchases driving towards E-commerce. Digital health platforms and specialty medical supply sites are broadening their product lines to offer subscription services and doorstep delivery and pushing use into home care and tech-savvy users.

By End-Use

The Hospitals segment accounted for over 45.7% share in the external urine management products market in 2024. Their leaders have a high admission rate of patients; the use of protocols of CAUTI prevention in most of the available health services, and working technical personnel for the placement of the external catheter. But hospitals remain the predominant proving ground, and clinical recommendations will largely determine their wider acceptance in the market.

On the other hand, home care is the fastest growing end-use segment of the market, driven by a growing geriatric population choosing home treatment and a shift towards patient-centred care. Growing demand for non-invasive urine management and incorporation with telemedicine and caregiver education in home settings is fueling demand for the products. Care products that are easy to apply and that can be applied independently reinforce this development.

Regional Analysis:

North America held over 43.2% share of total revenue in 2024 in the global external urine management products market. This market leadership is accountable to the presence of superior health care facilities, higher availability and adoption of urological care solutions, and strong infection control practices within the hospitals.

The U.S. external urine management products market size was valued at USD 206.38 million in 2024 and is expected to reach USD 272.17 million by 2032, growing at a CAGR of 3.57% over 2025-2032. The U.S. is a major Contributor in the region, on account of the high adoption of CAUTI-prevention protocols on a large scale, favorable reimbursement policies, and high investment in R&D by companies (such as BD and Hollister) operating in the region. Weakening consumer awareness, low purchasing power, and government support and influence on home care services hamper sales. Canada is also contributing a major share in the market as the geriatric population is increasing, and also the patients living on home-based urinary care are very supportive. Meanwhile, increased distribution and public health spending in Mexico are leading to greater availability of products.

Europe is the second fastest growing geographic region in the market due to the ageing population, growing number of people affected with urinary incontinence, and entering the market, and because of its healthcare infrastructure and patient-centric innovations. The presence of established clinical protocols, government support for incontinence care products, and early use of external urinary devices in hospitals and elderly homes in developed countries such as Germany and the UK are among the leading countries. External catheters are in high demand among the elderly in Germany as a sector of the population with an especially high incidence of incontinence and for whom reimbursement rates are favorable. There is an increasing move towards home care in the UK, where the NHS is pushing for alternatives to long-term use of indwelling catheters. Moreover, increasing outreach initiatives in France and Spain, rising the caregiver uptake, will uplift the overall regional external urine management products market revenue.

Asia Pacific is estimated to be the fastest-growing region in the external urine management products market over the forecast period. This can be attributed to increasing awareness, increasing healthcare expenditures, and a growing aging population in countries such as China, India, and Japan.

Urbanization and better availability of healthcare in China, coupled with increased investments in care homes, are leading to higher adoption of products. India, with increasing capacity to manufacture medical devices and an increasing number of post-acute and home care setups, is becoming one of the potential growth hubs. Urinary management products are widely demanded for elderly care in Japan, where it faces the world's most aged society, and hospitals are increasingly introducing state-of-the-art non-invasive devices for the prevention of infection. Furthermore, developing governmental support for older population care and home-based treatments in South Korea and Australia is adding to growth in the regional external urine management products market.

Table: Regional Market Snapshot – Drivers & Adoption Levels (2024)

|

Region |

Market Position |

Dominant Country |

Key Driver |

|

North America |

Market Leader |

U.S. |

Hospital infrastructure, reimbursement |

|

Asia Pacific |

Fastest Growing |

China, India |

Aging population, homecare shift |

|

Europe |

Second Fastest Growing |

Germany, UK |

Elderly care support, product innovation |

|

Latin America |

Emerging |

Brazil |

Public-private health investments |

|

Middle East & Africa |

Developing |

Saudi Arabia |

Hospital expansion, awareness campaigns |

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading external urine management products companies in the market include Cardinal Health, Coloplast Corp., Hollister Inc., BD (C. R. Bard), Teleflex Inc., B. Braun Melsungen AG, Consure Medical, Men’s Liberty (BioDerm), Sage Products (Stryker), and Boehringer Laboratories LLC, playing a vital role in innovation and market expansion.

Recent Developments:

-

In April 2025, Bright Uro received FDA 510(k) clearance for its Glean Urodynamics System, a wireless and catheter-free device providing ambulatory monitoring of lower urinary tract function, offering more physiologically accurate and comfortable diagnostics.

-

In April 2024, Medline announced an exclusive acute-care distribution agreement for the QiVi MEC male external urine management device, designed to reduce CAUTIs and incontinence-associated dermatitis through real-time suction and silicone-based adhesive.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 632.26 million |

| Market Size by 2032 | USD 940.76 million |

| CAGR | CAGR of 5.11% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Products (Male External Catheters, Female External Catheters, and Urine Collection Accessories) • By Distribution Channel (Online, Offline) • By End-Use (Hospital, Clinics, Home care settings, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cardinal Health, Coloplast Corp., Hollister Inc., BD (C. R. Bard), Teleflex Inc., B. Braun Melsungen AG, Consure Medical, Men’s Liberty (BioDerm), Sage Products (Stryker), and Boehringer Laboratories LLC |