Fast Melt Tablets Market Report Scope & Overview:

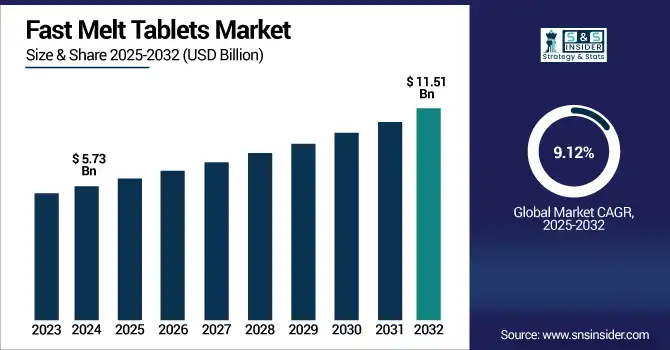

The fast melt tablets market size was valued at USD 5.73 billion in 2024 and is expected to reach USD 11.51 billion by 2032, growing at a CAGR of 9.12% over 2025-2032.

To Get more information on Fast Melt Tablets Market - Request Free Sample Report

The fast melt tablets market is also expected to thrive due to the rising demand from pediatric, geriatric, and dysphagic patient populations, who often have difficulty swallowing solid conventional dosage forms. These formulations provide ease of dosing, fast onset of action, and enhanced patient acceptance.

Increased prevalence of chronic diseases, such as neurological diseases, migraines, allergies, etc., has also contributed to enhancing the popularity of ODFs. Advances in formulation technologies, such as better taste masking agents and super-disintegrants, are driving development within leading pharmaceutical companies.

In September 2024, new CNS fast melt therapies gained regulatory approvals, demonstrating the clinical and commercial success of orally disintegrating tablets and advancing the fast melt tablets market.

Globally, a few fast melt tablets companies are taking efforts to develop innovative fast-melting dosage forms as an alternative in the medication system to overcome drawbacks from conventional dosage forms in therapeutic areas such as central nervous system (CNS) drugs, cardiovascular drugs, gastro-resistant drugs, and anti-psychotic drugs. Moreover, regulatory authorities are easing approvals of these patient-friendly formats, further instilling market confidence. Manufacturing facilities are being brought online, supported by factory automation and AI-based formulation modelling that can demonstrate consistent quality and reduced lead time. The fast melt tablets market is growing at a rapid pace, and the market will experience major growth during the forecast period.

For instance, the global fast-melt tablets market witnessed a path-breaking innovation in the design technology of 3D-printed fast melt tablets by early 2025 that led to a customization in the form of dose and quick dissolution features, making it a trailblazing stride towards the future fast melt tablets market trends.

Table: Technological Advancements in Fast Melt Manufacturing (2023–2025)

|

Technology |

Functionality |

Industry Adoption (High/Medium/Low) |

Example Use Case |

|

Nano-coating |

Taste masking & bioavailability |

High |

Pediatric antihistamines |

|

AI-Driven Modeling |

Preclinical formulation design |

Medium |

Fast-melt CNS therapies |

|

3D Tablet Printing |

Personalized dosage creation |

Low (emerging) |

Geriatric multi-drug therapy tablets |

Table: Leading Therapeutic Areas for Fast Melt Tablet Development (Pipeline, 2025)

|

Therapeutic Area |

Number of Ongoing Pipeline Projects |

Key Indications |

Active Companies |

|

CNS Disorders |

52 |

Schizophrenia, ADHD |

Teva, Johnson & Johnson |

|

Gastrointestinal |

33 |

GERD, IBS |

Sanofi, Aurobindo |

|

Cardiovascular |

28 |

Hypertension, Angina |

Sun Pharma, Novartis |

Market Dynamics:

Drivers:

-

Innovative Formulation, Patient-Centric Dosage Needs, and Rising Therapeutic Demand Drive the Fast Melt Tablets Market

The fast melt tablets market analysis is mainly driven by the growing demand for non-invasive and patient-friendly dosage forms, especially in pediatric and geriatric populations. More than 35% of the elderly and 28% of children have swallowing issues with such conventional tablets or capsules, leading to a great preference for orally dispersible tablets. This increasing trend is prompting a reformulation of existing popular drugs, such as antihistamines, analgesics, and antipsychotic drugs, into rapidly dissolving versions.

Demand for care has also been pushed by the rising prevalence of chronic disease, particularly in neurology and cardiovascular disease. R&D spending among drug makers has increased, and more than 15% of formulation-based pipelines target orally disintegrating delivery systems. Meanwhile, on the supply side, manufacturers are developing high-speed lyophilisation and spray drying technologies in order to cater to the volume demand.

Regulatory backing is also boosting segment expansion; the likes of the FDA and EMA have laid the ground for fast-track guidelines of age-appropriate formulations, especially for rare pediatric illnesses. Pharma majors are already collaborating with contract manufacturers to increase scalability and cut formulation-to-market time to bring products closer to market. This confluence of clinical demand, technology evolution, and regulatory drivers is driving strong, fast melt tablets market growth and will continue to be the foundation for further progress across a range of therapeutic areas.

Restraints:

-

Complex Formulation Barriers, Stability Issues, and Limited Drug Compatibility Hinder the Growth of the Fast Melt Tablets Market

Despite the increasing need, the demand for fast melt tablets encounters several obstacles, especially in terms of formulation complexity and manufacturing capacity. Fast-dissolving technology is not suitable for many APIs for various reasons, including bitterness, moisture sensitivity, and the dose they can accommodate. For instance, it is challenging to develop such as fast melts for high-dose drugs like metformin, antibiotics such as amoxicillin, without sacrificing the physical integrity of the tablet or patient's acceptability. In addition, it is technically difficult to retain the mechanical strength, coupled with a rapid disintegration of the tablet, i.e., use of expensive excipients or special equipment.

From the manufacturing point of view, the production yield is lower compared to that of the ordinary tablets, which increases the unit cost by 20–30%, resulting in limited accessibility of the technology in the low-cost market. Supply chain limitations in the sourcing of excipients such as super-disintegrants or taste maskers also affect consistency and scale. Furthermore, fast melt formulations are subject to greater regulatory review, which encompasses the requirement of bioequivalence studies, as well as palatability studies, particularly in the pediatric population. These barriers are obstacles to rapid growth for a number of players, which ultimately caps fast melt tablets market share in certain therapeutic areas and postpones broader utilization despite consumer enthusiasm.

Segmentation Analysis:

By Type

In 2024, anti-psychotics led the fast melt tablets market analysis with a share of 22.83%. The dominance is driven by the nearly universal use of orally disintegrating antipsychotic drugs for diseases like schizophrenia and bipolar disorder, where patient adherence is everything. These are easy to administer to people with cognitive deficits and/or an inability to swallow.

The CNS stimulants segment is growing most rapidly based on the increased number of ADHD diagnoses and the demand for fast-acting, child-friendly formats. Their use among school-aged children has driven product innovation and a surge in demand.

By Indication

Neurological disorders were the leading indication of the global fast melt tablets market in 2024, and are anticipated to 29.3% in 2024. Such conditions are frequently chronic and require long-term therapy and patient compliance, which is well suited for fast melt formulations, particularly in the case of psychiatric and seizure applications.

The allergy and respiratory disorders segment is the fastest growing due to the increasing number of seasonal allergies and asthma cases. These situations necessitate rapid relief of symptoms, and fast-melt formulations offer an effective, non-water-requiring method of administration, which is especially beneficial in children and elderly individuals.

By Dosage Form

The oral dosage forms are expected to have a share of 41.7% of the fast melt tablets market analysis in 2024, owing to their convenience in administration, familiarity, and applications across all age groups. Both OTC and prescription analgesics, antihistaminics, and neurotropic agents are commonly accepted.

Sublingual is the fastest growing segment and is driven by faster onset of action as well as higher bioavailability. More recently, it has been utilized for cardiovascular and analgesic drugs with better therapeutic efficacy due to the rapid absorption from the oral mucosa.

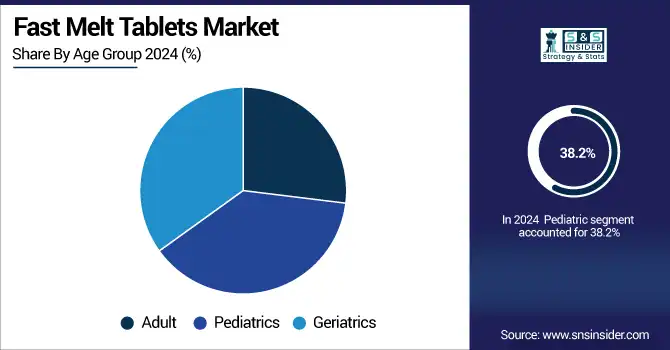

By Age Group

The pediatric segment dominated the fast melt tablets market with a share of about 38.2% in 2024. It’s also the case, for instance, with ADHD, the flu, and other conditions that affect children, and they may have a tough time swallowing pills. The convenience of use and acceptance by children are the most significant reasons why parents and health care professionals prefer these formulations.

The geriatric segment is expected to be the fastest-growing, owing to the increasing elderly population with dysphagia and chronic diseases. Fast melt tablets ease the administration of medicines, lower choking, and promote compliance in the elderly.

By Distribution Channel

The retail pharmacies segment accounted for the largest market share of 44.5% in 2024, due to easy availability of products, pharmacist counseling, and a large number of OTC medicine visitors. They are important channels of fast melt tablets, both Rx and OTC, in urban and semi-urban areas.

The fastest-growing one is the online pharmacies driven by increased adoption of digital health care, home delivery services, and the need for chronic disease care management. Consumers are showing a growing preference for the convenience of online shopping and the broader selection of drugs available for pediatric and elderly patients.

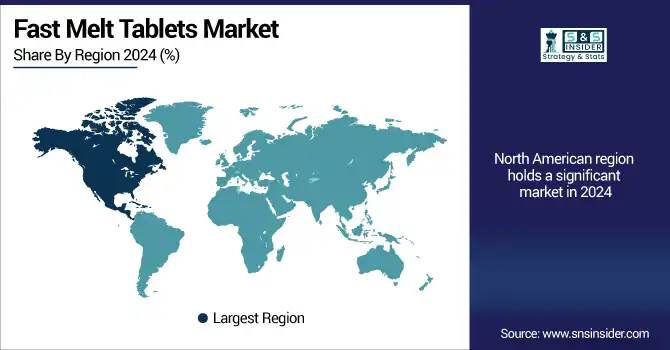

Regional Analysis:

Fast melt tablets market for North America held the maximum market revenue share in 2024 and will continue to dominate during the forecast period due to well well-developed pharmaceutical industry, rising patients' preference for patient-centric drug delivery systems, and a large number of patients suffering from chronic disorders such as neurological and respiratory diseases.

The U.S. fast melt tablets market size was valued at USD 1.87 billion in 2024 and is expected to reach USD 3.33 billion by 2032, growing at a CAGR of 7.52% over 2025-2032. The U.S. dominated the regional market, contributing over 65% of the overall regional share, attributed to higher R&D spending, approved orally disintegrating formulations, and increasing demand in the pediatric and geriatric populations. The strong retail and hospital pharmacy networks in the U.S. healthcare system also help optimize the distribution process. Canada is the second most rapidly expanding market in the region, with the rising investments by healthcare bodies and the supportive government policies for elderly and pediatric products in the country. Slow growth in Mexico has led local manufacturers to introduce fast-dissolving technologies in response to growing consumer demand.

Table: Regulatory Approvals for Fast Melt Tablets by Region (2023–2024)

|

Region |

No. of Approvals |

Major Approved Drugs |

Regulatory Trends |

|

North America |

42 |

CNS, Pediatric Antihistamines |

Pediatric fast-track pathways |

|

Europe |

36 |

Migraine, Anti-allergy ODTs |

EMA ODT-specific guidelines |

|

Asia Pacific |

29 |

GERD, Pediatric ADHD meds |

Generic fast melt expansion |

|

Latin America |

15 |

Pain Relief ODTs |

Easier import regulations |

Europe is also a mature but growing market driven by the advanced pharmaceutical industry in Germany and the high incidence of CNS disorders. Europe, Germany was the leading unit in 2024, with more than 24.5% of market share. The EMA encourages the development of pediatric-appropriate drug formulations in the region. France and the UK are also major contributors owing to the ageing population and the requirement for easy drug delivery forms. The highest growth market in Europe is Poland, supported by growing generic drug production and healthcare spending, while the government is actively incentivising local pharma manufacturing.

Asia Pacific is the most rapidly growing region in the global fast melt tablets market on account of a huge population base, increasing awareness about new methods of drug delivery, and easy availability of healthcare. India is the most prominent market in the region on account of a strong market share of generics, on account of strengthened generic manufacturing capacity, low production costs, increasing paediatric and geriatric population. India is also gaining from increased exports of fast-melting formulations to regulated and semi-regulated markets. Growth in China will be driven by a rising incidence of lifestyle-related diseases and health care reform efforts by the government. Orally disintegrating formulations are still widely used in geriatric care and neurology in Japan, which has a large population of elderly people and creative drug development environments.

Table: Competitive Strategies Adopted by Leading Companies (2024–2025)

|

Company |

Strategic Move |

Objective |

Outcome/Status |

|

Pfizer |

R&D partnership with a biotech firm |

Novel ODT formulation |

New CNS ODT pipeline initiated |

|

Zydus Lifesciences |

Fast melt launch for pediatric GERD |

Market penetration in India |

Approved and launched Q1 2025 |

|

Teva Pharmaceutical |

Automation in the ODT production line |

Lower production costs |

Capacity doubled in the EU facility |

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading fast melt tablets companies in the market include Pfizer, GSK, Johnson & Johnson, Merck, Novartis, Sanofi, Teva, Amgen, Sun Pharmaceutical, and Aurobindo Pharma.

Recent Developments:

-

In March 2025, Teva Pharmaceuticals expanded its fast melt product portfolio by launching a new orally disintegrating version of a widely prescribed antipsychotic drug, enhancing its reach in the mental health therapeutics segment.

-

In January 2025, Zydus Lifesciences received regulatory approval for its fast melt tablet formulation for pediatric allergy treatment in India, aiming to improve compliance among children with seasonal allergies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.73 billion |

| Market Size by 2032 | USD 11.51 billion |

| CAGR | CAGR of 9.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Anti Psychotics, Anti Epileptics, CNS Stimulants, Anxiolytics, Anti-Parkinsonian Drugs, Anti-Hypertensives, NSAIDs, Anti-Allergy Drugs, Proton Pump Inhibitors, and Others) • By Indication (Pain Management, Allergy and Respiratory Disorders, Neurological Disorders, Gastrointestinal Disorders, Cardiovascular Disorders, and Others) • By Dosage Form (Oral, Sublingual, Buccal, and Chewable) • By Age Group (Adult, Pediatrics, and Geriatrics) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Pfizer, GSK, Johnson & Johnson, Merck, Novartis, Sanofi, Teva, Amgen, Sun Pharmaceutical, and Aurobindo Pharma. |