Feed Binders Market Report Scope & Overview:

The Feed Binders Market was valued at USD 4.96 billion in 2025E and is expected to reach USD 6.85 billion by 2032, growing at a CAGR of 4.20% from 2026-2033.

The Feed Binders Market is growing due to rising global demand for high-quality animal nutrition and improved feed stability. Increasing livestock production, driven by expanding meat, dairy, and aquaculture industries, is boosting the need for effective binders that enhance feed durability and palatability. Additionally, stricter regulations on feed safety, the shift toward natural and sustainable ingredients, and advancements in binder formulations are supporting wider adoption across commercial farming operations.

In 2024, over 65% of commercial feed mills globally incorporated advanced binders to meet pellet durability standards, with the aquaculture sector’s feed binder usage rising by 10% supporting a projected 7% year-over-year growth in global binder demand through 2025.

Feed Binders Market Size and Forecast

-

Market Size in 2025E: USD 4.96 Billion

-

Market Size by 2033: USD 6.85 Billion

-

CAGR: 4.20% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Feed Binders Market - Request Free Sample Report

Feed Binders Market Trends

-

Rising demand for high-quality compound feed driving increased adoption of efficient and reliable feed binders globally

-

Growing shift toward natural and clean-label binders as producers emphasize sustainability and reduced chemical usage

-

Increasing use of binders to enhance pellet durability, reduce wastage, and improve overall livestock feed efficiency

-

Expansion of commercial livestock farming boosting requirement for binders that support better digestion and nutrient absorption

-

Advancements in binder formulations improving stability, moisture control, and performance across diverse feed applications and species

U.S. Feed Binders Market was valued at USD 0.89 billion in 2025E and is expected to reach USD 1.19 billion by 2032, growing at a CAGR of 3.74% from 2026-2033.

Growth in the U.S. Feed Binders Market is driven by increasing demand for high-quality, nutritionally stable animal feed and rising livestock production. Stricter feed safety regulations, along with a shift toward natural and sustainable binder ingredients, are further supporting market expansion across poultry, cattle, and aquaculture sectors.

Feed Binders Market Growth Drivers:

-

Rising demand for high-quality animal feed boosts adoption of feed binders to improve pellet durability, nutritional value, and overall feed efficiency

As livestock producers focus on improving animal nutrition and productivity, the demand for premium-quality feed continues to rise. Feed binders play a crucial role in enhancing pellet durability, preventing breakage during handling, and ensuring consistent nutrient intake. Their ability to improve feed texture, reduce dust, and enhance overall efficiency makes them essential for modern feed formulation. With growing emphasis on maximizing feed conversion ratios and maintaining product quality across supply chains, feed binders are increasingly adopted in poultry, cattle, aquaculture, and swine feed manufacturing.

In 2024, over 65% of livestock and poultry feed manufacturers increased binder usage to enhance pellet quality, supporting a 7.2% year-over-year rise in feed binder consumption globally.

-

Rapid growth in livestock and poultry production increases need for stable, uniform feed pellets that enhance digestion and animal performance

Expanding global consumption of meat, dairy, and poultry products has led to significant growth in livestock production, driving demand for reliable feed solutions. Uniform, durable feed pellets contribute to better digestion, reduced feed loss, and improved animal performance. Feed binders support the formation of cohesive pellets that maintain shape during storage and transport, ensuring consistent nutrient delivery. As producers aim to meet rising protein demand while optimizing production efficiency, feed binders become essential in maintaining feed quality across high-volume poultry, cattle, and swine operations.

Poultry feed pellet demand grew by 6.5% in 2024, with over 85% of commercial operations prioritizing pellet durability (>90% hardness) to boost nutrient absorption and weight gain in broilers and layers.

Feed Binders Market Restraints:

-

Fluctuating raw material prices increase production costs for feed binders, limiting profitability and creating uncertainty for manufacturers and suppliers globally

The feed binders market is highly sensitive to volatility in raw material prices, including plant gums, starches, clays, and synthetic ingredients. Frequent fluctuations in global commodity markets make cost forecasting difficult, causing financial instability for manufacturers. Rising transportation, energy, and processing costs further strain profit margins. These uncertainties force producers to adjust pricing frequently, which can reduce competitiveness and weaken relationships with feed manufacturers. Overall, cost instability limits production planning, affects long-term contracts, and slows market growth, especially in price-sensitive regions.

In 2024, volatile prices of key raw materials like bentonite and lignosulfonates rose up to 22%, squeezing feed binder manufacturers’ margins by 12–15% and disrupting supply chain planning globally.

-

Strict regulatory standards for feed additives complicate approval processes, increasing compliance costs and slowing market expansion for binder manufacturers worldwide

Feed binders must meet stringent safety and quality regulations imposed by regional and international authorities. Compliance requires extensive testing, documentation, and approval procedures, which are time-consuming and costly for manufacturers. Companies must invest in research, regulatory expertise, and facility upgrades to meet evolving standards. These requirements often delay product launches and limit the entry of new formulations into the market. Smaller manufacturers face greater challenges due to limited resources, which slows overall innovation and restricts global expansion opportunities within the feed binders industry.

Over 60% of binder manufacturers report delays of 6–18 months in feed additive approvals due to stringent global regulations, with compliance costs rising by 25–30% since 2020.

Feed Binders Market Opportunities:

-

Rising demand for high-quality compound feed creates opportunities for advanced binders that improve pellet durability, nutrient retention, and overall feed performance

As intensive livestock farming expands globally, producers are increasingly focused on delivering nutritionally balanced and high-quality compound feed. This shift is creating strong opportunities for advanced feed binders that enhance pellet durability, reduce breakage during handling, and support consistent nutrient delivery. Feed manufacturers are willing to invest in binders that improve overall feed efficiency, storage stability, and digestibility. Additionally, growing awareness about optimizing feed conversion ratios and reducing waste is driving the adoption of innovative binder formulations tailored for poultry, swine, ruminants, and specialty feeds.

In 2024, over 70% of feed mills reported increased investment in advanced binders, driven by a 12% annual growth in demand for high-quality compound feed to support intensive livestock production.

-

Growing aquaculture production boosts demand for water-stable feed binders that enhance pellet strength and reduce nutrient loss in aquatic environments

The rapid expansion of global aquaculture—driven by rising seafood consumption and limited capture fisheries—is increasing the need for durable, water-stable aquafeed. This trend creates significant opportunities for specialized feed binders that maintain pellet integrity in water, minimize nutrient leaching, and improve feeding efficiency. Aquafeed producers are seeking binder solutions that support better floatability, uniformity, and stability to meet the nutritional requirements of fish and shrimp. As sustainability and cost efficiency gain importance, water-stable binders are becoming essential for reducing feed wastage and enhancing overall farm productivity.

In 2024, over 70% of commercial aquafeed producers reported prioritizing water-stable binders to address pellet disintegration, with feed wastage estimated at 20–30% in systems using conventional binders.

Feed Binders Market Segment Highlights

-

By Source: In 2025, Natural Binders dominated with 62% share and will also grow fastest from 2026–2033.

-

By Livestock: In 2025, Poultry led the Feed Binders Market with 41% share, while Aquaculture is set to grow fastest from 2026–2033.

-

By Product Type: In 2025, Lignosulfonates dominated with 30% share, while Synthetic Binders will grow fastest from 2026–2033.

-

By Application: In 2025, Pelleting & Processing Efficiency held 38% share, while Feed Stability & Durability will grow fastest from 2026–2033.

Feed Binders Market Segment Analysis

By Source, Natural Binders segment led in 2025; Natural Binders segment expected fastest growth 2026–2033

Natural Binders segment dominated the Feed Binders Market with the highest revenue share of about 62% in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to increasing preference for safe, sustainable, and eco-friendly feed components. Rising use of plant gums, starches, and natural polymers supports better digestibility and animal health. Growing regulatory pressure against synthetic additives and producer demand for clean-label, nutrient-enhancing feed solutions continue to strengthen both dominance and rapid growth of natural binders worldwide.

By Livestock, Poultry segment led in 2025; Aquaculture segment expected fastest growth 2026–2033

Poultry segment dominated the Feed Binders Market with the highest revenue share of about 41% in 2025 due to rising global poultry consumption, increasing commercial poultry farming, and the strong need for binders to enhance pellet quality, reduce feed wastage, and improve nutrient absorption.

Aquaculture segment is expected to grow at the fastest CAGR from 2026-2033 driven by expansion of fish and shrimp farming, demand for water-stable pellets, and focus on improving feed efficiency in rapidly growing aquaculture systems.

By Product Type, Lignosulfonates segment led in 2025; Synthetic Binders segment expected fastest growth 2026–2033

Lignosulfonates segment dominated the Feed Binders Market with the highest revenue share of about 30% in 2025 because of their cost-effectiveness, strong binding capability, and wide use across poultry, cattle, and aquaculture feed formulations.

Synthetic Binders segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing adoption of high-performance, consistent-quality binders that offer superior pellet durability, moisture stability, and customized functional properties for modern feed production systems.

By Application, Pelleting & Processing Efficiency segment led in 2025; Feed Stability & Durability segment expected fastest growth 2026–2033

Pelleting & Processing Efficiency segment dominated the Feed Binders Market with the highest revenue share of about 38% in 2025 due to the growing need for improved pellet strength, reduced fines, and optimized machine performance during feed production.

Feed Stability & Durability segment is expected to grow at the fastest CAGR from 2026-2033 driven by rising focus on high-quality pellets that maintain integrity during storage, transportation, and feeding, especially in aquaculture and poultry applications.

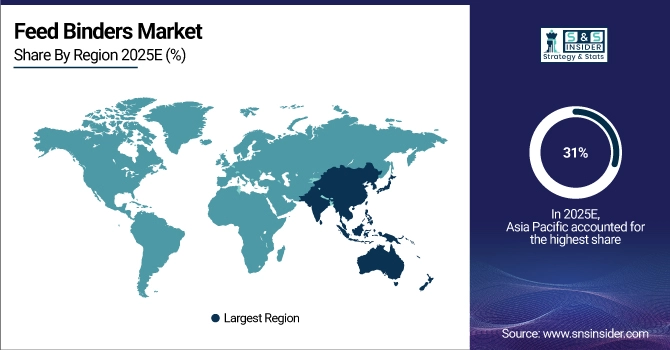

Feed Binders Market Regional Analysis

Asia Pacific Feed Binders Market Insights

Asia Pacific dominated the Feed Binders Market with a 31% revenue share in 2025 and is projected to grow at the fastest CAGR of 5.62% from 2026–2033 due to expanding livestock production, rising meat consumption, and increasing preference for high-quality compound feed. Growing aquaculture activities and continuous feed innovation further accelerate regional demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Feed Binders Market Insights

North America captured a significant share of the Feed Binders Market in 2025 due to strong industrial livestock farming, high adoption of compound feed, and stringent quality standards promoting the use of efficient binding agents. The region’s advanced feed manufacturing infrastructure and growing focus on nutritional optimization continue to support steady market expansion.

Europe Feed Binders Market Insights

Europe held a substantial share of the Feed Binders Market in 2025, supported by strict regulatory frameworks promoting high-quality and safe feed production. The region’s strong emphasis on sustainable animal nutrition, rising adoption of natural binders, and well-established livestock and aquaculture industries further enhanced demand for advanced feed binding solutions.

Middle East & Africa and Latin America Feed Binders Market Insights

The Middle East & Africa and Latin America together accounted for a moderate share of the Feed Binders Market in 2025, driven by expanding livestock populations, rising demand for cost-effective feed solutions, and gradual modernization of feed production systems. Growing aquaculture activities, improving feed quality standards, and increased investments in animal nutrition further supported market growth across both regions.

Feed Binders Market Competitive Landscape:

Darling Ingredients Inc.

Darling Ingredients Inc. is a global leader in sustainable ingredients, specializing in converting organic by-products into value-added products for animal feed, food, fuel, fertilizer, and pharmaceuticals. In the feed binders market, the company provides high-quality gelatin, collagen, and specialty proteins that enhance pellet durability and nutritional value. With a strong global presence and advanced processing technologies, Darling supports the rising demand for natural and functional feed ingredients, emphasizing circular economy practices and environmentally responsible production.

-

2025, Darling Ingredients Inc. launched Nextida, a collagen- and gelatin-based health and nutrition platform, expanding its specialty proteins portfolio for food, feed, and wellness applications while reinforcing its circular, sustainable ingredient strategy.

Archer Daniels Midland (ADM)

Archer Daniels Midland (ADM) is a major global agribusiness firm headquartered in the United States, offering a broad portfolio of feed ingredients, including natural binders such as starches, gums, and plant-based polymers. ADM’s strong supply chain, large-scale processing capabilities, and innovations in animal nutrition make it a key contributor to the feed binders market. The company focuses on improving feed quality, stability, and digestibility through sustainable solutions backed by extensive research and global distribution networks.

-

2025, Archer Daniels Midland introduced Digest Carb, a synergistic ruminant feed solution launched at SPACE 2025 in Europe to enhance fiber degradability, milk yield, feed efficiency, and sustainability for dairy producers.

DuPont de Nemours, Inc.

DuPont de Nemours, Inc. is a science-driven global company known for advanced biomaterials, enzymes, and specialty chemicals used across various industries, including animal nutrition. In the feed binders market, DuPont offers cellulose derivatives, alginates, and enzymatic solutions that enhance pellet strength and feed efficiency. The company emphasizes innovation, sustainability, and precision formulations backed by strong R&D capabilities. DuPont’s technology-driven approach supports improved feed performance, stability, and animal health across diverse livestock sectors.

-

2024, DuPont de Nemours, Inc. launched Film Tec Hyper shell NF245XD nanofiltration elements for dairy processing, enhancing milk and whey separation efficiency while supporting sustainable, high-performance solutions for food and nutrition manufacturers

BASF SE

BASF SE is a leading chemical company based in Germany, supplying a wide range of ingredients and additives for the animal nutrition sector. Its feed binder offerings include high-performance polymers, lignosulfonates, and functional additives designed to improve pellet quality, reduce feed waste, and enhance nutrient absorption. BASF’s strong global footprint, advanced material science expertise, and commitment to sustainability drive its influence in the feed binder’s market. The company continuously invests in research to deliver innovative and efficient feed solutions.

-

2025, BASF introduced Lutavit A/D3 1000/200 NXT, a next-generation animal nutrition vitamin blend that combines vitamins A and D3 in a highly stable microencapsulated form. The launch enhances feed efficiency and nutrient stability, supporting improved animal health and performance.

Feed Binders Market Key Players

Some of the Feed Binders Market Companies are:

-

Darling Ingredients Inc.

-

Archer Daniels Midland (ADM)

-

DuPont de Nemours, Inc.

-

BASF SE

-

Roquette Frères

-

Borregaard ASA

-

CP Kelco, Inc.

-

Cra-Vac Industries, Inc.

-

Beneo GmbH

-

Kemin Industries, Inc.

-

Alltech

-

Visco Starch

-

Bentoli AgriNutrition Pvt. Ltd.

-

Uniscope, Inc.

-

Allwyn Chem Industries

-

Royal Avebe U.A.

-

FMC Corporation

-

Gelita AG

-

Ingredion Incorporated

-

Kalsec Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.96 Billion |

| Market Size by 2033 | USD 6.85 Billion |

| CAGR | CAGR of 4.20% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Natural Binders, Synthetic Binders) • By Livestock (Poultry, Swine, Cattle, Aquaculture, Pet Animals, Others – Sheep, Goats, etc.) • By Product Type (Lignosulfonates, Hemoglobin & Other Specialty Binders, Plant Gums & Starches, Gelatin & Collagen, Clay – Bentonite, Kaolin, etc., Molasses, Synthetic Binders) • By Application (Feed Stability & Durability, Pelleting & Processing Efficiency, Nutrient Preservation, Anti-Dusting & Flowability Improvement) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Darling Ingredients Inc., Archer Daniels Midland (ADM), DuPont de Nemours Inc., BASF SE, Roquette Frères, Borregaard ASA, CP Kelco Inc., Beneo GmbH, Kemin Industries Inc., Alltech Inc., Bentoli AgriNutrition Pvt. Ltd., Uniscope Inc., Visco Starch, Avebe U.A., Gelita AG, Ingredion Incorporated, FMC Corporation, Allwyn Chem Industries, Cargill Incorporated, Nutreco N.V. |