Fermenters Market Report Scope And Overview:

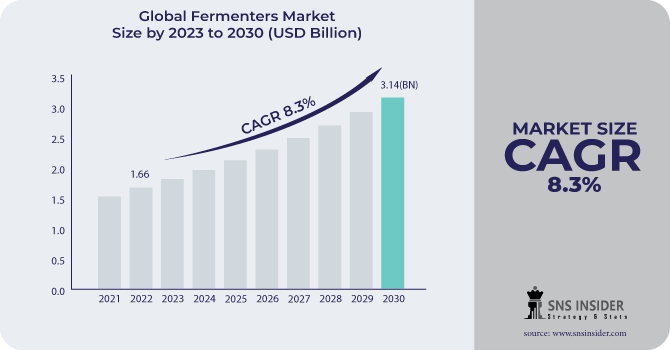

The Fermenters Market size was USD 1.66 billion in 2022 and is expected to Reach USD 3.14 billion by 2030 and grow at a CAGR of 8.3 % over the forecast period of 2023-2030.

A fermenter is a device that is used to grow microorganisms, such as yeast, bacteria, or fungi, in a controlled environment. Fermenters are used to produce a variety of applications such as Food, Beverage, Healthcare & Personal Care, and Others.

Based on applications, the healthcare and personal care category is predicted to rise rapidly throughout the forecast period due to increased global demand for active pharmaceutical ingredients and vaccines.

The ability of fermenters to produce significant yields and withstand atypical growth conditions, such as acidic or high temperatures, is driving the expansion of the fermenter market. Fermenters are widely employed in the pharmaceutical sector to produce chemical compounds, enzymes, and medications as a result of their advantageous features. By adding helpful bacteria that are good for the human body, the fermentation process eliminates undesired and toxic microbes.

MARKET DYNAMICS

KEY DRIVERS

-

Rising consumption of fermented foods and beverages

increased demand for a healthy lifestyle, paired with increased disposable wealth, has moved consumer tastes toward fermented products. These items are broken down naturally, which has nutritional and health benefits. These items are high in probiotics, which are live microorganisms that are beneficial to gut health. Probiotics have been demonstrated to enhance digestion, boost immunity, and aid in weight loss. This is increasing demand for fermenters, which are used to manufacture these products.

RESTRAIN

-

High investment costs of fermenters

Fermenters are expensive because of a variety of parameters, such as the complexity of the equipment, the requirement for high-quality materials, and severe regulatory requirements. Fermenters must maintain a controlled environment for the fermentation process, which necessitates the use of specific equipment and ingredients. As a result, fermenters can be prohibitively expensive, particularly for large-scale production. This can be a barrier to admission for new players as well as a challenge for existing players looking to grow their production capacity.

OPPORTUNITY

-

Rising use of fermenters in various application sectors

Fermenters are increasingly widely employed in the food, beverage, healthcare, and personal care industries, attributable to increased research and development. The fermentation process is widely used in industry. Fermentation is used to manufacture vaccines, insulin, and antibiotics. The fermentation process produces foods such as bread, beer, wine, and cheese. Fermentation is required for single-cell protein synthesis. This broadens the addressable market for fermenters and opens up new avenues for expansion.

-

Increasing investment in research and development

CHALLENGES

-

Stringent government regulations

The European Union, the United States Food and Drug Administration (FDA), the Chinese government, and many other countries have regulations in place to protect buyers' interests in critical sectors such as healthcare, food, beverages, and personal care. Stringent government rules also operate as a barrier to innovation. However, a lack of laws in some markets can stifle the industry's growth.

IMPACT OF RUSSIAN-UKRAINE WAR

The war between Russia and Ukraine has had a significant impact on the fermenters business. Fermenter prices have risen by approximately 15% as a result of the conflict in Ukraine. Russia and Ukraine are large producers of stainless steel, which is used to make fermenters. The war has also resulted in higher energy prices, which has raised the cost of producing fermenters. This is because stainless steel and other raw materials are more expensive. The Ukrainian conflict is projected to reduce demand for fermenters in a variety of businesses. Because of the war, the global food and beverage business, for example, is likely to develop at a slower rate in 2022.

IMPACT OF ONGOING RECESSION

The Recession has led to a negative impact on fermenters as steel prices have risen due to Russia Russia-Ukrainian war, whereas other commodity prices have also risen due to inflation. Many countries are facing recession due to disruptions in supply chains, geopolitical instability, and sanctions applied by other countries. In 2022, steel demand is predicted to fall. According to the World Steel Association (WSA), global steel demand has decreased by 2.3% in 2022. Hence, manufacturers of fermenters are delaying production as the prices of energy, labor costs, and scarcity of raw materials all impact the growth of the fermenters market.

MARKET SEGMENTATION

by Process

-

Batch Fermentation

-

Continuous Fermentation

-

Others

by Microorganism

-

Fungi

-

Bacteria

by Mode of Operation

-

Semi-automatic

-

Automatic

by Application

-

Food

-

Beverage

-

Healthcare & Personal Care

-

Others

.png)

REGIONAL ANALYSIS

North America is the dominant market accounting for 39% of the market share in 2022 owing to the growing popularity of fermentation-based food and medicinal processes. Regulations issued by institutions promote green chemistry, the expansion of which is aided by the use of fermentation Processes. The US food and beverage industry is one of the largest in the world, and the US healthcare industry is a global leader. The US market is also expected to benefit from the growing popularity of fermented foods and beverages in the country. Rising demand for fermented beverages such as beer and wine also drives market expansion.

Europe is another significant market player for fermenters. The European food and beverage industry is one of the largest in the world, and the European biopharmaceutical industry is a global leader. The European market is also expected to benefit from the growing popularity of fermented foods and beverages in the region.

The Asia Pacific fermenters market is expected to be the fastest-growing market in the coming years. This is due to the expanding population, connected with rising per capita income, as well as rising food, personal care, and pharmaceutical sectors in this region's emerging countries such as China, India, and Japan. India is another major market for fermenters in this region.

Latin America, the Middle East and Africa markets are emerging markets for fermenters. Diversified demand for fermentation Processes in such as Brazil, UAE, Saudi Arabia, and other countries drive the market owing to an increase in the variety of applications is expected to give market expansion possibilities.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Fermenters Market are Sartorius AG, GEA Group Aktiengesellschaft, Eppendorf AG, SOLARIS BIOTECHNOLOGY srl, Bioengineering AG, Getinge AB, Broadley-James Corporation, CerCell A/S, Electrolab Biotech, BBI-Biotech GmbH, Thermo Fisher Scientific Inc., Cytiva, and other key players.

Eppendorf AG-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, Spadetown Brewing Co., based in Lurgan, invested £800,000 in its Silverwood Road manufacturing plant, adding three additional fermenters and a new in-house canning process.

In 2021, ABEC CSR® Single-Use Fermenters Enhance Catalent Cell & Gene Therapy Manufacture Expansion. Catalent Cell & Gene Therapy received two 50L CSR single-use fermenters from ABEC, a top global supplier of integrated solutions and services for biopharmaceutical manufacturing.

| Report Attributes | Details |

| Market Size in 2022 | US$ 1.66 Billion |

| Market Size by 2030 | US$ 3.14 Billion |

| CAGR | CAGR of 8.3 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Process (Batch Fermentation, Continuous Fermentation, and Others) • by Microorganism (Fungi, Bacteria) • by Mode of Operation (Semi-automatic and Automatic) • by Application (Food, Beverage, Healthcare & Personal Care, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Sartorius AG, GEA Group Aktiengesellschaft, Eppendorf AG, SOLARIS BIOTECHNOLOGY srl, Bioengineering AG, Getinge AB, Broadley-James Corporation, CerCell A/S, Electrolab Biotech, BBI-Biotech GmbH, Thermo Fisher Scientific Inc., Cytiva |

| Key Drivers | • Rising consumption of fermented foods and beverages |

| Market Opportunity | • Rising use of fermenters in various application sectors • Increasing investment in research and development |