Fiber Optic Preform Market Report Scope & Overview:

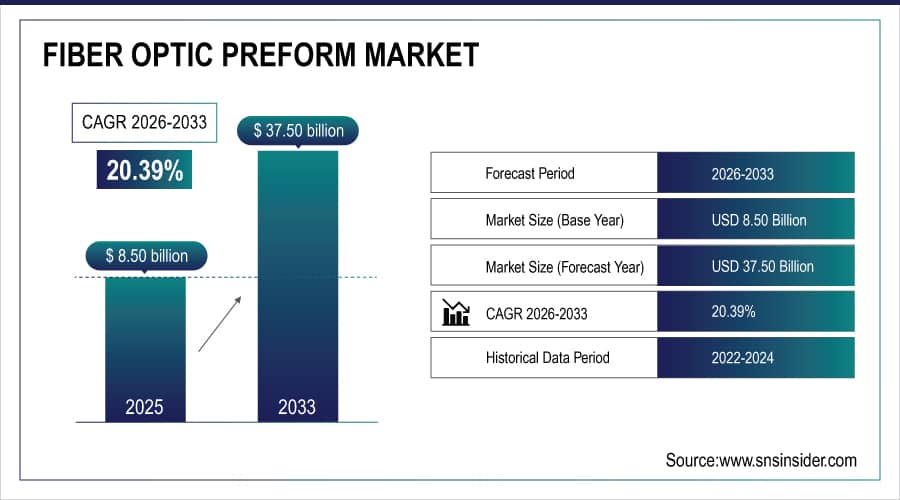

The Fiber Optic Preform Market size was valued at USD 8.50 Billion in 2025E and is projected to reach USD 37.50 Billion by 2033, growing at a CAGR of 20.39% during 2026–2033.

The fiber optic preform market is gaining momentum as demand rises for ultra-thin, high-precision fibers used in advanced consumer electronics and specialty devices. Increasing focus on device aesthetics, dynamic lighting effects, and energy-efficient performance is pushing manufacturers to seek high-quality, customizable preforms that support intricate designs. Precision manufacturing, innovative materials, and miniaturized fiber structures are becoming critical to meet these requirements. While traditional telecom and data transmission remain key segments, emerging design-driven applications are opening high-margin markets. Suppliers investing in advanced production capabilities and flexible preform solutions are well-positioned to capitalize on this evolving landscape and sustained market growth.

On Jan 8, 2025, TECNO revealed its Starry Optical Fiber technology, integrating 150 ultra-thin optical fibers with 108 mini-LEDs into phone rear covers to create galaxy-like lighting patterns with energy efficiency, durability, and seamless heat management.

To Get More Information On Fiber Optic Preform Market - Request Free Sample Report

Fiber Optic Preform Market Size and Forecast:

-

Market Size in 2025E: USD 8.50 Billion

-

Market Size by 2033: USD 37.50 Billion

-

CAGR (2026–2033): 20.39%

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

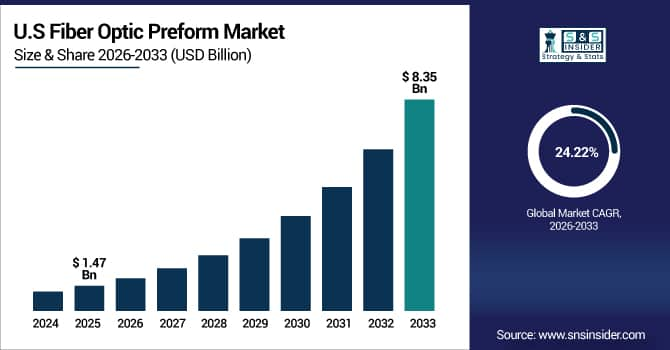

The U.S. Fiber Optic Preform Market size was valued at USD 1.47 Billion in 2025E and is projected to reach USD 8.35 Billion by 2033, growing at a CAGR of 24.22% during 2026–2033. driven by rising demand for high-speed data transmission, expanding telecom infrastructure, and increasing adoption of advanced consumer electronics. Protective measures, technological advancements in ultra-thin and energy-efficient fibers, and investment in precision manufacturing are further supporting market growth. These factors collectively enhance domestic production capabilities and enable suppliers to meet growing connectivity and design-focused applications.

Fiber Optic Preform Market Highlights:

-

Market driver is strong protective policies that stabilize local prices, shield domestic manufacturers from global overcapacity, and encourage investment in production capacity and technology upgrades, supporting long-term market growth

-

Market restraint comes from high production costs, complex manufacturing, dependence on specialized raw materials, competition from low-cost imports, and rapid technological changes, creating barriers to entry and limiting market expansion

-

Opportunity arises from rising demand for ultra-thin, energy-efficient optical fibers in consumer electronics and specialty devices, opening high-margin markets beyond telecom, including wearables, smart devices, and specialty lighting

-

Innovation trend includes advanced fiber designs with precision manufacturing and miniaturized structures enabling enhanced functionality, aesthetic appeal, and efficiency, supporting new applications

-

Industry example is TECNO’s Starry Optical Fiber Technology unveiled on Jan 10, 2025, integrating 150 ultra-fine fibers with 108 mini-LEDs in smartphone covers, highlighting potential in design-centric applications

-

Overall outlook shows that protective measures, innovation, and emerging high-design applications drive growth while cost, supply, and technological challenges remain key restraints

Fiber Optic Preform Market Drivers:

-

Protective Measures Driving Optical Fiber Preform Market Growth

The optical fiber preform market is being driven by strong protective measures that stabilize local prices and shield domestic manufacturers from global overcapacity. These factors encourage investment in production capacity and technology upgrades, allowing local players to strengthen competitiveness and consolidate market positions. By fostering innovation, efficiency, and resilience, the market can meet rising demand while mitigating risks from cheaper alternatives. Such a supportive environment ensures long-term growth, enhances supplier capabilities, and maintains steady market dynamics, making protective policies a key underlying driver of the optical fiber preform industry’s expansion.

July 10, 2024 – China has extended anti-dumping duties on US and Japanese optical fiber preforms until 2029, maintaining tariffs of 14.4%–31.2% for Japan and 17.4%–41.7% for the US to protect its fragile domestic industry amid high foreign overcapacity and declining local prices.

Fiber Optic Preform Market Restraints:

-

Fiber Optic Preform Market Faces Cost, Supply, and Innovation Hurdles

The fiber optic preform market faces several key restraints that could hinder growth. High production costs and complex manufacturing processes limit scalability, while dependence on specialized raw materials exposes suppliers to price volatility and supply chain disruptions. Intense competition from low-cost overseas manufacturers pressures profit margins, and stringent environmental regulations increase compliance burdens. Additionally, technological obsolescence and the rapid pace of innovation require continuous investment in R&D, which can strain smaller players. These factors collectively create barriers to entry, slow market penetration in emerging regions, and challenge sustained growth for established companies.

Fiber Optic Preform Market Opportunities:

-

Illuminating Growth Through High-Design Optical Fiber Preforms

The growing demand for advanced, ultra-thin, and energy-efficient optical fibers in consumer electronics and specialty devices is driving new growth avenues for the optical fiber preform market. As manufacturers increasingly focus on differentiating products through aesthetic appeal, functional integration, and enhanced user experience, the need for high-quality, customizable optical preforms rises. This trend supports expansion into high-margin segments beyond traditional telecom applications, including wearables, smart devices, and specialty lighting. Investments in precision manufacturing, innovative materials, and miniaturized fiber designs position suppliers to capture emerging opportunities in rapidly evolving, design-centric markets.

On Jan 10, 2025, TECNO unveiled its Starry Optical Fiber Technology at CES 2025, integrating 150 ultra-fine optical fibers with 108 mini-LEDs into smartphone battery covers, creating galaxy-like luminescent effects while ensuring energy efficiency, durability, and heat management.

Fiber Optic Preform Market Segment Highlights:

-

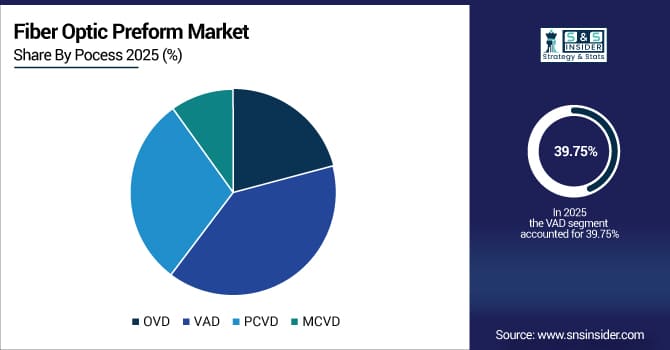

By Process: Dominant – VAD (39.75% in 2025 → 38.25% in 2033); Fastest-Growing – OVD (CAGR 22.44%)

-

By Product Type: Dominant – multi-Mode (44.38% in 2025 → 40.63% in 2033); Fastest-Growing – Plastic Optical Fiber (CAGR 23.17%)

-

By End User: Dominant – Telecom (34.51% in 2025 → 31.59% in 2033); Fastest-Growing – Others (CAGR 26.25%)

-

By Technology: Dominant – Germanium-Doped Silica (38.75% in 2025 → 31.25% in 2033); Fastest-Growing – Fluorine-Doped Silica (CAGR 22.90%)

Fiber Optic Preform Market Segment Analysis:

By Process, VAD Dominating and OVD Fastest-Growing

VAD remains the dominant process segment, accounting for the largest share due to its established use in telecom, data communication, and high-quality optical fiber manufacturing. In contrast, OVD is the fastest-growing segment, driven by rising demand for high-performance fibers, increasing investments in advanced production technologies, and the need for superior optical properties in emerging applications like 5G networks and high-speed data transmission.

By Product Type, Multi-Mode Dominating and Plastic Optical Fiber Fastest-Growing

Multi-Mode fiber remains the dominant product type, widely used in telecom and data centers due to its cost-effectiveness and ease of installation. Plastic Optical Fiber is the fastest-growing segment, fueled by increasing adoption in short-distance communication, consumer electronics, and automotive applications, along with advancements in flexible, durable, and high-bandwidth polymer-based optical fibers.

By End User, Telecom Dominating and Others Fastest-Growing

Telecom continues to dominate the end-user segment, driven by the global expansion of broadband, 5G networks, and data communication infrastructure. The Others segment is the fastest-growing, supported by rising demand in emerging sectors such as smart cities, IoT, renewable energy, and specialized industrial applications requiring optical fiber solutions.

By Technology, Germanium-Doped Silica Dominating and Fluorine-Doped Silica Fastest-Growing

Germanium-Doped Silica remains the dominant technology, preferred for high-performance fiber with low attenuation and broad bandwidth. Fluorine-Doped Silica is the fastest-growing technology, benefiting from advances in low-loss fibers, high-speed transmission requirements, and increasing applications in next-generation telecom networks and high-capacity data centers.

Fiber Optic Preform Market Regional Highlights:

-

North America: In 2025 26.16% → 34.25%, Dominating Region, Fastest Growth (CAGR 24.44%)

-

Europe: In 2025 23.69% → 21.50%, Significant Market, Slight Decline (CAGR 18.93%)

-

Asia-Pacific: In 2025 39.23% → 33.88%, Largest Share, Moderate Decline (CAGR 18.18%)

-

South America: In 2025 5.91% → 5.25%, Steady Share, Slight Decline (CAGR 18.62%)

-

Middle East & Africa: In 2025 5.02% → 5.13%, Stable Share, Moderate Growth (CAGR 20.71%)

Fiber Optic Preform Market Regional Analysis:

North America Fiber Optic Preform Market Insights:

North America leads the Fiber Optic Preform market, supported by rapid 5G deployment, strong telecom infrastructure, and increasing investment in high-speed broadband expansion. While it maintains a dominant and growing share through 2033, rising demand for advanced connectivity solutions further accelerates regional adoption across data centers, cloud networks, and emerging digital applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Fiber Optic Preform Market Insights:

The U.S. dominates the Fiber Optic Preform market, driven by extensive 5G rollout, strong broadband investments, and rising demand for high-performance optical fiber across telecom, data centers, cloud infrastructure, and advanced digital applications.

Asia-Pacific Fiber Optic Preform Market Insights:

Asia-Pacific is the fastest-growing region in the Fiber Optic Preform market, propelled by massive telecom expansion, rapid 5G deployments, and rising data consumption. Increasing investments in fiber networks, smart city projects, and large-scale digital transformation across China, India, Japan, and Southeast Asia continue to accelerate growth and strengthen the region’s market position.

China Fiber Optic Preform Market Insights:

China is dominating the Asia-Pacific Fiber Optic Preform market, driven by large-scale 5G deployment, strong domestic manufacturing capacity, and continuous investments in fiber network expansion supporting telecom, data centers, and high-speed digital infrastructure.

Europe Fiber Optic Preform Market Insights:

The Europe Fiber Optic Preform market is witnessing emerging trends, driven by expanding fiber-to-the-home deployments, increasing digital transformation initiatives, and growing demand for high-speed broadband. Rising investments in data centers, 5G infrastructure, and cross-border connectivity projects are strengthening market growth while supporting the region’s shift toward advanced, resilient communication networks.

Germany Fiber Optic Preform Market Insights:

Germany is dominating the Europe Fiber Optic Preform market, supported by strong telecom expansion, rapid fiber-to-the-home adoption, and significant investments in high-speed broadband and 5G infrastructure, strengthening its leadership across regional optical fiber development.

Latin America Fiber Optic Preform Market Insights:

The Latin America Fiber Optic Preform market is steadily expanding, driven by growing broadband penetration, increasing investments in fiber network upgrades, and rising demand for reliable connectivity. Countries like Brazil, Mexico, and Chile are accelerating digital infrastructure projects, boosting adoption across telecom, enterprise networks, and emerging smart city initiatives throughout the region.

Brazil Fiber Optic Preform Market Insights:

Brazil is dominating the Latin America Fiber Optic Preform market, supported by rapid fiber network expansion, increasing demand for high-speed broadband, and strong investments in telecom infrastructure. Its growing digital ecosystem and nationwide connectivity initiatives further reinforce its leadership in the region.

Middle East & Africa Fiber Optic Preform Market Insights:

The Middle East and Africa Fiber Optic Preform market is witnessing moderate growth, driven by rising investments in broadband expansion, growing adoption of fiber networks, and national digital transformation programs. Increasing demand for high-speed connectivity across telecom, enterprise, and smart city projects is gradually strengthening the region’s market presence and development.

Saudi Arabia Fiber Optic Preform Market Insights:

Saudi Arabia is dominating the Middle East and Africa Fiber Optic Preform market, driven by large-scale fiber network expansion, accelerated 5G deployment, and strong government-led digital transformation initiatives that continue to boost high-speed connectivity across the country.

Fiber Optic Preform Market Competitive Landscape:

Corning Incorporated, established in 1851, is a global leader in specialty glass, ceramics, and optical communications, providing innovative fiber-optic solutions, display technologies, and advanced materials for multiple industries.

-

In Aug 2024, Corning and Lumen Technologies partnered to supply next-generation AI-ready fiber-optic cables, reserving 10% of Corning’s global fiber capacity to more than double Lumen’s U.S. intercity network miles and support high-bandwidth data center demands.

Sterlite Technologies Limited (STL), established in 2000, is a global leader in optical fiber, cables, and connectivity solutions, providing advanced high-density, bend-insensitive fiber-optic products for telecom, data centers, and hyperscalers, with manufacturing facilities across North America, Europe, and Asia, delivering scalable and next-generation digital infrastructure solutions.

-

In Sept 2025, Sterlite Technologies (STL) launched its Celesta IBR Cable, the world’s slimmest optical fiber packing 864 fibers into just 11.7 mm, delivering ultra-high-density, bend-insensitive performance for data centers and hyperscalers with rapid installation and global deployment capabilities.

Fiber Optic Preform Market Key Players:

-

Corning Incorporated

-

Optical Cable Corporation

-

Sterlite Technologies Limited

-

OFS Fitel, LLC

-

Prysmian Group

-

AFL

-

Furukawa Electric Co., Ltd.

-

Sumitomo Electric Industries, Ltd.

-

Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC)

-

HENGTONG GROUP CO., LTD

-

Fujikura Ltd.

-

Shin-Etsu Chemical Co., Ltd.

-

Jiangsu Zhongtian Technology Co., Ltd.

-

Nexans S.A.

-

Finolex Cables Ltd.

-

CommScope, Inc.

-

Hitachi Cable, Ltd.

-

LS Cable & System Ltd.

-

Belden Inc.

-

FiberHome Telecommunication Technologies Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.50 Billion |

| Market Size by 2033 | USD 37.50 Billion |

| CAGR | CAGR of 20.39% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Process (OVD, VAD, PCVD and MCVD) • By Product Type (Single-Mode, Multi-Mode and Plastic Optical Fiber) • By End User (Telecom, Oil & Gas, Military & Aerospace, BFSI, Medical, Railway and Others) • By Technology (Fluorine-Doped Silica, Germanium-Doped Silica, Phosphorus-Doped Silica and Pure Silica) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Key players in the fiber optic preform market include Corning Incorporated, Optical Cable Corporation, Sterlite Technologies Limited, OFS Fitel LLC, Prysmian Group, AFL, Furukawa Electric Co. Ltd., Sumitomo Electric Industries Ltd., Yangtze Optical Fibre and Cable (YOFC), HENGTONG GROUP CO. LTD, Fujikura Ltd., Shin-Etsu Chemical Co. Ltd., Jiangsu Zhongtian Technology Co. Ltd., Nexans S.A., Finolex Cables Ltd., CommScope Inc., Hitachi Cable Ltd., LS Cable & System Ltd., Belden Inc., and FiberHome Telecommunication Technologies Co. Ltd. |