Forensic Technology Market Report Scope & Overview:

Get more information on Forensic Technology Market - Request Free Sample Report

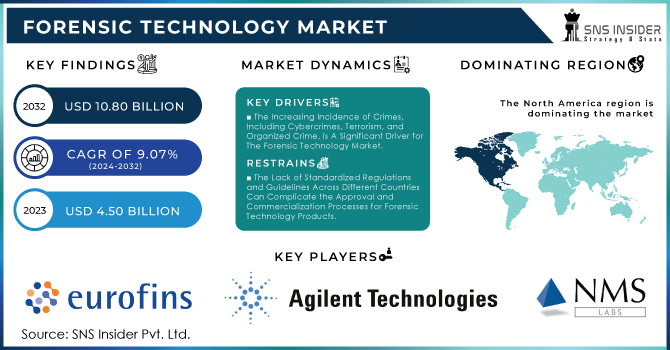

The Forensic Technology Market Size was valued at USD 4.50 Billion in 2023, and is expected to reach USD 10.80 Billion by 2032, and grow at a CAGR of 9.07% over the forecast period 2024-2032.

Growing instances of crime including cybercrimes, terrorism, and organized crime a major driver for the forensic technology market. Cybercrime, for instance, has surged to over USD 6.9 billion just in 2021 across reported losses by the Federal Bureau of Investigation (FBI), a major increase from prior years. Our increasing vulnerability to ransomware and phishing scams necessitates more specialized digital forensic tools for investigation and mitigation. Mass shootings are on the rise, and over 60,000 terrorist incidents have taken place worldwide in recent years according to Global Terrorism Index data. These narratives illustrate the potential for using next-generation forensic technologies to deeply understand, and effectively counteract terrorist threats.

Organized crime groups are increasingly using technology to facilitate their operations, according to the United Nations Office on Drugs and Crime (UNODC). Enterprises need to employ digital forensics and surveillance technologies to trace cybercriminal networks and break them down. As these types of crime change and get more advanced, the need for law enforcement agencies and forensic professionals to utilize top-notch technologies that can help them deal effectively with such threats remains paramount. This increased necessity of sophisticated forensic solutions powers the growth in the market for forensic technology.

MARKET DYNAMICS:

KEY DRIVERS:

-

The Increasing Incidence of Crimes, Including Cybercrimes, Terrorism, and Organized Crime, is A Significant Driver for The Forensic Technology Market.

-

The Expanding Applications of Forensic Technology Across Various Fields, Including Environmental Forensics, Automotive Forensics, And Healthcare, are Contributing to Market Growth.

RESTRAINTS:

-

The Lack of Standardized Regulations and Guidelines Across Different Countries Can Complicate the Approval and Commercialization Processes for Forensic Technology Products.

-

Stringent Regulatory Requirements and Privacy Laws, Such as GDPR In Europe and HIPAA In the United States, Can Restrict the Use of Certain Technologies or Methodologies, Complicating the Adoption and Integration Process.

OPPORTUNITY:

-

Continuous Advancements in Technology, Including Artificial Intelligence, Machine Learning, And Big Data Analytics, Are Creating New Opportunities for The Forensic Technology Market.

- Government Support in The Form of Funding, Grants, And Initiatives Aimed at Enhancing Forensic Capabilities is a Major Driver of Market Growth.

KEY MARKET SEGMENTATION:

By Type

The highest share in 2023 was owed to the capillary electrophoresis segment, which held up a value of about 33%, due to its advantages compared with other techniques. The techniques offer advantages such as reduced risk of cross-contamination, high-speed analysis, low sample consumption, and online detection capability among others integrated to realize advanced resolution and user-friendly design. The second also helps to estimate and give fast profiling of anionic components discovered in explosives, toxins, etc.

Though gel electrophoresis is not widely employed in forensic sciences, capillary electrophoresis finds a wide application because of its ability to micro-sample and it requires low sample preparation and easy detection. Due to its increased capability and sensitivity of DNA-based paternity testing as well as human identification in forensic situations with degraded biological samples. It also helps in the minimization of bias & errors and the generation of whole human genome data. This is anticipated to boost the NGS penetration and many companies are developing advanced, low-cost benchtop systems. An example in forensics: Verogen introduced a workflow ForenSeq MainstAY Kit that permits high-throughput next-generation sequencing (NGS) to be viable for the forensic laboratory, enabling support of volume case work sexual assault cases starting from May 2021.

By Service

DNA profiling held the largest market share of 45% in 2023. DNA profiling has the largest market share due to a variety of applications in disaster victim identification, paternity testing, forensic investigation, and blood fluid analysis. Furthermore, the surge in spending on R&D and the rising number of DNA databases is anticipated to propel its growth. In December 2020 NIJ awarded USD 17 million to fund 36 forensic science R&D projects aiming at improving the accuracy speed and reliability of the analysis.

Among the technologies, the forensic technology market is largely conquered by chemical analysis and holds almost 30% of the total share in these forensics. In terms of the growth rate forecast period, an impressive trend shows that this segment will grow at a CAGR above than last few years tuned to ~8. A large number of applications such as fingerprinting, bloodstain pattern analysis, and alcohol testing, etc. is expected to propel the segment growth during this period due to a huge potential in chemical forensic sciences including serology, fire debris analysis; trace evidence & toxicology studies polls. Additionally, higher adoption of chemical analysis by forensic experts in drug abuse cases is also propelling the growth of the segment. For example, if a patrol vehicle or police squad car notices alcohol intoxication THEN they will find out through a Breathalyzer.

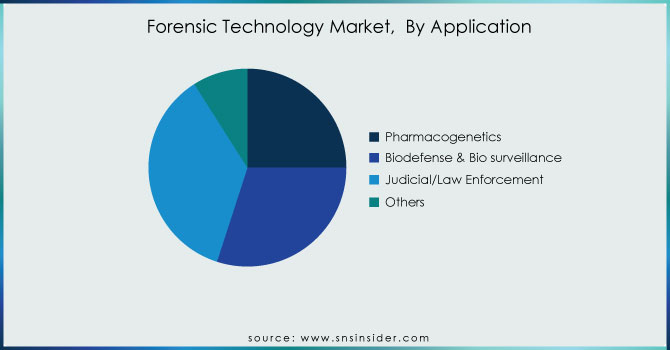

By Application

Of these, the judicial/law enforcement segment dominated in 2023 with a share of 36%. This is attributed to rising initiatives by government authorities across regions, for the production of DNA databases. This led to the immediate creation of a national DNA database to aid forensic evidence and its wide range of uses related to justice. In the US such technique used is known as forensics) was initiated by the FBI Criminal Justice System when Congress passed its version of criminal activities (Veronica Tucson_case). Likewise, a myriad of other tools that help lab techs obtain information from DNA samples more cheaply and quickly are the easy flow for these rising judicial uses. Such quick turnarounds are also possible in the laboratory - by using more sophisticated methods, DNA profiles can be produced from swabs within 90 minutes.

By pharmacogenetics, the market is segregated into diagnostics and treatment. The growing need for solving crimes and decreasing the number of pending cases is expected to propel growth in the market. The study is carried out by studying the bones, teeth, and other tissues of this age-old corpse in a living dead man at the root level of the crime scene available to them. Additionally, the development of technologically advanced and innovative products along with several symposiums & conferences organized to raise awareness about the utilization of these technologies in day-to-day DNA analysis are slated to catapult the market growth over the forecast period.

Get Customized Report as per your Business Requirement - Request For Customized Report

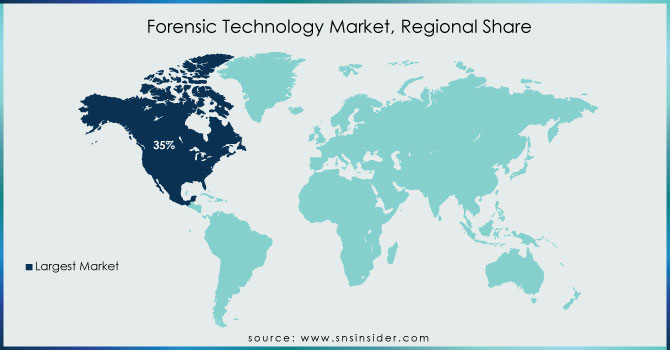

REGIONAL ANALYSIS:

In 2023, North America held the largest market share of 35% of the global forensic technologies and services as a result of rising criminal cases that led to a rise in the number of forensics analyses. In addition to other industries such as healthcare, law enforcement agencies, and private organizations are promoting the implementation of forensic services. Moreover, increasing progress in advanced forensic techniques and healthcare infrastructure is further anticipated to propel regional growth of the market for forensic analysis performed.

KEY PLAYERS:

The key market players include Eurofins Medigenomix GmbH, Agilent Technologies, NMS Labs, Thermo Fisher Scientific, Inc., Forensic Fluids Laboratories, Forensic Pathways, SPEX Forensics, LGC Forensics, Pyramidal Technologies Ltd, GE Healthcare & other players.

RECENT DEVELOPMENTS

-

Thermo Fisher Scientific also acquired Mesa Biotech in 2021, as a developer of point-of-care diagnostic tests. Molecular diagnostics and expand the forensic technology market by increasing its share in global markets

-

In 2021, Agilent Technologies released its new software solution called Agilent Forensic Toxicology Advisor, which has been introduced to get rid of the complexities in forensic toxicology analysis. These improvements are anticipated to tremendously escalate lab efficiency and precision, further solidifying Agilent's representation in the worldwide forensic tech industry.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 4.50 Billion |

|

Market Size by 2032 |

US$ 10.80 Billion |

|

CAGR |

CAGR of 9.07% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Polymerase Chain Reaction (PCR), Capillary Electrophoresis, Next Generation Sequencing (NGS), Rapid DNA Analysis, Automated Liquid Handling Technology, Microarrays & others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Eurofins Medigenomix GmbH, Agilent Technologies, NMS Labs, Thermo Fisher Scientific, Inc., Forensic Fluids Laboratories, Forensic Pathways, SPEX Forensics, LGC Forensics, Pyramidal Technologies Ltd, GE Healthcare & other players. |

|

Key Drivers |

•The Increasing Incidence of Crimes, Including Cybercrimes, Terrorism, and Organized Crime, is A Significant Driver for The Forensic Technology Market. |

|

RESTRAINTS |

•The Lack of Standardized Regulations and Guidelines Across Different Countries Can Complicate the Approval and Commercialization Processes for Forensic Technology Products. |