Glycerin Market Report Scope & Overview:

The Glycerin Market size is valued at USD 4.00 Billion in 2025E and is projected to reach USD 6.46 Billion by 2033, growing at a CAGR of 6.24% during 2026-2033.

The Glycerin Market analysis highlights the demand through pharmaceuticals, personal care, food and industrial applications. Growing demand for natural and sustainable products is driving the uptake of vegetable, and by-product glycerin. Increasing applications in cosmetic and health care are boosting the market penetration.

Glycerin was used in 75% of global moisturizers and cleansers in 2024, with natural formulations driving a 12% annual increase in vegetable-based glycerin demand

Market Size and Forecast:

-

Market Size in 2025E: USD 4.00 Billion

-

Market Size by 2033: USD 6.46 Billion

-

CAGR: 6.24% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Glycerin Market - Request Free Sample Report

Glycerin Market Trends

-

Rising demand for natural or bio-based glycerin is leading to adoption of sustainable production processes across pharmaceuticals, cosmetics and food industries worldwide.

-

Rising penetration of personal care & skincare sector will drive the global USP-grade high-purity glycerin market demand.

-

Growing consumption of glycerin in humectant and solvent un food & beverage products is driving the product demand on industry wide scale.

-

New developments are occurring in the field of extraction technology and refining processes which increases glycerin quality, as well as efficiency and economy to industrial purposes.

-

Increasing environmental awareness and regulations are driving the use of biobased glycerin, growth in production and recycling in key markets.

The U.S. Glycerin Market size is valued at USD 0.77 Billion in 2025E and is projected to reach USD 1.29 Billion by 2033, growing at a CAGR of 6.60% during 2026-2033. Glycerin Market growth is driven by growing personal care, pharmaceutical and food industries. Favourable market for USP and bio-based glycerin boosts technology in production. And already developed supply chains in the country assure that manufacturers have steady access.

Glycerin Market Growth Drivers:

-

Rising Demand for Natural and Bio-Based Glycerin Across Multiple End-Use Industries

Increasing need for natural and bio-based glycerin in pharmaceuticals, cosmetics, personal care, and food applications. Growth in the consumption of vegetable and by-product glycerin is driven by consumer demand for environmentally friendly, sustainable, and plant-based goods. With technological developments in the extraction as well as the purification processes, better quality glycerin is made available for multiple applications. Moreover, growth in applications such as skin care, food additives, and industrial products is also providing an impetus to the market growth across the world.

Ion-exchange and multi-stage distillation now produce USP/EP-grade glycerin at 99.7% purity from crude biodiesel glycerin, enabling use in injectables and high-end skincare

Glycerin Market Restraints:

-

Fluctuating Raw Material Prices and Regulatory Challenges Limiting Market Expansion

Raw material price fluctuation such as consumption of vegetable oils and animal fats increasing glycerin processing cost, which in turn is expected to limit global glycerin market growth. Such regulations and high-quality requirements for pharmaceutical, food or personal care applications can be a burden to comply with for the manufacturers. With the limited supply of high-purity glycerin and reliance on feedstock from certain regions, supply chains can be affected. In addition, substitute products in respect of glycerin that are obtained synthetically and the price volatility of primary markets may inhibit overall market growth and profitability.

Glycerin Market Opportunities:

-

Growing Applications in Pharmaceuticals, Personal Care, and Food Industries Worldwide

The glycerin market offers substantial opportunities, given its growing applications in food, cosmetics and personal care, pharmaceuticals, etc. Awareness among consumers related to natural ingredients and sustainable substitutes is contributing towards the demand for high purity & bio-based glycerin. Advancements in glycerin formulations for skincare, beverage and medical applications provide new opportunities. In addition, the Asia-Pacific, Latin American and Middle Eastern developing markets are unexplored territories for glycerin producers. These opportunities could be further captured through strategic partnership, acquisition and investment to implement green production process.

In 2025, USP/EP-grade glycerin demand grew by 16%, driven by pharmaceutical injectables and premium skincare requiring ≥99.5% purity, with global compliance driving quality upgrades.

Glycerin Market Segment Analysis

-

By Source, LDI led the market with a 55.24% share in 2025, while Synthetic Glycerin registered the fastest growth.

-

By Application, Pharmaceuticals & Personal Care dominated with 45.39% in 2025, while Industrial Applications grew the fastest.

-

By Purity, USP Grade led with 51.28% in 2025, while Industrial Grade recorded the fastest growth.

-

By Form, Liquid held 60.75% in 2025, while Powder showed the fastest growth.

By Source, Vegetable Glycerin Leads Market While Synthetic Glycerin Registers Fastest Growth

Vegetable glycerin is the largest segment as it has strong penetration in food, pharmaceutical and personal care industries pushing its popularity. The cost-effective production methods offered by synthetic glycerin is providing it with an edge over its counterpart. While synthetic glycerin grows at the fastest pace with increasing industrial applications. Increasing preference for natural and organic ingredients is fueling vegetable glycerin demand. Global production of vegetable glycerin reached approximately 1.2 million tons, with consumption closely matching production trends, highlighting robust demand across end-use sectors.

By Application, Pharmaceuticals & Personal Care Dominate While Industrial Applications Shows Rapid Growth

pharmaceuticals & personal care accounted for dominating market share, in 2025 owing to wide application in skincare, cosmetics and medicinal preparation. Industrial applications are rapidly expanding in biofuels, resins and lubricants. This move towards multi-faceted, safe and natural ingredients will continue to fuel the use of glycerin in other industry verticals as well. Global glycerin consumption for pharmaceuticals and personal care reached around 950,000 tons, representing the largest application segment and indicating strong market reliance on these industries.

By Purity, USP Grade Lead While Industrial Grade Registers Fastest Growth

USP-grade glycerin dominated the industry in 2025 attributable to the fire demand from pharmaceutical, personal care and food industries. While Industrial grade glycerin will witness the highest growth on account of rising application scope in chemical, biofuel, industrial manufacturing. There remains a demand for high quality, consistent glycerin keeping USP grade in the lead and industrial grade increase its presence in other markets with more economical pricing. Global USP-grade glycerin production totaled approximately 780,000 tons, closely reflecting consumption, with industrial-grade production at around 460,000 tons, highlighting its rapid adoption.

By Form, Liquid Lead While Powder Grow Fastest

Liquid glycerin held the largest market share in 2025, application in food, personal care and pharmaceuticals industries is another factor driving the product demand. Meanwhile, Powder form of glycerin is the fastest growing over consumption as it provides ease handling and formulation stability. Innovations in crystalline and gel formulations are broadening still more the opportunities in the market. Global production of liquid glycerin reached roughly 1.1 million tons, with consumption aligning closely, whereas powder and crystalline forms accounted for approximately 350,000 tons, showing accelerating adoption in industrial and cosmetic applications.

Glycerin Market Regional Analysis:

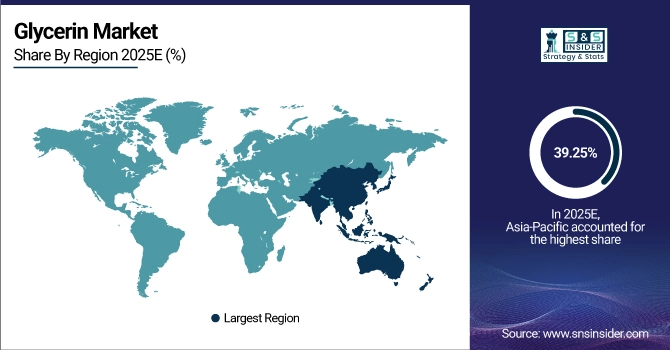

Asia-pacific Glycerin Market Insights

In 2025 Asia-Pacific dominated the Glycerin Market and accounted for 39.25% of revenue share, this leadership is due to rising pharmaceutical, personal care, and food industries. Increasing need for natural ingredients and vegetable glycerin is expected to drive market growth. Progressive industrialization and rising disposable income spur consumption in countries such as China, India and Japan. Advances in technology help to maximize supply by improving extraction and production. Asia-Pacific produced approximately 1.1 million tons of glycerin, with consumption closely following production trends, reflecting strong regional demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Glycerin Market Insights

China is dominate the market in APAC region due to massive production of vegetable oils and increasing personal care & pharmaceutical industries. Rising use of glycerin in industries drives the growth. biodiesel-related glycerin production recently technological advances increase supplies. In 2025, China produced around 450,000 tons of glycerin, and domestic consumption matched this output, highlighting its role as the largest producer-consumer in the region.

North America Glycerin Market Insights

North America is expected to witness the fastest growth in the Glycerin Market over 2026-2033, with a projected CAGR of 6.94% due to Advanced chemical processing and large-scale use of glycerin in America has made the country the regional leader. Growing use in the biodiesel and industrial sectors drives demand for synthetic glycerin. Rising concerns for sustainability drive market towards adopting natural and USP based glycerin. In 2025, North America produced roughly 520,000 tons of glycerin, with consumption tracking production closely, underscoring steady regional demand.

U.S. Glycerin Market Insights

In the U.S. demand from pharmaceuticals, personal care and food sectors largely accounts for glycerin market share with increasing industrial uses. In both the production and extraction technology forges ahead, enabling the supply to remain stable. In 2025, the U.S. produced around 280,000 tons of glycerin, with consumption closely following, highlighting strong domestic demand.

Europe Glycerin Market Insights

Europe emerged as a promising region in the Glycerin Market, due to pharmaceuticals, cosmetics and industrial sectors are strong so glycerin market is also booming. Growing the utilization of bio-based glycerin in personal care products is further driving demand. Adoption is spurred by regulation for sustainable and circular economy ingredients. Germany and France are very significant for regional growth. In 2025, Europe produced approximately 620,000 tons of glycerin, with consumption nearly equal, reflecting stable demand across industrial and personal care applications.

Germany Glycerin Market Insights

Germany is one of the most reputed markets in Europe, and has grown rapidly in the field of Pharmaceutical, personal care as well industrial sector. Sustainability programs and developed manufacturing technologies drive glycerin use. In 2025, Germany produced around 150,000 tons of glycerin, with domestic consumption closely matching production levels.

Latin America (LATAM) and Middle East & Africa (MEA) Glycerin Market Insights

The Glycerin Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the significant player and growing preference for natural and vegetable glycerin primarily due to the sustainable trend. Extraction technology advancements will increase the effectiveness of supplies. In 2025, LATAM & MEA produced approximately 430,000 tons of glycerin, with consumption closely following production, highlighting emerging regional demand.

Glycerin Market Competitive Landscape:

KLK OLEO is a leading producer of Glycerin from natural renewable supply chain derived from Agri commodities. Its offerings include premium food, cosmetic glycerin’s; and a technical-grade product for industrial applications. Strategic expansions in Asia, Europe solidify global market reach. Ongoing research and development improve the efficiency of extraction, and the quality of products. In 2025, KLK OLEO produced around 85,000 tons of glycerin, supporting strong regional and global consumption.

-

In October 2024, KLK OLEO launched a new line of pharmaceutical- and food-grade Glycerin under its “Olebased PureGlyc” brand, derived from sustainable vegetable oils. This innovation meets consumer and regulatory demand for traceable, non-GMO, RSPO-certified inputs, reinforcing KLK’s commitment to ethical sourcing and high-purity standards.

Emery Oleochemicals specializes in bio-based glycerin for personal care, pharmaceutical and industrial applications. High quality product produced with sustainable production methods and advanced purification technologies. With the company’s excellent distribution network, you will get your products to market quickly around the world. Investments in Southeast Asia and expansion through North America to increase production capacity. In 2025, Emery Oleochemicals generated approximately 78,000 tons of glycerin, contributing significantly to regional supply.

-

In February 2025, Emery Oleochemicals expanded technical-grade Glycerin production at its Cincinnati, Ohio facility to meet rising industrial demand. The expansion enhances North American supply reliability and strengthens market position in resins, antifreeze, and lubricant applications, where Glycerin acts as a humectant and solvent.

Godrej Industries manufactures high quality vegetable glycerin to pharma, personal care and food industries with a sustainable and natural bend. Investments in green production technologies have an impact through efficiency and CO 2 -footprint. Its robust domestic and international sales networks ensure steady availability. R&D efforts increase purity of end products and widen applications. In 2025, Godrej Industries produced nearly 60,000 tons of glycerin, driving growth in emerging markets.

-

In May 2024, Godrej Industries expanded Glycerin production capacity in India, targeting domestic and Southeast Asian markets. The refined Glycerin serves personal care, oral hygiene, and food applications, capturing rising demand for bio-based, halal-certified ingredients and strengthening Godrej’s regional value-added oleochemical portfolio.

Glycerin Market Key Players:

Some of the Glycerin Market Companies are:

-

P&G Chemicals

-

KLK OLEO

-

Emery Oleochemicals

-

Cargill Incorporated

-

Godrej Industries

-

IOI Oleochemicals

-

Wilmar International

-

Aemetis Inc.

-

Repsol S.A.

-

Avril Group

-

Vance Group Ltd.

-

Musim Mas Holdings

-

Croda International Plc

-

Vantage Specialty Chemicals Inc.

-

Sakamoto Yakuhin Kogyo Co. Ltd.

-

Archer Daniels Midland Company

-

BASF SE

-

DowDuPont

-

Lanxess

-

Evonik Industries

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4 Billion |

| Market Size by 2033 | USD 6.46 Billion |

| CAGR | CAGR of 6.24% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Vegetable Glycerin, Animal Glycerin, Synthetic Glycerin, By-Product Glycerin, Others) • By Application (Pharmaceuticals & Personal Care, Food & Beverages, Cosmetics, Industrial Applications, Others) • By Purity (USP Grade, Industrial Grade, Technical Grade, Food Grade, Others) • By Form (Liquid, Powder, Crystalline, Gel, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | P&G Chemicals, KLK OLEO, Emery Oleochemicals, Cargill Incorporated, Godrej Industries, IOI Oleochemicals, Wilmar International, Aemetis Inc., Repsol S.A., Avril Group, Vance Group Ltd., Musim Mas Holdings, Croda International Plc, Vantage Specialty Chemicals Inc., Sakamoto Yakuhin Kogyo Co. Ltd., Archer Daniels Midland Company, BASF SE, DowDuPont, Lanxess, Evonik Industries |