Healthcare Creditor Insurance Market Report Scope & Overview:

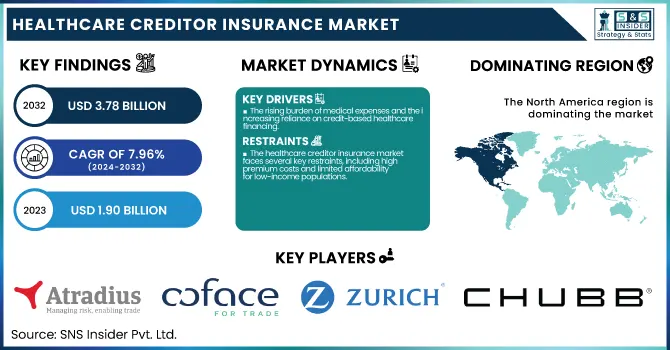

The Healthcare Creditor Insurance Market was valued at USD 1.90 billion in 2023 and is expected to reach USD 3.78 billion by 2032, growing at a CAGR of 7.96% over the forecast period of 2024-2032.

To Get more information on Healthcare Creditor Insurance Market - Request Free Sample Report

This study identifies policy coverage and adoption trends fueled by rising healthcare costs and growing demand for financial protection against medical costs. The research analyzes premium trends and pricing analysis by region, based on economic conditions, regulatory policies, and competition among insurers. Moreover, it examines default risk and insurance use trends with variables like inflation, levels of patient debts, and repayment abilities taking center stage in determining the market landscape. The report examines regulatory and compliance trends affecting insurers with a particular emphasis on changing government policies, risk mitigation mechanisms, and healthcare financing regulation standardization. Technological innovation in policy administration and claims handling is also discussed, with digital technologies, automation, and AI-based solutions improving efficiency and fraud prevention in the sector.

The U.S. Healthcare Creditor Insurance Market valued at USD 0.62 billion in 2023 and is expected to reach to USD 1.12 billion by 2032 at a CAGR of 6.88% over the forecast period of 2024-2032. In the United States, the health creditor insurance sector is growing as a result of rising medical debt issues, heightened regulatory attention on credit-based insurance products, and heightened investment in fintech-based solutions in streamlining claim payments and risk evaluation.

Market Dynamics

Drivers

-

The rising burden of medical expenses and the increasing reliance on credit-based healthcare financing.

More than 40% of the healthcare costs worldwide are paid out-of-pocket, and hence people seek financial security by opting for creditor insurance to stay away from financial stress. The rise in consumer awareness regarding protection from medical debt has also contributed to the increased adoption of policies. The rising expense of medical treatments, particularly of chronic ailments like cancer and cardiovascular diseases, further drives the market, as patients choose financing products with bundled insurance coverage.

The growth of digital underwriting and artificial intelligence risk assessment has improved the availability of such insurance policies, with faster approvals and customized premium pricing. Further, insurers are also working together with banks, financial institutions, and healthcare providers to provide bundled insurance along with healthcare loans, which becomes an easy choice for borrowers. Support from the regulators, in the form of mandatory credit insurance inclusion in some loan deals, is also boosting market expansion. For example, banks in most nations mandate insurance cover for expensive healthcare loans to ensure against default risk. With deepening telehealth and digital financing platforms of healthcare, demand for creditor insurance is likely to stay robust, thereby propelling the market further.

Restraints

-

The healthcare creditor insurance market faces several key restraints, including high premium costs and limited affordability for low-income populations.

Most consumers see creditor insurance as another expense, especially in countries where healthcare costs are already expensive. The non-standardization of policy terms and benefits also raises confusion, causing consumers to compare and choose the wrong coverage. Another significant restriction is the extensive claim rejection ratio. Insurers tend to adopt stringent eligibility terms, and several claims are rejected because of improper documentation, previous medical conditions, or technical grounds for loan agreement breaches. This discourages reliance on the system and prevents the adoption of new policies. Furthermore, regulatory differences within regions make it challenging for insurers to expand globally since they would have to tackle multiple compliance protocols. Consumer distrust of insurers' honesty and fairness in handling claims also limits market expansion. Most policyholders find insurance conditions to be convoluted, thus showing unwillingness to buy policies. Insufficient knowledge of policy benefits, particularly in developing economies, further restricts market penetration, inhibiting most prospective customers from acquiring healthcare creditor insurance.

Opportunities

-

The growing digital transformation in the insurance industry presents a significant opportunity for market expansion.

AI-powered risk assessment models and blockchain-based claims processing are enhancing efficiency, combating fraud, and building consumer confidence. Insurers using these technologies are getting a competitive advantage through quicker settlement of claims and more bespoke premium structures. A new opportunity exists in the growth of microinsurance and low-cost coverage designed for underserved markets. Low-income groups cannot afford conventional creditor insurance, but insurers are creating more affordable products with flexible payment schemes. For example, on-demand insurance schemes, whereby policies are activated only if a loan is borrowed, are picking up speed. Collaborations between healthcare providers and insurers also provide growth opportunities. By incorporating creditor insurance into hospital financing plans, insurers can capture a larger customer base. Additionally, the growth of embedded insurance in digital lending platforms enables consumers to have access to policies easily at the time of financing. The growing demand for subscription healthcare services is another potential area of expansion since insurers can package coverage into membership schemes. As digital financial inclusion continues to advance across the world, new markets are opening up, allowing insurers to serve a broader spectrum of policyholders.

Challenges

-

One of the biggest challenges in the healthcare creditor insurance market is fraud and misuse of insurance policies.

Fraudulent claims lose the global insurance sector more than USD 80 billion a year, and they increase the premium rates and make claim verification procedures stricter. This, in turn, causes claim settlement delays and creates a negative public image of the industry. The other significant challenge is the integration of creditor insurance into changing healthcare financing models. With the emergence of Buy Now, Pay Later (BNPL) healthcare, traditional insurance models are being challenged. Most consumers prefer flexible, short-term financing that does not always fit long-term insurance coverage models. Insurers need to accommodate these changing trends to stay competitive. In addition, data security issues are a challenge, as digitalization raises the threat of cyberattacks and breaches of sensitive financial information. Most consumers are reluctant to provide their health and financial information online, which can hinder the adoption of digital insurance platforms. Lastly, customer retention is also a challenge, as policyholders tend to change providers because of price competition, further raising acquisition costs for insurers. Overcoming these challenges calls for strategic investments in fraud prevention, policy innovation, and cybersecurity improvements to establish consumer confidence and market stability.

Segmentation Analysis

By Age Group

In 2023, the adult segment dominated the healthcare creditor insurance sector with a strong 82.3% market share of the total revenue. This is due to the large number of working-aged individuals obtaining healthcare loans and applying for creditor insurance for financial security. Adults form the biggest segment of covered people because they are more likely to incur medical bills, have work-associated insurance products, and have easier access to financing products.

The pediatric segment is anticipated to be the most rapidly growing segment during the forecast period. The surging need for pediatric healthcare financing, growing awareness regarding child-specific health coverage, and increasing number of families choosing financial protection in medical emergencies are the major drivers of growth in this sector. Insurers are also launching niche policies catering to pediatric healthcare requirements, contributing further to market growth in this segment.

By Distribution Channels

The brokers and individual agents segment became the leading distribution channel in 2023, with the majority of overall revenue. Their robust market position is influenced by customized customer service, large client networks, and the ability to provide customized insurance products. Brokers and agents are essential in walking consumers through intricate insurance language, hence, they are the preferred option for policy distribution.

Conversely, the bankers segment is anticipated to be the most rapidly growing distribution channel in the next few years. The growing overlap of insurance policies with banking products, rising consumer demand for packaged financial products, and mutually beneficial agreements between insurers and banks are propelling this growth. As banks sell hassle-free policy enrollment along with loan products, this segment is likely to grow rapidly.

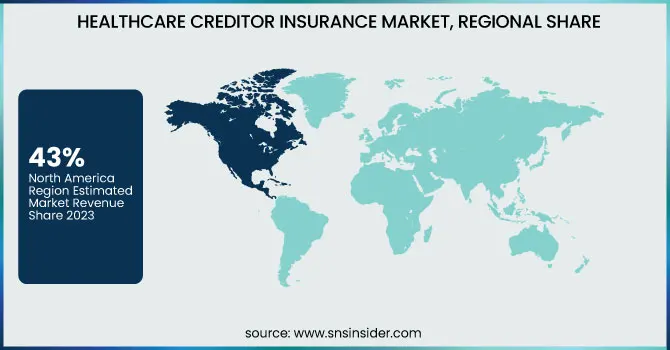

Regional Analysis

North America led the market with around 43% revenue share in 2023, fueled by high healthcare spending and widespread credit-based medical financing. The U.S., with its more than USD 4.5 trillion healthcare spending, experiences a firm uptake of creditor insurance as consumers chase financial protection from increasing medical bills. Existence of top insurance companies, as well as regulatory schemes promoting loan protection policies, respectively, makes the market firm in this location.

Europe comes next with government-sponsored financing programs for healthcare and high rates of insurance penetration in nations such as Germany, the UK, and France. The demand for creditor insurance, however, is partially tempered through universal public health coverage. Contrarily, the Asia-Pacific market is the one with the greatest growth, as nations such as India, China, and South East Asian nations have seen rising adoption. This expansion is driven by escalating medical expenses, rising healthcare loans, and deepening financial inclusion. In India, the medical credit market is growing at more than 10% every year, which is creating higher demand for policies against loans. Also, digitization and InsurTech advancements are increasing accessibility, making APAC the most profitable market for future growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Atradius N.V.

-

Coface

-

Zurich Insurance Group

-

Chubb Limited

-

Tokio Marine HCC

-

Allianz

-

Securian Financial Group, Inc.

-

Euler Hermes Group (Allianz Trade)

-

AXA Credit & Lifestyle Protection

-

BNP Paribas Cardif

Recent Developments

-

In Feb 2025, Healthcare Funding Partners successfully secured a USD 180 million credit facility, with JP Morgan serving as the sole bookrunner and joint lead arranger. Citi also played a key role as the supporting joint lead arranger in this financing arrangement.

-

In Jan 2024, SaveIN launched healthcare services offering no-cost EMI plans for credit card holders. These EMI-based plans provide access to a range of services, including dermatology, elective surgeries, hair transplants, dental, ophthalmology, wellness, alternate therapies, and fertility treatments. The initiative aims to make healthcare more affordable in areas not typically covered by traditional insurance, which often involves high out-of-pocket costs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.90 billion |

| Market Size by 2032 | USD 3.78 billion |

| CAGR | CAGR of 7.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Age Group [Pediatric, Adult, Geriatric] • By Distribution Channels [Direct Sales, Brokers and Individual Agents, Bankers, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atradius N.V., Coface, Zurich Insurance Group, Chubb Limited, Tokio Marine HCC, Allianz, Securian Financial Group, Inc., Euler Hermes Group (Allianz Trade), AXA Credit & Lifestyle Protection, BNP Paribas Cardif. |