Healthcare Mobility Solutions Market Report Scope & Overview:

Get more information on Healthcare Mobility Solutions Market - Request Sample Report

The Healthcare Mobility Solutions Market Size was valued at USD 150.19 billion in 2023, and is expected to reach USD 1143.40 billion by 2032, and grow at a CAGR of 25.3% over the forecast period 2024-2032.

The healthcare mobility solutions market is rapidly expanding, driven by factors such as digitalization, the rise of smart devices, and increased awareness of healthcare benefits. Social media has played a crucial role in promoting healthcare engagement, while the growing need for point-of-care services and personalized medicine has further fueled demand for mobile solutions. The shift towards a patient-centered approach emphasizes accessible and convenient healthcare, which mobile solutions can effectively provide. As of April 2024, over 5 billion people worldwide were active social media users, representing nearly two-thirds of the global population. This trend is projected to continue, with the number of social media users expected to reach nearly 6 billion by 2027.

The aging population, particularly in developed countries, is driving demand for healthcare services. Mobile solutions can help address the challenges associated with aging, such as chronic disease management, independent living, and access to care. According to the United Nations, the global population aged 65 or over is expected to double between 2020 and 2050.

Recent initiatives like the Smile on Wheels mobile health unit and the Ayushman Bharat Digital Mission (ABDM) have demonstrated the potential of mobile healthcare in reaching underserved communities and providing digital health records. The increasing demand for high-quality healthcare, coupled with the widespread adoption of mHealth devices and smartphones, is driving market growth.

However, challenges such as safety and security concerns regarding patient health information and a shortage of skilled professionals in healthcare technology can hinder market expansion. Despite these obstacles, the healthcare mobility solutions market is expected to continue growing significantly in the coming years. Addressing issues related to security, privacy, and the availability of skilled professionals will be essential for ensuring sustained market growth and realizing the full potential of mobile healthcare.

In March 2024, Cerner Corporation launched a new mobile app for healthcare providers, designed to streamline workflows and improve patient care. In March 2024, McKesson Corporation announced a partnership with Amazon Web Services to develop cloud-based healthcare mobility solutions.

Governments worldwide are recognizing the potential of mobile healthcare solutions to improve healthcare delivery and reduce costs. Many countries have implemented policies and initiatives to promote the adoption of these technologies, such as funding research and development, developing interoperable standards, and incentivizing healthcare providers to use mobile solutions.

MARKET DYNAMICS

Drivers

-

Digitalization and Technological Advancements:

The increasing adoption of smartphones and other connected devices, coupled with advancements in mobile technology, has created a favorable environment for healthcare mobility solutions. These technologies enable remote patient monitoring, virtual consultations, and access to health information, enhancing the overall patient experience. For instance, the number of smartphone users worldwide is projected to reach 7.33 billion by 2027, up from 5.27 billion in 2023.

-

Rising Demand for Quality Healthcare:

The growing emphasis on quality healthcare delivery has led to a surge in demand for innovative solutions that improve patient outcomes and efficiency. Mobile applications and devices can play a crucial role in achieving these goals by providing personalized care, facilitating communication between healthcare providers and patients, and enabling remote monitoring of chronic conditions.

-

Increasing Prevalence of Chronic Diseases:

The global burden of chronic diseases, such as diabetes, heart disease, and respiratory illnesses, is on the rise. Mobile healthcare solutions offer effective tools for managing these conditions through remote monitoring, medication adherence, and patient education. A study published in The Lancet found that the global prevalence of diabetes increased from 4.7% in 1990 to 8.8% in 2019.

Restraints

-

Overcoming Barriers to Healthcare Mobility Solutions by Addressing Security, Interoperability, and Adoption Challenges

The widespread adoption of healthcare mobility solutions is hindered by several key challenges. Ensuring patient data security and compliance with regulations is crucial but can be complex and costly. Interoperability issues and the digital divide limit the reach of these solutions. Overcoming user resistance and addressing infrastructure requirements are also essential for successful implementation. These challenges necessitate collaborative efforts and strategic investments to fully realize the potential of healthcare mobility solutions.

KEY MARKET SEGMENTS:

By Product & Services Type

The mobile devices segment dominated the market in 2023 with a 35.6% share due to the increased use of smartphones and tablets, facilitated by widespread 3G and 4G network coverage.

Mobile applications have proven to be powerful tools in raising awareness about the causes, prevention, and treatment of chronic diseases. For instance, in 2022, the World Health Organization (WHO) introduced a new Quit Tobacco app. This mobile application aims to help individuals quit smoking by providing personalized support, tracking tools, and information about the benefits of quitting.

By Application

The enterprise solutions segment led the overall healthcare mobility solutions market in 2023 with a 46.8% share, driven by growing demand for secure and cost-effective business solutions. The increasing need for improved operational efficiency, optimized internal processes, and reduced operational costs is expected to fuel the demand for enterprise mobility solutions in the coming years.

Additionally, the benefits associated with these services, including meeting consumer demands, enhancing patient engagement, and ensuring secure information sharing, are anticipated to drive market growth in the near future.

By End-Use

The healthcare providers segment dominated the market in 2023 with a 37.9% share due to the widespread use of enterprise mobility solutions in hospitals for managing electronic health records, treating and assessing patients online, and providing medical education. The growing influence of social media is another significant factor contributing to the segment's growth.

Social media has become an essential part of modern life, evolving from a personal tool to a platform for serious discussions and business opportunities. While the healthcare industry faces regulatory constraints, the usefulness of social media has made a substantial impact on the contemporary healthcare landscape.

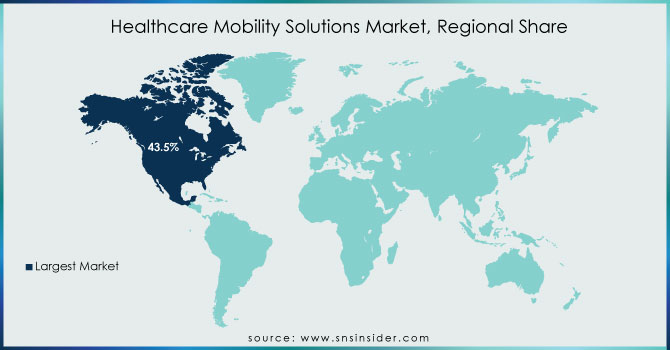

REGIONAL ANALYSIS

North America dominated the healthcare mobility solutions market in 2023 with a 43.5% share, driven by factors such as higher smartphone penetration, greater adoption of online services, and favorable government initiatives supporting mHealth applications. The region's growing geriatric population, coupled with increased product launches, mergers, and acquisitions, further contributes to market growth. For example, the acquisition of BioTelemetry Inc. by Philips in 2021 demonstrates the strategic investments being made in this sector.

Asia Pacific is expected to experience significant growth in the healthcare mobility solutions market, primarily due to rising awareness among end-users and the increasing adoption of mHealth apps by healthcare providers. The region's large population and growing middle class offer a promising market for these solutions.

Need any customization research on Healthcare Mobility Solutions Market - Enquiry Now

KEY PLAYERS:

The Major key players are as follows: McKesson Corporation, AT&T Inc., Cisco Systems, Inc., Hewlett-Packard Company, Air Strip Technologies, Inc., Omron Corporation, Apple Inc., International Business Machines Corporations, Oracle Corporation, Cerner Corporation and other players.

Recent Developments

-

April 2024:

-

Medtronic released an updated version of its diabetes management app, incorporating new features for personalized care and data tracking.

-

Philips introduced a new telehealth platform focused on remote patient monitoring and virtual consultations.

-

-

May 2024:

-

IBM Watson Health unveiled a new AI-powered mobile app for early detection of chronic diseases.

-

GE Healthcare partnered with Microsoft to develop a digital health platform leveraging Microsoft Azure cloud technology.

-

-

June 2024:

-

Allscripts acquired Netsmart Technologies, a leading provider of electronic health records and population health management solutions.

-

Epic Systems announced a significant expansion of its telehealth services, offering virtual consultations to patients across the United States.

-

-

July 2024:

-

Siemens Healthineers launched a new mobile app for radiology professionals, enabling remote image interpretation and analysis.

-

Verily Life Sciences partnered with Johnson & Johnson to develop a wearable device for continuous glucose monitoring.

-

-

August 2024:

-

Teladoc Health acquired Livongo Health, a leading provider of diabetes and chronic disease management solutions.

-

Qualcomm Technologies announced a new chipset designed specifically for healthcare applications, enabling advanced features in wearable devices and mobile health apps.

-

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 150.19 Billion |

| Market Size by 2032 | US$ 1143.40 Billion |

| CAGR | CAGR of 25.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Services type (Mobile Devices, Mobile Applications, Enterprise Mobility Platforms) • By Application (Enterprise Solutions, mHealth Applications) • By End-use (Payers, Providers, Patients) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | McKesson Corporation, AT&T Inc., Cisco Systems, Inc., Hewlett-Packard Company, Air Strip Technologies, Inc., Omron Corporation, Apple Inc., International Business Machines Corporations, Oracle Corporation, Cerner Corporation. |

| Key Drivers | • Digitalization and Technological Advancements • Rising Demand for Quality Healthcare • Increasing Prevalence of Chronic Diseases |

| RESTRAINTS | • Overcoming Barriers to Healthcare Mobility Solutions by Addressing Security, Interoperability, and Adoption Challenges |