Heterogeneous Integration Market Report Scope & Overview:

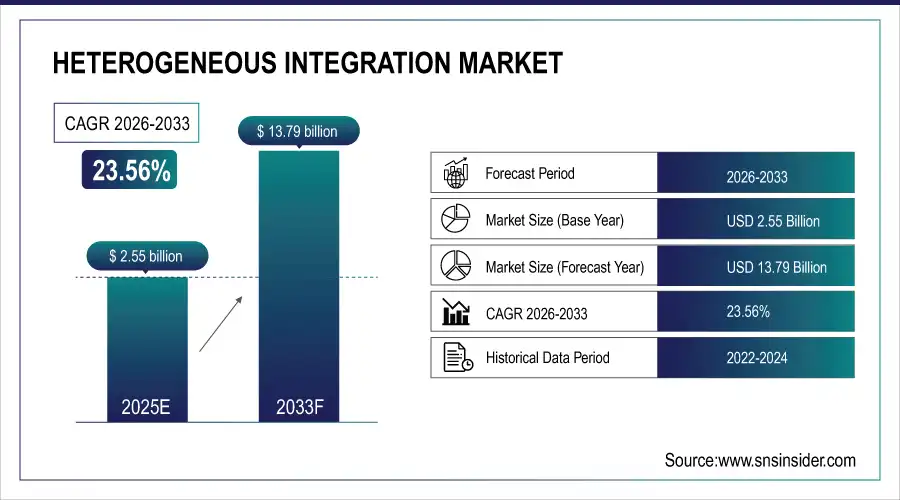

The Heterogeneous Integration Market size was valued at USD 2.55 Billion in 2025E and is projected to reach USD 13.79 Billion by 2033, growing at a CAGR of 23.56% during 2026-2033.

The Heterogeneous Integration Market is growing due to rising demand for compact, high-performance, and energy-efficient electronic systems across multiple sectors. Increasing adoption of advanced packaging technologies like 2.5D, 3D integration, and System-in-Package (SiP) enables higher functionality in smaller footprints. Growth in consumer electronics, 5G infrastructure, AI, HPC, automotive, and IoT applications drives the need for advanced interconnects and high-bandwidth memory. Additionally, regional investments in semiconductor manufacturing, R&D, and smart device proliferation further accelerate market expansion.

Market Size and Forecast:

-

Market Size in 2025E USD 2.55 Billion

-

Market Size by 2033 USD 13.79 Billion

-

CAGR of 23.56% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information On Heterogeneous Integration Market - Request Free Sample Report

Key Heterogeneous Integration Market Trends

-

Adoption of Advanced Packaging Technologies – Increasing use of 2.5D/3D integration, SiP, and FOWLP for compact, multi-functional designs.

-

Growth in High-Performance, Energy-Efficient Electronics – Rising demand across consumer electronics, telecom, automotive, healthcare, and industrial automation.

-

Expansion Driven by AI, 5G, Edge Computing, and IoT – Need for complex heterogeneous systems with higher efficiency and performance.

-

Opportunities in Emerging Regions – Asia Pacific presents growth potential due to semiconductor hubs, R&D investments, and government support.

-

Automotive and Miniaturization Trends – EVs, autonomous vehicles, and advanced driver-assistance systems driving specialized heterogeneous integration solutions.

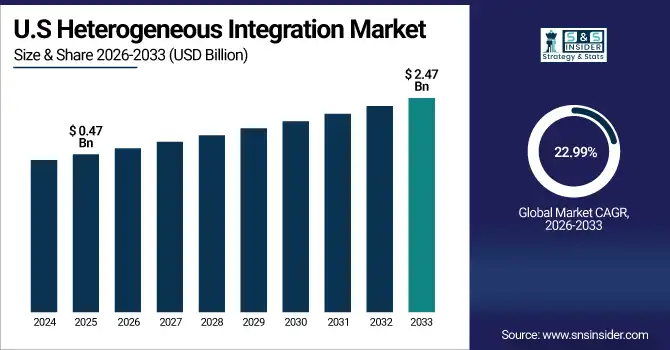

The U.S. Heterogeneous Integration Market size was valued at USD 0.47 Billion in 2025E and is projected to reach USD 2.47 Billion by 2033, growing at a CAGR of 22.99% during 2026-2033. The U.S. Heterogeneous Integration Market is growing due to increasing demand for advanced semiconductor packaging in AI, HPC, 5G, and defense applications. Strong R&D investments, government support for domestic chip manufacturing, and rising adoption of compact, high-performance electronics in consumer, automotive, and industrial sectors are driving market expansion.

Heterogeneous Integration Market Growth Drivers:

-

Rising Demand for Compact High-Performance Electronics Fuels Global Heterogeneous Integration Market Growth

The global heterogeneous integration market is primarily driven by the rising demand for high-performance, compact, and energy-efficient electronic systems across various industries. The rapid adoption of advanced packaging technologies such as 2.5D and 3D integration, System-in-Package (SiP), and Fan-Out Wafer-Level Packaging (FOWLP) enables designers to integrate multiple functionalities in smaller form factors while improving performance and reducing power consumption. Key growth sectors, including consumer electronics, telecommunications, automotive, healthcare, and industrial automation, are fueling demand for high-bandwidth memory, advanced processors, RF/analog components, and multi-chip modules. Additionally, the proliferation of AI, machine learning, 5G networks, edge computing, and IoT devices is creating a need for complex, heterogeneous systems that deliver higher efficiency and performance in constrained spaces, supporting robust market growth.

More than 180 million 2.5D/3D IC units shipped globally in 2023, reinforcing the shift toward advanced multi‑die packages for high‑performance applications

Heterogeneous Integration Market Restraints:

-

Heterogeneous Integration Market Growth Hindered by Complexity Skill Gaps and Scaling Challenges in Manufacturing

The Heterogeneous Integration Market faces restraints such as high process complexity, stringent requirements for ultra-clean surfaces and precise alignment, and yield sensitivity at advanced nodes. Limited availability of skilled expertise, challenges in scaling hybrid bonding for high-volume manufacturing, and integration issues with existing fabrication lines also slow adoption, particularly for smaller foundries and OSATs.

Heterogeneous Integration Market Opportunities:

-

Emerging Regions Automotive Electrification And Advanced Connectivity Create Strong Long Term Opportunities For Market Players

Significant opportunities exist in emerging regions, particularly Asia Pacific, which hosts major semiconductor manufacturing hubs. Companies can capitalize on increasing investments in research and development, as well as government initiatives supporting domestic semiconductor fabrication and advanced packaging capabilities. Furthermore, the automotive sector driven by electric vehicles, autonomous driving, and advanced driver-assistance systems offers strong potential for specialized heterogeneous integration solutions. Expanding 5G infrastructure, growing demand for high-performance computing, and miniaturization trends across consumer and industrial electronics present continued opportunities for market players to innovate and capture value globally.

Consumer devices, including smartphones and wearables, drove over 58% adoption in chiplet packaging and fan‑out formats in 2024, underlining demand for miniaturization and integrated solutions.

Heterogeneous Integration Market Segment Analysis

-

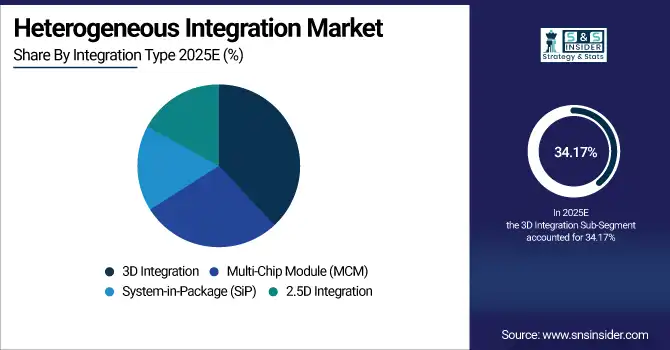

By Integration Type, 3D Integration dominated with 34.17% in 2025E, and it is expected to grow at the fastest CAGR of 24.06% from 2026 to 2033.

-

By Technology, Through-Silicon Via (TSV) dominated with 29.96% in 2025E, and Fan-Out Wafer-Level Packaging (FOWLP) is expected to grow at the fastest CAGR of 24.05% from 2026 to 2033.

-

By Component, Logic/Processor Chips dominated with 34.24% in 2025E, and RF/Analog Components is expected to grow at the fastest CAGR of 24.38% from 2026 to 2033.

-

By End-User, Consumer Electronics dominated with 34.75% in 2025E, Automotive & Transportation is expected to grow at the fastest CAGR of 24.38% from 2026 to 2033.

By Integration Type, 3D Integration Drives Market Leadership Today While Accelerating Future Growth Across High Performance Applications

The 3D Integration segment is expected to dominate the heterogeneous integration market in 2025E due to its ability to deliver high performance, increased functionality, and efficient use of space in electronic systems. It enables stacking of multiple dies in a single package, improving bandwidth, power efficiency, and miniaturization. The segment is also projected to grow at the fastest CAGR from 2026–2033, driven by rising demand in AI, high-performance computing, 5G infrastructure, automotive electronics, and compact consumer devices requiring advanced multi-die integration solutions.

By Technology, TSV Leads Advanced Integration Today While FOWLP Emerges as the Fastest Growing Packaging Technology

The Through-Silicon Via (TSV) technology segment is expected to dominate the heterogeneous integration market in 2025E, owing to its widespread adoption in 2.5D and 3D ICs for high-performance computing, AI, and networking applications. TSV enables efficient vertical interconnections, enhancing bandwidth and reducing power consumption. Meanwhile, Fan-Out Wafer-Level Packaging (FOWLP) is projected to grow at the fastest CAGR from 2026–2033, driven by demand for compact, cost-effective solutions in consumer electronics, IoT devices, 5G infrastructure, and automotive applications.

By Component, Logic Processors Dominate Current Demand While RF Analog Components Power Rapid Future Growth Globally

The Logic/Processor Chips segment is expected to dominate the heterogeneous integration market in 2025E due to high demand for advanced processors in AI, high-performance computing, networking, and consumer electronics. These chips drive performance and functionality in multi-die packages. Meanwhile, RF/Analog Components are projected to grow at the fastest CAGR from 2026–2033, fueled by increasing adoption in 5G infrastructure, IoT devices, automotive radar systems, and other high-frequency applications requiring compact, high-performance heterogeneous integration solutions.

By End-User, Consumer Electronics Lead Today While Automotive Innovation Accelerates Future Growth in Heterogeneous Integration Market

The Consumer Electronics segment is expected to dominate the heterogeneous integration market in 2025E due to high demand for smartphones, wearables, tablets, and other compact devices that require multi-functional, high-performance packaging. Meanwhile, Automotive & Transportation is projected to grow at the fastest CAGR from 2026–2033, driven by the rapid adoption of electric vehicles, autonomous driving technologies, advanced driver-assistance systems (ADAS), and connected vehicle electronics, which increasingly rely on heterogeneous integration for performance, reliability, and miniaturization.

Heterogeneous Integration Market Report Analysis

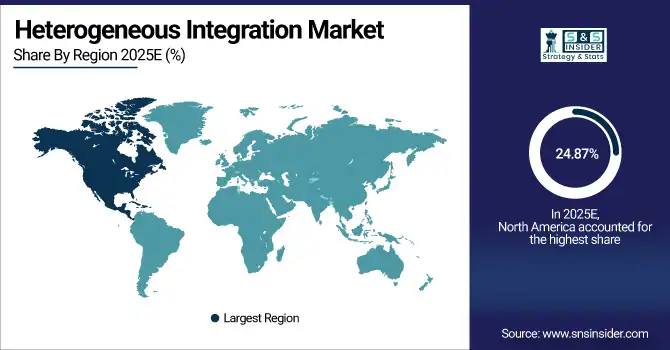

North America Heterogeneous Integration Market Insights

In 2025E, North America is expected to hold approximately 24.87% of the global heterogeneous integration market, making it a significant regional contributor. The region’s growth is driven by strong technological innovation, high adoption of AI, high-performance computing, and 5G infrastructure, as well as government initiatives supporting semiconductor research and domestic fabrication. Key demand comes from consumer electronics, automotive, telecommunications, and industrial sectors, with companies focusing on advanced packaging, compact multi-die integration, and next-generation electronic systems to maintain a competitive edge.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Heterogeneous Integration Market Insights

The United States dominates the North American heterogeneous integration market due to its strong semiconductor R&D ecosystem, leading chip designers, advanced packaging innovations, and high demand from AI, defense, automotive, data centers, and 5G infrastructure applications.

Europe Heterogeneous Integration Market Insights

In 2025E, Europe is expected to account for approximately 16.26% of the global heterogeneous integration market. Growth is driven by strong demand from the automotive, industrial automation, aerospace, and healthcare sectors, particularly in advanced driver-assistance systems and electric vehicles. European investments in semiconductor R&D, supported by government initiatives and regional chip programs, are strengthening advanced packaging capabilities. The region’s focus on energy efficiency, reliability, and high-quality manufacturing continues to support steady adoption of heterogeneous integration technologies.

Germany Heterogeneous Integration Market Insights

Germany dominates the European heterogeneous integration market due to its strong automotive electronics industry, advanced industrial automation base, robust semiconductor R&D ecosystem, and high adoption of advanced packaging technologies for EVs, ADAS, industrial systems, and aerospace applications.

Asia Pacific Heterogeneous Integration Market Insights

In 2025E, Asia Pacific is expected to dominate the global heterogeneous integration market with a 48.38% share and is projected to grow at a rapid CAGR of 23.98% during the forecast period. This growth is driven by the region’s strong semiconductor manufacturing ecosystem, presence of major foundries and OSAT players, and high demand from consumer electronics, automotive, 5G, and industrial sectors. Continuous investments in advanced packaging, chiplet architectures, and government-supported semiconductor initiatives further strengthen Asia Pacific’s market leadership.

China Heterogeneous Integration Market Insights

China dominates the Asia Pacific heterogeneous integration market due to its large-scale semiconductor manufacturing base, rapid expansion of advanced packaging and OSAT capacities, strong government support, and high demand from consumer electronics, 5G infrastructure, automotive, and industrial applications.

Latin America (LATAM) and Middle East & Africa (MEA) Heterogeneous Integration Market Insights

In Latin America (LATAM) and Middle East & Africa (MEA), the heterogeneous integration market remains smaller compared to other regions but shows growing potential. Demand is increasing as digital transformation, industrial automation, and increasing smartphone and IoT adoption drive need for compact, high-performance electronic solutions. Investments in local semiconductor capabilities are emerging, supported by government initiatives and technology partnerships. Automotive electronics, telecommunications infrastructure, and healthcare systems are key sectors expected to fuel market interest and future growth opportunities.

Competitive Landscape for Heterogeneous Integration Market:

Taiwan Semiconductor Manufacturing Company (TSMC) is a global leader in advanced semiconductor manufacturing and heterogeneous integration technologies. The company offers cutting-edge 2.5D and 3D packaging solutions such as CoWoS, InFO, and SoIC, enabling high-performance, energy-efficient chips for AI, HPC, 5G, automotive, and advanced computing applications.

-

In March 2025, TSMC announced a major US$100 billion investment expansion in the United States, including two advanced packaging facilities and an R&D center to strengthen AI and heterogeneous integration capabilities.

Samsung Electronics is a leading global technology company driving innovation in semiconductor and heterogeneous integration markets. It develops advanced packaging and 2.5D/3D integration solutions, high-performance memory (HBM), and multi-die systems for AI, mobile, automotive, and networking applications, strengthening its role in compact, energy-efficient, next-generation electronic systems.

-

In May 2024, Samsung begins offering turnkey solutions with advanced 2.5D package tech using its 2 nm GAA process in collaboration with Preferred Networks, boosting AI accelerator chip integration capabilities.

Heterogeneous Integration Market Key Players:

Some of the Heterogeneous Integration Market Companies are:

-

Taiwan Semiconductor Manufacturing Company (TSMC)

-

Samsung Electronics

-

Intel Corporation

-

ASE Technology Holding

-

Amkor Technology

-

Applied Materials, Inc.

-

JCET Group

-

Siliconware Precision Industries

-

Powertech Technology Inc.

-

UTAC Holdings

-

EV Group (EVG)

-

Unimicron Technology Corporation

-

Shinko Electric Industries

-

Hana Micron

-

Chipbond Technology Corporation

-

Tongfu Microelectronics

-

Huatian Technology

-

King Yuan Electronics

-

Nepes Corporation

-

NXP Semiconductors

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 13.79 Billion |

| Market Size by 2033 | USD 3.44 Billion |

| CAGR | CAGR of 23.56% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Integration Type (2.5D Integration, 3D Integration, System-in-Package (SiP)m, and Multi-Chip Module (MCM)) • By Technology (Through-Silicon Via (TSV), Micro-Bump, Advanced Interposers, and Fan-Out Wafer-Level Packaging (FOWLP)) • By Component (Logic/Processor Chips, Memory (DRAM/Flash), RF/Analog Components, and Passive Components (Resistors, Capacitors, Inductors)) • By End-User (Consumer Electronics, Automotive & Transportation, Telecommunications & 5G Infrastructure, and Industrial & Healthcare Systems) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Taiwan Semiconductor Manufacturing Company, Samsung Electronics, Intel Corporation, ASE Technology Holding, Amkor Technology, Applied Materials, JCET Group, Siliconware Precision Industries, Powertech Technology, UTAC Holdings, EV Group, Unimicron Technology, Shinko Electric Industries, Hana Micron, Chipbond Technology, Tongfu Microelectronics, Huatian Technology, King Yuan Electronics, Nepes Corporation, NXP Semiconductors. |