High Intensity Focused Ultrasound Market Report Scope & Overview:

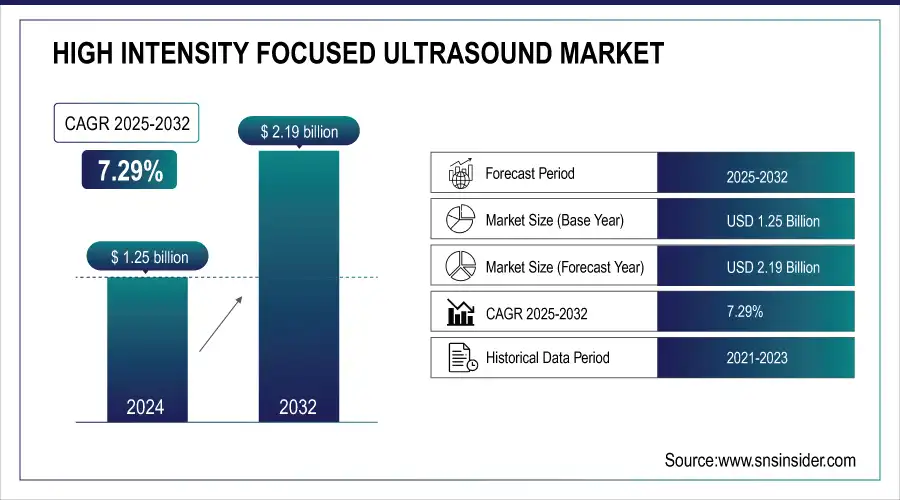

The High Intensity Focused Ultrasound Market size was valued at USD 1.25 billion in 2024 and is expected to reach USD 2.19 billion by 2032, growing at a CAGR of 7.29% over the forecast period of 2025-2032.

The global high-intensity focused ultrasound market is increasing due to the increasing incidence globally. The people are aware of the advanced Cancer Treatments, which should be non-invasive and effective techniques. Another global high-intensity focused ultrasound market trend is the expansion in non-cancerous indications, including uterine fibroids, adenomyosis, and others, which increases its acceptance. As a combined group, these trends underscore HIFU as a disruptive solution in oncology and women’s health.

To Get more information on High Intensity Focused Ultrasound Market - Request Free Sample Report

For instance, in February 2024, the WHO & IARC projected global cancer cases to surge over 20M (2022) to 30M (2040), driving strong demand for minimally invasive therapies, including HIFU

Key High Intensity Focused Ultrasound Market Trends

-

Expansion of specialized therapies: Rising development of advanced insulin analogs, oral antidiabetic formulations, and continuous glucose monitoring (CGM) systems designed specifically for High-intensity Focused Ultrasound (HIFU) Systems and Ultrasound Imaging Systems.

-

Integration of smart devices: Increasing adoption of wearable glucose monitors, smart insulin pens, and mobile apps to track glucose levels, improve dosing accuracy, and enhance owner compliance.

-

Focus on personalized care: Diabetes management plans increasingly tailored based on pet species, age, weight, lifestyle, and comorbidities, ensuring optimized therapeutic outcomes.

-

Collaboration across stakeholders: Growing partnerships among veterinary clinics, biotech firms, pet health CDMOs, and tech providers for co-development of therapies and seamless technology transfer.

-

Novel delivery platforms: Introduction of sustained-release insulin, glucose-monitoring patches, oral gels, and transdermal delivery systems to reduce stress and improve convenience in therapy administration.

-

Growing awareness and regulatory support: Enhanced veterinary guidelines, clinical trials, and stronger regulatory frameworks increasing confidence in pet diabetes care products and supporting market growth.

High Intensity Focused Ultrasound Market Report Highlights

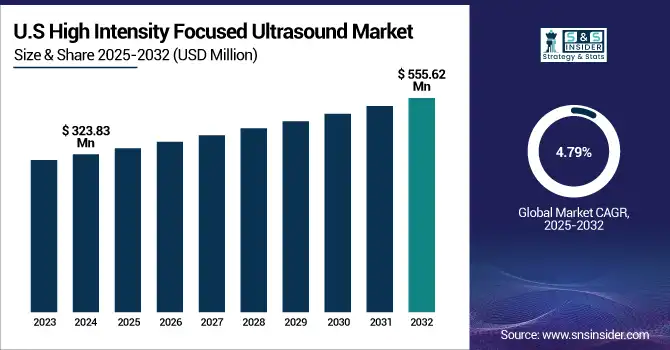

The U.S. high-intensity focused ultrasound market was valued at USD 323.83 million in 2024 and is expected to reach USD 555.62 million by 2032, growing at a CAGR of 4.79% over 2025-2032. The developed medical infrastructure of the U.S., including well-established hospitals and cancer centers, boosts the implementation of innovative non-invasive Cancer Treatments, and thereby, the U.S. leads the high-intensity focused ultrasound market analysis. The increased prevalence of cancer, in particular prostate and breast cancer, and the demand for minimally invasive therapy drive the acceptance, boosting HIFU as an attractive alternative for precision oncology and targeted therapy.

High Intensity Focused Ultrasound Market Growth Drivers:

-

Rising Cancer Incidence is Driving the High-Intensity Focused Ultrasound Market Growth

Growing cancer prevalence, prostate, liver, and breast cancer in particular, is one of the key factors propelling the high-intensity focused ultrasound (HIFU) market share. As the number of global cancer cases continues to rise, demand for safer, non-invasive, and more effective Cancer Treatment alternatives grows. Unlike other current tumor ablation methods, HIFU provides focused ablation with few, if any, side effects and has thus become a more popular cancer treatment.

For instance, in February 2025, the American Cancer Society reported 2.0 million new U.S. cancer cases, up over 1.96 million in 2024, boosting High Intensity Focused Ultrasound Market share adoption.

High Intensity Focused Ultrasound Market Restraints:

-

Limited Reimbursement Policies are Hampering the High Intensity Focused Ultrasound Market Growth

The lack of compensation policies is a substantial restraint hampering the global high-intensity focused ultrasound market growth. HIFU Cancer Treatments are out of pocket for a substantial patient population in multiple health care systems. This cost burden is a barrier for both hospitals and patients for adoption, limiting access despite the established clinical utility, and inhibiting wider-reaching market penetration globally.

High Intensity Focused Ultrasound Market Opportunities:

-

Telehealth And Remote Monitoring Drive Future Growth Opportunities for the High Intensity Focused Ultrasound Market

Telehealth and remote monitoring a features to utilise digital veterinary services to track the condition and to stay connected with your pet while ensuring long-term care is in place for a diabetic pet and its owner. Veterinarians can follow glucose trends using wearable glucose monitors and app-based reporting, provide timely interventions, and change Cancer Treatments without having to see patients in person. Not only is pet health improved, but owner convenience, engagement, and compliance with the prescribed diabetes management protocol are also improved.

For instance, in February 2025, telehealth consultations for diabetic pets rose 42% in North America, showing rapid adoption of remote monitoring solutions.

Key High Intensity Focused Ultrasound Market Segment Analysis

-

By devices, high-intensity focused ultrasound (HIFU) systems held the largest share of around 90.87%in 2024, and the ultrasound imaging systems segment is expected to register the highest growth with a CAGR of 8.23%.

-

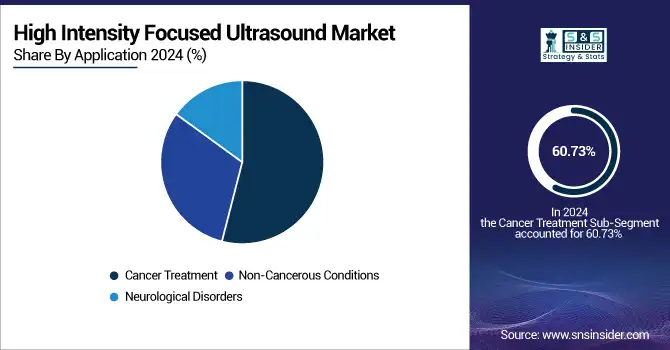

By application, the cancer treatment segment dominated the market with approximately 60.73% share in 2024, while non-cancerous conditions are expected to register the highest growth with a CAGR of 7.91%

-

By technology, focused ultrasound (FUS) accounted for the leading share of nearly 82.88% in 2024, while ultrasound-mediated gene delivery is expected to register the highest growth with a CAGR of 8.59%.

-

By end user, the hospitals segment led the market with about 55.80% share in 2024, while the ambulatory surgical centers segment is forecasted to grow the fastest at a CAGR of 8.47%.

By Application, the Cancer Treatment Segment dominates, while the Non-Cancerous Conditions Segment Shows Rapid Growth

The cancer treatment segment held the largest revenue share of approximately 60.73% in 2024, owing to the growing incidence of prostate, liver, and breast cancers globally. Growth factors include non-invasive ablation of tumors and accurate targeting of tumors with the least effect on the body, along with FDA and CE approvals, increasing patient inclination towards minimally invasive procedures. On the other hand, the non-cancerous conditions segment is predicted to grow at the strongest CAGR of approximately 7.91% during 2025–2032, owing to an increasing demand for uterine fibroid, adenomyosis, and cosmetic procedures. Driving forces include minimally invasive methods, quicker healing times, fewer complications.

By Devices, High-intensity Focused Ultrasound (HIFU) Systems Lead the Market, While Ultrasound Imaging Systems Register Fastest Growth

The High-intensity Focused Ultrasound (HIFU) Systems segment accounted for the highest revenue share of approximately 90.87% in 2024, owing to their broad application in clinical practice in oncology, gynecology, and neurology. Enabling factors include advantages of non-invasive treatment, accuracy in treating tumors, shorter recovery period, FDA and CE approvals, and advanced technology in the field of imaging guidance. In comparison, the ultrasound imaging systems segment is anticipated to achieve the highest CAGR of nearly 8.23% during the 2025–2032 period, as a result of increasing requirements for accurate, real-time imaging in HIFU applications. Factors driving the growth of this market include the technological advancements in 3D/4D imaging technologies.

By Technology, Focused Ultrasound (FUS) Segment Lead, While Ultrasound-Mediated Gene Delivery Registers Fastest Growth

The focused ultrasound (FUS) segment accounted for the largest share of the High Intensity Focused Ultrasound Market with about 82.88%, as this is widely used in oncology, neurology, and gynecology. The growth can be attributed to the advantages, including non-invasive treatment, low probability of infection, and bleeding. In addition, the Ultrasound-Mediated Gene Delivery segment is slated to grow at the fastest rate with a CAGR of around 8.59% throughout the forecast period of 2025–2032, driven by its promise in targeted gene therapy, oncology, and regenerative medicine. Key elements for this success are the precise ultrasonic delivery, nanoplatform integration, and clinical trials.

By End User, Hospitals Segment Lead, While the Ambulatory Surgical Centers Segment Grows the Fastest

The Hospitals segment held the largest revenue share of around 55.80% in the High Intensity Focused Ultrasound Market in 2024, owing to their established infrastructure, large patient numbers, and multidisciplinary care centres. Drivers for the market are the availability of MR- and ultrasound-guided HIFU systems. On the flip side, the Ambulatory Surgical Centers segment, however, is projected to register the highest CAGR of around 8.47% during the forecast period of 2025 - 2032, owing to the growing need for ambulatory, low-cost, and minimally invasive interventional therapies. Shorter patient recovery times, fewer hospital stays, utilization of HIFU for prostate, fibroid.

Asia Pacific High Intensity Focused Ultrasound Market Insights

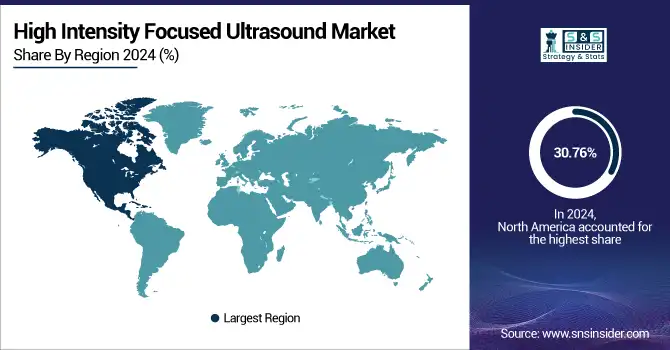

North America High Intensity Focused Ultrasound Market Insights

In 2024, the North American region held a dominant market share of 30.76% of the global high-intensity focused ultrasound market, as a result of its developed healthcare infrastructure, high incidence of cancer, and early uptake of novel medical technologies. Factors enabling the growth in the HIFU market include the number of FDA approvals being granted for HIFU for different applications, and the presence of the key market players. stringent hospital networks, high patient awareness, a well-established reimbursement framework, and an increasing demand for minimally invasive, outpatient procedures. These factors combine and make North America the biggest and most established HIFU market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is the fastest-growing segment in the High Intensity Focused Ultrasound Market with a CAGR of 8.04%, due to the growing healthcare spending, rising prevalence of diseases, and growing medical infrastructure. Key factors contributing to the growth include high prevalence of cancer, uterine fibroids, increasing awareness about the benefits of minimally invasive treatment options, and major HIFU device manufacturers, including Chongqing Haifu and Insightec, penetrating the region. Furthermore, favorable government initiatives for the development of advanced healthcare technology, cost-effective treatment options, and the growing medical tourism also stimulate the market growth. Furthermore, an increasing number of hospitals, clinics, and ambulatory surgical centers with HIFU systems, coupled with a high patient population and an improving reimbursement scenario in China, India, South Korea, and Japan, are accelerating market growth.

Europe High Intensity Focused Ultrasound Market Insights

The second largest share in the high-intensity focused ultrasound market is held by Europe owing to the presence of reportedly well-established healthcare systems, rising prevalence of cancer, and higher penetration rates of minimally invasive treatments. Factors including the HIFU devices approval, saw presence of key players, enhanced awareness among both patients and physicians, sophisticated imaging facilities, and increasing reimbursement are driving the European market, which will be a significant and growing HIFU market globally.

Latin America (LATAM) and Middle East & Africa (MEA) High Intensity Focused Ultrasound Market Insights

The High Intensity Focused Ultrasound Market in these regions is primarily due to inadequate medical infrastructure, poor knowledge of non-invasive treatments, high cost of devices, and insufficient HIFU devices. Poor reimbursement policies, limited trained professionals, and slower regulatory approvals further restrain the penetration levels, due to which the market in the region still lags behind the other major markets, including North America, Europe, and the Asia Pacific by a fair margin.

Competitive Landscape for the High Intensity Focused Ultrasound Market:

Insightec specializes in non-invasive MR-guided focused ultrasound (MRgFUS) systems for treating neurological disorders and tumors. Its Exablate platform integrates imaging with precise ultrasound delivery, enabling targeted therapy without incisions. The company leads in neurosurgery and uterine fibroid treatments globally.

-

In June 2024, Boehringer launched a next-generation continuous glucose monitoring system for pets, improving real-time diabetes management and owner compliance globally.

Haifu Medical focuses on HIFU devices for oncology, including liver, pancreatic, and prostate tumors. The company emphasizes affordability and accessibility, particularly in Asian markets, and invests in R&D for improving precision, safety, and real-time imaging integration.

-

In September 2024, Merck introduced an innovative sustained-release insulin formulation for High-intensity Focused Ultrasound (HIFU) Systems, reducing injection frequency and enhancing glycemic control in veterinary practices.

EDAP TMS develops HIFU systems for prostate cancer treatment and urological applications. Its Ablatherm platform combines advanced imaging and robotic control for minimally invasive therapy. EDAP also invests in clinical research and expansion across European and North American markets.

-

In March 2025, Elanco partnered with a biotech firm to co-develop oral antidiabetic supplements for Ultrasound Imaging Systems and High-intensity Focused Ultrasound (HIFU) Systems, targeting personalized and species-specific diabetes management.

High Intensity Focused Ultrasound Market Key Players:

Some of the High Intensity Focused Ultrasound Market companies are:

-

Insightec Ltd.

-

Chongqing Haifu Medical Technology Co., Ltd.

-

EDAP TMS S.A.

-

Philips Healthcare

-

SonaCare Medical, LLC

-

Profound Medical Corp.

-

Theraclion SA

-

Alpinion Medical Systems

-

Medsonic Ltd

-

Shanghai A&S Science Technology Development

-

Wikkon

-

Changjiangyuan Technology Development

-

InnoSound Technologies Co., Ltd.

-

Focus Surgery, Inc.

-

Integra Radionics

-

Image Guided Therapy

-

Mianyang Sonic Electronic Ltd.

-

Ulthera, Inc.

-

HIFU Prostate Services, LLC

-

MDxHealth

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.25 billion |

| Market Size by 2032 | USD 2.19 billion |

| CAGR | CAGR of 7.29% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Devices (High-intensity Focused Ultrasound system, Ultrasound Imaging Systems) • By Application (Cancer Treatment, Non-Cancerous Conditions, Neurological Disorders) • By Technology (Focused Ultrasound, Ultrasound-Mediated Gene Delivery, Sonoporation Technologies) • By End User (Hospitals, Clinics, Ambulatory Surgical Centers, Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Insightec Ltd., Chongqing Haifu Medical Technology, Co., Ltd., EDAP TMS S.A., Philips Healthcare, SonaCare Medical, LLC, Profound Medical Corp., Theraclion SA, Alpinion Medical Systems, Medsonic Ltd., Shanghai A&S Science Technology, Development, Wikkon, Changjiangyuan Technology Development, InnoSound Technologies Co., Ltd., Focus Surgery, Inc., Integra Radionics, Image Guided Therapy, Mianyang Sonic Electronic Ltd., Ulthera, Inc., HIFU Prostate Services, LLC, MDxHealth and other players. |