High-Speed PCB Market Report Scope & Overview:

The High-Speed PCB Market Size is valued at USD 26.28 Billion in 2025E and is projected to reach USD 39.89 Billion by 2033, growing at a CAGR of 5.39% during the forecast period 2026–2033.

The High-Speed PCB Market analysis report provides a detailed overview of market dynamics, highlighting advanced material adoption, multi-layer designs and high-frequency applications. Rising demand in telecommunications, automotive, aerospace and consumer electronics is expected to propel market growth during the forecast period.

High-Speed PCB shipments reached 1.72 billion units in 2025, driven by growing demand in telecommunications, automotive, consumer electronics and aerospace applications.

Market Size and Forecast:

-

Market Size in 2025: USD 26.28 Billion

-

Market Size by 2033: USD 39.89 Billion

-

CAGR: 5.39% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On High-Speed PCB Market - Request Free Sample Report

High-Speed PCB Market Trends:

-

Growing demand for high-performance electronics is driving adoption of multi-layer and high-frequency PCBs.

-

Expansion in telecommunications, automotive, aerospace and consumer electronics is broadening application areas for advanced PCBs.

-

Rising preference for lightweight, flexible and compact designs is boosting flexible and rigid-flex PCB usage.

-

Increasing awareness of signal integrity and high-speed data requirements is accelerating demand for premium PCB materials such as Rogers and Polyimide.

-

Online and specialized distribution channels are enhancing PCB accessibility for manufacturers and EMS providers.

-

Focus on energy-efficient, high-reliability and miniaturized PCBs is aligning with trends in modern electronics and IoT devices.

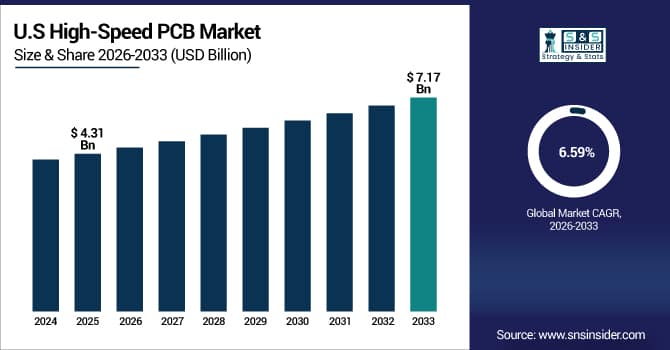

U.S. High-Speed PCB Market Insights:

The U.S. High-Speed PCB Market is projected to grow from USD 4.31 Billion in 2025E to USD 7.17 Billion by 2033, at a CAGR of 6.59%. Growth is driven by 5G network deployment, AI infrastructure, advanced automotive electronics and rising demand for multi-layer, high-frequency PCBs across industrial and consumer applications.

High-Speed PCB Market Growth Drivers:

-

Explosive growth in high-speed data transmission across 5G, AI and cloud infrastructure driving advanced PCB demand.

Explosive growth in high-speed data transmission across 5G, AI and cloud infrastructure is a major driver of the High-Speed PCB Market Growth. Next-generation networks and data centers require ultra-low latency, high signal integrity and reliable performance, increasing demand for advanced PCB materials and multi-layer designs. High-speed PCBs enable faster processing, reduced signal loss and improved thermal management in routers, servers, base stations and AI accelerators. As digitalization accelerates, manufacturers increasingly invest in high-performance PCBs to support bandwidth-intensive applications and scalable infrastructure.

High-speed PCB demand increased 6.4% in 2025, driven by rapid deployment of 5G networks and rising investments in AI servers and cloud data center infrastructure.

High-Speed PCB Market Restraints:

-

High manufacturing complexity, material costs and stringent signal integrity requirements limiting scalable high-speed PCB production.

High manufacturing complexity, elevated material costs and stringent signal integrity requirements significantly restrain High-Speed PCB Market growth. Production demands advanced design expertise, precise impedance control and specialized materials such as low-loss laminates, increasing overall costs. Minor design or fabrication errors can cause signal degradation, rework, or product failure. Additionally, limited availability of skilled engineers and high-capital manufacturing equipment restrict scalability. These factors raise entry barriers for new manufacturers and limit cost-effective adoption across price-sensitive electronics segments.

High-Speed PCB Market Opportunities:

-

Rapid expansion of AI, EVs and advanced automotive electronics creating strong opportunities for high-speed PCB innovation.

Rapid expansion of AI, electric vehicles and advanced automotive electronics presents a significant opportunity for the High-Speed PCB Market. Increasing integration of AI processors, autonomous driving systems and high-voltage power electronics requires ultra-reliable, high-speed signal transmission. This drives demand for advanced PCB architectures, high-frequency materials and compact multi-layer designs. Manufacturers investing in innovative PCB technologies can differentiate offerings, support next-generation mobility and computing platforms and unlock long-term growth across automotive, industrial and data-centric applications.

AI, EV, and automotive electronics accounted for 29% of high-speed PCB demand in 2025, driven by advanced computing and connectivity needs.

High-Speed PCB Market Segmentation Analysis:

-

By Type, Rigid PCBs held the largest market share of 48.37% in 2025, while Rigid-Flex PCBs are expected to grow at the fastest CAGR of 6.94% during 2026–2033.

-

By Material, FR4 accounted for the highest market share of 41.26% in 2025, while Rogers materials are projected to expand at the fastest CAGR of 7.18% over the forecast period.

-

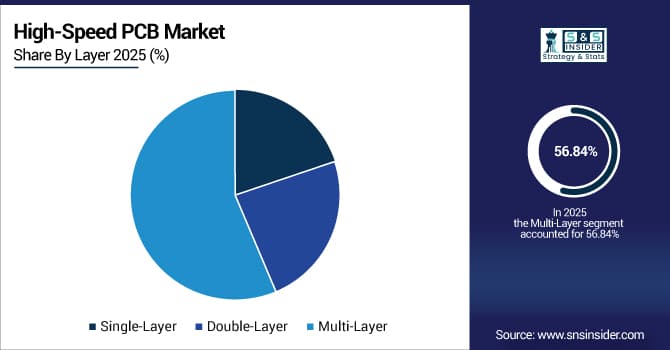

By Layer, Multi-Layer PCBs dominated with a 56.84% share in 2025 and are also anticipated to register the fastest CAGR of 5.73% through 2026–2033.

-

By Application, Telecommunications led the market with a 29.42% share in 2025, while Automotive applications are forecasted to record the fastest CAGR of 7.21% during the forecast timeline.

-

By End-Use, Original Equipment Manufacturers held the largest share of 62.58% in 2025, while Electronics Manufacturing Services are expected to grow at the fastest CAGR of 6.37% from 2026–2033.

By Type, Rigid PCBs Dominate While Rigid-Flex Expands Rapidly:

Rigid PCBs segment dominated the market due to their cost efficiency, mechanical stability and widespread use in telecom infrastructure, servers and industrial electronics. Their compatibility with high-volume manufacturing makes them the preferred choice for large-scale deployments. In 2025, rigid high-speed PCB production exceeded 820 million units.

Rigid-Flex is the fastest growing segment, driven by demand for compact, lightweight and space-efficient electronics in automotive, aerospace and wearables. In 2025, rigid-flex PCB shipments crossed 110 million units, reflecting accelerating adoption. Miniaturization and design flexibility remain key growth catalysts.

By Material, FR4 Dominates While Rogers Materials Grow Fastest:

FR4 segment dominated the market owing to its affordability, acceptable dielectric properties and suitability for a wide range of high-speed electronic applications. It remains extensively used in consumer electronics, networking hardware and industrial systems. In 2025, FR4-based high-speed PCBs accounted for over 610 million fabricated boards.

Rogers are the fastest growing segment due to their superior signal integrity, low dielectric loss and high-frequency performance. Ideal for 5G, AI servers and RF applications. Rising deployment in 5G base stations and AI servers pushed Rogers-based PCB demand beyond 145 million boards in 2025.

By Layer, Multi-Layer PCBs Dominate and Grow the Fastest:

Multi-layer segment dominated the market as advanced electronic systems increasingly require dense interconnections, improved signal routing and reduced electromagnetic interference. Their ability to support high-speed data transmission makes them essential in networking, computing and automotive electronics. In 2025, production of multi-layer high-speed PCBs surpassed 980 million units.

Multi-layer is also the fastest growing segment, supported by AI accelerators, cloud infrastructure and autonomous systems. Rising demand for compact, high-density circuits further fuels multi-layer PCB adoption. Demand rose sharply, with newly installed multi-layer PCB capacity increasing by over 120 manufacturing lines.

By Application, Telecommunications Dominates While Automotive Accelerates:

Telecommunications segment dominated the market due to massive investments in 5G infrastructure, data centers and fiber-optic networks. High-speed PCBs are critical in routers, switches and base stations to support low latency and high bandwidth. In 2025, telecom-related deployments consumed more than 410 million high-speed PCB units.

Automotive is the fastest growing segment, driven by electric vehicles, ADAS and in-vehicle infotainment systems. Advanced mobility solutions boost demand. In 2025, automotive-grade high-speed PCB installations exceeded 95 million units, reflecting rapid integration of digital and autonomous technologies.

By End-Use, OEMs Dominate While EMS Grows Rapidly:

Original Equipment Manufacturers segment dominated the market as they control product design, system integration and direct sourcing of high-speed PCBs for mission-critical electronics. OEM-led demand remained strong across telecom, aerospace and industrial equipment. In 2025, OEMs accounted for procurement of over 720 million high-speed PCB assemblies.

Electronics Manufacturing Services are the fastest growing segment, benefiting from outsourcing trends and rising complexity of PCB fabrication. Increasing demand for flexible, scalable production and specialized assembly drives EMS market expansion. EMS-based high-speed PCB output crossed 260 million assemblies in 2025, supported by supply chain diversification.

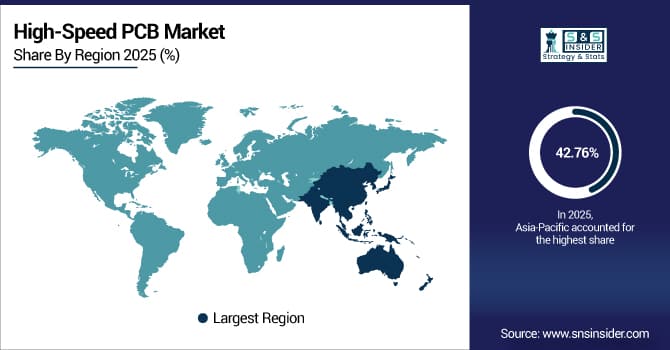

High-Speed PCB Market Regional Analysis:

Asia-Pacific High-Speed PCB Market Insights:

The Asia-Pacific High-Speed PCB Market dominated with a market share of 42.76% in 2025. Growth is driven by rapid adoption of 5G networks, AI infrastructure and high-performance electronics across China, Japan, South Korea and India. Expanding automotive, aerospace, and consumer electronics sectors are boosting demand for multi-layer, rigid and advanced material PCBs. Strong manufacturing capabilities, technology investments and rising digitalization make Asia-Pacific the largest and most influential market for high-speed PCBs.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China High-Speed PCB Market Insights:

China’s High-Speed PCB Market is driven by rapid 5G deployment, AI infrastructure growth and rising demand in automotive and consumer electronics. Expansion of advanced manufacturing, adoption of multi-layer and high-frequency PCBs and strong industrial investment position China as a dominant contributor to the Asia-Pacific high-speed PCB market.

North America High-Speed PCB Market Insights:

North America is the fastest-growing High-Speed PCB Market, projected to expand at a CAGR of 6.77% during 2026–2033. Rising deployment of 5G networks, AI data centers and electric vehicles is fueling demand for advanced multi-layer and high-frequency PCBs. Growth in aerospace, industrial automation and consumer electronics sectors further supports market expansion. Increasing investments in cutting-edge manufacturing technologies and specialized EMS services position North America as a key region for innovation and adoption.

U.S. High-Speed PCB Market Insights:

The U.S. High-Speed PCB Market is driven by rapid adoption of 5G technology, AI computing and electric vehicles. Increasing demand for high-frequency, multi-layer PCBs in aerospace, industrial automation and consumer electronics, combined with advanced manufacturing capabilities and specialized EMS services, reinforces the U.S. as a dominant contributor in North America.

Europe High-Speed PCB Market Insights:

The Europe High-Speed PCB Market is growing due to increasing adoption of 5G networks, AI computing and advanced automotive electronics. Germany, the UK, France and Italy are leading contributors, supported by strong industrial automation, aerospace and consumer electronics sectors. Rising demand for multi-layer, high-frequency and rigid-flex PCBs, combined with investments in advanced manufacturing and specialized EMS services, underpins Europe’s position as a key growth market in high-speed PCB technology.

Germany High-Speed PCB Market Insights:

Germany is a key High-Speed PCB market due to strong industrial automation, advanced automotive electronics and aerospace demand. Rising adoption of multi-layer and high-frequency PCBs, combined with investments in precision manufacturing and EMS services, strengthens Germany’s position as a leading contributor to the European high-speed PCB market.

Latin America High-Speed PCB Market Insights:

The Latin America High-Speed PCB Market is expected to grow with rising demand for advanced electronics in automotive, telecommunications and industrial sectors across Brazil, Mexico and Argentina. Increasing adoption of multi-layer and high-frequency PCBs, coupled with expanding manufacturing capabilities, is driving regional market growth.

Middle East and Africa High-Speed PCB Market Insights:

The Middle East & Africa High-Speed PCB Market is expanding with rising demand for advanced electronics in telecommunications, automotive and industrial automation. Growth in countries such as Saudi Arabia, UAE and South Africa, coupled with adoption of multi-layer and high-frequency PCBs, is driving regional market development.

High-Speed PCB Market Competitive Landscape:

Zhen Ding Technology Holding Limited, headquartered in Taiwan is a leader in advanced printed circuit boards, specializing in high-density interconnect (HDI), rigid-flex, multi-layer and IC substrate boards. Serving telecommunications, mobile devices, automotive and AI computing, Zhen Ding dominates through large-scale manufacturing, integrated supply chains and strong R&D. Its ability to deliver high-quality, next-generation PCB solutions for 5G, IoT and high-speed applications reinforces its leadership and solidifies its position as one of the world’s top PCB manufacturers.

-

In October 2025, Zhen Ding showcased advanced high‑frequency, high‑density PCB and IC substrate solutions at SEMICON Taiwan, targeting AI, 5G and semiconductor integration, reinforcing its leadership in next‑generation electronic applications.

Unimicron Technology Corporation, based in Taoyuan, Taiwan, is a leading PCB manufacturer offering HDI, flexible, rigid-flex boards and IC carriers. The company serves consumer electronics, telecommunications, computing and automotive sectors. Unimicron maintains market dominance through advanced manufacturing, rigorous quality control and strong partnerships with leading OEMs. Its focus on innovation, technical expertise and the ability to deliver high-speed PCB solutions for emerging technologies ensures its status as a key player in the high-performance PCB market.

-

In May 2025, TTM launched five new high-performance RF components, including broadband transformers and hybrid couplers, supporting 5G infrastructure, telecommunications and aerospace applications, expanding its advanced PCB and RF solutions portfolio.

TTM Technologies, headquartered in Santa Ana, California, is North America’s largest PCB manufacturer and a top player. It specializes in high-density interconnect, rigid-flex, RF/microwave and high-speed PCBs, serving aerospace, defense, automotive, industrial, computing and telecommunications markets. TTM’s strategic acquisitions, manufacturing capabilities and comprehensive design-to-manufacturing services reinforce its market leadership. Focused on innovation, reliability and complex PCB solutions, TTM has established itself as a dominant supplier of high-speed, mission-critical electronic components.

-

In June 2025, Unimicron focused on next-generation IC substrates and advanced packaging solutions for cloud-based AI and high-performance computing, addressing growing demand for high-speed, complex PCBs and semiconductor interconnect technologies.

High-Speed PCB Market Key Players:

Some of the High-Speed PCB Market Companies are:

-

Zhen Ding Technology Holding Limited

-

Unimicron Technology Corporation

-

TTM Technologies

-

Compeq Manufacturing Co., Ltd.

-

Nippon Mektron Ltd.

-

AT&S Austria Technologie & Systemtechnik AG

-

Ibiden Co., Ltd.

-

Sanmina Corporation

-

Flex Ltd.

-

Jabil Inc.

-

Shenzhen Fastprint Circuit Tech

-

LG Innotek

-

Shennan Circuits Co., Ltd.

-

Tripod Technology Corporation

-

Bomin Electronics

-

Suntak Technology

-

Nan Ya PCB

-

Kingboard Holdings Limited

-

HannStar Board Corporation

-

SEMCO

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 26.28 Billion |

| Market Size by 2033 | USD 39.89 Billion |

| CAGR | CAGR of 5.39% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Rigid PCMs, Flexible, Rigid-Flex, Others) • By Material (FR4, Rogers, Polyimide, Ceramic, Others) • By Layer (Single-Layer, Double-Layer, Multi-Layer) • By Application (Telecommunications, Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Medical Devices, Others) • By End-Use (Original Equipment Manufacturers, Electronics Manufacturing Services, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Zhen Ding Technology Holding Limited, Unimicron Technology Corporation, TTM Technologies, Compeq Manufacturing Co., Ltd., Nippon Mektron Ltd., AT&S Austria Technologie & Systemtechnik AG, Ibiden Co., Ltd., Sanmina Corporation, Flex Ltd., Jabil Inc., Shenzhen Fastprint Circuit Tech, LG Innotek, Shennan Circuits Co., Ltd., Tripod Technology Corporation, Bomin Electronics, Suntak Technology, Nan Ya PCB, Kingboard Holdings Limited, HannStar Board Corporation, SEMCO |