Human Fibrinogen Concentrate Market Report Scope & Overview:

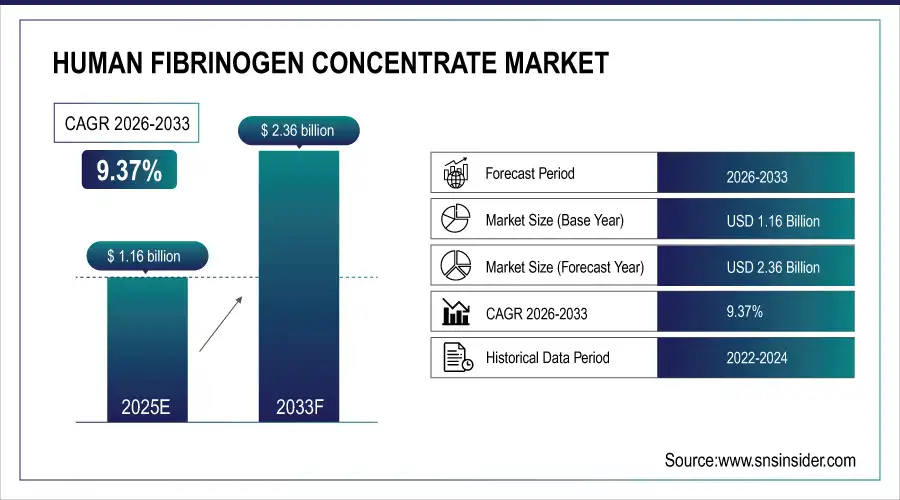

Human Fibrinogen Concentrate Market is valued at USD 1.16 billion in 2025E and is expected to reach USD 2.36 billion by 2033, growing at a CAGR of 9.37% from 2026-2033.

The Human Fibrinogen Concentrate market is witnessing significant growth due to increasing prevalence of bleeding disorders and surgical procedures that require rapid hemostasis. Rising awareness among healthcare professionals about the advantages of fibrinogen concentrates over traditional therapies like cryoprecipitate and fresh frozen plasma is fueling adoption. Technological advancements, availability of recombinant products, and expanding applications in trauma, cardiac, and obstetric care are further driving demand. Additionally, supportive healthcare infrastructure, growing hospital spending, and favorable reimbursement policies in key regions are contributing to the steady market expansion.

85% of hospitals adopted human fibrinogen concentrate driven by rising surgical and trauma needs, clinical preference over cryoprecipitate, and expanding access solidifying its role in global hemostasis care.

Human Fibrinogen Concentrate Market Size and Forecast

-

Market Size in 2025E: USD 1.16 Billion

-

Market Size by 2033: USD 2.36 Billion

-

CAGR: 9.37% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Human Fibrinogen Concentrate Market - Request Free Sample Report

Human Fibrinogen Concentrate Market Trends

-

Increasing clinical adoption for managing congenital and acquired fibrinogen deficiencies across emergency and surgical settings

-

Rising use in trauma care and massive bleeding management protocols to improve patient outcomes

-

Growing preference for plasma-derived concentrates due to established safety profiles and rapid availability

-

Expansion of indications in cardiac, orthopedic, and obstetric surgeries driving consistent demand growth

-

Advancements in plasma fractionation and purification technologies enhancing product safety and efficacy

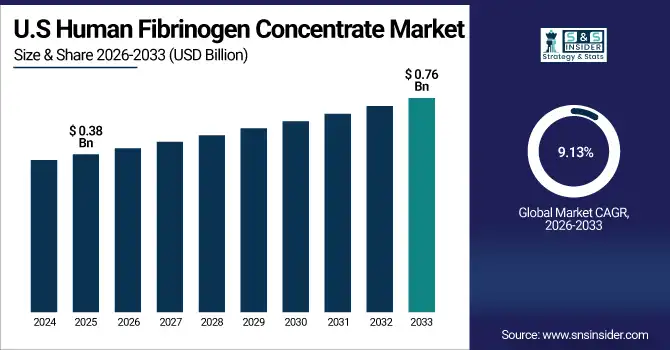

U.S. Human Fibrinogen Concentrate Market is valued at USD 0.38 billion in 2025E and is expected to reach USD 0.76 billion by 2033, growing at a CAGR of 9.13% from 2026-2033.

The U.S. Human Fibrinogen Concentrate market is growing due to increasing cases of congenital and acquired bleeding disorders, along with rising demand for rapid hemostasis during surgeries and trauma care. Greater awareness among healthcare providers, adoption of advanced recombinant products, and supportive reimbursement policies are driving the shift from traditional therapies, boosting market growth steadily.

Human Fibrinogen Concentrate Market Growth Drivers:

-

Rising prevalence of congenital and acquired fibrinogen deficiencies and increasing surgical procedures are driving demand for human fibrinogen concentrate therapies globally

The incidence of congenital fibrinogen deficiency, along with acquired conditions caused by liver disease, trauma, and massive bleeding, is steadily increasing worldwide. Additionally, the growing number of complex surgical procedures, including cardiac, orthopedic, and transplant surgeries, has heightened the risk of perioperative bleeding. Human fibrinogen concentrates are widely used for rapid hemostatic control due to their effectiveness and ease of administration. Increasing clinical awareness and adoption of targeted coagulation therapies further support demand, positioning fibrinogen concentrates as essential treatments in both emergency and planned clinical settings.

81% of global hemostasis protocols integrated human fibrinogen concentrates fueled by rising fibrinogen deficiencies and surgical volumes boosting demand for rapid, life-saving hemostatic therapy.

-

Growing adoption of plasma-derived therapies in trauma, cardiac, and obstetric care is supporting market growth due to rapid hemostatic effectiveness

Plasma-derived fibrinogen concentrates are increasingly preferred in trauma, cardiovascular surgeries, and obstetric hemorrhage management due to their fast action and reliable clot stabilization. Compared to fresh frozen plasma or cryoprecipitate, fibrinogen concentrates offer standardized dosing, reduced infection risk, and quicker preparation. Hospitals and emergency care centers are integrating these products into bleeding management protocols to improve patient outcomes. The growing emphasis on patient blood management programs and evidence-based hemostatic treatment guidelines continues to accelerate the adoption of plasma-derived fibrinogen therapies across advanced healthcare systems.

79% of trauma, cardiac, and obstetric care units adopted plasma-derived therapies like fibrinogen concentrates driven by their rapid hemostatic efficacy and expanding clinical validation.

Human Fibrinogen Concentrate Market Restraints:

-

High treatment costs, limited reimbursement coverage, and complex plasma fractionation processes restrict widespread adoption of human fibrinogen concentrates in developing regions

Human fibrinogen concentrates involve costly plasma collection, purification, and quality assurance processes, resulting in high treatment prices. In many developing regions, limited reimbursement coverage and constrained healthcare budgets make these therapies less accessible. Hospitals often rely on lower-cost alternatives despite clinical advantages of fibrinogen concentrates. Additionally, the need for specialized manufacturing facilities and cold-chain storage increases operational expenses. These cost-related challenges limit adoption in price-sensitive markets and slow penetration in regions where healthcare infrastructure and insurance coverage remain underdeveloped.

72% of patients in developing regions lacked access to human fibrinogen concentrates due to high costs, limited reimbursement, and complex plasma fractionation restricting widespread clinical adoption.

-

Risks related to plasma supply shortages and stringent regulatory requirements create manufacturing challenges, increasing operational costs and limiting market expansion

The production of human fibrinogen concentrates depends heavily on the availability of high-quality plasma, which can be affected by donor shortages, regulatory restrictions, and supply disruptions. Stringent regulatory requirements governing plasma collection, testing, and fractionation add complexity and cost to manufacturing processes. Compliance with evolving safety standards requires continuous investment in technology and quality systems. These challenges can constrain production capacity, increase lead times, and limit the ability of manufacturers to scale operations efficiently, ultimately restraining market growth.

75% of human fibrinogen manufacturers faced elevated costs and supply constraints due to plasma shortages and strict regulations hampering scalability and market growth.

Human Fibrinogen Concentrate Market Opportunities:

-

Advancements in recombinant fibrinogen development and improved purification technologies present opportunities to enhance safety, scalability, and treatment availability

Technological progress in recombinant fibrinogen development offers promising alternatives to plasma-derived products, reducing dependency on human plasma sources. Improved purification and viral inactivation technologies enhance product safety, consistency, and shelf life. These advancements enable manufacturers to scale production more efficiently while meeting stringent regulatory standards. Recombinant approaches also reduce the risk of pathogen transmission and supply variability. Continued investment in research and development can expand treatment availability, support innovation, and open new therapeutic applications, creating long-term growth opportunities in the fibrinogen concentrate market.

80% of fibrinogen developers advanced recombinant platforms and purification tech boosting product safety, scalable manufacturing, and broader access to life-saving therapies for bleeding disorders.

-

Rising awareness of bleeding disorders and expanding healthcare infrastructure in emerging economies offer significant growth opportunities for human fibrinogen concentrate manufacturers

Awareness of rare bleeding disorders and trauma-related coagulopathies is increasing among healthcare professionals in emerging economies. Governments and private sectors are investing in healthcare infrastructure, improving access to advanced diagnostics and specialized treatments. Expanding hospital networks, emergency care facilities, and blood management programs are supporting adoption of fibrinogen concentrates. Educational initiatives and international clinical guidelines are further improving diagnosis and treatment rates. As healthcare systems modernize, manufacturers have significant opportunities to expand market presence and increase penetration in high-growth emerging regions.

78% of human fibrinogen concentrate manufacturers expanded into emerging markets leveraging growing awareness of bleeding disorders and strengthening healthcare infrastructure to drive global growth.

Human Fibrinogen Concentrate Market Segment Highlights

-

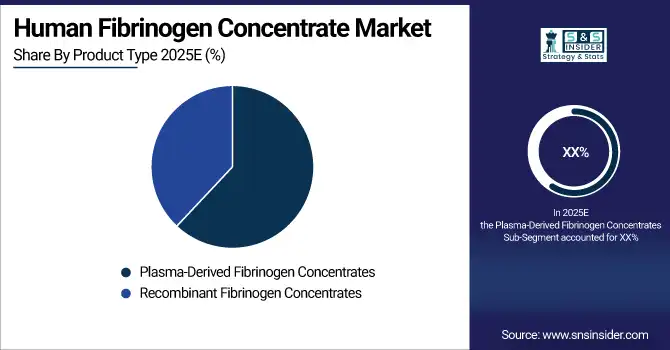

By Product Type: Plasma-Derived Fibrinogen Concentrates led, while Recombinant Fibrinogen Concentrates are the fastest-growing segment.

-

By Indication: Congenital Fibrinogen Deficiency led, while Trauma-Induced Hemorrhage is the fastest-growing segment.

-

By Application: Hemophilia Treatment led, while Emergency & Trauma Care is the fastest-growing segment.

-

By End User: Hospitals led, while Ambulatory Surgical Centers are the fastest-growing segment.

Human Fibrinogen Concentrate Market Segment Analysis

By Product Type: Plasma-Derived Fibrinogen Concentrates led, while Recombinant Fibrinogen Concentrates are the fastest-growing segment.

Plasma-derived fibrinogen concentrates dominate the market due to their long-standing clinical use, proven safety profile, and strong regulatory approval across major healthcare systems. These products are widely used in both congenital and acquired fibrinogen deficiencies and are preferred for emergency bleeding control because of their immediate availability and physician familiarity. Established plasma fractionation infrastructure, strong reimbursement support in developed markets, and broad hospital adoption further reinforce their leading position. Their effectiveness in managing surgical, obstetric, and trauma-related bleeding continues to sustain dominance.

Recombinant fibrinogen concentrates are the fastest-growing segment due to increasing focus on pathogen-free, plasma-independent therapies. Advancements in biotechnology, improved manufacturing scalability, and rising concerns over blood-borne infections are accelerating adoption. These products offer consistent purity, controlled dosing, and reduced reliance on donor plasma, making them attractive for long-term prophylaxis and pediatric use. Growing clinical trial success, expanding regulatory approvals, and increasing investment in recombinant therapies are driving rapid growth, particularly in regions strengthening advanced biologics infrastructure.

By Indication: Congenital Fibrinogen Deficiency led, while Trauma-Induced Hemorrhage is the fastest-growing segment.

Congenital fibrinogen deficiency dominates due to the lifelong need for replacement therapy and regular prophylactic treatment among affected patients. Early diagnosis, genetic screening programs, and established treatment protocols support consistent demand. Patients with inherited disorders often require repeated dosing during bleeding episodes, surgeries, and pregnancy, reinforcing sustained consumption. Strong awareness among hematologists and availability of approved fibrinogen concentrates further support dominance. Additionally, favorable reimbursement in developed healthcare systems ensures continued adoption, making congenital indications the largest contributor to overall market revenue.

Trauma-induced hemorrhage is the fastest-growing indication driven by rising incidence of road accidents, industrial injuries, and emergency surgical interventions globally. Rapid fibrinogen depletion in trauma patients has increased the use of fibrinogen concentrates in acute bleeding management protocols. Adoption is further supported by growing implementation of trauma care guidelines emphasizing early fibrinogen replacement. Expansion of emergency medical infrastructure, particularly in emerging economies, and increasing awareness among trauma surgeons are accelerating growth in this segment.

By Application: Hemophilia Treatment led, while Emergency & Trauma Care is the fastest-growing segment.

Hemophilia treatment dominates the application segment as fibrinogen concentrates are essential in managing bleeding episodes and surgical procedures in patients with coagulation disorders. The need for precise clot stabilization, regular monitoring, and prophylactic therapy ensures continuous demand. Established hemophilia treatment centers, strong clinician familiarity, and integration into standard care protocols support market leadership. Additionally, increasing life expectancy of hemophilia patients and expanding access to specialty care reinforce the sustained dominance of this application segment globally.

Emergency and trauma care is the fastest-growing application segment due to increasing emphasis on rapid hemostasis in critical bleeding scenarios. Hospitals are increasingly adopting fibrinogen concentrates as first-line therapy for massive bleeding protocols. Growth is supported by rising trauma admissions, improved emergency response systems, and expanding surgical capacity worldwide. The ability of fibrinogen concentrates to provide fast clot stabilization with predictable dosing makes them ideal for emergency use, driving strong uptake in both developed and emerging healthcare systems.

By End User: Hospitals led, while Ambulatory Surgical Centers are the fastest-growing segment.

Hospitals dominate the end-user segment due to their central role in managing complex surgeries, trauma cases, obstetric emergencies, and inherited bleeding disorders. Access to specialized hematology units, surgical facilities, and blood management programs enables high utilization of fibrinogen concentrates. Hospitals also benefit from established procurement systems, reimbursement coverage, and trained medical personnel. Their ability to deliver immediate treatment in critical care settings ensures sustained dominance, particularly in tertiary care and large multispecialty hospitals.

Ambulatory surgical centers are the fastest-growing end-user segment due to the shift toward minimally invasive procedures and same-day surgeries. Rising adoption of outpatient orthopedic, cardiac, and gynecological procedures has increased the need for efficient bleeding management solutions. Improved access to fibrinogen concentrates, cost efficiency, and shorter patient recovery times are supporting growth. Expansion of ambulatory care infrastructure, especially in developed markets, and increasing preference for outpatient treatment models are driving rapid adoption in this segment.

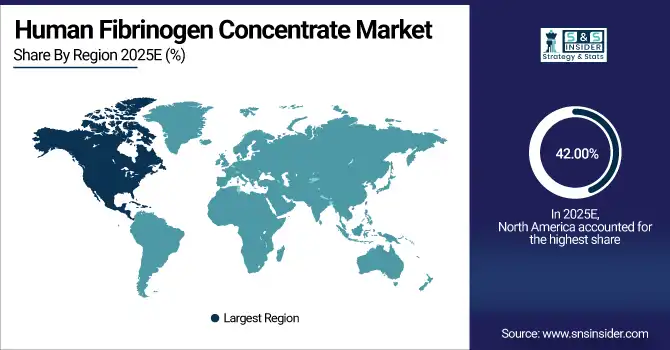

Human Fibrinogen Concentrate Market Regional Analysis

North America Human Fibrinogen Concentrate Market Insights:

North America dominated the Human Fibrinogen Concentrate Market with a 42.00% share in 2025 due to advanced healthcare infrastructure, high diagnosis rates of bleeding disorders, and strong adoption of plasma-derived therapies. Favorable reimbursement policies, well-established blood collection networks, and the presence of leading manufacturers further supported widespread clinical use across hospitals and specialty treatment centers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Human Fibrinogen Concentrate Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 11.81% from 2026–2033, driven by improving healthcare access, rising awareness of congenital and acquired bleeding disorders, and increasing surgical volumes. Expanding plasma collection programs, growing investments in healthcare infrastructure, and wider availability of fibrinogen concentrates are accelerating regional market growth.

Europe Human Fibrinogen Concentrate Market Insights

Europe held a significant share in the Human Fibrinogen Concentrate Market in 2025, supported by strong public healthcare systems, well-established plasma collection infrastructure, and increasing adoption of fibrinogen concentrates in surgical, trauma, and congenital bleeding disorder management. Strict regulatory oversight and rising focus on patient safety further reinforced steady market demand across the region.

Middle East & Africa and Latin America Human Fibrinogen Concentrate Market Insights

The Middle East & Africa and Latin America together showed moderate growth in the Human Fibrinogen Concentrate Market in 2025, driven by improving healthcare infrastructure, rising awareness of bleeding disorders, and expanding access to advanced hemostatic therapies. Increasing investments in hospital modernization, gradual expansion of plasma collection capabilities, and growing surgical procedures supported market development across these regions.

Human Fibrinogen Concentrate Market Competitive Landscape:

CSL Behring

CSL Behring is a global leader in plasma-derived therapies, including human fibrinogen concentrates. The company focuses on developing innovative, safe, and high-quality products for treating bleeding disorders such as congenital and acquired fibrinogen deficiencies. With a strong research and development pipeline, CSL Behring emphasizes clinical efficacy, safety, and accessibility. Its global presence spans over 60 countries, providing life-saving therapies to patients worldwide, while consistently investing in technology and production capabilities to meet growing demand for fibrinogen replacement therapies.

-

March 2024, CSL Behring received FDA approval for RiaSTAP Liquid, the first ready-to-use liquid formulation of human fibrinogen concentrate in the U.S., eliminating the need for reconstitution.

Octapharma AG

Octapharma AG, headquartered in Switzerland, specializes in human protein therapies derived from plasma and recombinant technologies. The company produces high-purity fibrinogen concentrates for patients with congenital or acquired deficiencies and bleeding disorders. Octapharma emphasizes research-driven innovation, safety, and global accessibility, serving hospitals and treatment centers worldwide. By integrating advanced plasma collection and purification techniques, the company ensures consistent product quality. Its commitment to improving patient outcomes has made Octapharma a recognized leader in the global fibrinogen therapeutics market.

-

November 2023, Octapharma announced EMA approval to expand the indication for Fibryga (human fibrinogen concentrate) to include treatment of acquired hypofibrinogenemia in postpartum hemorrhage (PPH).

LFB Group

LFB Group, based in France, is a biopharmaceutical company focused on plasma-derived and recombinant therapies, including fibrinogen concentrates. The company develops and manufactures products to treat rare bleeding disorders, emphasizing quality, safety, and clinical efficacy. LFB invests in R&D, advanced manufacturing technologies, and global distribution to ensure reliable access to life-saving therapies. With a strong presence in Europe and expanding international operations, LFB plays a significant role in improving patient care for individuals suffering from fibrinogen deficiencies and other hemostatic disorders.

-

January 2025, LFB Group launched an optimized formulation of Fibrinogène LFB, featuring improved solubility that reduces reconstitution time to <3 minutes while maintaining high specific activity (>85% monomeric fibrinogen).

Human Fibrinogen Concentrate Market Key Players

Some of the Human Fibrinogen Concentrate Market Companies are:

-

CSL Behring

-

Octapharma AG

-

LFB Group

-

Grifols S.A.

-

Shanghai RAAS Blood Products Co., Ltd.

-

Hualan Biological Engineering Inc.

-

Harbin Pacific Biopharmaceutical Co., Ltd.

-

Green Cross Corporation

-

Shanghai XinXing Medical

-

Jiangxi Boya Bio-Pharmaceutical Co., Ltd.

-

Baxter International Inc.

-

Kedrion Biopharma Inc.

-

Biotest AG

-

Sanquin Blood Supply Foundation

-

China Biologic Products Holdings, Inc.

-

BPL (Bio Products Laboratory)

-

Kamada Ltd.

-

ProMetic Life Sciences Inc.

-

Beijing Tiantan Biological Products Co., Ltd.

-

Scripps Laboratories.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.16 Billion |

| Market Size by 2033 | USD 2.36 Billion |

| CAGR | CAGR of 9.37% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Plasma-Derived Fibrinogen Concentrates, Recombinant Fibrinogen Concentrates) • By Indication (Congenital Fibrinogen Deficiency, Acquired Fibrinogen Deficiency, Surgical Bleeding, Trauma-Induced Hemorrhage, Postpartum Hemorrhage) • By Application (Hemophilia Treatment, Cardiac Surgery, Orthopedic Surgery, Emergency & Trauma Care, Obstetric Procedures) • By End User (Hospitals, Specialty Clinics, Blood Banks, Ambulatory Surgical Centers, Research & Academic Institutes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CSL Behring, Octapharma AG, LFB Group, Grifols S.A., Shanghai RAAS Blood Products Co., Ltd., Hualan Biological Engineering Inc., Harbin Pacific Biopharmaceutical Co., Ltd., Green Cross Corporation, Shanghai XinXing Medical, Jiangxi Boya Bio-Pharmaceutical Co., Ltd., Baxter International Inc., Kedrion Biopharma Inc., Biotest AG, Sanquin Blood Supply Foundation, China Biologic Products Holdings, Inc., BPL (Bio Products Laboratory), Kamada Ltd., ProMetic Life Sciences Inc., Beijing Tiantan Biological Products Co., Ltd., Scripps Laboratories. |