Industrial Maintenance Services Market Report Scope & Overview:

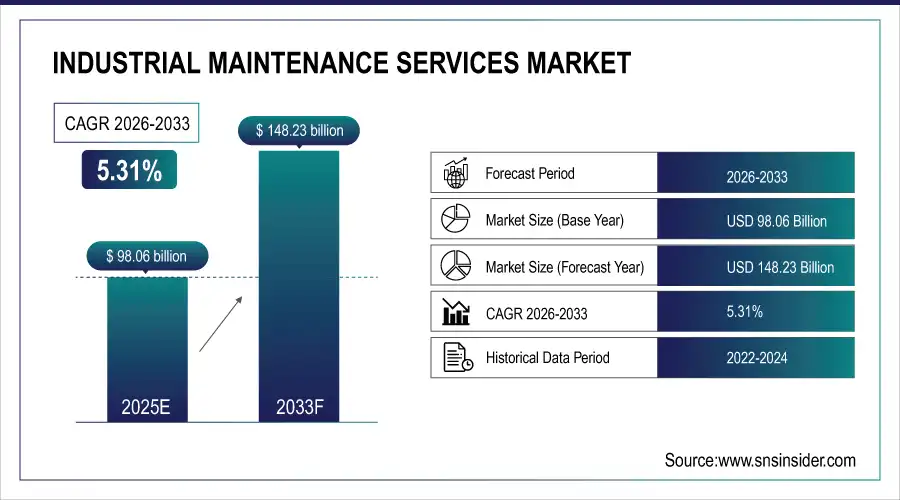

The Industrial Maintenance Services Market size is valued at USD 98.06 Billion in 2025E and is expected to reach USD 148.23 Billion by 2033 and grow at a CAGR of 5.31% over the forecast period 2026-2033.

The Industrial Maintenance Services Market analysis, driven by the growing need to reduce unplanned downtime, extend equipment life, and improve operational efficiency across manufacturing and process industries. Increasing industrial automation, aging infrastructure in developed economies, and strict safety and regulatory compliance requirements are accelerating demand for regular maintenance services.

According to study, Unplanned downtime reduction initiatives account for 30–35% of total industrial maintenance service demand, as industries prioritize asset uptime and cost control.

Market Size and Forecast:

-

Market Size in 2025: USD 98.06 Billion

-

Market Size by 2033: USD 148.23 Billion

-

CAGR: 5.31% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Industrial Maintenance Services Market - Request Free Sample Report

Industrial Maintenance Services Market Trends:

-

Increasing adoption of predictive maintenance to minimize unplanned downtime.

-

Integration of IoT and AI enhances equipment monitoring and operational efficiency.

-

Shift from reactive to condition-based maintenance models across industrial sectors.

-

Growing outsourcing of maintenance services to specialized providers for cost efficiency.

-

Rapid digitalization in emerging economies fuels demand for advanced maintenance solutions.

-

Investment in preventive maintenance extends machinery lifespan and reduces production losses.

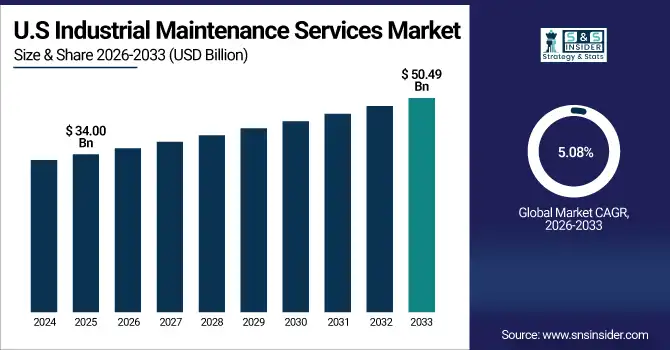

The U.S. Industrial Maintenance Services Market size is USD 34.00 Billion in 2025E and is expected to reach USD 50.49 Billion by 2033, growing at a CAGR of 5.08% over the forecast period of 2026-2033,

The U.S. industrial maintenance services market is experiencing rapid growth due to advanced manufacturing, aging infrastructure, and increased automation adoption. Rising use of predictive maintenance powered by IoT and AI, along with outsourcing of specialized maintenance services, enhances operational efficiency and minimizes downtime across automotive, aerospace, energy, and industrial sectors.

Industrial Maintenance Services Market Growth Drivers:

-

Rising Need to Minimize Unplanned Downtime and Improve Asset Reliability

The industrial maintenance services market is strongly driven by the increasing focus on minimizing unplanned downtime and maximizing equipment uptime across manufacturing and process industries. Unexpected equipment failures can lead to significant production losses, safety risks, and higher operational costs. As a result, industries are investing in preventive and predictive maintenance services to ensure asset reliability, extend machinery lifespan, and maintain continuous operations, especially in capital-intensive sectors such as oil & gas, chemicals, and general manufacturing.

Maintenance-related costs represent nearly 15–20% of total operational expenditure in sectors such as oil & gas, chemicals, and heavy manufacturing.

Industrial Maintenance Services Market Restraints:

-

High Cost of Advanced Maintenance Technologies and Skilled Workforce

A key restraint for the industrial maintenance services market is the high cost associated with advanced maintenance solutions and the shortage of skilled professionals. Technologies such as AI-driven predictive maintenance, IoT sensors, and data analytics platforms require substantial upfront investment and technical expertise. Small and medium-sized enterprises often struggle to adopt these solutions due to budget constraints, limited digital infrastructure, and difficulties in training or hiring specialized maintenance personnel.

Industrial Maintenance Services Market Opportunities:

-

Growing Adoption of Predictive and Digital Maintenance Solutions

The increasing adoption of predictive and digital maintenance solutions presents a significant growth opportunity for the market. Advancements in IoT, AI, and real-time monitoring systems allow industries to shift from reactive to condition-based maintenance models. These solutions help reduce maintenance costs, prevent unexpected breakdowns, and improve operational efficiency. Rapid digitalization in emerging economies and growing acceptance of outsourced smart maintenance services further enhance long-term market opportunities.

Condition-based maintenance can reduce overall maintenance costs by approximately 20–30%, encouraging faster adoption across asset-intensive industries.

Industrial Maintenance Services Market Segmentation Analysis:

-

By Type: In 2025, Preventive Maintenance led the market with a share of 42.50%, while Predictive Maintenance is the fastest-growing segment with a CAGR of 7.50%.

-

By Location: In 2025, Onshore maintenance dominated the market with a share of around 81.30%, while Offshore maintenance is the fastest-growing segment with a CAGR of 6.86%.

-

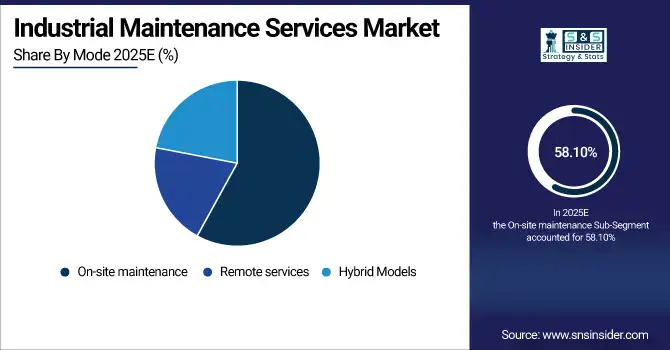

By Mode: In 2025, On-site maintenance led the market with a share of 58.10%, while Hybrid Models are the fastest-growing segment with a CAGR of 6.25%.

-

By End Use: In 2025, General Manufacturing led the market with a share of 32.60%, while Aerospace & Defense is the fastest-growing segment with a CAGR of 6.80%.

By Type, Preventive Maintenance Leads Market While Predictive Maintenance Records Fastest Growth

Preventive maintenance dominates the market due to its cost-effectiveness and ability to reduce unexpected equipment failures through scheduled inspections and routine servicing. Industries prefer preventive approaches to ensure operational continuity and asset longevity. It is widely implemented across manufacturing, oil & gas, chemicals, and general industrial sectors to maintain machinery reliability and avoid costly production downtime.

Predictive maintenance is the fastest-growing type, driven by IoT sensors, AI, and data analytics that enable real-time condition monitoring and early fault detection. This approach reduces downtime and maintenance costs while improving operational efficiency. Increasing adoption in capital-intensive industries and smart factories is accelerating the shift from reactive to predictive maintenance models.

By Location, Onshore Maintenance Leads Market While Offshore Maintenance

Onshore maintenance dominates the market as most industrial facilities, manufacturing plants, and processing units are land-based. Routine inspections, easy accessibility, and lower operational complexity support its dominance. Industries rely on onshore services for continuous operations, regulatory compliance, and equipment reliability across heavy manufacturing, oil & gas, and chemical processing sectors.

Offshore maintenance is the fastest-growing segment due to rising offshore oil & gas exploration, wind farms, and marine infrastructure projects. Specialized, high-value maintenance services are critical in these environments to ensure safety and uninterrupted operations. Remote monitoring and advanced service techniques are driving the rapid adoption of offshore maintenance solutions.

By Mode, On-site Maintenance Leads Market While Hybrid Models Witness Fastest Growth

On-site maintenance leads the marekt due to physical inspections, immediate repairs, and hands-on servicing are essential for heavy machinery and complex industrial systems. Industries depend on on-site teams for quick response, compliance, and minimizing operational disruptions, especially in sectors like manufacturing, energy, and chemicals.

Hybrid maintenance models are the fastest-growing segment, combining on-site expertise with remote monitoring and diagnostics. This approach optimizes maintenance schedules, reduces downtime, and lowers costs by leveraging digital technologies. Its adoption is rising in advanced manufacturing, smart factories, and large-scale industrial setups requiring both immediate and data-driven maintenance interventions.

By End Use, General Manufacturing Leads Market While Aerospace & Defense Registers Fastest Growth

General manufacturing dominates the market due to its broad equipment base, continuous production cycles, and high dependency on machinery reliability. Regular maintenance ensures operational continuity and avoids costly production losses across various manufacturing verticals, including automotive, machinery, and electronics.

Aerospace & defense is the fastest-growing segment, driven by stringent safety standards, rising aircraft production, and demand for precision maintenance. Advanced inspection, compliance-driven servicing, and adoption of predictive maintenance solutions are fueling growth in this high-value, specialized sector.

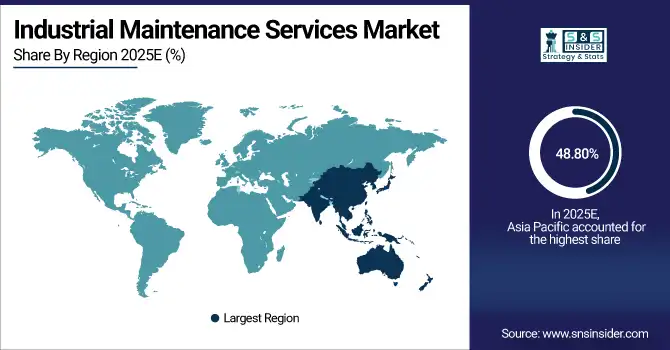

Industrial Maintenance Services Market Regional Analysis:

Asia Pacific Industrial Maintenance Services Market Insights:

The Asia Pacific dominated the Industrial Maintenance Services Market in 2025E, with over 48.80% revenue share, due to rapid industrialization, expanding manufacturing bases, and increasing infrastructure investments in countries like China, India, and Japan. The presence of large-scale manufacturing plants, chemical processing units, and automotive industries drives high demand for preventive and predictive maintenance services. Additionally, government initiatives supporting industrial growth, smart factories, and automation adoption further boost market penetration, making the region the largest contributor to industrial maintenance services revenue.

Get Customized Report as per Your Business Requirement - Enquiry Now

China and India Industrial Maintenance Services Market Insights

China and India dominate industrial fastener demand due to rapid industrialization, expanding manufacturing sectors, and growing adoption of smart factories. Increasing investments in preventive and predictive maintenance solutions accelerate market growth.

North America Industrial Maintenance Services Market Insights:

The North America region is expected to have the fastest-growing CAGR 6.84%, driven by increasing investments in advanced manufacturing, renewable energy, and digital industrial solutions. The adoption of predictive and condition-based maintenance through IoT, AI, and data analytics enables industries to optimize operations and reduce downtime. Aging industrial infrastructure, stringent safety regulations, and outsourcing of maintenance services to specialized providers further accelerate market growth, particularly in the United States and Canada, positioning the region as a hub for innovative maintenance technologies.

U.S and Canada Industrial Maintenance Services Market Insights

The U.S. and Canada show fast-growing adoption due to advanced automation, aging infrastructure, and outsourcing of maintenance services. Integration of IoT and AI-based predictive solutions further drives market expansion.

Europe Industrial Maintenance Services Market Insights

Europe maintains steady growth in the industrial maintenance services market, supported by a mature industrial base, high adoption of automation, and stringent regulatory compliance requirements. Germany, France, and the UK are leading contributors, particularly in automotive, aerospace, and chemical sectors. The focus on predictive maintenance, energy-efficient solutions, and sustainability initiatives drives demand for specialized services. Europe also benefits from technological advancements and skilled maintenance professionals, ensuring reliable operations across various industrial verticals.

Germany and U.K. Industrial Maintenance Services Market Insights

Germany and the U.K. demonstrate steady growth with a mature industrial base, high automation adoption, and strict regulatory standards. Demand for specialized maintenance services in automotive, aerospace, and chemical industries supports market development.

Latin America (LATAM) and Middle East & Africa (MEA) Industrial Maintenance Services Market Insights

Latin America and the Middle East & Africa markets are growing steadily, driven by industrialization, manufacturing expansion, and key sectors such as oil & gas, energy, and automotive. Countries like Brazil, Mexico, Saudi Arabia, UAE, and South Africa are investing in industrial infrastructure and preventive maintenance to ensure operational continuity. While limited adoption of advanced maintenance technologies and workforce skill gaps pose challenges, the regions offer significant opportunities for predictive and digital maintenance solutions, outsourcing services, and improving overall operational efficiency.

Industrial Maintenance Services Market Competitive Landscape:

Schneider Electric SE delivers industrial maintenance services with a strong focus on energy management, digital solutions, and operational efficiency. Through initiatives like EcoConsult, it helps industries optimize asset performance, reduce maintenance costs, and implement sustainable practices. The company combines preventive and predictive maintenance strategies with IoT-based monitoring systems, targeting manufacturing, energy, and infrastructure sectors. Schneider’s expertise in digitalization and consulting positions it as a key contributor to growth in the industrial maintenance services market.

-

In February 2025, Schneider Electric launched EcoConsult in India, offering consulting services to improve asset performance and reduce operational costs. The initiative also helps industries implement energy-efficient and digital maintenance strategies, boosting long-term operational reliability.

Rockwell Automation is a major player in industrial maintenance services, offering comprehensive automation, control, and cybersecurity solutions. Its Security Monitoring and Response service provides 24/7 operational technology protection, ensuring system resilience and reducing unplanned downtime. The company emphasizes smart manufacturing, digital maintenance, and data-driven operations to enhance asset performance. Rockwell’s innovative solutions and presence strengthen its market position, catering to sectors such as manufacturing, automotive, energy, and critical infrastructure.

-

In April 2024, Rockwell launched Security Monitoring and Response, a 24/7 managed service for operational technology cyber protection and resilience. This service strengthens industrial cybersecurity, minimizing downtime risks and safeguarding critical manufacturing and automation systems.

Siemens AG is a leading provider of industrial maintenance solutions, leveraging digitalization, IoT, and AI technologies to optimize equipment reliability and operational efficiency. Its Industrial Copilot platform enables predictive maintenance, real-time monitoring, and data-driven decision-making across manufacturing, energy, and process industries. Siemens focuses on integrating automation with advanced analytics, helping clients reduce downtime, extend asset life, and enhance productivity, positioning the company as a key innovator in the maintenance services market.

-

In March 2025, Siemens launched its Industrial Copilot with generative AI‑powered predictive maintenance capabilities, enhancing repair prediction and optimization across maintenance cycles. The platform also integrates real-time analytics to improve decision-making and reduce maintenance costs significantly.

Industrial Maintenance Services Market Key Players:

Some of the industrial maintenance services market companies are:

-

Siemens AG

-

ABB Ltd.

-

Schneider Electric SE

-

Honeywell International Inc.

-

Emerson Electric Co.

-

Rockwell Automation, Inc.

-

Mitsubishi Electric Corporation

-

General Electric Company

-

SKF Group

-

Parker-Hannifin Corporation

-

Metso Outotec

-

Wärtsilä Corporation

-

Flowserve Corporation

-

Petrofac Limited

-

Bilfinger SE

-

Advanced Technology Services, Inc.

-

Caverion Corporation

-

Global Electronic Services, Inc.

-

Lee Industrial Contracting

-

Marshall Industrial Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 98.06 Billion |

| Market Size by 2033 | USD 148.23 Billion |

| CAGR | CAGR of 5.31% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Preventive Maintenance, Predictive Maintenance, Shutdown / Turnaround Management) •By Locations (On shore, Off shore) •By Mode (On-site Maintenance, Remote Services, Hybrid Models) •By End Use (Oil & Gas, Automotive, Aerospace & Defense, Chemicals, Food & Beverage, Pharmaceutical, General Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens AG, ABB Ltd., Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Rockwell Automation, Inc., Mitsubishi Electric Corporation, General Electric Company, SKF Group, Parker-Hannifin Corporation, Metso Outotec, Wärtsilä Corporation, Flowserve Corporation, Petrofac Limited, Bilfinger SE, Advanced Technology Services, Inc., Caverion Corporation, Global Electronic Services, Inc., Lee Industrial Contracting, and Marshall Industrial Technologies |