Insulation Market Report Scope & Overview:

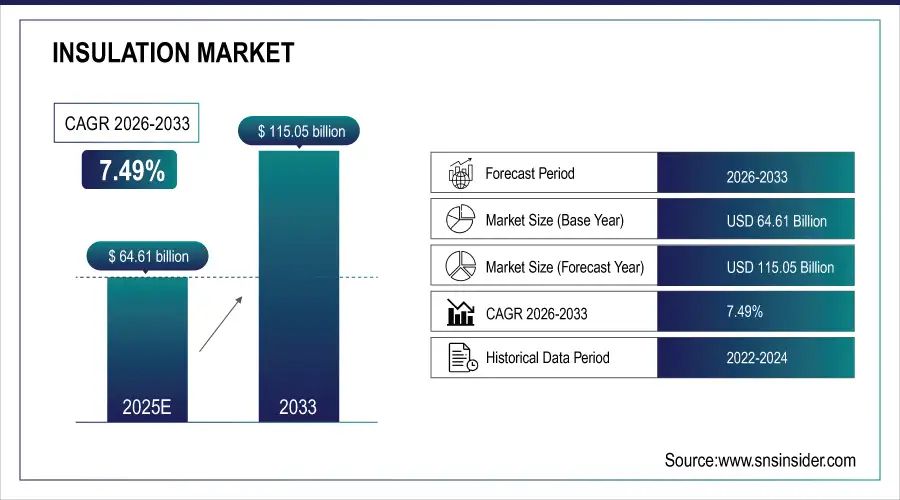

The Insulation Market Size is valued at USD 64.61 Billion in 2025E and is expected to reach USD 115.05 Billion by 2033 and grow at a CAGR of 7.49% over the forecast period 2026-2033.

The insulation market analysis, due to global push for energy efficiency and sustainable construction. As buildings residential, commercial, and industrial contribute a large share of energy consumption, better insulation reduces heating and cooling needs, lowering energy bills and carbon emissions. Stricter building codes and regulations around thermal performance and green‑building standards in many countries are compelling builders and developers to use modern insulation materials.

According to study, Insulation adoption can reduce heating and cooling energy demand by up to 30–35% in residential and commercial buildings.

Market Size and Forecast:

-

Market Size in 2025: USD 64.61 Billion

-

Market Size by 2033: USD 115.05 Billion

-

CAGR: 7.49% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Insulation Market - Request Free Sample Report

Insulation Market Trends:

-

Growing adoption of thermal insulation in residential and commercial construction projects.

-

Acoustic insulation increasingly used in urban buildings and industrial facilities worldwide.

-

Rise of eco-friendly materials like aerogels and recycled insulation solutions.

-

Automotive and industrial sectors leveraging insulation for energy efficiency and noise reduction.

-

Government incentives for energy-efficient buildings boosting insulation material penetration.

-

Smart insulation solutions integrated with IoT and building management systems emerging.

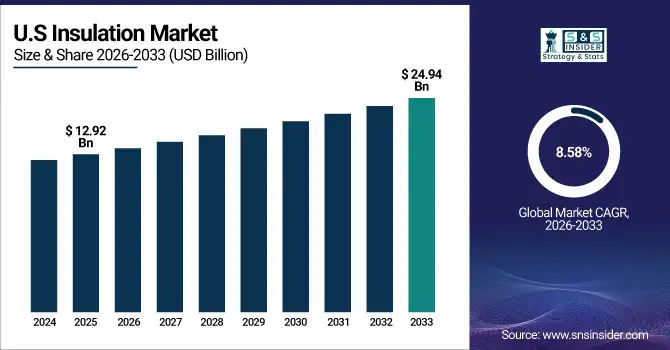

The U.S. Insulation Market size is USD 12.92 Billion in 2025E and is expected to reach USD 24.94 Billion by 2033, growing at a CAGR of 8.58% over the forecast period of 2026-2033,

The U.S. insulation market grows strongly due to strict energy-efficiency regulations, large-scale building retrofits, and rising demand for sustainable construction materials. Increasing adoption of spray foam, fiberglass, and mineral wool, combined with modernization of HVAC systems and expanding residential renovation activities, continues to drive significant market expansion nationwide.

Insulation Market Growth Drivers:

-

Rising Demand for Energy Efficiency in Residential and Commercial Buildings

A major driver for the insulation market growth is the growing focus on energy efficiency and sustainable building practices across the globe. Governments are implementing strict building codes and regulations to reduce energy consumption and carbon emissions, encouraging the use of thermal, acoustic, and electrical insulation materials. Residential, commercial, and industrial sectors are increasingly adopting insulation solutions to improve heating and cooling efficiency, reduce energy bills, and enhance occupant comfort.

Thermal and acoustic insulation account for nearly 70% of total energy-efficient building material usage.

Insulation Market Restraints:

-

High raw material costs and price volatility limit insulation adoption worldwide.

A major restraint for the market is the fluctuating cost of raw materials, such as fiberglass, mineral wool, polyurethane, and polystyrene, which directly impacts the production cost of insulation products. Volatility in oil, gas, and chemical prices can make insulation solutions expensive, particularly for high-performance materials. Additionally, small-scale manufacturers and contractors in developing regions often struggle to absorb these cost fluctuations, limiting adoption. Price-sensitive end users may opt for lower-quality or alternative materials, which can affect market penetration, especially in emerging economies where cost constraints are a significant barrier.

Insulation Market Opportunities:

-

Advanced, eco-friendly insulation technologies offer significant growth opportunities globally.

A major opportunity lies in the development and adoption of eco-friendly, high-performance, and smart insulation solutions. Innovations such as vacuum insulated panels, aerogels, phase-change materials, and recycled insulation products are gaining traction due to their superior thermal efficiency, lightweight nature, and lower environmental impact. Governments are offering incentives and subsidies for energy-efficient building materials, while the industrial and automotive sectors are increasingly using insulation for process efficiency and noise reduction. The rising construction activities in emerging markets, coupled with increasing demand for green buildings and sustainable industrial operations, present significant opportunities for manufacturers and suppliers in the global insulation market.

Government incentives and subsidies cover nearly 20–25% of energy-efficient insulation installation costs in developed regions.

Insulation Market Segmentation Analysis:

-

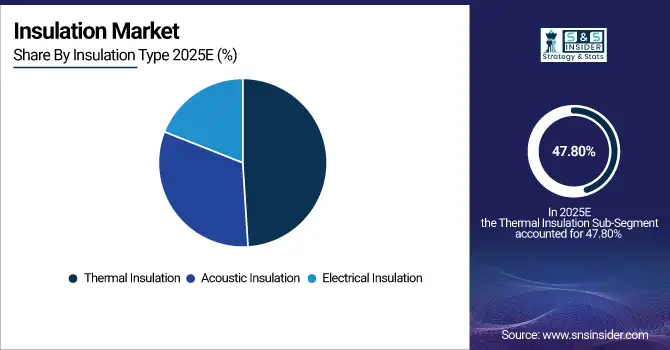

By Insulation Type: In 2025, Thermal Insulation led the market with a share of 47.80%, while Acoustic Insulation is the fastest-growing segment with a CAGR of 9.20%.

-

By Form: In 2025, Foam led the market with a share of 32.40%, while Spray Foam is the fastest-growing segment with a CAGR of 8.95%.

-

By Material Type: In 2025, Polyurethane led the market with a share of 41.60%, while Aerogel is the fastest-growing segment with a CAGR of 10.50%.

-

By End User: In 2025, Building & Construction dominated with a share of 52.10%, while Transportation is the fastest-growing end-user segment with a CAGR of 8.80%.

By Insulation Type, Thermal Insulation Lead Market and Acoustic Insulation Fastest Growth

In 2025, Thermal insulation dominates the market due to of its essential role in maintaining energy efficiency across residential, commercial, and industrial buildings. Its use in walls, roofs, and HVAC systems continues to grow as global regulations push for better energy conservation.

Meanwhile, Acoustic insulation is the fastest-growing segment, driven by rising urbanization, noise pollution concerns, and increasing demand for soundproofing in offices, transportation, and residential complexes. Enhanced consumer awareness and stricter building codes are accelerating adoption.

By Form, Foam Leads Market and Spray Fastest Growth

In 2025, Foam segment dominates the market due to its superior thermal resistance, moisture control, and suitability for a wide range of applications including building envelopes, HVAC systems, and industrial equipment. Its lightweight and durable structure make it a preferred choice in large-scale construction projects.

Meanwhile, Spray is the fastest-growing segment, supported by its excellent air-sealing properties, flexibility, and quick installation. The segment is expanding rapidly in retrofitting projects and green buildings, where high-efficiency solutions are increasingly prioritized.

By Material Type, Polyurethane Lead Market and Aerogel Fastest Growth

In 2025, Polyurethane segment dominates the market, favored for its outstanding thermal performance, versatility, and compatibility with foam and spray applications. It supports stringent energy-efficiency standards in construction and industrial sectors.

Meanwhile, Aerogel is the fastest-growing segment, driven by its ultra-high insulation capability, lightweight nature, and expanding use in aerospace, oil & gas, and high-performance building applications. As costs gradually decline, aerogel adoption is accelerating across premium energy-efficient projects.

By End User, Building & Construction Leads Market and Transportation Fastest Growth

In 2025, Building and construction dominate the insulation market, as insulation remains essential for improving energy efficiency, regulating indoor temperatures, and meeting stricter green building codes. Demand continues to rise across residential, commercial, and industrial construction activities.

Meanwhile, Transportation is the fastest-growing segment, fueled by the need for lightweight, thermally efficient insulation in electric vehicles, aircraft, and rail systems. The shift toward energy-efficient mobility and advanced vehicle design is significantly driving this growth.

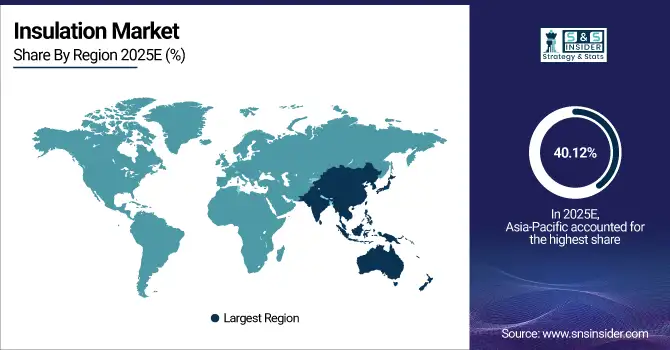

Insulation Market Regional Analysis:

Asia-Pacific Insulation Market Insights:

The Asia-Pacific dominated the Insulation Market in 2025E, with over 40.12% revenue share, due to rapid urbanization, large-scale construction activities, and expanding industrial sectors across China, India, and Southeast Asia. Strong government initiatives promoting energy-efficient buildings and sustainable manufacturing further strengthen demand. The region also benefits from extensive production capabilities, competitive raw material availability, and accelerated infrastructure development. Rising residential construction and adoption of green building standards continue to elevate insulation usage across HVAC systems, industrial facilities, and commercial complexes. Increasing investments in smart cities and renewable energy projects further reinforce the region’s leading market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

China and India Insulation Market Insights

China and India drive strong insulation market growth due to rapid urbanization, large construction volumes, and expanding industrial sectors. Government policies promoting energy-efficient buildings and green infrastructure further accelerate adoption. Rising residential demand, smart city projects, and modernization of commercial spaces strengthen market expansion in both countries.

North America Insulation Market Insights:

The North America region is expected to have the fastest-growing CAGR 8.63%, driven by stringent energy-efficiency regulations, advanced construction practices, and widespread building retrofitting activities. The U.S. and Canada emphasize sustainable infrastructure and carbon reduction targets, boosting demand across residential, commercial, and industrial applications. High penetration of premium insulation materials such as spray foam, fiberglass, and mineral wool supports continued growth. Increasing industrial expansion, modernization of HVAC systems, and rising awareness of thermal and acoustic comfort further accelerate adoption. Government incentives for green buildings and energy-efficient upgrades strengthen North America’s rapid market expansion.

U.S. and Canada Insulation Market Insights

The U.S. and Canada experience rising insulation demand driven by strict energy-efficiency regulations, retrofitting of aging buildings, and increased focus on sustainable construction. Growing use of advanced materials, modernization of HVAC systems, and strong residential renovation activity further boost market growth across both countries.

Europe Insulation Market Insights

Europe maintains steady insulation market growth fueled by strict energy-efficiency directives, especially under EU climate and building performance regulations. Countries such as Germany, France, and the U.K. prioritize green construction, low-emission buildings, and renovation of aging structures. Strong awareness of thermal efficiency and soundproofing requirements enhances demand across residential and commercial environments. The region also leads in sustainable insulation materials, including mineral wool and eco-friendly alternatives. Ongoing industrial modernization and emphasis on achieving net-zero energy goals continue to support robust adoption across multiple end-use sectors.

Germany and U.K. Insulation Market Insights

The Germany and the U.K. maintain strong insulation markets supported by stringent EU and national energy-efficiency regulations. High renovation rates, widespread adoption of green building standards, and emphasis on reducing heating energy consumption drive demand.

Latin America (LATAM) and Middle East & Africa (MEA) Insulation Market Insights

Latin America and the Middle East show steady growth in the insulation market, driven by expanding construction, infrastructure development, and rising industrial activity. In Latin America, increasing urbanization, modernized building structures, and greater awareness of energy conservation support adoption across residential, commercial, and industrial spaces. In the Middle East, extreme climatic conditions, large-scale infrastructure projects, and strong investments in commercial complexes and petrochemical industries fuel demand for high-performance insulation. Both regions benefit from growing sustainability initiatives and the need for energy-efficient buildings, enhancing long-term market potential.

Insulation Market Competitive Landscape:

BASF is a leading global chemicals company offering high-performance insulation materials such as polyurethane (PU), polystyrene (EPS, XPS), and advanced foam solutions. Its insulation products are widely used in construction, automotive, and industrial applications to improve energy efficiency and reduce carbon emissions. BASF focuses on sustainable materials, lightweight solutions, and innovative thermal insulation technologies. With strong R&D, global presence, and a broad product portfolio, BASF plays a key role in driving energy-efficient building solutions and supporting green construction trends.

-

In January2025, BASF unveiled a “bio-based” variant of its insulation material (Neopor), aiming to reduce embodied carbon and meet rising demand for greener building materials.

Owens Corning is a global leader in insulation materials, offering fiberglass, mineral wool, and foam products for residential, commercial, and industrial applications. The company focuses on enhancing energy efficiency, acoustic performance, and building durability through advanced insulation technologies. Owens Corning promotes sustainability through recycled content, low environmental impact materials, and high-performance building solutions. With extensive distribution, strong brand presence, and continuous innovation, it remains one of the most influential players shaping the global insulation market.

-

In March2024, Owens Corning launched a new extruded polystyrene product line “FOAMULAR NGX” with reduced global-warming potential, aligning with stricter sustainability and environmental standards.

Covestro AG is a major producer of high-quality polyurethanes and polyisocyanates used in rigid foam insulation for buildings, appliances, and industrial systems. The company emphasizes energy-efficient, durable, and sustainable insulation materials that help reduce energy consumption and enhance thermal performance. Covestro invests in bio-based and circular economy solutions, developing next-generation insulating materials that meet stringent environmental standards. Its strong global manufacturing capabilities and innovation-driven approach position it as a key contributor in the global insulation market.

-

In July 2024, Covestro AG ntroduced a low-carbon MDI used in producing rigid polyurethane-foam insulation for sustainable construction.

Insulation Market Key Players:

Some of the Insulation Market Companies are:

-

GAF Materials Corporation

-

Huntsman International LLC

-

Johns Manville

-

Cellofoam North America, Inc.

-

Rockwool International A/S

-

DuPont

-

Atlas Roofing Corporation

-

Saint-Gobain S.A.

-

Kingspan Group

-

BASF

-

Knauf Insulation

-

Armacell International Holding GmbH

-

URSA

-

Covestro AG

-

Recticel NV/SA

-

Carlisle Companies, Inc.

-

Bridgestone Corporation

-

Fletcher Building

-

3M Company

-

Owens Corning

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 64.61 Billion |

| Market Size by 2033 | USD 115.05 Billion |

| CAGR | CAGR of 7.49% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Insulation Type (Thermal Insulation, Acoustic Insulation, Electrical Insulation) •By Form (Blanket, Board, Foam, Batt, Loose Fill, Spray) •By Material Type (Glass Wool, Mineral Wool, Expanded Polystyrene (EPS), Extruded Polystyrene Foam Insulation (XPS), Calcium-Magnesium-Silicate (CMS) Fibers, Calcium Silicate, Polyurethane, Aerogel, Others – Cellulose, Phenolic Foam, etc.) •By End User (Building & Construction, HVAC & OEM, Transportation, Appliances, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | GAF Materials Corporation, Huntsman International LLC, Johns Manville, Cellofoam North America Inc., Rockwool International A/S, DuPont, Atlas Roofing Corporation, Saint-Gobain S.A., Kingspan Group, BASF, Knauf Insulation, Armacell International Holding GmbH, URSA, Covestro AG, Recticel NV/SA, Carlisle Companies Inc., Bridgestone Corporation, Fletcher Building, 3M Company, and Owens Corning |