Life Sciences BPO Market Report Scope & Overview:

The Life Sciences BPO Market Size is valued at USD 497.12 Billion in 2025E and is expected to reach USD 963.12 Billion by 2033 and grow at a CAGR of 8.62% over the forecast period 2026-2033.

The Life Sciences BPO Market analysis, due to pharmaceutical, biotechnology, and medical-device companies are under increasing pressure to reduce costs and speed up the time-to-market for new products. Outsourcing non-core but essential functions such as clinical-trial management, regulatory compliance, data management, pharmacovigilance, and administrative work enable these firms to allocate more resources toward core competencies like research, development, and commercialization.

According to study, Life sciences companies are increasingly outsourcing up to 40–50% of non-core functions such as regulatory compliance and administrative tasks to reduce operational costs.

To Get More Information On Life Sciences BPO Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 497.12 Billion

-

Market Size by 2033: USD 963.12 Billion

-

CAGR: 8.62%% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Life Sciences BPO Market Trends:

-

Rising outsourcing of clinical trials management, pharmacovigilance, and regulatory services globally.

-

Growing demand for AI-driven and data analytics-enabled life sciences BPO solutions.

-

Increased adoption of cloud platforms and robotic process automation for efficiency.

-

Emerging markets offer cost-effective and scalable BPO opportunities for life sciences.

-

Focus on compliance and data security shaping service offerings in BPO sector.

-

Expansion in real-world evidence generation and personalized medicine fueling specialized services.

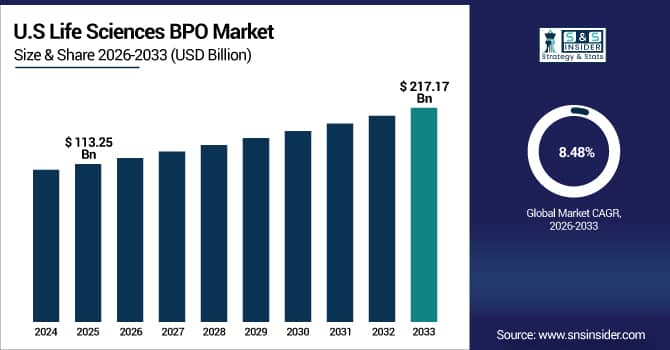

The U.S. Life Sciences BPO Market size is USD 113.25 Billion in 2025E and is expected to reach USD 217.17 Billion by 2033, growing at a CAGR of 8.48% over the forecast period of 2026-2033,

The U.S. Life Sciences BPO market is strong due to high demand for outsourced clinical trials, regulatory, and pharmacovigilance services. Advanced healthcare infrastructure, skilled workforce, and focus on operational efficiency drive adoption, supported by digital solutions and robust compliance standards.

Life Sciences BPO Market Growth Drivers:

-

Outsourcing Non-Core Life Sciences Functions Accelerates Efficiency and Reduces Operational Costs Globally

A major driver for the Life Sciences BPO market growth is the growing trend of outsourcing non-core activities, such as clinical trials management, pharmacovigilance, regulatory affairs, medical writing, and data management. Life sciences companies are focusing on core competencies like R&D, drug discovery, and commercialization while leveraging BPO providers for cost efficiency, faster turnaround, and regulatory compliance. Rising complexity in clinical data, stringent global regulations, and the need for timely submissions drive organizations to partner with specialized BPO providers. This approach allows life sciences firms to reduce operational costs, accelerate drug development timelines, and improve overall business efficiency, fueling demand for outsourced services.

Global outsourcing of non-core life sciences functions is expected to grow at 12–15% CAGR through 2030.

Life Sciences BPO Market Restraints:

-

Data Security, Compliance, and Quality Challenges Restrict BPO Market Adoption Worldwide

A major restraint for the market is the risk associated with data security, regulatory compliance, and service quality. Life sciences BPO deals often involve handling sensitive patient data, intellectual property, and clinical trial information across multiple geographies. Ensuring compliance with regulations such as HIPAA, GDPR, and FDA requirements is challenging and requires robust cybersecurity and quality control measures. Any breach, non-compliance, or error in clinical data can lead to legal penalties, reputational damage, and delays in product launches. These risks make some organizations hesitant to fully outsource critical functions, restraining rapid market adoption.

Life Sciences BPO Market Opportunities:

-

Advanced Analytics and Digital Platforms Unlock New Opportunities in Life Sciences BPO

A significant opportunity lies in leveraging AI, cloud platforms, and advanced analytics to enhance the efficiency and scope of outsourced services. Life Sciences BPO providers are increasingly offering data-driven solutions, predictive analytics for clinical trials, robotic process automation for back-office operations, and real-time dashboards for regulatory and pharmacovigilance monitoring. Emerging markets with growing healthcare infrastructure also offer untapped potential for BPO services, as companies seek cost-effective, scalable solutions.

AI and advanced analytics-enabled BPO solutions are projected to capture over 35% of market share by 2027

Life Sciences BPO Market Segmentation Analysis:

-

By Services: In 2025, Pharmaceutical outsourcing led the market with a share of 46.20%, while Medical devices outsourcing is the fastest-growing segment with a CAGR of 8.64%.

-

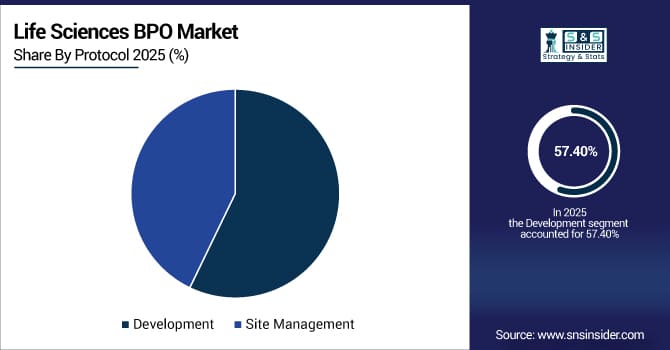

By Protocol: In 2025, Development led the market with a share of 57.40%, while Site Management is the fastest-growing segment with a CAGR of 10.04%.

-

By Delivery Model: In 2025, Offshore led the market with a share of 41.80%, while Remote/Virtual-first is the fastest-growing segment with a CAGR of 11.24%.

-

By Application: In 2025, Pharmaceuticals led the market with a share of 39.50%, while Biopharmaceuticals is the fastest-growing segment with a CAGR of 10.96%.

By Services, Pharmaceutical outsourcing Lead Market and Medical devices outsourcing Fastest Growth

In 2025, Pharmaceutical outsourcing dominates the market, driven by large-scale clinical trial management, regulatory compliance, pharmacovigilance, and data processing needs of major pharma companies. Its extensive adoption ensures stable recurring revenue, supported by long-term contracts with leading global pharmaceutical firms.

Meanwhile, Medical devices outsourcing is the fastest-growing segment, fueled by increasing complexity in medical device regulations, global approvals, and need for specialized post-market surveillance. Rising demand for end-to-end solutions, including manufacturing support, clinical trials, and regulatory documentation, drives rapid expansion in this niche segment.

By Protocol, Development Leads Market and Site Management Fastest Growth

In 2025, Development protocols dominate the life sciences BPO market, encompassing preclinical and clinical trial design, regulatory filings, and process optimization. These services are essential for timely drug approvals, ensuring compliance and standardization across multiple geographies.

Meanwhile, Site management protocols are the fastest-growing segment, as sponsors increasingly outsource site monitoring, patient recruitment, and on-site trial coordination. This growth is driven by rising trial volumes, multi-site studies, and demand for streamlined operational efficiency, particularly in emerging markets where outsourcing reduces costs and accelerates timelines.

By Delivery Model, Offshore Lead Market and Remote/Virtual-first Fastest Growth

In 2025, Offshore delivery dominates the market, benefiting from cost arbitrage, access to skilled labor, and scalability in clinical and regulatory services. Countries like India, the Philippines, and Eastern Europe provide large talent pools, enabling high-volume support for global pharmaceutical and biotech clients.

Meanwhile, Remote/Virtual-first models are the fastest-growing, accelerated by digitalization, cloud-based platforms, and the need for flexible, scalable, and secure collaboration across geographies. These models support decentralized clinical trials, virtual monitoring, and real-time data management, enabling rapid adoption by both emerging and established clients.

By Application, Pharmaceuticals Leads Market and Biopharmaceuticals Fastest Growth

In 2025, Medical device applications dominate the life sciences BPO market, driven by regulatory compliance, post-market surveillance, and quality management outsourcing. As device innovation increases, specialized support for documentation, validation, and clinical testing ensures high market share.

Meanwhile, Biopharmaceutical applications are the fastest-growing segment, fueled by rising biologics, biosimilars, and gene therapy development. The complexity of biopharma trials, need for specialized analytics, and regulatory expertise drive rapid outsourcing adoption, particularly for research, development, and manufacturing support across global markets.

Life Sciences BPO Market Regional Analysis:

Asia Pacific Life Sciences BPO Market Insights:

The Asia Pacific dominated the Life Sciences BPO Market in 2025E, with over 38.10% revenue share, due to its large pool of skilled professionals, cost-effective service delivery, and established outsourcing infrastructure. The region has become a global hub for clinical research, regulatory affairs, pharmacovigilance, and medical writing services. Rapid adoption of digital technologies, including AI-driven data management and cloud-based clinical trial solutions, enhances efficiency and accuracy. Growing pharmaceutical and biotechnology sectors, combined with strong government support for healthcare initiatives, further accelerate demand for outsourced life sciences services across the region.

Moreover, Asia Pacific is also the fastest-growing market with CAGR 9.37%, for Life Sciences BPO, driven by increasing R&D activities, expanding clinical trial volumes, and rising awareness of outsourcing benefits. Companies in the region are investing in infrastructure, IT systems, and talent development to meet global standards. Cost advantages, faster turnaround times, and high-quality service delivery attract multinational life sciences companies to partner with BPO providers. With ongoing investments in regulatory compliance, advanced analytics, and digital healthcare solutions, Asia Pacific is expected to maintain robust growth and strengthen its position as a global leader in life sciences outsourcing.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China and India Life Sciences BPO Market Insights

China and India dominate Life Sciences BPO due to cost advantages, skilled talent, and large outsourcing infrastructure. Strong adoption of clinical trials, regulatory services, and pharmacovigilance, combined with growing pharmaceutical and biotechnology sectors, accelerates market growth in both countries.

North America Life Sciences BPO Market Insights:

North America maintains significant market share in Life Sciences BPO due to the concentration of pharmaceutical, biotechnology, and medical device companies. The region emphasizes outsourcing high-complexity services like clinical trials, regulatory affairs, and medical writing. Strong regulatory frameworks, advanced IT infrastructure, and demand for high-quality data management and analytics services sustain market growth. Increasing focus on cost optimization and operational efficiency encourages life sciences companies to partner with BPO providers for non-core functions. Continuous innovation in digital health and AI-driven outsourcing further strengthens North America’s market presence.

U.S and Canada Life Sciences BPO Market Insights

The U.S. and Canada maintain significant market share with high outsourcing demand for clinical, regulatory, and R&D services. Advanced healthcare infrastructure, compliance expertise, and focus on operational efficiency drive continued partnerships with BPO providers, supporting market expansion.

Europe Life Sciences BPO Market Insights

Europe holds a stable position in the Life Sciences BPO Market, driven by stringent regulatory requirements, mature healthcare infrastructure, and increasing outsourcing of clinical and regulatory services. Pharmaceutical and biotechnology companies are increasingly leveraging BPO providers to improve operational efficiency, reduce costs, and accelerate product development. The region benefits from skilled talent, technological adoption in clinical data management, and compliance expertise. Growing demand for pharmacovigilance, regulatory submissions, and medical writing outsourcing supports consistent market growth. Europe remains an attractive market for specialized life sciences BPO services.

Germany and U.K. Life Sciences BPO Market Insights

The U.K. and Germany are mature markets with outsourcing demand for regulatory compliance, clinical data management, and pharmacovigilance. Skilled workforce, regulatory frameworks, and strong pharmaceutical and biotech presence ensure steady growth in Life Sciences BPO services.

Latin America (LATAM) and Middle East & Africa (MEA) Life Sciences BPO Market Insights

Latin America shows moderate growth in the Life Sciences BPO Market, supported by cost-effective service delivery and emerging pharmaceutical and biotech sectors. Adoption of outsourced clinical trial management, regulatory support, and pharmacovigilance services is increasing. Improving healthcare infrastructure and regulatory frameworks are enabling higher-quality service delivery.

Additionally, The Middle East & Africa region is experiencing gradual growth in the Life Sciences BPO Market, driven by increasing healthcare digitization, clinical research, and regulatory support needs. Rising demand for outsourced medical writing, data management, and pharmacovigilance services contributes to market expansion. Adoption remains slower due to infrastructure gaps, limited skilled workforce, and lower awareness of outsourcing benefits.

Life Sciences BPO Market Competitive Landscape:

Covance, Inc., a leading contract research organization (CRO), provides end-to-end life sciences BPO services including clinical trials management, laboratory testing, regulatory support, and pharmacovigilance. Its solutions help pharmaceutical, biotechnology, and medical device companies streamline drug development, reduce time-to-market, and maintain regulatory compliance. With global operations, advanced data analytics, and a strong focus on quality and innovation, Covance enables cost-effective, scalable, and reliable life sciences outsourcing solutions that enhance operational efficiency and support informed decision-making.

-

In October 2025, Covance, Inc. announced a strategic partnership with a leading tech‑firm to embed advanced data analytics into clinical trial processes, aiming for improved data management and trial efficiency.

Cognizant Technology Solutions provides specialized life sciences BPO services, including clinical trial operations, regulatory compliance, pharmacovigilance, medical writing, and data management. The company integrates AI, automation, and digital platforms to improve efficiency, accuracy, and decision-making across the pharmaceutical and biotechnology sectors. With global delivery capabilities, industry knowledge, and a focus on innovation, Cognizant helps life sciences organizations reduce operational complexity, accelerate drug development, and ensure regulatory adherence while optimizing costs and productivity.

-

In March 2024, Cognizant partnered with NVIDIA to integrate NVIDIA’s generative‑AI BioNeMo platform into life‑sciences BPO workflows, accelerating drug‑discovery data analytics and boosting R&D efficiency.

Accenture plc offers comprehensive life sciences BPO services, encompassing finance and accounting, clinical data management, regulatory operations, supply chain management, and digital transformation solutions. Leveraging advanced analytics, AI, and cloud technologies, Accenture helps pharmaceutical, biotech, and healthcare companies optimize operational efficiency, reduce costs, and accelerate commercialization. Its global delivery network, industry expertise, and innovation-driven approach position Accenture as a key partner in enabling scalable, compliant, and technology-enabled life sciences outsourcing solutions.

-

In May 2024, Accenture launched an advanced life‑sciences BPO platform powered by AI and cloud automation targeting clinical operations and regulatory compliance, enhancing outsourcing efficiency

Life Sciences BPO Market Key Players:

Some of the Life Sciences BPO Market Companies are:

-

International Business Machines Corp

-

IOVIA

-

PAREXEL International Corp

-

Lonza Group

-

Infosys.Ltd

-

ICON plc

-

Genpact LTD

-

Covance, Inc.

-

Catalent, Inc

-

Boehringer Ingelheim Gmbh

-

Atos SE

-

Accenture plc

-

Syneos Health, Inc

-

Charkes River Laboratories International, Inc

-

Wuxi AppTec Co, Ltd

-

Medpace Holdings, Inc

-

PRA Health Sciences, Inc

-

Cognizant Technology Solutions

-

Quintiles Transactional Corporation

-

ProMab Biotechnologies, Inc

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 497.12 Billion |

| Market Size by 2033 | USD 963.12 Billion |

| CAGR | CAGR of 8.62% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Services (Pharmaceutical Outsourcing, Medical Devices Outsourcing, Contract Sales & Market Outsourcing, Others) •By Protocol (Development, Site Management) •By Delivery Model (Onshore, Nearshore, Offshore, Hybrid, Captive/Shared Services Center, Remote/Virtual-First) •By Application (Pharmaceuticals, Medical Device Applications, Biopharmaceuticals, Research & Development, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | International Business Machines Corp, IOVIA, PAREXEL International Corp, Lonza Group, Infosys Ltd, ICON plc, Genpact Ltd, Covance Inc, Catalent Inc, Boehringer Ingelheim GmbH, Atos SE, Accenture plc, Syneos Health Inc, Charles River Laboratories International Inc, Wuxi AppTec Co Ltd, Medpace Holdings Inc, PRA Health Sciences Inc, Cognizant Technology Solutions, Quintiles Transactional Corporation, and ProMab Biotechnologies Inc., |