Medical Biomimetics Market Report Scope & Overview:

The Medical Biomimetics Market was valued at USD 38.17 billion in 2025E and is expected to reach USD 69.65 billion by 2033, growing at a CAGR of 7.87% from 2026-2033.

The Medical Biomimetics Market is growing due to increasing demand for bio-inspired materials and devices that mimic natural biological processes. Rising prevalence of chronic diseases, advancements in tissue engineering, and regenerative medicine are driving the adoption of biomimetic implants, scaffolds, and drug delivery systems. Technological innovations, coupled with growing research and development initiatives, are enhancing product efficacy and safety. Additionally, expanding healthcare infrastructure and rising awareness of advanced therapeutic solutions are further fueling market growth.

Over 60% of new biomimetic implants now integrate bio-inspired designs, with tissue engineering advancements boosting adoption in regenerative therapies. Rising R&D investments and expanded healthcare access are accelerating use of biomimetic scaffolds and targeted drug delivery systems globally.

Medical Biomimetics Market Size and Forecast

-

Market Size in 2025E: USD 38.17 Billion

-

Market Size by 2033: USD 69.65 Billion

-

CAGR: 7.87% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Medical Biomimetics Market - Request Free Sample Report

Medical Biomimetics Market Trends

-

Rising adoption of biomimetic materials for tissue engineering and regenerative medicine applications globally

-

Increasing focus on drug delivery systems using biomimetic nanoparticles to enhance therapeutic efficacy

-

Advancements in synthetic and natural biomaterials driving innovative implants and prosthetics development

-

Growing demand for wound healing solutions incorporating biomimetic scaffolds and hydrogel-based technologies

-

Expansion of biomimetic applications across cardiovascular, orthopedic, ophthalmology, and dental healthcare segments worldwide

-

Integration of 3D printing and biomimetic designs for personalized and patient-specific medical solutions

U.S. Medical Biomimetics Market was valued at USD 12.18 billion in 2025E and is expected to reach USD 21.66 billion by 2033, growing at a CAGR of 7.52% from 2026-2033.

Growth in the U.S. Medical Biomimetics Market is driven by increasing adoption of bio-inspired implants, scaffolds, and drug delivery systems for regenerative medicine and chronic disease management. Technological advancements, rising healthcare investments, and growing awareness of innovative, effective therapeutic solutions are further supporting market expansion.

Medical Biomimetics Market Growth Drivers:

-

Increasing prevalence of chronic diseases drives demand for biomimetic materials, enhancing tissue repair, regenerative medicine, and advanced therapeutic applications globally

The growing incidence of chronic diseases such as cardiovascular disorders, diabetes, and orthopedic conditions is fueling the need for advanced medical solutions. Biomimetic materials that mimic natural tissue properties are increasingly used in tissue repair, wound healing, and regenerative medicine. These materials improve patient outcomes by promoting faster recovery and reducing complications. Healthcare providers and researchers are adopting biomimetic technologies for advanced therapeutic applications, driving global demand for innovative materials that can address complex medical challenges and improve overall quality of care.

Over 40% of regenerative medicine applications now use biomimetic materials, with chronic disease driving 60% of demand, enhancing tissue repair and supporting advanced therapies in orthopedics, wound care, and cardiovascular treatments globally.

-

Technological advancements in biomaterials and nanotechnology accelerate development of biomimetic devices, improving safety, effectiveness, and patient-specific treatment outcomes

Recent innovations in biomaterials, nanotechnology, and 3D printing have significantly advanced biomimetic device development. These technologies enable the creation of highly precise, biocompatible, and patient-specific implants, prosthetics, and tissue scaffolds. Enhanced safety, reduced rejection risks, and improved treatment effectiveness are key benefits. Continuous research and development in material engineering and nanotechnology are fostering new applications in drug delivery, regenerative medicine, and surgical interventions. As a result, healthcare providers are increasingly adopting these advanced biomimetic solutions, driving rapid growth in the global medical biomimetics market.

Over 60% of next-gen ankle implants now incorporate bioactive coatings and nanotextured surfaces, enhancing osseointegration and reducing wear; 70% of surgeons report improved patient outcomes with biomimetic designs tailored via 3D imaging.

Medical Biomimetics Market Restraints:

-

High research and development costs limit the commercialization of medical biomimetic products, restricting adoption among healthcare providers and manufacturers

Developing medical biomimetic products requires extensive R&D investment in material science, testing, and clinical validation to replicate natural biological structures accurately. High costs associated with experimentation, prototyping, and long development cycles make it difficult for smaller companies to commercialize products. Healthcare providers may hesitate to adopt expensive biomimetic solutions over conventional alternatives, limiting market penetration. This financial barrier slows technological advancement and discourages innovation, ultimately constraining overall growth in the medical biomimetics market, especially in cost-sensitive regions and emerging economies.

R&D costs for biomimetic orthopedic devices exceed USD50 million per product, with 70% of developers citing funding gaps; only 20% of prototypes reach clinical use due to regulatory and manufacturing challenges.

-

Complex regulatory approval processes for biomimetic materials and devices delay product launches, increasing time-to-market and associated compliance expenses

Medical biomimetic products must undergo rigorous regulatory evaluations to ensure safety, efficacy, and biocompatibility. Different countries have varying standards, requiring extensive documentation, preclinical and clinical trials, and multiple approvals. These regulatory hurdles extend time-to-market, increase compliance costs, and create uncertainty for manufacturers. Delays in obtaining certifications can reduce competitiveness, especially in fast-moving markets. Companies must invest in legal, scientific, and quality assurance teams to navigate these processes, which can further limit market growth and slow the adoption of innovative biomimetic solutions in healthcare.

Biomimetic orthopedic devices face 3–5 years of regulatory review, with approval success rates below 60%, significantly delaying clinical availability and increasing compliance costs for advanced ankle replacement technologies.

Medical Biomimetics Market Opportunities:

-

Rising demand for advanced tissue engineering solutions offers opportunities for biomimetic materials in regenerative medicine and wound healing applications

The growing need for effective tissue repair and regeneration is driving interest in biomimetic materials that mimic natural biological structures. These materials are increasingly used in wound healing, skin grafts, and organ repair, offering improved functionality and faster recovery. Advances in material science and bioengineering allow the development of scaffolds and matrices that support cell growth and tissue regeneration. As healthcare providers seek innovative solutions for complex injuries and chronic wounds, the demand for biomimetic tissue engineering products continues to expand globally.

Over 70% of regenerative medicine trials now include biomimetic scaffolds, with tissue engineering solutions showing a 25% annual increase in clinical adoption for wound healing and musculoskeletal repair.

-

Increasing prevalence of chronic diseases and aging populations drives adoption of biomimetic devices for cardiovascular, orthopedic, and ophthalmic treatments

Rising cases of heart disease, joint degeneration, and vision impairments, especially among aging populations, are fueling demand for biomimetic devices. These devices replicate natural tissue properties, enhancing treatment outcomes in cardiovascular stents, orthopedic implants, and ophthalmic prosthetics. The ability to reduce complications, improve biocompatibility, and accelerate patient recovery makes biomimetic solutions increasingly attractive to healthcare providers. Additionally, growing awareness and adoption of advanced medical technologies across hospitals and clinics worldwide are creating significant opportunities for market growth in the biomimetics sector.

With over 16% of the global population aged 65+, and chronic conditions like osteoarthritis and diabetes rising, biomimetic implants are increasingly adopted to restore mobility, circulation, and vision through biocompatible, anatomy-mimicking solutions.

Medical Biomimetics Market Segment Highlights

-

By Type: In 2025, Cardiovascular led the market with 35% share, while Orthopedic is the fastest-growing segment with the highest CAGR (2026–2033)

-

By Application: In 2025, Wound Healing led the market with 42% share, while Drug Delivery is the fastest-growing segment with the highest CAGR (2026–2033)

-

By Material: In 2025, Synthetic Biomaterials led the market with 80% share, while Natural Biomaterials is the fastest-growing segment with the highest CAGR (2026–2033)

-

By End-Use: In 2025, Hospitals & Clinics led the market with 50% share, while Research & Academic Institutes is the fastest-growing segment with the highest CAGR (2026–2033)

Medical Biomimetics Market Segment Analysis

By Material, Synthetic Biomaterials segment led in 2025; Natural Biomaterials segment expected fastest growth 2026–2033

Synthetic Biomaterials segment dominated the Medical Biomimetics Market with the highest revenue share of about 80% in 2025 owing to their superior mechanical properties, durability, ease of mass production, and widespread adoption across various medical applications, including implants, prosthetics, and tissue engineering.

Natural Biomaterials segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing preference for biocompatible, biodegradable materials, growing research in regenerative medicine, and rising awareness of eco-friendly, patient-friendly biomimetic solutions.

By Type, Cardiovascular segment led in 2025; Orthopedic segment expected fastest growth 2026–2033

Cardiovascular segment dominated the Medical Biomimetics Market with the highest revenue share of about 35% in 2025 due to the increasing prevalence of heart-related disorders, rising demand for advanced cardiovascular implants, and growing adoption of biomimetic technologies for minimally invasive procedures.

Orthopedic segment is expected to grow at the fastest CAGR from 2026-2033 owing to the surge in orthopedic disorders, expanding geriatric population, and continuous innovation in biomimetic bone and joint repair materials, driving demand for advanced orthopedic solutions globally.

By Application, Wound Healing segment led in 2025; Drug Delivery segment expected fastest growth 2026–2033

Wound Healing segment dominated the Medical Biomimetics Market with the highest revenue share of about 42% in 2025 because of the rising incidence of chronic wounds, diabetic ulcers, and burns, coupled with the increasing use of biomimetic dressings and scaffolds that accelerate tissue repair and improve patient recovery outcomes.

Drug Delivery segment is expected to grow at the fastest CAGR from 2026-2033 due to the growing focus on targeted therapies, development of advanced biomimetic carriers, and increasing demand for precision medicine, which enhances therapeutic efficiency and minimizes side effects.

By End-Use, Hospitals & Clinics segment led in 2025; Research & Academic Institutes segment expected fastest growth 2026–2033

Hospitals & Clinics segment dominated the Medical Biomimetics Market with the highest revenue share of about 50% in 2025 because of the high patient influx, adoption of advanced treatment procedures, and established infrastructure supporting the use of biomimetic devices for diagnostics, therapies, and surgical interventions.

Research & Academic Institutes segment is expected to grow at the fastest CAGR from 2026-2033 due to rising investments in R&D, growing focus on innovative biomimetic solutions, and increasing collaborations for developing next-generation medical materials and devices.

Medical Biomimetics Market Regional Analysis

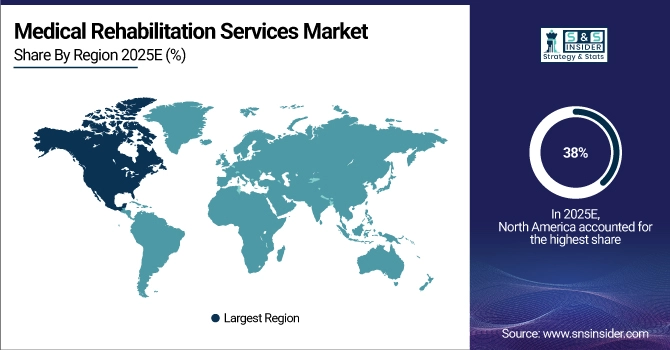

North America Medical Biomimetics Market Insights

North America dominated the Medical Biomimetics Market with a 39% share in 2025 due to advanced healthcare infrastructure, strong R&D capabilities, and high adoption of biomimetic medical devices. Presence of leading manufacturers, favorable reimbursement policies, and increasing demand for innovative wound healing, cardiovascular, and orthopedic solutions further strengthened the region’s market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Medical Biomimetics Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 9.97% from 2026–2033, driven by rising healthcare investments, growing prevalence of chronic diseases, and expanding adoption of advanced biomimetic technologies. Increasing medical infrastructure, rising awareness of innovative treatments, and government initiatives supporting healthcare modernization accelerate market growth across the region.

Europe Medical Biomimetics Market Insights

Europe held a significant share in the Medical Biomimetics Market in 2025, supported by well-established healthcare systems, strong R&D and manufacturing capabilities, and high adoption of advanced medical devices. Growing focus on minimally invasive procedures, increasing prevalence of chronic diseases, and favorable regulatory frameworks further strengthened Europe’s market position.

Middle East & Africa and Latin America Medical Biomimetics Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Medical Biomimetics Market in 2025, driven by improving healthcare infrastructure, rising prevalence of chronic diseases, and increasing adoption of advanced medical devices. Expanding investments in hospitals and clinics, growing awareness of innovative biomimetic treatments, and government support for healthcare modernization strengthened the regions’ market presence.

Medical Biomimetics Market Competitive Landscape:

Abbott Laboratories

Abbott Laboratories is a global healthcare leader headquartered in the United States, specializing in diagnostics, medical devices, nutrition, and branded generic pharmaceuticals. The company focuses on innovative solutions for chronic diseases, cardiovascular conditions, and diabetes care. Abbott’s biomimetic technologies, such as tissue-engineered products and advanced medical devices, support minimally invasive procedures and improve patient outcomes. Its strong R&D capabilities and global presence make it a key player in the medical biomimetics market.

-

April 2024, Abbott announced FDA approval for its Tri Clip transcatheter edge-to-edge repair (TEER) system to treat tricuspid regurgitation, offering a minimally invasive option for a previously underserved patient population

Johnson & Johnson

Johnson & Johnson, headquartered in the United States, is a multinational conglomerate operating in pharmaceuticals, medical devices, and consumer health products. In medical biomimetics, it offers advanced orthopedic implants, tissue regeneration technologies, and surgical solutions inspired by natural biological processes. The company emphasizes innovation, quality, and patient safety, leveraging extensive research networks. Its global footprint and strong financial performance position it as a dominant force in the healthcare and biomimetics industry.

-

March 2025, Johnson & Johnson MedTech showcased a “new era” of digital orthopedics, unveiling data‑driven implants and surgical solutions across joint reconstruction, trauma, spine, and more.

Medtronic plc

Medtronic plc, headquartered in Ireland, is a leading medical technology company providing innovative therapies and devices for cardiovascular, neurological, and musculoskeletal conditions. Its biomimetic products include implantable devices and tissue-inspired solutions designed to enhance surgical outcomes and patient recovery. Medtronic focuses on R&D-driven innovation, regulatory compliance, and global distribution. Its commitment to improving patient care through advanced medical technologies makes it a prominent player in the medical biomimetics market.

-

September 2024, Medtronic expanded its Aibel spine surgery ecosystem, announcing new AI‑driven navigation, robotic systems, imaging, software tools, and implants. It also formed a partnership with Siemens Healthiness to integrate advanced imaging into the ecosystem.

Zimmer Biomet Holdings, Inc.

Zimmer Biomet, based in the United States, specializes in musculoskeletal healthcare and orthopedic solutions, including joint reconstruction, dental, and spine products. Its biomimetic offerings include tissue-engineered implants and advanced prosthetics that replicate natural biomechanical functions. The company emphasizes innovation, surgical precision, and improving patient quality of life. Through strong R&D, strategic acquisitions, and global market penetration, Zimmer Biomet has become a key leader in the medical biomimetics and orthopedic device sector.

-

October 2025, Zimmer secured Breakthrough Device Status from the FDA for a total hip implant with a controlled-release iodine layer, aimed at reducing post-surgical joint infections

Medical Biomimetics Market Key Players

Some of the Medical Biomimetics Market Companies are:

-

Abbott Laboratories

-

Johnson & Johnson

-

Medtronic plc

-

Zimmer Biomet Holdings, Inc.

-

Stryker Corporation

-

Biomimetics Technologies, Inc.

-

Avinent Science & Technology

-

Applied Biomimetic A/S

-

Veryan Medical Ltd

-

SynTouch LLC

-

Osteopore International Pte Ltd

-

Vandstrom, Inc.

-

Swedish Biomimetics 3000 ApS

-

Keystone Dental Group

-

LifeMatrix

-

Curasan, Inc.

-

CorNeat Vision

-

Forschungszentrum Jülich GmbH

-

BioHorizons

-

Boston Scientific Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 38.17 Billion |

| Market Size by 2033 | USD 69.65 Billion |

| CAGR | CAGR of 7.87% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cardiovascular, Orthopedic, Ophthalmology, Dental, Others) • By Application (Wound Healing, Tissue Engineering, Drug Delivery, Other Applications) • By Material (Natural Biomaterials, Synthetic Biomaterials) • By End-Use (Hospitals & Clinics, Research & Academic Institutes, Diagnostic & Therapeutic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Abbott Laboratories, Johnson & Johnson, Medtronic, Zimmer Biomet, Stryker Corporation, Avinent Science & Technology, Biomimetics Technologies Inc., Veryan Medical Ltd., Applied Biomimetic A/S, SynTouch LLC, BioHorizons, Blatchford (Chas A. Blatchford & Sons), Forschungszentrum Jülich GmbH, Otsuka Medical Devices Group, Keystone Dental Group, LifeMatrix, Curasan, Inc., CorNeat Vision, Osteopore International, Hstar Technologies Corporation |