Medical Electrodes Market Size:

To Get More Information on Medical Electrodes Market - Request Sample Report

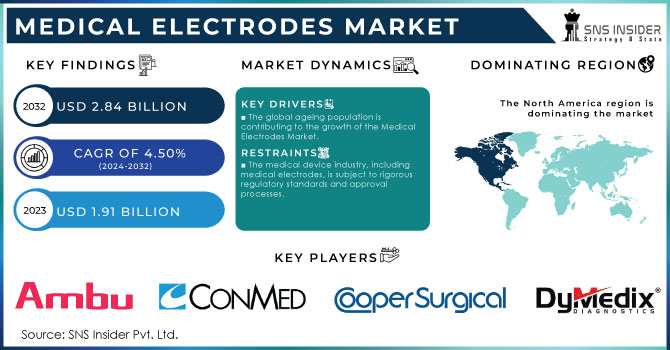

The Medical Electrodes Market was valued at USD 2.07 billion in 2023 and is expected to reach USD 3.17 billion by 2032, growing at a CAGR of 4.89% from 2024 to 2032.

The medical electrodes market is expected to witness steady growth, aided by technological innovations in the field of diagnostics and monitoring systems, the aging population, and the rising burden of chronic disorders. Other medical electrodes play a key role in diagnostic techniques, such as electrocardiography (ECG), electroencephalography (EEG), and electromyography (EMG), which are used to diagnose neurological, cardiac, and muscular disorders, respectively.

The regional market is driven by key growth factors such as the increasing prevalence of cardiovascular diseases (CVDs), which is contributing to the demand for ECG electrodes; the WHO states that CVDs claim nearly 17.9 million lives every year. Likewise, as the incidence of neurological disorders like epilepsy and Parkinson’s disease are rising, EEG electrodes are being used more frequently for diagnosis and monitoring.

Technological developments are also driving the market. The improvement of miniaturized, wireless, and disposable electrodes is enhancing patient comfort and extending their application for remote and ambulatory care. Moreover, the increasing popularity of remote patient monitoring has led to the growth of wearable medical electrodes being integrated into consumer health devices.

Smart electrodes using artificial intelligence (AI) technology are also emerging to improve diagnostic efficiency, as well as biodegradable electrodes to address environmental pollution issues. Yet more growth drivers are also expected to come from extensive research related to graphene-based electrodes that have higher conductivity and biocompatibility, resulting in more effective and patient-friendly options.

MARKET DYNAMICS

DRIVERS

-

The rising prevalence of chronic conditions such as cardiovascular diseases (CVDs), neurological disorders, and musculoskeletal diseases is a key driver for the medical electrodes market.

ECG electrodes are in high demand due to the increased incidence of cardiovascular diseases, heart disease, and arrhythmias, for continuous monitoring and diagnostics. Likewise, neurological disorders such as epilepsy and Parkinson’s disease require the use of EEG electrodes for accurate diagnosis and treatment monitoring. This is projected to fuel the demand for medical electrodes for the development of reliable diagnostic tools, owing to the increasing global burden of these conditions on the aging population. With early detection becoming increasingly important in terms of managing chronic conditions, effective, non-invasive diagnostic procedures with electrodes are even more in demand, and this further contributes to the market growth. Moreover, the growing prevalence of lifestyle-related diseases, including diabetes, is positively impacting the wider acceptance of electrodes-based monitoring solutions.

-

Technological innovations are transforming the medical electrodes market, making them more efficient, user-friendly, and versatile.

Wireless and miniaturized disposable electrodes have substantially improved the user experience and increased their application in remote or home healthcare systems. Innovations in smart electrodes with artificial intelligence diagnostics are improving the performance and utility of medical electrodes in clinical and consumer health settings. The development of such innovations stimulates market growth and provides better suitability as well as new application horizons in diagnostics and treatment monitoring. Novel electrode materials (e.g., graphene) also provide improved conductivity and higher biocompatibility, allowing for high-performance, stable, and flexible electrodes to be developed. This has not only helped in better patient outcomes but has also lowered the cost of healthcare by enabling faster and more accurate diagnoses, aiding the global usage of medical electrodes.

RESTRAINT

-

One of the primary restraints for the medical electrode market is the high cost of advanced electrode technologies, especially smart electrodes and graphene-based electrodes.

The high cost of advanced electrode technology (smart electrodes and graphene-based electrodes) is one of the major factors restraining market growth. Such new generation solutions' excellent performance and durability added a significant premium over traditional electrodes' price. This can hamper their common usage, particularly in lower- and middle-income countries with constrained healthcare budgets. Also, disposable electrodes become increasingly more common, as they offer around-the-clock functionality; these electrodes have a combined expense, thus limiting their affordability over time for both the patient and the healthcare provider. As healthcare systems across the globe continue to search for the right balance between quality and cost-effectiveness, the relatively high pricing associated with superior-quality electrode products may restrict their availability, ultimately hindering the growth of the overall market.

MARKET SEGMENTATION

By product

The wet electrodes segment dominated the market with a 49% market share. This progressive transition is mainly attributed to the growing usage of wet electrodes for disease diagnosis via medical devices over the past few years. Wet electrodes are typically made of silver chloride or silver materials and use an electrolytic gel as a conductor between the electrode and the skin. These electrodes stick to the skin and involve preparation like electrolytic gel. Wet electrodes are highly sought after because they are not invasive. Thus, these factors are expected to contribute significantly towards the positive growth of the market.

Dry electrodes segment will grow at the fastest rate with a 7.45% CAGR. In contrast, the dry electrodes offer several advantages, in that they do not need an extra step of preparation, as the electrodes are connected to the surface of the skin and can pass through epidermal layers, thus forming a low-impedance circuit that can help recording the neural signal. Dry electrode technology allows obtaining electroencephalogram (EEG) signals in scenarios that were traditionally hard to derive, as they do not require the application of gel on the subject’s hair. Moreover, the need for paste or conductive gel contributed to minimizing electrode application time and has been driving the market growth over the series of inventions. These factors are projected to generate robust demand for dry electrodes in the upcoming years.

By Application

The cardiology segment dominated the market with a 56% market share in 2023, primarily due to the rising global prevalence of cardiovascular diseases (CVD). The increasing adoption of sedentary lifestyles and unhealthy eating habits, along with the growing trend of binge eating, has contributed to the surge in CVD cases in many regions. Additionally, the rising consumption of nicotine through cigarette smoking remains a significant factor driving the incidence of CVD. As a result, diagnostic tests related to CVD, such as electrocardiography (ECG), have seen substantial growth in recent years. These factors are collectively fueling the market's growth in the cardiology sector during the forecast period.

The neurophysiology segment is anticipated to grow considerably during the forecast period, with the highest CAGR of around 7%. This Segment created a large amount of revenue and is expected to hold a considerable market share during the forecast period. The provided growth is primarily fueled by the increasing prevalence of neurological ailments, including neurodegenerative diseases, multiple sclerosis, sleep disorders, etc.

Do You Need any Customization Research on Medical Electrodes Market - Enquire Now

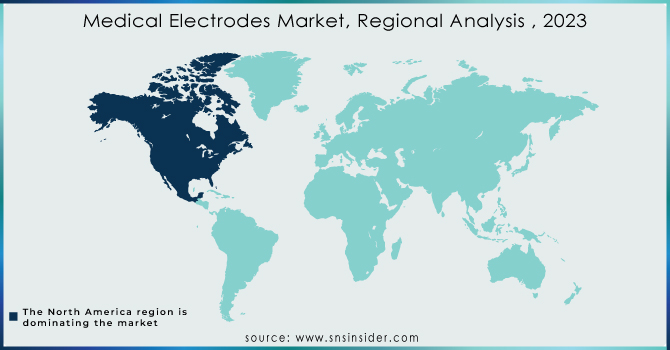

KEY REGIONAL ANALYSIS

North America dominated the medical electrodes market with a 45% market share in 2023, owing to factors such as developed healthcare infrastructure, increasing adoption of advanced technologies, and significant healthcare investment in the region. MicroWire technology permits the introduction of functional electrodes into the human body, allowing for long-term continuous monitoring of tissue bioelectric activities, opening doors to an excellent forecast for medical devices worldwide, especially in the United States, where a massive demand for diagnostic and therapeutic electrodes in a wide range of fields, including cardiac care, neurology, and pain management, is expected. Additionally, the presence of leading medical device manufacturers and strong regulatory support from the FDA are driving the market growth in the region. August 2024 – Nissha Medical Technologies (NMT) announced the successful registration of its ZBrand Electrodes in Mexico as part of its global expansion into the healthcare industry.

Asia Pacific is the fastest growing region and is expected to experience the fastest CAGR throughout the forecast period, due to the large geriatric populace, growing healthcare systems, and surging spending in healthcare is rapidly expanding the market for electrodes in both commercial & non-commercial medical devices. Countries like China, Japan, and India are among the crucial drivers of this growth, owing to an increasing requirement for medical devices in diagnosis and therapeutic applications. In May 2024, four innovative directional deep brain stimulation (DBS) devices were approved in China by the National Medical Products Association (NMPA). In doing so, these advanced, locally-built machines comprise an electrode lead kit and dual-channel pulse generators for the specific stimulation of brain target regions. This technology helps reduce the side effects and reduces the need for additional surgeries compared to traditional electrode-based technology.

Some of the major key players in the Medical Electrodes Market

-

3M Health Care (3M Red Dot Electrodes, 3M Clear Track Electrodes)

-

Nihon Kohden Corporation (EEG Electrodes, ECG Electrodes)

-

Medtronic (NIM-Response Electrodes, Medtronic ECG Electrodes)

-

Philips Healthcare (Philips ECG Electrodes, Philips EEG Electrodes)

-

GE Healthcare (ECG Electrodes, Neurodiagnostic Electrodes)

-

Advent Health (Advent Diagnostic Electrodes, Advent Disposable ECG Electrodes)

-

Biopac Systems, Inc. (EEG Electrodes, ECG Electrodes)

-

Conmed Corporation (Conmed ECG Electrodes, Conmed EEG Electrodes)

-

Rhythmlink International (Rhythmlink EEG Electrodes, EMG Electrodes)

-

Vernon Hills (Reusable ECG Electrodes, Disposable Electrodes)

-

Axonics Modulation Technologies (Axonics Neurostimulation Electrodes, Axonics Sacral Electrodes)

-

Covidien (Medtronic) (Covidien ECG Electrodes, Covidien EEG Electrodes)

-

Mindray (Mindray ECG Electrodes, Mindray EEG Electrodes)

-

Abbott Laboratories (Cardiac Electrodes, Neurostimulation Electrodes)

-

Medizintechnik GmbH (EEG Electrodes, EMG Electrodes)

-

Rose Medical Solutions (ECG Electrodes, EMG Electrodes)

-

Kendall Healthcare (Covidien) (Kendall ECG Electrodes, Kendall Electroencephalograph Electrodes)

-

Johnson & Johnson (Neurostimulation Electrodes, ECG Monitoring Electrodes)

-

Neurotechnology (Neurostimulation Electrodes, EEG Monitoring Electrodes)

-

St. Jude Medical (Abbott) (Cardiac Electrodes, Neurostimulator Electrodes)

RECENT DEVELOPMENT

-

In February 2024, Threshold NeuroDiagnostics, a stealth startup, introduced the Medusa Electrode, an FDA-registered device that connects neuromodulation electrodes to neurodiagnostic equipment using artificial intelligence. This innovation facilitates access to over 70,000 invasive electrodes annually in the U.S., improving neurodiagnostic capabilities and expanding research applications by converting electrode connections into universal formats.

-

In November 2024, Nihon Kohden acquired a 71.4% interest in NeuroAdvanced Corp., which is the parent company of Ad-Tech Medical Instrument Corporation. This strategic acquisition enhances Nihon Kohden's leadership in the medical device market by combining its expertise in EEG technology with Ad-Tech's specialized electrodes for epilepsy treatment. The move aims to boost Nihon Kohden's ability to address challenging neurological disorders, particularly those resistant to medication.

-

In April 2024, Soterix Medical Inc. launched the MxN-GO EEG, a groundbreaking device designed for real-world research settings. This system integrates non-invasive brain stimulation with EEG technology, offering a wireless, lightweight design for mobile use. It features 33 channels for stimulation and 32 for recording brain activity, enabling precise data collection and enhancing mobile research capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.07 Billion |

| Market Size by 2032 | US$ 3.17 Billion |

| CAGR | CAGR of 4.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Wet, Dry, Needle) • By Application (Cardiology, Neurophysiology, Others) • By Usage (Disposable, Reusable) • By End User (Hospitals and Ambulatory Surgery Centers, Specialty Clinics and Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Health Care, Nihon Kohden Corporation, Medtronic, Philips Healthcare, GE Healthcare, Advent Health, Biopac Systems, Inc., Conmed Corporation, Rhythmlink International, Vernon Hills, Axonics Modulation Technologies, Covidien (Medtronic), Mindray, Abbott Laboratories, Medizintechnik GmbH, Rose Medical Solutions, Kendall Healthcare (Covidien), Johnson & Johnson, Neurotechnology, St. Jude Medical (Abbott), and other players. |

| Key Drivers | •The rising prevalence of chronic conditions such as cardiovascular diseases (CVDs), neurological disorders, and musculoskeletal diseases is a key driver for the medical electrodes market. •Technological innovations are transforming the medical electrodes market, making them more efficient, user-friendly, and versatile. |

| Restraints | •One of the primary restraints for the medical electrode market is the high cost of advanced electrode technologies, especially smart electrodes and graphene-based electrodes. |