Medical Foam Market Report Scope And Overview:

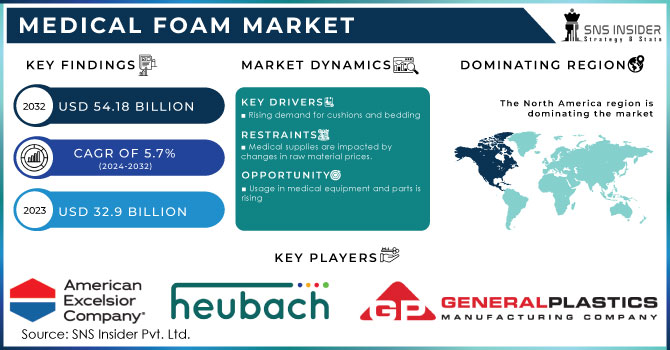

The Medical Foam Market size was valued at USD 34.78 billion in 2024, and is expected to reach USD 54.18 billion by 2032, and grow at a CAGR of 5.7% over the forecast period 2024-2032.

The medical foam market is experiencing robust growth driven by its diverse applications across healthcare. Fueled by a growing global investment in healthcare, the medical foam market is thriving. Aging populations require more wound care, prosthetics, and rehabilitation equipment, all areas where medical foams play a crucial role. Advanced wound dressings, for example, promote faster healing and greater comfort compared to traditional methods. Similarly, the booming implantable device market relies on medical foams for components like implants, catheters, and drug delivery systems.

Get More Information on Medical Foam Market - Request Sample Report

Key applications of medical foams span from patient care to medical device protection. In hospitals and rehabilitation centers, foam-based bedding and cushioning enhances patient comfort and support. Wound care dressings utilize foam's absorbent and conformable properties to facilitate healing. The protective packaging of medical devices and pharmaceuticals relies heavily on foam's cushioning capabilities. Additionally, medical foams play crucial roles in prosthetics, orthotics, surgical procedures, and diagnostic equipment. Globally, an estimated 35 to 40 million people need prosthetics or orthotics, according to the World Health Organization.

Key Medical Foam Market Trends

-

Smart sensor integration in medical foams improves patient monitoring, enhances product responsiveness, and boosts usage efficiency in clinical and home care environments.

-

Advanced antimicrobial foam coatings are gaining popularity, reducing infection risks, extending product lifespan, and meeting stringent healthcare sanitation standards.

-

Adoption of eco-friendly and biodegradable foam materials is rising, supporting sustainability goals, decreasing environmental impact, and appealing to regulatory-conscious buyers.

-

Customized foam solutions for specialized medical applications, such as wound care and orthopedic supports, drive higher patient compliance and therapeutic effectiveness.

-

Wireless connectivity in foam-based medical devices enables remote data collection, supports predictive maintenance, and improves overall treatment tracking across healthcare facilities.

Medical Foam Market Growth Drivers:

Drivers

-

Rising demand for cushions and bedding

Medical foam is becoming more and more popular for cushioning and bedding. The growing need for hospital beds, bed accessories, and seat cushions in the healthcare industry is driving up demand for medical foam in bedding and cushioning. In addition, there is an increasing need for cushions and bedding due to the rise in diseases worldwide. Therefore, the market is expanding due to the rising demand for cushions and bedding.

Medical Foam Market Restraints:

-

Medical supplies are impacted by changes in raw material prices.

Crude oil determines the price of benzoene, and changes in the price of crude oil contribute to the high cost of medical foam. In addition, the price of styrene and other important raw materials affects the price of polystyrene foam. These variations also help the medical foam alternatives. People are choosing other products as the cost of raw materials rises, which is a significant barrier impeding the market's expansion.

Medical Foam Market Opportunities:

-

Usage in medical equipment and parts is rising

The growing demand for a variety of medical device products is driving up the use of medical foam in medical devices and components. When compared to other options, medical foam is more affordable and has superior biocompatibility. The market is expanding in part because consumers are becoming more conscious of their hygiene and health. The world population is growing at an accelerated rate, which is fueling the market's expansion by raising the need for medical foam.

-

Growing utilisation of medical foam in spinal implants

Medical foam has a number of advantages, including an excellent strength-to-weight ratio, biocompatibility, and remarkable performance. Injection moulding is a process that uses medical foam as a Foam of developer to create titanium spinal implants. Medical foams have interconnected porosity throughout the implant and are modelled after cancellous bone. Thus, the market is expanding due to the growing usage of medical foam in spinal implants.

Medical Foam Market Segment Analysis

By Foam

Flexible foams, owing to their versatility in applications like wound care, cushioning, and packaging, dominated the market with 58% share in 2024. However, the spray foam segment is emerging as the fastest-growing, driven by its increasing use in wound care, orthopedic and surgical applications due to its customizable properties and ease of application.

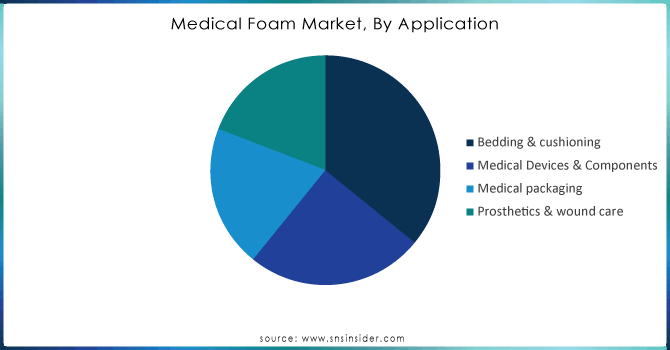

By Application

Bedding & cushioning dominated the market with 36.07% share in 2024 due to its extensive use in hospitals and healthcare facilities. However, the fastest-growing segment is medical devices & components, driven by increasing demand for advanced medical equipment and the growing focus on minimally invasive procedures.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Medical Foam Market Regional Analysis:

North America Medical Foam Market Insights

North America dominated the medical foam market in 2024, accounting for over 32% of the global share. The region's robust growth is attributed to escalating healthcare expenditure, particularly in the U.S., which has spurred demand for medical devices and subsequently, medical foam. Increased health insurance coverage in the U.S. has further boosted the market by driving up demand for generic drugs and medical devices. Key applications within the region include medical packaging and medical component manufacturing. The COVID-19 pandemic accelerated demand for hospital bedding, medical devices, and wound dressings, positively impacting overall market growth.

U.S. Medical Foam Market

The U.S. market is characterized by advanced medical technology adoption and significant healthcare spending. Demand is fueled by growing awareness of patient safety and comfort, along with increased production of medical devices and hospital supplies. Applications range from medical packaging to prosthetics and wound management. Regulatory frameworks and healthcare insurance coverage encourage widespread adoption of innovative foam materials. Moreover, the pandemic highlighted the importance of medical foam in hospital settings, including bedding, cushions, and wound dressings, further reinforcing its role in supporting efficient healthcare delivery.

Asia-Pacific Medical Foam Market

The Asia-Pacific region is experiencing rapid growth in medical foam due to expanding healthcare infrastructure, rising disposable incomes, and government initiatives to improve access to medical care. Demand is growing for medical devices, hospital bedding, and wound care solutions. A large population base, coupled with increased healthcare awareness, is driving innovation and adoption of medical foam products. Manufacturers focus on lightweight, cost-effective, and safe materials, making them suitable for various clinical applications. The market is also influenced by rising investment in healthcare facilities and increased production of medical components.

Europe Medical Foam Market

Europe’s medical foam market benefits from an aging population and emphasis on healthcare quality and patient safety. Strict regulations ensure high-quality foam materials in medical applications such as wound care, surgical support, and orthopedic devices. Advanced healthcare infrastructure, research, and development activities promote innovation in foam products. Hospitals and clinics increasingly adopt foam solutions for comfort, infection prevention, and device manufacturing. The focus on patient-centric care, combined with robust healthcare policies, drives demand for diverse applications while maintaining high standards for safety and efficiency in clinical settings.

Latin America & MEA Medical Foam Market

Latin America and the Middle East & Africa are emerging markets for medical foam, driven by growing healthcare investments and awareness of advanced medical treatments. Rising prevalence of chronic diseases and demand for hospital and home-care solutions fuel market growth. Applications include wound care, medical packaging, and device cushioning. Regional adoption is supported by the development of healthcare infrastructure and gradual implementation of safety and quality standards. Manufacturers focus on cost-effective, safe, and durable foam materials suitable for diverse medical applications, addressing both patient comfort and clinical performance across hospitals and care centers.

Medical Foam Market Key Players:

Some of the Medical Foam Market Companies

-

American Excelsior Company

-

General Plastics Manufacturing Company, Inc.

-

UFP Technologies, Inc.

-

FXI

-

3M

-

Allied Aerofoam, LLC

-

Rempac Foam, LLC

-

BASF SE

-

Dow Chemical Company

-

Armacell

-

Recticel NV

-

Woodbridge Foam Corporation

-

Zotefoams PLC

-

Pregis Corporation

-

Vitafoam Group

-

Carpenter Co.

Medical Foam Market for Competitive Landscape:

Dow Chemical Company, founded in 1897 and headquartered in Midland, Michigan, USA, is a global leader in materials science and chemical manufacturing. It produces a wide range of chemicals, plastics, and performance materials, serving industries like agriculture, packaging, electronics, and water treatment, focusing on innovation and sustainable solutions.

- Dow Chemical enhanced its operational efficiency and sustainability in 2023 by relocating its MDI distillation and prepolymers facility from La Porte to Freeport, Texas. Key players are likely to invest in research and development to create advanced foam materials with enhanced properties like antimicrobial resistance and biocompatibility. Additionally, there might be increased emphasis on circular economy initiatives and recycling technologies to address environmental concerns.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 32.9 Billion |

| Market Size by 2032 | USD 54.18 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Foam (Flexible, Rigid & Spray) • By Application (Bedding & cushioning, Medical packaging, Medical devices & components, Prosthetics & wound care) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles |

American Excelsior Company, American Foam Products, Heubach Corporation, General Plastics Manufacturing Company, Inc., LEXTECH GLOBAL SERVICES, UFP Technologies, Inc., FXI, Rogers Corporation, 3M, Allied Aerofoam, LLC, Rempac Foam, LLC, BASF SE, Dow Chemical Company, Armacell, Recticel NV, Woodbridge Foam Corporation, Zotefoams PLC, Pregis Corporation, Vitafoam Group, Carpenter Co. |