Microbial Products Market Report Scope & Overview:

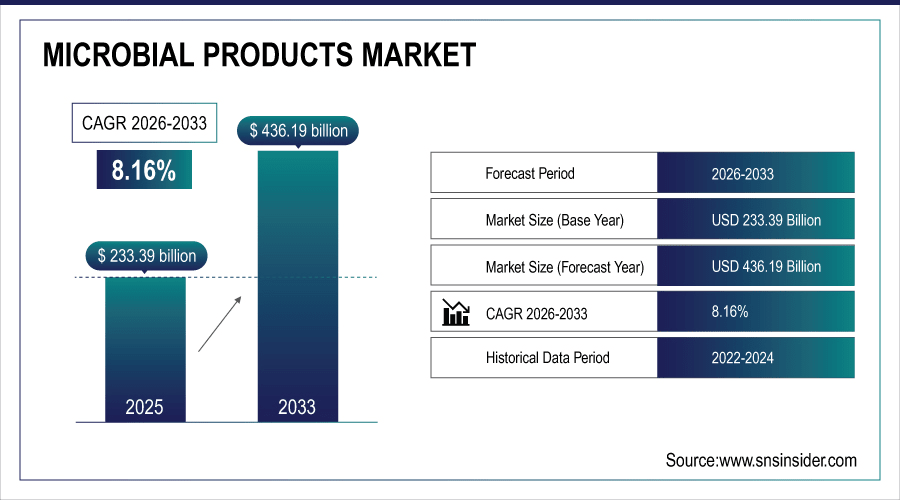

The Microbial Products Market size was valued at USD 233.39 Billion in 2025E and is projected to reach USD 436.19 Billion by 2033, growing at a CAGR of 8.16% during 2026-2033.

The Microbial Products Market analysis highlights the growing demand for bacterial, viral, and fungal products across pharmaceutical, biotechnology, and diagnostic industries. Increasing adoption of enzymes, antibiotics, and vaccines, along with advancements in bioengineering and fermentation technologies, is driving market expansion.

By 2025, microbial-derived enzymes accounted for more than 60% of global enzyme sales, with major use in pharmaceuticals, diagnostics, and biocatalysis for green chemistry and drug synthesis.

To Get More Information On Microbial Products Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025E: USD 233.39 Billion

-

Market Size by 2033: USD 436.19 Billion

-

CAGR: 8.16% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Microbial Products Market Trends

-

Increasing use of microbial products in drug development and vaccines is driving market growth globally.

-

Innovations in fermentation, bioengineering, and microbial strain optimization are improving production efficiency and product quality.

-

Growing adoption of microbial-based diagnostic kits and assays is fueling demand across hospitals, labs, and research institutions.

-

Environmentally friendly microbial products are replacing chemical alternatives in agriculture, pharmaceuticals, and biotechnology, supporting eco-conscious initiatives.

-

Rising interest in probiotics, nutraceuticals, and functional foods is creating new opportunities for microbial product utilization.

U.S. Microbial Products Market Insights

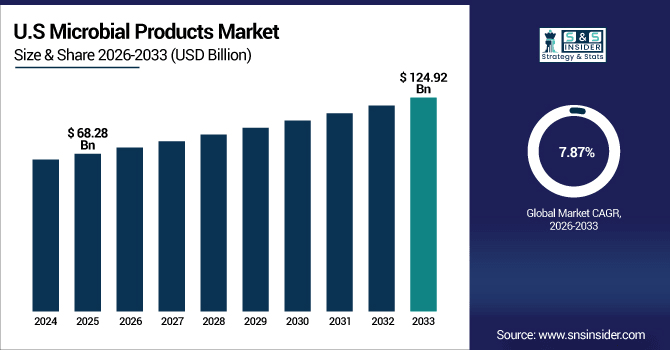

The U.S. Microbial Products Market size was valued at USD 68.28 Billion in 2025E and is projected to reach USD 124.92 Billion by 2033, growing at a CAGR of 7.87% during 2026-2033. Microbial Products Market growth is driven by increasing demand for bacterial, viral, and fungal products in pharmaceuticals, biotechnology, and diagnostics. The market is driven by the development of advanced enzymes, antibiotics, vaccines, and probiotics.

Microbial Products Market Growth Drivers:

-

Growing Biopharmaceutical and Biotechnology Demand Propels Expansion of the Global Microbial Products Market

The Microbial Products Market is primarily driven by rising demand in pharmaceuticals, biotechnology, and diagnostics. Increasing use of bacterial, viral, and fungal products for vaccines, antibiotics, enzymes, and probiotics is accelerating adoption. Technological advancements in fermentation, bioengineering, and microbial strain optimization improve production efficiency and product quality. Rising R&D investments and regulatory support for innovative microbial solutions further fuel growth. Additionally, the expanding applications in nutraceuticals, functional foods, and healthcare are creating new avenues for market expansion globally.

In 2025, over 75% of recombinant vaccines and monoclonal antibodies were produced using engineered microbial hosts like E. coli and Pichia pastoris, underpinning robust demand for GMP-compliant microbial systems.

Microbial Products Market Restraints:

-

High Production Costs and Regulatory Challenges Limiting Growth of the Microbial Products Market

Despite strong demand, the Microbial Products Market faces challenges due to high production costs, including fermentation, purification, and quality control expenses. Stringent regulatory approvals for microbial-based pharmaceuticals, vaccines, and diagnostic products increase time-to-market and compliance costs. Limited availability of specialized microbial strains and raw materials can hinder large-scale production. Additionally, complex supply chains, risk of contamination, and requirement for skilled workforce pose operational challenges. These factors collectively restrict rapid adoption, particularly in emerging markets, slowing overall growth and creating barriers for smaller players seeking to enter the market.

Microbial Products Market Opportunities:

-

Rising Applications in Probiotics, Nutraceuticals, and Functional Foods Create New Growth Opportunities

The growing interest in probiotics, functional foods, and nutraceuticals offers significant opportunities for the Microbial Products Market. Increasing consumer awareness about gut health and immune support is driving demand for microbial-based solutions. Expanding applications in animal feed, agriculture, and industrial biotechnology provide additional growth avenues. Innovations in microbial fermentation, bioengineering, and strain development enhance product efficiency and diversity. Strategic collaborations, new product launches, and entry into emerging markets are expected to further propel the adoption of microbial products globally.

In 2025, over 65% of global consumers actively sought products with probiotics or postbiotics, citing gut health and immunity as top wellness priorities—fueling demand for microbial ingredients in foods and supplements.

Microbial Products Market Segment Analysis

-

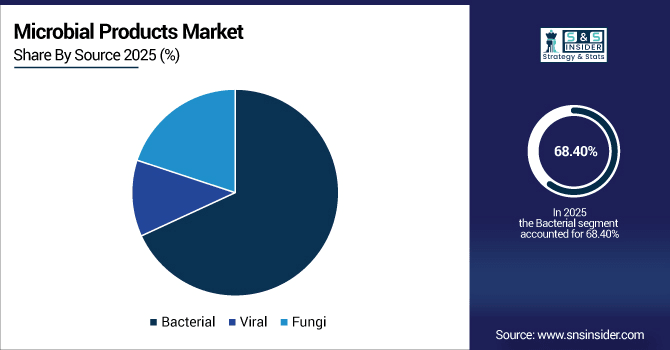

By Source, bacterial products led the market with a 68.40% share in 2025, while fungal products are the fastest-growing segment, registering a CAGR of 7.50%.

-

By Application, the pharmaceutical segment dominated the market with 41.25% in 2025, whereas biotechnology is the fastest-growing application, growing at a CAGR of 9.90%.

-

By Type, enzymes held the largest share at 37.61% in 2025, while nutrients are the fastest-growing segment with a CAGR of 6.50%.

-

By End-User, pharmaceutical industries accounted for 34.47% of the market in 2025, while research and academic institutions are the fastest-growing end-users, growing at a CAGR of 7.90%.

By Source, Bacterial Leads Market While Fungi Registers Fastest Growth

In the Microbial Products Market, bacterial products dominate due to their extensive use in pharmaceuticals, diagnostics, and biotechnology. They offer proven efficacy, stability, and a wide range of applications. Meanwhile, fungi products are registering the fastest growth, driven by increasing applications in enzymes, nutraceuticals, and functional foods. Advances in fungal strain development, fermentation technologies, and bioengineering are further accelerating adoption. Growing interest in sustainable and eco-friendly microbial solutions is supporting the rapid expansion of fungal-based products globally.

By Application, Pharmaceutical Dominate While Biotechnology Shows Rapid Growth

The pharmaceutical sector leads the microbial products market due to high demand for vaccines, antibiotics, enzymes, and probiotics. Pharmaceutical applications drive significant revenue growth, fueled by R&D investments and technological innovation. Meanwhile, the biotechnology segment is experiencing rapid growth, supported by increasing microbial utilization in bioprocessing, genetic engineering, and industrial biotechnology. Enhanced microbial production efficiency, digital monitoring, and fermentation optimization are further boosting adoption, positioning biotechnology as a key growth segment with emerging opportunities across global microbial product markets.

By Type, Enzymes Lead While Nutrients Registers Fastest Growth

Enzymes constitute the largest share of the microbial products market due to their critical role in pharmaceuticals, diagnostics, and industrial processes. They offer high efficiency, specificity, and cost-effectiveness. Nutrients, growth factors derived from microbial sources, are registering the fastest growth. Rising applications in food, feed, and nutraceuticals, along with advancements in microbial fermentation and strain optimization, are driving rapid adoption. Continuous innovation and regulatory support are further enabling growth in nutrient-based microbial products globally.

By End-User, Pharmaceutical Industries Lead While Research & Academics Grow Fastest

Pharmaceutical industries dominate the microbial products market due to extensive use in drug development, vaccines, and diagnostics. These applications ensure steady demand and high revenue contributions. While, research and academic institutions are the fastest-growing end-user segment, fueled by increasing microbial studies, laboratory experiments, and biotechnological innovations. Rising funding for microbiology, genetic engineering, and industrial biotech research, combined with the growing need for microbial products in experimental and educational applications, is driving rapid adoption across universities, research centers, and laboratories globally.

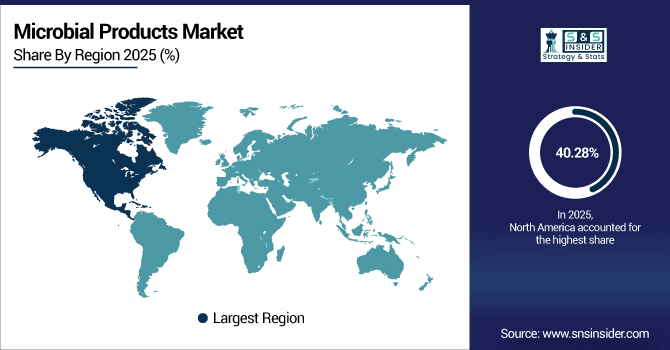

Microbial Products Market Regional Analysis:

North America Microbial Products Market Insights

In 2025 North America dominated the Microbial Products Market and accounted for 40.28% of revenue share, this leadership is due to the advanced healthcare infrastructure and a strong emphasis on research and development. High demand for antibiotics, enzymes, and probiotics fuels market expansion. Regulatory support and a robust supply chain further enhance market dynamics. The U.S. remains at the forefront of innovation in microbial product applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Microbial Products Market Insights

The U.S. is a leader in the microbial products market, driven by a well-established pharmaceutical industry. There is a high consumption of microbial-based products, including probiotics and enzymes. Significant investments in biotechnology research and development propel market growth.

Asia-Pacific Microbial Products Market Insights

Asia-Pacific is expected to witness the fastest growth in the Microbial Products Market over 2026-2033, with a projected CAGR of 8.90% due to large populations and growing healthcare needs. The demand for probiotics, enzymes, and antibiotics is rising in these nations. Advancements in biotechnology and increased healthcare investments are driving market growth. The region is expected to continue its upward trajectory, supported by both government initiatives and private sector investments.

China Microbial Products Market Insights

China is a key player in the microbial products market, leading in production and consumption. The country's vast population and expanding healthcare sector contribute to the high demand for microbial-based products. Government support for biotechnology research and development fosters innovation.

Europe Microbial Products Market Insights

In 2025, Europe emerged as a promising region in the Microbial Products Market, due to well-developed healthcare system and a growing biotechnology sector. There is increasing demand for microbial-based products in pharmaceuticals and agriculture. Regulatory frameworks in Europe support the development and commercialization of these products. The market is expected to expand as innovation and consumer awareness rise.

Germany Microbial Products Market Insights

Germany stands out in Europe for its robust pharmaceutical and biotechnology industries. The country is a major producer and consumer of microbial products, including antibiotics and enzymes. Strong research and development initiatives drive innovation in microbial applications.

Latin America (LATAM) and Middle East & Africa (MEA) Microbial Products Market Insights

The Microbial Products Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to growing healthcare needs and agricultural development drive market growth. There is a rising interest in probiotics and bio-based agricultural solutions. However, challenges such as regulatory hurdles and infrastructure limitations exist. Despite these challenges, the regions present significant opportunities for market expansion.

Microbial Products Market Competitive Landscape:

Amgen, Inc. is a leading biotechnology company specializing in microbial products for pharmaceuticals, including therapeutic proteins, enzymes, and vaccines. The company emphasizes innovation in biomanufacturing, R&D, and biotechnology solutions. Amgen’s global operations focus on developing advanced microbial-based therapies to address chronic diseases and enhance healthcare outcomes worldwide.

-

In September 2025, Amgen announced a $650 million expansion of its U.S. manufacturing network, creating hundreds of new jobs. This investment underscores the company's commitment to enhancing production capabilities and meeting growing demand for its biopharmaceutical products.

Merck & Co., Inc. is a global pharmaceutical and biotechnology leader offering microbial-based products for vaccines, antibiotics, and enzymes. With a strong focus on research and innovation, Merck develops solutions for human and animal health. Its advanced production capabilities and regulatory compliance ensure high-quality microbial products worldwide.

-

In July 2025, Merck acquired Verona Pharma for approximately $10 billion, adding the COPD treatment Ohtuvayre to its portfolio. This strategic move strengthens Merck's respiratory medicine pipeline and positions the company for long-term growth amid patent expirations of existing drugs.

Valent BioSciences Corp. specializes in microbial solutions for agriculture and biotechnology, producing bioinsecticides, bio fungicides, and beneficial microbial strains. The company focuses on sustainable and eco-friendly microbial products, supporting crop protection and yield improvement. Continuous R&D efforts drive innovation, positioning Valent BioSciences as a key player in the global microbial products market.

-

In September 2025, Valent BioSciences received EPA approval for the expanded use of LEAP® ES, a bacterial disease management biological insecticide. This approval allows broader application in agriculture, enhancing crop protection and supporting sustainable farming practices.

GlaxoSmithKline plc (GSK) is a global pharmaceutical and biotechnology company providing microbial-based vaccines, antibiotics, and therapeutic enzymes. Its R&D initiatives target human and animal health, with strong emphasis on innovation, quality, and regulatory compliance. GSK’s extensive global presence supports widespread adoption of microbial products across multiple sectors.

-

In January 2025, GSK acquired a 100% stake in a company for $1.25 billion, enhancing its capabilities in the microbial products sector. This acquisition is part of GSK's strategy to strengthen its position in the market.

Microbial Products Market Key Players:

Some of the Microbial Products Market Companies are:

-

Amgen, Inc.

-

Merck & Co., Inc.

-

Valent BioSciences Corp.

-

GlaxoSmithKline plc

-

Pfizer, Inc.

-

Ajinomoto Co., Inc.

-

Sanofi S.A.

-

Novartis AG

-

NOVADIGM Therapeutics, Inc.

-

Kyowa Hakko Bio Co. Ltd.

-

BASF SE

-

Bayer AG

-

Syngenta AG

-

Novozymes A/S

-

Thermo Fisher Scientific Inc.

-

BioMerieux SA

-

Lallemand Inc.

-

JH Biotech Inc.

-

Vedanta Biosciences Inc.

-

Earthrise Nutritionals LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 246.09 Billion |

| Market Size by 2033 | USD 436.19 Billion |

| CAGR | CAGR of 8.16% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Bacterial, Viral, and Fungi), • By Application (Pharmaceutical, Diagnostic, and Biotechnology) • By Type (Enzymes, Polysaccharides, Nutrients, Chemotherapeutic Agents, Antibiotics, and Vaccines) • By End-User (Pharmaceutical Industries, Biotechnological Industries, Hospitals & Clinics, Diagnostic Labs, and Research & Academics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amgen, Inc., Merck & Co., Inc., Valent BioSciences Corp., GlaxoSmithKline plc, Pfizer, Inc., Ajinomoto Co., Inc., Sanofi S.A., Novartis AG, NOVADIGM Therapeutics, Inc., Kyowa Hakko Bio Co. Ltd., BASF SE, Bayer AG, Syngenta AG, Novozymes A/S, Thermo Fisher Scientific Inc., BioMerieux SA, Lallemand Inc., JH Biotech Inc., Vedanta Biosciences Inc., Earthrise Nutritionals LLC |