Mononucleosis Diagnostic Market Report Scope & Overview:

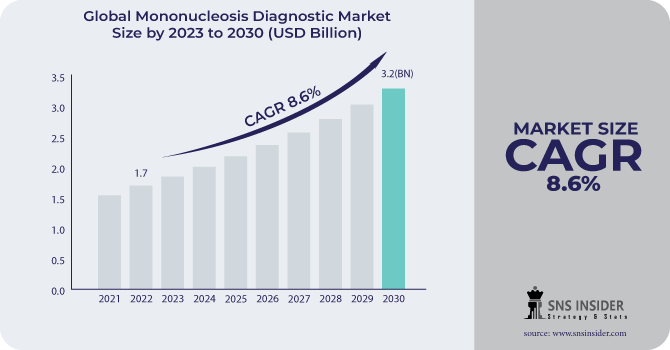

The Mononucleosis Diagnostic Market size was estimated at USD 1.7 billion in 2022 and is expected to reach USD 3.2 billion by 2030 with a growing CAGR of 8.6% during the forecast period of 2023-2030.

Mononucleosis is an infectious disease conveyed by the Epstein-Barr virus through saliva. Early detection allows for effective infection therapy, necessitating the use of mononucleosis diagnostics. The advantages of mononucleosis diagnostics, such as exact diagnosis, faultless detection, and accurate results, may lead to promising growth prospects. All of these variables could help the mononucleosis diagnostic market flourish.

To Get More Information on Mononucleosis Diagnostic Market - Request Sample Report

MARKET DYNAMICS

DRIVERS

-

Increasing teenager population is laying the foundation for expansion

The growing adolescent population worldwide is also a crucial element driving market expansion, as mononucleosis is most common in teenagers and adults. Asia is home to more than half of the world's adolescents. South Asia has the most teenagers of any region, with almost 350 million. With almost 300 million people, it is followed by East Asia and the Pacific. In either of these places, the teenage population eclipses that of any other region on the planet. According to a World Health Organization (WHO) report, nearly 1.2 billion adolescents (10-19 years old) live in the world. Teenagers represent for a quarter of the population in some countries, and the number of adolescents is predicted to climb until 2050, primarily in low- and middle-income countries (LMICs), where close to 90% of 10- to 19-year-olds live.

RESTRAIN

-

Patients lack of knowledge about the availability and benefits of modern diagnostic tests.

OPPORTUNITY

-

The rising prevalence of infectious mononucleosis is driving expansion.

The increasing prevalence of infectious mononucleosis (IM), rising awareness and information about mononucleosis, and increased research and development activities for IM diagnosis and treatment are the primary drivers driving the global mononucleosis diagnostic market.

CHALLENGES

-

The high cost of mononucleosis diagnostics will provide a hurdle to the market.

The high cost of mononucleosis diagnostics and poor acceptance rate in emerging and developing nations may stymie industry expansion. Some constraints connected with mononucleosis diagnostic tests are projected to impede market expansion throughout the projection period. There are just three tests that can diagnose mononucleosis, which is extremely low given the rate at which infectious mononucleosis is spreading.

IMPACT OF RUSSIA-UKRAINE WAR

Even in peacetime, the Ukrainian healthcare system was far from ideal. People suffering from chronic ailments frequently experienced pauses in medication supplies, doctors complained about inadequate pay, and hospital extortions had long ceased to be shocking. The conflict had every opportunity of utterly destroying the system, but instead spurred the government and local specialists to find effective solutions, due to which medicine in the country not only survived, but also continued to improve. Doctors must work in the outdoors, substituting sterile operating rooms with cellars and bomb shelters. In certain cities, the medical personnel does not leave the hospital, which has become their second home.

IMPACT OF ONGOING RECESSION

The diagnostic sector confronts a "challenging set-up" in 2022, as persistent recession in the United States and Europe dampens chances for a post-pandemic volume recovery. Analysts said there will be "limited visibility over the course of the year" as corporations report second-quarter results, and that businesses may need to focus more on demonstrating their paths to profitability in a more tough macro environment. Changes in market mood, along with the possibility of a recession, may make it more difficult for businesses to raise finance. According to the experts, Invitae has a "tighter cash picture."

KEY MARKET SEGMENTATION

By Test Type

-

Infectious Mononucleosis (IM) Test

-

Epstein-Barr Virus (EBV) Test

-

Others

In 2022, infectious mononucleosis (IM) test segment is expected to held the highest market share during the forecast period due to the prevalence of infectious mononucleosis is rapidly increasing, there is an increase in demand for diagnostics, which is driving revenue growth in this field. The Epstein-Barr virus (EBV), which causes IM and is exceedingly common around the world, also adds to the rising need for IM testing. A blood sample is frequently used in the IM test, and it is checked for the presence of specific antibodies produced by the body in response to the virus. This test, which is widely available, is the most commonly used approach for diagnosing IM.

By End User

-

Hospitals

-

Diagnostic Laboratories

-

Others

.png)

Do You Need any Customization Research on Mononucleosis Diagnostic Market - Enquire Now

In 2022, the hospitals segment is expected to dominate the market growth during the forecast period because of the availability of a variety of diagnostic tests, advanced imaging technology, and the presence of highly experienced healthcare workers. Furthermore, hospitals are outfitted with modern equipment and specialized departments that allow for rapid and accurate disease diagnosis.

REGIONAL ANALYSES

North America held a significant market share in 2022 owing to the increased prevalence of mononucleosis and other viral illnesses, the presence of a well-established healthcare infrastructure, and the widespread adoption of cutting-edge diagnostic technologies. The increasing demand for early and accurate mononucleosis diagnoses, as well as growing public awareness of the importance of fast diagnosis and treatment, are the primary drivers of this region's mononucleosis diagnostic market expansion. The United States and Canada are the two countries most responsible for the market's expansion in this region.

Asia Pacific is witness to expand fastest CAGR rate during the forecast period owing to the region's growing adolescent population and the increased incidence of infectious mononucleosis (IM). According to UNICEF figures, Asia is home to more than half of all adults worldwide, with South Asia having the most adolescents of any area in the globe.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are Daiichi, Digene, Hemagen, Meridian, Gene-Tac, Biotest, Abbott Laboratories, Bio-Rad, Genzyme, Roche, Johnson & Johnson, Becton Dickinson, Diasorin, Beckman Coulter, and Others.

Hemagen-Company Financial Analysis

RECENT DEVELOPMENT

Orthofix Medical Inc., will develop Opus BA for cervical and lumbar spine fusion surgeries in February 2022. Opus BA acts as a scaffold, allowing bone to grow over the surface before being reabsorbed and replaced with normal bone during healing.

In 2021, Abbott Laboratories purchased Walk Vascular, LLC, a medical device business focusing on developing minimally invasive devices for vascular disease, in order to extend its vascular portfolio.

|

Report Attributes |

Details |

|

Market Size in 2022 |

US$ 1.7 billion |

|

Market Size by 2030 |

US$ 3.2 billion |

|

CAGR |

CAGR of 8.6% From 2023 to 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023-2030 |

|

Historical Data |

2019-2021 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Test Type (Infectious Mononucleosis (IM) Test, Epstein-Barr Virus (EBV) Test, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Daiichi, Digene, Hemagen, Meridian, Gene-Tac, Biotest, Abbott Laboratories, Bio-Rad, Genzyme, Roche, Johnson & Johnson, Becton Dickinson, Diasorin, Beckman Coulter |

|

Market Opportunities |

• The rising prevalence of infectious mononucleosis is driving expansion. |

|

Market Challenges |

•The high cost of mononucleosis diagnostics will provide a hurdle to the market. |