mRNA Therapeutics Market Report Scope & Overview:

Get More Information on mRNA Therapeutics Market - Request Sample Report

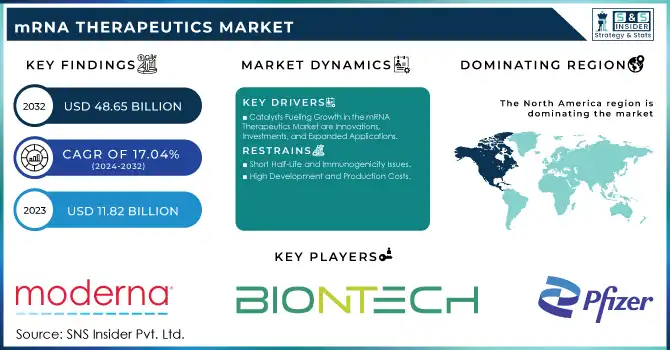

The mRNA Therapeutics Market Size was valued at USD 11.82 billion in 2023 and is expected to grow to USD 48.65 billion by 2032 and grow at a CAGR of 17.04 % over the forecast period of 2024-2032.

The mRNA therapeutics market gained much attention due to the nature of the field in discussing chronic diseases and the advantages of DNA vaccines. Higher production efficiency and distribution capabilities along with safety profiles have enhanced the acceptance and popularity of mRNA vaccines. The U.S. provided reliable clinical results and used authorization urgently, late. FDA Approvals for COVID-19 mRNA vaccines, which showed a high efficacy of 94.1% in preventing symptomatic cases. The expansion of clinical trials across the globe and the growing use of stem cell therapy also drive the industry in line with market growth.

Biopharmaceuticals, monoclonal antibodies, peptides, and nucleic acids are becoming promising therapeutic approaches, and there has been an influx of new and innovative therapies for treating diseases, which has placed a strong focus on mRNA technologies both for the treatment and prevention of such diseases. Over the last decade, several technological breakthroughs have solved earlier challenges of mRNA therapy: mRNA has a short half-life and intrinsic immunogenicity. Several technologies, that helped in its adoption, included easier production, reduced cytotoxicity, and clinical validation.

The market of mRNA therapeutics is growing fast with high levels of innovation and technological advancement. Notably, the focus will now shift to oncology and rare disease applications. Some of the important technology trends include improvements in lipid nanoparticle delivery systems, personalized mRNA sequences, and self-amplifying platforms. It can also be noted that significant partnerships and collaborations across the industry are a market characteristic to enhance product portfolios and expand their market reach. For example, the strategic collaboration of BioNTech SE with CEPI in September 2023 to develop an mRNA-based Mpox vaccine fits this bill.

Regulatory trends are also friendly to innovation. With flexible approval processes now being adopted by agencies like the FDA, having made provision for expedited authorization as was seen in the case of the Pfizer-BioNTech COVID-19 vaccine, a new way of planning the timeline for approval might be noticed in the future. Companies are also building up their mRNA product lines. Moderna, Inc., and organizations from Australia launched an mRNA platform in November 2023 for faster therapeutic development. Complementing this is Sanofi opening a new mRNA research facility at Griffith University for faster R&D. It indicates growth in the healthy market for mRNA therapeutics while the R&D activities are picking up alongside increasing technological improvements and acceptance of these novel treatments.

mRNA Therapeutics Market Dynamics

Drivers

-

Catalysts Fueling Growth in the mRNA Therapeutics Market are Innovations, Investments, and Expanded Applications

mRNA vaccine for COVID-19 has shown spectacular success. Such a success has dramatically increased the interest and investment in the underlying technology. The success is demonstrating the potential of mRNA-based treatments for diseases of various genres, be it infectious or rare chronic conditions. Advances in mRNA technology, especially the improvement in lipid nanoparticle delivery systems and self-amplifying platforms, further enhance the feasibility and efficacy of mRNA therapeutics. The main driver in the market for mRNA products is increased governmental and institutional funding as well as strategic partnerships and collaborations with big pharmaceutical companies. An increasing prevalence of chronic diseases and thus a progressive demand for personalized medicine further boost the market. Enhanced clinical research along with an expansion of mRNA application beyond COVID into areas like oncology and rare diseases fuel the growth in the market. The sector, as demonstrated in the case of Moderna's extension into new therapeutic areas and CureVac's Phase 2 study of modified mRNA vaccines, is one of the continuing innovations and possibility of future revenue growth.

Restraint

-

High Development and Production Costs

-

Short Half-Life and Immunogenicity Issues

-

Public Skepticism and Acceptance

-

Complex Manufacturing Processes

mRNA Therapeutics Market Segmentation Analysis

By Application

Application is the basis for the division of the market into mRNA therapeutics for rare genetic diseases, oncology, respiratory diseases, infectious diseases, and other categories. Infectious diseases were the highest-end application in the market in 2023 due primarily to the rise in the demand for COVID-19 treatments. mRNA vaccines are increasingly being adopted and more candidates in clinical trials for different infectious diseases are expected to continue fueling growth in this segment. For example, this August 2021, the Pfizer-BioNTech COVID-19 mRNA vaccine received an Emergency Use Authorization or EUA among individuals of 16 years and above. In September 2023, BioNTech and Pfizer reportedly secured U.S. FDA approval for its mRNA-based COVID-19 vaccine, COMIRNATY 2023-2024, for use in adults 12 years of age and older. The next wave of FDA approvals for innovative mRNA medicines should further speed up this class.

The oncology segment is expected to grow at the highest compound annual growth rate (CAGR) during the forecast period. mRNA technology has exhibited immense potential in cancer research, with numerous clinical trials currently ongoing in RNA vaccines and therapies for various types of cancers. For instance, personalized mRNA cancer vaccines can provoke an exact immune response to devastate the cancer cells-one promising development in the treatment of cancer.

By Type

The mRNA therapeutics market can be further divided into two types: prophylactic and therapeutic. In 2023, the prophylactic segment accounted dominated market share. This is primarily due to the high revenue generated through COVID-19 vaccines. With the introduction of vaccines across other diseases such as influenza and RSV, the segment is expected to rise going forward. Many top companies are carrying out clinical studies and developing RNA vaccines for COVID-19, flu, HIV, and more against viral diseases to gain market share and take in revenue-positive business deals. In February 2023, RVAC Medicines initiated a phase IB clinical trial in Singapore of three candidates for its COVID-19 mRNA vaccine with approval from the Health Sciences Authority (HSA).

On the other hand, the therapeutic segment is expected to achieve the highest compound annual growth rate between 2024 and 2032. This growth is due to the huge investment made by the primary market players in the development of novel and more effective RNA therapeutics. For instance, during July 2022, Axcelead, Inc. subsidiarities, Axcelead Drug Discovery Partners, Inc., and ARCALIS, Inc., collaboratively provided comprehensive drug discovery support services mainly for mRNA-based vaccines and therapeutics. With the investment, the therapeutic segment is likely to increase in future years.

By End-Use

The mRNA therapeutics market is segmented by end-use into hospitals & clinics, research organizations, and other categories. Hospitals & clinics accounted for the largest share of 45.3% in 2023. This segment is also expected to grow at the fastest rate from 2024 to 2032. The prime reason is the growing demand for mRNA-based vaccines and therapeutics for controlling chronic diseases with concurrent growth in patients being treated in such facilities.

The "other" category, including specialty pharmacies, is also anticipated to grow by considerable percentage points over the forecasting period. Specialty pharmacies are integral to the distribution and delivery of mRNA vaccines, and this is further facilitated by the specific storage requirements inherent in mRNA vaccines. For example, the Pfizer-BioNTech mRNA COVID-19 vaccine, which initially required ultra-low-temperature storage, has benefited greatly from these pharmacies' specialized handling expertise. The growth in specialty pharmacies mirrors this essential role in the management of temperature-sensitive medications.

Regional Insights

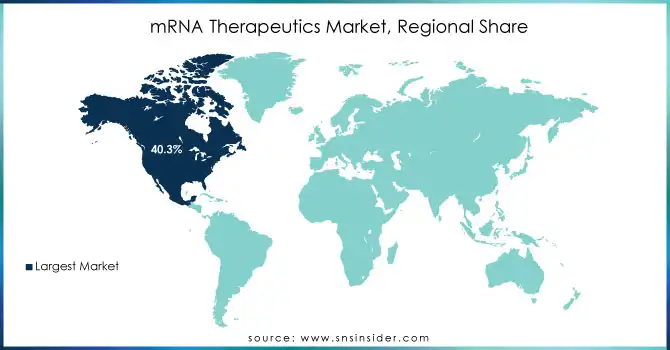

North America dominated the mRNA therapeutics market in 2023 with a humongous revenue share of 40.3%. This is because of heavy research funding, federal programs for RNA-based medicines, and a large number of clinical trials. For example, this 'vaccine development in a matter of few months' is possible only due to the significant research support given by the NIH and other federal bodies. The US market will continue to be promising and is set to grow further with appropriate strategy steps by leading players who join other organizations or businesses.

Europe is a very attractive market, especially because of excellent government support, state-of-the-art research infrastructure, and successful Covid-19 mRNA vaccines. The UK will continue growing since government deals related to pandemic management will continue in the future. France is becoming increasingly investing in research for mRNA vaccines. Germany would be growing on its own because it has immense numbers of mRNA providers and is expanding.

The fastest growth from 2024 to 2032 is expected in the Asia Pacific region due to the rising investment in biotech, better healthcare infrastructure, and focus on precision medicine. Developments that led to the growth of trends include those in China, wherein there is ample investment into mRNA research, and Japan, where efforts are seen in personalized medicine.

The Middle East and Africa are poised to grow with improved investments in health care coupled with increased interest in advanced medical solutions. Biotechnology is driven by the commitment in the region by the UAE, as well as by the growth of the biologics industry in Saudi Arabia. Multinational and regional pharmaceutical players continue to grow the market in Kuwait.

Need any customization research on mRNA Therapeutics Market - Enquiry Now

mRNA Therapeutics Companies

-

Moderna Inc.

-

CureVac N.V.

-

Sanofi

-

GSK Plc.

-

Argos Therapeutics Inc.

-

Ethris

-

Pfizer Inc.

-

AstraZeneca

-

Translate Bio, Inc

-

Sangamo therapeutics

-

Etherna Immunotherapies.

-

Crisper Therapeutics and others

Recent Development

-

In September 2023, Moderna, Inc. broadened its mRNA research to encompass oncology, respiratory diseases, and rare conditions. This strategic expansion was expected to boost the company’s revenue.

-

In August 2023, CureVac began dosing the first participant in a Phase 2 study of modified COVID-19 mRNA vaccine candidates, developed in collaboration with GSK Plc.

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.82 Billion |

| Market Size by 2032 | US$ 48.65 Billion |

| CAGR | CAGR of 17.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Rare genetic disease, Respiratory disease, Infectious disease) • By type (Prophylactic vaccines, Therapeutic Vaccines, Therapeutic Drugs) • By end user (Hospitals and clinics, Research Organizations) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Moderna Inc., BioNTech SE, CureVac N.V., Arcturus Therapeutics, Sanofi, GSK Plc., Argos Therapeutics Inc., Ethris, Pfizer Inc. and Others |

| Key Drivers | • Catalysts Fueling Growth in the mRNA Therapeutics Market are Innovations, Investments, and Expanded Applications |

| Market Restraints | • High Development and Production Costs • Short Half-Life and Immunogenicity Issues |