Mulching Materials Market Report Scope & Overview:

Get More Information on Mulching Materials Market - Request Sample Report

The Mulching Materials Market Size was valued at USD 3.5 Billion in 2023. It is expected to grow to USD 6.8 Billion by 2032 and grow at a CAGR of 7.7% over the forecast period of 2024-2032.

A rise in awareness towards sustainable agricultural practices and environment conservation among the end-users is the primary factor driving the market issue. Since it conserves moisture, regulates temperature, and kills weeds, mulch is an indispensable weapon for improving crop performance, especially in water-starved regions. Rising inclination toward organic farming practices, in turn, needs the use of organic mulching materials like straw, compost, and wood chips has also promoted the demand for mulch. Moreover, increasing home gardening and landscaping trends have boosted the demand for mulching materials in residential.

Consumers and businesses are becoming increasingly more environmentally aware and this is driving a move to biodegradable ecofriendly mulching alternatives. Also, the increasing focus of the agricultural industry on lowering the chemical inputs and enhancing soil health bodes well for mulching practices which supports market expansion. Diverse initiatives taken by governments, resulting in the promotion of sustainable farming across the Asia Pacific and widening subsidy landscape for eco-friendly practices are other crucial points aiding the growth of the market.

In 2022, BASF launched its biodegradable mulch films made from innovative materials that break down into biomass and natural minerals in the soil. This initiative aligns with its commitment to sustainable agricultural practices and reducing chemical inputs in farming.

In the future, the lucrative prospects through advancements in agricultural technologies such as precision farming and automated mulching have led the market to an increasing emergence of opportunities. As these technologies proliferate the effectiveness and cost-efficiency of mulching will also improve making it more popular among large-scale agriculture as well as everyday gardening. Urban landscaping and farming new areas offer scope for market expansion outside of traditional farming.

According to the U.S. Department of Agriculture (USDA) allocated approximately USD 1 billion in 2022 for programs supporting sustainable agricultural practices, including the adoption of eco-friendly mulching materials and precision farming technologies.

The cost of some types of mulching materials, particularly synthetic variations such as plastics and rubber mulch are expensive. High capital investment required for good quality mulches limits their use across small-scale farmers, especially in the Asia Pacific belt where the agriculture budget is lower than other parts of the world. Otherwise, the widespread use of modern techniques for mulching that is able to increase agricultural output continues to remain low due either to ignorance with regard to their existence to quality products.

| Mulching Material | Environmental Impact | Sustainability | Usage Lifespan | Cost-Effectiveness |

|---|---|---|---|---|

| Organic Mulch (e.g., Wood Chips, Straw) | Biodegradable, adds nutrients to soil; low carbon footprint | Highly sustainable, renewable, improves soil health | 6 months to 1 year | Affordable, especially in bulk |

| Inorganic Mulch (e.g., Gravel, Stones) | Neutral impact, but mining can affect the environment | Less sustainable, non-renewable, no soil benefits | 5+ years | High initial cost, low maintenance |

| Plastic Mulch | Non-biodegradable; disposal contributes to plastic waste | Unsustainable, contributes to pollution; recycling options limited | 1 growing season | Moderate cost, but disposal adds extra expenses |

| Rubber Mulch | Made from recycled tires; prevents tire waste in landfills | Moderately sustainable, long-lasting, repurposed material | 10+ years | Expensive initially, but low maintenance |

| Compost Mulch | Fully biodegradable, enriches soil; made from recycled organic waste | Highly sustainable, improves soil structure | 6 months to 1 year | Cost-effective if self-produced; moderate if purchased |

Mulching Materials Market Dynamics

Drivers

-

Rising Organic Farming Practices Drives the Market Growth.

The push for organic agriculture and environmentally friendly solutions has led to a major increase in the use of natural mulch materials like wood chips, straw, and grass cuttings. Consequently, the number of organic farming in the United States has grown over decades to over 17.5 million acres from 3.5 million acres, as consumers continue opting for organic produce and sustainable agricultural practices (USDA). This trend includes key announcements from industry leaders. 2020 saw The Mulch & Soil Company add to its portfolio of organic mulching products, utilizing natural wood chips and straw with a new emphasis on which they will introduce more sustainably sourced materials in response to the growing demand for organic inputs. More recently, Scotts Miracle-Gro expanded its organic mulch offerings with the 2022 introduction of a new line aimed at home gardeners, reinforcing the role of natural solutions in landscaping and horticulture. In addition, the sustainability efforts at all of these sites show a clear direction for eco-friendly mulching solutions as it is in alignment with the trends and needs of an expanding organic farming culture.

Restraint

-

Limited accessibility of raw materials hampers the market growth.

The limited number of raw material operation providers and the short span length of acquiring mulch materials, in addition to high prices, have made the mulching materials market more challenging. Supply can also be a problem due to seasonal variations, changes in farming practices, and other consumers who compete for feedstocks such as the biomass energy industry or animal bedding. Therefore, irregular availability can add cost and volatility pressures for both those producing and consuming these materials, keeping a ceiling on discount opportunities due to attenuation of margins in the value chain preventing cheaper alternatives to mulching with limits market demand side growth.

Mulching Materials Market Segmentation

By Product

The organic segment held the largest market share around 58% in 2023. These materials decompose slowly over time and add essential nutrients to the soil, improve its structure, and enhance microbial activity. As mulch decomposes it works to return all these good things back in and does an outstanding job of keeping the soil moist, smothering out weeds, and moderating the temperature. In addition, as they decompose, they are added to the organic content in the soil which can result in the flourishing growth of plants and the reduced use of chemical fertilizers. Organic farmers find them beneficial for their soil as they break down in a natural way that works well with nature and sustainable landscaping. But organic mulches have a few downfalls: they need to be replaced every year or so when they decompose, leading to higher maintenance costs over time. Apart from housing moisture, excess wood bundles can also easily attract pests like termites or rodents. However, increasing emphasis on sustainable agriculture and environmental conservation across major regions focusing on organic farming such as North America and Europe is expected to drive demand for organic mulching materials over the forecast period. It’s something highly valued locally grown organic compost, making the products even more appealing (especially among small landscape and residential gardeners).

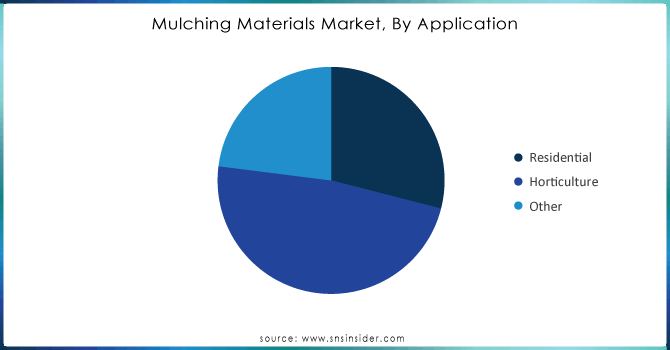

By Application

The horticulture segment held the largest share around 48% in 2023. This is due to the widely increasing usage of mulches in improving soil structure, encouraging microbial activity, and other uses for enhancing plant growth. In horticulture, both organic and inorganic mulch materials are widely used, depending on the particular needs of the gardeners. For example, organic mulches are generally favored for improving the soil as they decompose, releasing nutrients to urban horticultural plants fruits, vegetables, and flowers. In fruit and vegetable production, inorganic mulches such as plastic films are commonly used to decrease weed infestation while improving soil moisture conservation in large-scale horticultural operations. For example, plastic mulch is often used in the cultivation of strawberries and tomatoes to provide optimal yields by retaining constant soil temperatures and struggling evaporation. To this end, the organic ones are not used and the goal is to maximize crop yield and minimize labor costs as a result of the durability and weed suppression in inorganic materials.

Need any customization research on Mulching Materials Market - Enquiry Now

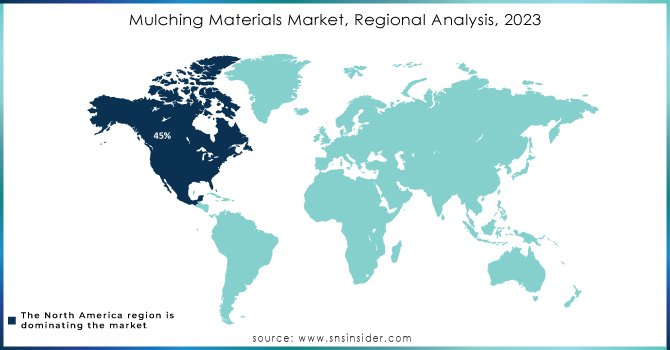

Mulching Materials Market Regional Analysis

In 2023, North America held the largest share around 45% in 2023. The North American market is propelled by the large-scale implementation of eco-friendly agricultural activities coupled with an upsurge in water conservation methods, especially in drought-affected areas. The increasing trend of organic farming practices has propelled the use of biodegradable mulching materials, especially in the U.S. & Canada; where environmental regulations support sustainable land management practices. In the U.S., also in response to greater awareness of soil health and ecosystem services, particularly among agriculture and landscaping sectors. The residential gardening industry, influenced by a rage for becoming environmentally friendly has also broadened the market. Moreover, support from the U.S. Department of Agriculture regarding sustainable agricultural practices coupled with government assistance for organic farming also pushes the demand for mulching materials.

The Asia Pacific mulching materials market is anticipated to register the fastest CAGR of 6.9% over the forecast period on account of the expanding agricultural sector and the rise in the application of promoting crop yield. Leading production countries such as China, India, and Japan are major drivers of the market growth due to the adoption of increasingly high rates by farmers in these regions on account of benefits associated with mulch practices have resulted in saving water without compromising the crop yield. Increasing organic farming in the economies of Australia and New Zealand, too is aiding the demand for biodegradable mulching materials.

Key Players

-

The Scotts Miracle-Gro Company (Organic Mulch, Garden Soil)

-

Barkman Concrete Ltd. (Wood Mulch, Rubber Mulch)

-

The Mulch & Soil Company (Cypress Mulch, Pine Bark Mulch)

-

Pine Tree Farms, Inc. (Natural Cedar Mulch, Premium Pine Bark Mulch)

-

Landscaping Supplies (Landscape Fabric, Decorative Rock)

-

Ewing Irrigation & Landscape Supply (Bark Mulch, Rubber Mulch)

-

A.M.A. Horticulture Inc. (Compost Mulch, Wood Chip Mulch)

-

Soil and Mulch Company, LLC (Organic Pine Bark, Hardwood Mulch)

-

Gardener’s Supply Company (Organic Mulch Mats, Straw Mulch)

-

Duke’s Landscape Supply (Organic Mulch, Colored Mulch)

-

Greenview Fertilizer (Wood Mulch, Bark Mulch)

-

Stihl (Mulching Blades, Mulching Kits)

-

TruGreen (Mulch Installation Service, Mulch Type Selection)

-

Rivermill (Cedar Mulch, Colored Mulch)

-

Walnut Creek Foods (Compost Mulch, Premium Wood Chips)

-

Nature's Way Resources (Compost Mulch, Pine Bark Nuggets)

-

Dunn DIY (Cypress Mulch, Black Mulch)

-

Lowe's Companies, Inc. (Pine Bark Mulch, Cypress Mulch)

-

Home Depot (Colored Mulch, Organic Mulch)

-

Alberta Landscape Products (Recycled Rubber Mulch, Landscape Bark)

Recent Development:

-

In 2023, The Mulch & Soil Company expanded its distribution network to include more regions across the United States, focusing on increasing the availability of its natural mulching materials. This strategic move aims to meet the rising demand for sustainable landscaping solutions.

-

n 2023, Scotts Miracle-Gro launched a new line of organic mulching products specifically designed for home gardens, emphasizing eco-friendly ingredients and sustainable sourcing. This expansion aims to cater to the growing demand for organic gardening solutions.

-

In 2022, Barkman Concrete introduced a new range of rubber mulch products in, targeting landscaping and playground applications. This product line aims to provide a durable and environmentally friendly alternative to traditional wood mulches, enhancing safety while minimizing maintenance.