Nitinol-Based Medical Device Market Report Scope & Overview:

The Nitinol-Based Medical Device Market size was valued at USD 4.35 billion in 2025E and is expected to reach USD 7.55 billion by 2033, growing at a CAGR of 7.15% over the forecast period of 2026-2033.

The global nitinol-based medical devices market is driven mainly by an increasing interest in minimally invasive treatments, which provide quicker recovery, shorter hospital stays, and fewer complications. Nitinol’s super elasticity and shape memory characteristics are well-suited for devices, including stents, guidewires, and retrieval tools used in cardiovascular and urological procedures.

Nitinol-Based Medical Device Market Size and Forecast

-

Market Size in 2025: USD 4.35 billion

-

Market Size by 2033: USD 7.55 billion

-

CAGR: 7.15% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Nitinol-Based Medical Device Market - Request Free Sample Report

Key Trends in the Nitinol-Based Medical Device Market

-

Growing adoption of minimally invasive surgical procedures globally, driving higher demand for Nitinol stents, guidewires, and orthopedic implants.

-

Rising use of Nitinol’s superelastic and shape-memory properties in cardiovascular and neurovascular interventions for enhanced device performance.

-

Increasing advancements in laser cutting, surface finishing, and heat-treatment technologies supporting next-generation Nitinol medical devices.

-

Expanding applications of Nitinol in robotic-assisted surgeries, improving precision, flexibility, and procedural efficiency.

-

Growing demand for Nitinol-based implants in trauma management due to its biocompatibility and durability.

-

Technological innovations in Nitinol wire manufacturing enabling thinner, stronger, and fatigue-resistant structures for medical devices.

For instance, in October 2024, GlobalData HealthTech reported an 11.5% year-over-year increase in global nitinol stent sales, driven by rising peripheral and neurovascular procedure volumes.

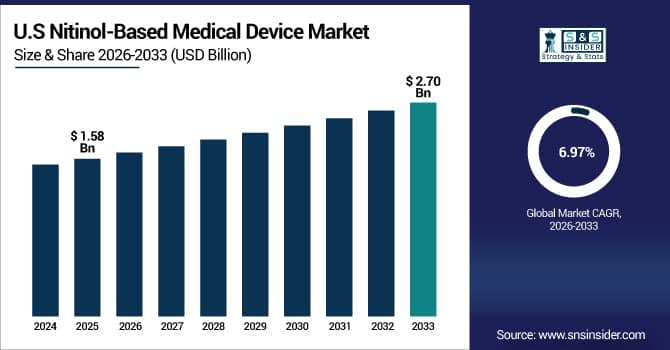

The U.S. Nitinol-Based Medical Device Market was valued at USD 1.58 billion in 2025E and is expected to reach USD 2.70 billion by 2033, growing at a CAGR of 6.97% over 2026-2033. The U.S. is the trendsetter in the nitinol medical devices market globally, owing to the high prevalence of chronic diseases, about 50% of the population, demanding superior disease management solutions, including nitinol implants. Large-scale adoption of digital health devices, greater acceptance by doctors, and a health care system under pressure to cut costs all contribute to the demand. But, spurred on by the high levels of use, innovation spreads very quickly.

Nitinol-Based Medical Device Market Drivers:

-

Advancements in AI integration, Driving the Nitinol-Based Medical Device Market Growth

The integration of AI is one of the important reasons for the development of the nitinol-based medical device market, in which respect, the production speed is accelerated, the quality performance is raised, and the product is customized. AI-based quality control, predictive maintenance and real-time process optimisation minimise waste and downtime to deliver high precision. Such inventions enable scalable, lean production of complex nitinol implants. Accordingly, the nitinol-based medical devices market growth is because to smarter, faster, and flexible production.

For instance, in March 2025, MD+DI Tech Outlook reported that 47% of U.S. medical device manufacturers use AI-driven quality control systems to inspect nitinol implants, enhancing precision and compliance.

Top of Form

Nitinol-Based Medical Device Market Restraints:

-

Material Variability and Machining Difficulties are Restraining the Nitinol-Based Medical Device Market

Material variance and difficult machining are the main deterrents for the nitinol medical device market. The superelasticity and shape memory of Nitinol complicate the machining process by making it difficult to machine precise features and form the components to close tolerances, which often result in surface flaws, scattered dimensions, and high reject rates. In addition, the variability of material properties complicates the production. These challenges hamper scalability and regulatory compliance, thus constraining the growth of the nitinol-based medical device market share that the global clinical demand for high-performance implants would otherwise demand.

For instance, in February 2025, Frost & Sullivan reported that lead times for nitinol components are 26% longer than stainless steel, due to complex machining and precision requirements.

Nitinol-Based Medical Device Market Segmentation Analysis:

By Product Type, Retrieval Devices Dominate Nitinol-Based Medical Device Market With 38.60% Share in 2025, Catheters Segment to Register Fastest CAGR of 7.71% From 2026 to 2033

Retrival device was the dominant in the nitinol-based medical device market analysis, with a 38.60% market share in 2025, owing to their important role in the less-invasive image-guided treatments, including neuro-vascular and cardio-vascular interventions. The superelastic and shape memory properties of Nitinol allow the surgeon to maneuver through difficult anatomies with exactitude, leading to enhanced procedural success and patient safety. Increased incidence of stroke and demand for better thrombectomy devices drive adoption, thus contributing towards increased nitinol-based medical device market share for retrieval devices.

Catheters are emerging as the fastest-growing segment in the nitinol-based medical device market trend, with a CAGR of 7.71% in the forecasted period 2026-2033, following their growing application in urology, cardiology, and neurovascular procedures. The flexibility, kink resistance, and biocompatibility of Nitinol make it particularly useful in navigating tortuous vessels and challenging anatomies. Increasing demand for minimally invasive procedures, a growing aging population, and the development of steerable catheters are some of the major factors driving the nitinol-based medical devices market growth across the globe.

By Application, Cardiovascular Applications Lead Nitinol-Based Medical Device Market With 62.64% Share in 2025, Others Segment (Orthopedic, Neurovascular, Gastrointestinal) to Record Fastest Growth

In 2025, the cardiovascular, controlled nitinol-based medical device market had with 62.64% market share, owing to the high proportion of patients globally who have ischemic heart disease and peripheral artery disease. Nitinol’s SM and SE nature allows it to be employed for self-expanding stents, guidewires, and embolic protection devices in complex vascular procedures. Growing preference for minimally invasive cardiac surgeries and increased geriatric population also fuel demand, which in turn raises the nitinol-based medical devices share in the cardiovascular sector.

The Others segment, including orthopedic staples, neurovascular clot retrievers, and gastrointestinal stents, is the fastest-growing segment in the global nitinol-based medical device market trend, owing to broadening uses in areas other than cardiology and urology. Increasing demand for minimally invasive spinal, neuro, and gastrointestinal procedures, coupled with nitinol's capability in conforming to the complex anatomies, is driving the adoption. Specialty implants, innovation, and growing volumes of surgical procedures are contributing to the growth of the nitinol-based implants market in a variety of clinical areas.

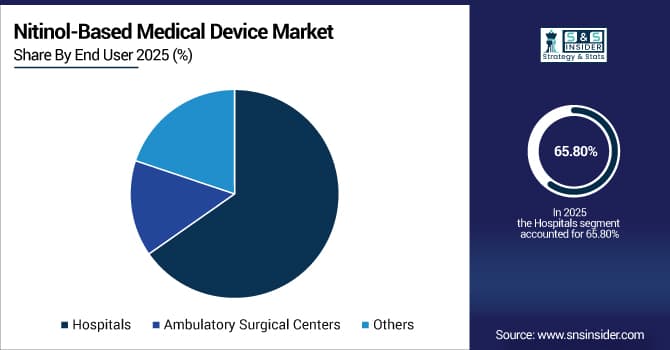

By End-User, Hospitals Command 65.80% Market Share in Nitinol-Based Medical Device Industry in 2025, Ambulatory Surgical Centres Segment to Grow Fastest During Forecast Period

In 2025, the Hospital controls the global nitinol-based medical device industry with a significant market share of 65.80%. owing to their high productivity in performing complex procedures, including cardiovascular and neurovascular interventions. Nitinol stents, guidewires, and retrieval devices are readily taken up by hospitals, which have the surgical capabilities and trained staff to use them. Favorable reimbursement policies and growing chronic disease prevalence also contribute to the use, with hospital end-users resulting in a much larger nitinol-based medical devices market share globally.

In the global nitinol-based medical device industry, the ambulatory surgical Centers segment plays a vital role, registering the fastest growth over the forecast period, fueled by the increasing tendency to perform outpatient operations. The flexibility and precision of nitinol are perfect for minimally invasive procedures in the urology, cardiology, and vascular treatment markets, which drives the nitinol-based medical device market growth.

Nitinol-Based Medical Device Market Regional Analysis:

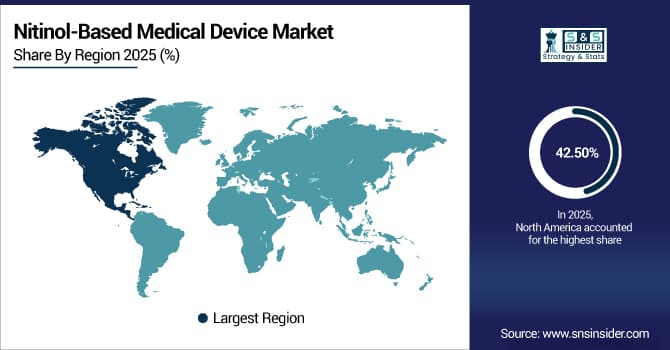

North America Dominates the Nitinol-Based Medical Device Market in 2025E

In 2025E, the North America region dominated the global nitinol-based medical device market and accounted for 42.50% of the overall revenue share, owing to its developed medical infrastructure, high incidence of chronic diseases, and the presence of established medical equipment companies. The area enjoys a high level of adoption of minimally invasive techniques and strong insurance coverage for nitinol-implant-based procedures. Substantial investments in R&D and digital health incorporation also drive innovation. All these factors together lead to the region having the highest nitinol-based medical device market share globally, especially in cardiovascular and neurovascular applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Holds a Significant Share in the Global Nitinol-Based Medical Device Market

Europe also has the prominent market share in nitinol-based medical devices on account of its established healthcare market, higher volumes of cardiovascular and peripheral procedures, and an increase in the preference for minimally invasive procedures. Germany, France, and the UK are leading in advanced surgery practices and medical equipment innovation. Nitinol’s overall market position in Europe is also positively influenced by reimbursement practices, an ageing population, and a sound regulatory environment, and nitinol-based stents, guidewires, and implants continue to be used increasingly throughout Europe.

Asia Pacific Emerges as the Fastest-Growing Region with a 7.84% CAGR (2026–2033)

The Asia Pacific region is projected to grow with the fastest CAGR of 7.84% over the forecast period 2026-2033, owing to the growing advent of healthcare infrastructures, increased awareness about minimally invasive procedures, and high incidence of chronic disorders, including cardiovascular and urological diseases. Nations including China, India, and Japan are seeing an escalation in the number of surgeries as more middle-class citizens get access to healthcare and governments invest in medical technology. Medical tourism is also growing in the region, which is also contributing to the demand for sophisticated devices, including nitinol stents, guidewires, and catheters. Local production capacity and partnerships with device makers globally are also increasing supply and reducing the cost. These trends are driving the nitinol-based medical devices market growth, and Asia Pacific is the most dynamic and progressive market for the future.

Middle East & Africa Show Gradual Growth with Increasing Healthcare Investments

The Middle East & Africa have a relatively smaller nitinol-based medical device market share, owing to the underdeveloped healthcare sector and lack of technical knowledge. Key Players Expansion by specialty centers and hospital chains in countries including the UAE, South Africa, and Saudi Arabia is boosting nitinol-based implants penetration. The growth is being aided by greater awareness, medical tourism, and partnerships with multinational medical device manufacturers looking to cater to demand in emerging markets.

Latin America Witnesses Steady Growth in Nitinol-Based Medical Device Adoption

Latin America has a small but improving nitinol-based medical device market share, due to expanding chronic disease prevalence, a growing healthcare sector, and a preference for less invasive treatments. Countries including Brazil, Mexico, and Argentina are driving adoption, with enhancements in the availability of hospitals and doctors. Government initiatives to upgrade public healthcare and a rise in the number of private healthcare establishments are other key factors. Furthermore, international co-operations and training programs are aiding the development of regional expertise and are further driving the nitinol-based medical devices market growth.

competitive landscape for Nitinol-Based Medical Device Market:

Medtronic

Medtronic is a global leader in advanced medical technologies and a dominant player in the nitinol-based medical device segment, particularly in cardiovascular, neurovascular, and endovascular applications. The company designs and manufactures nitinol-enhanced stents, guidewires, vena cava filters, and occlusion devices known for their flexibility, shape memory, and long-term performance. Medtronic leverages its deep engineering capabilities, large-scale R&D programs, and extensive global distribution network to deliver minimally invasive solutions that improve patient outcomes in complex vascular procedures. Its role in the nitinol-based medical device market is significant, as it drives innovation through high-end device engineering, physician training programs, and continuous product evolution across structural heart and peripheral vascular portfolios.

-

In 2025, Medtronic expanded its nitinol-enabled endovascular platform with enhanced delivery system upgrades designed to improve navigability and precision for complex peripheral interventions.

Boston Scientific

Boston Scientific is a major innovator in the nitinol-based medical device market, recognized for its broad portfolio of stents, guidewires, filters, and specialized vascular implants that utilize nitinol’s advanced mechanical properties. The company’s technologies are widely used in interventional cardiology, electrophysiology, and peripheral vascular procedures, where durability, kink resistance, and deployment accuracy are critical. Boston Scientific’s market role is strengthened by its dedication to physician-centric innovation, clinical trials, and device miniaturization aimed at improving procedural efficiency. With a global commercial footprint and robust R&D investment, the company continues to shape the competitive landscape through next-generation nitinol devices engineered for minimally invasive care.

-

In 2025, Boston Scientific introduced a next-generation nitinol peripheral stent platform featuring improved radial strength and enhanced durability for long-segment arterial disease treatment.

Abbott Laboratories

Abbott Laboratories is a key competitor in the nitinol-based medical device market, with a strong presence in structural heart, vascular intervention, and electrophysiology product categories. The company integrates nitinol into stents, occluders, transcatheter repair systems, and access devices, emphasizing precision engineering and biocompatibility. Abbott’s leadership in minimally invasive treatments is supported by its global clinical research programs and continuous development of advanced nitinol-based implants designed to address complex cardiovascular pathologies. The company plays an essential role in shaping clinical practice by expanding therapeutic options and advancing device safety, reliability, and ease of use across interventional procedures.

-

In 2025, Abbott advanced its nitinol-based structural heart portfolio with an upgraded delivery platform designed to enhance placement accuracy during transcatheter repair procedures.

Stryker Corporation

Stryker Corporation is a prominent medical technology manufacturer with a solid footprint in the nitinol-based medical device market, particularly in neurovascular and minimally invasive surgical applications. Its nitinol-enabled products include thrombectomy devices, clot retrievers, guidewires, and implantable systems engineered for high flexibility and precise deployment within delicate anatomical pathways. Stryker’s market presence is reinforced by its innovation-driven strategy, robust clinical evidence generation, and collaborations with neurosurgeons and interventional specialists worldwide. The company plays a key role in advancing neurovascular device performance, focusing on improved navigation, durability, and treatment outcomes for stroke and vascular disorders.

-

In 2025, Stryker expanded its nitinol neurovascular portfolio with a redesigned clot retrieval system engineered to improve capture efficiency during ischemic stroke intervention.

Nitinol-Based Medical Devices Market Key Players:

-

Medtronic

-

Boston Scientific

-

Abbott Laboratories

-

Stryker Corporation

-

Cardinal Health

-

Cook Medical

-

C. R. Bard (now part of BD)

-

Terumo Corporation

-

MicroPort Scientific

-

Teleflex Incorporated

-

Conformis, Inc.

-

Merit Medical Systems, Inc.

-

Endologix, Inc.

-

B. Braun Melsungen AG

-

Gore & Associates

-

BD (Becton, Dickinson and Company)

-

Olympus Corporation

-

A. A. Bellucci (or similar niche Nitinol device innovators)

-

Cochlear Limited

-

Olympus Terumo Biomaterials (OTB)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.35 billion |

| Market Size by 2033 | USD 7.55 billion |

| CAGR | CAGR of 7.15% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Stents, Guidewires, Retrival device, Catheters, Others) • By Application (Cardiovascular, Urology, Others) • By End User (Hospitals, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Medtronic, Boston Scientific, Abbott Laboratories, Stryker Corporation, Cardinal Health, Cook Medical, C. R. Bard (BD), Terumo Corporation, MicroPort Scientific, Teleflex Incorporated, Conformis Inc., Merit Medical Systems, Endologix Inc., B. Braun Melsungen AG, Gore & Associates, BD (Becton, Dickinson and Company), Olympus Corporation, Cochlear Limited, Olympus Terumo Biomaterials, A. A. Bellucci. |