Non-alcoholic Beverages Market Report Scope & Overview:

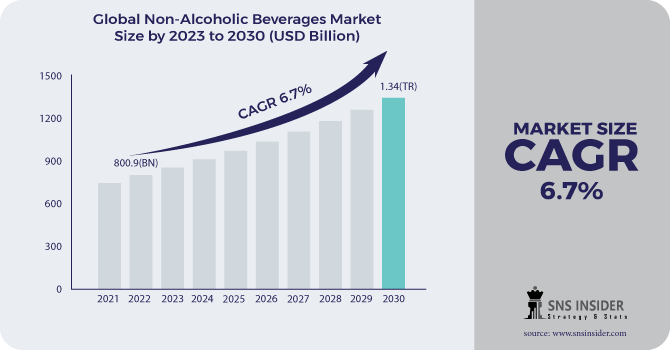

The Global Non-alcoholic Beverage Market Size was esteemed at USD 800.9 billion in 2022 and is supposed to arrive at USD 1.34 trillion by 2030, and develop at a CAGR of 6.7% over the forecast period 2023-2030.

Non-cocktails, otherwise called 'virgin beverages', 'mocktails', and 'close to lager', alluding to the refreshments that involve under 0.5% of liquor content by volume. The non-cocktail market incorporates a wide scope of reward refreshments, including caffeinated drinks, juices, sodas, espresso and tea, filtered water, and probiotics. The drink business has confronted marvelous changes in customer inclinations in the previous 10 years.

The non-alcoholic beverage industry is involved organizations engaged with the creation and deals of drinking items not containing liquor. The expansiveness of this portion ranges from filtered water to espresso and tea, to soda pops, juices, and different items.

The absolute greatest patterns in the business pursue the overall direction in purchaser merchandise results of an expanded spotlight on wellbeing and health. In the non-cocktail area, this has articulated itself thoughts through useful drinks and aged refreshments. The two kinds of items expect to give a few advantages to the purchaser past straightforward refreshing or flavor. On account of practical water, extra supplements or normally happening synthetic substances are added to the water, while matured items like fermented tea market the normally happening medical advantages of the item, frequently stomach related wellbeing.

Market Dynamics:

Driving Factors:

-

Developing worry about the COVID-19 pandemic and expanded attention to medical problems.

Restraining Factors:

-

Ascend in awareness a session its impact on wellbeing because of its unreasonable sugar content and unnaturally improved.

Opportunities:

-

Give inventive bundling.

-

Presentation of recently sent-off drinks.

Challenges:

-

Fake improved beverages can cause coronary illness and disease, while caffeine content in caffeinated drinks builds the gamble of caffeine glut.

Impact of Covid-19:

Moreover, developing worry about the COVID-19 pandemic and expanded attention to medical problems are moving customer inclinations toward better refreshments and non-cocktails. Buyers expect to work on actual wellbeing by quitting refreshments that contain no alcoholic substance. Zero-proof spirits, liquor-free mixed drinks, low calories, and low carb drinks are of late liked by the shoppers in nations like the U.S. furthermore, the U.K., as indicated by the Beverage Trends Report of 2021 by Goliath Consulting Group. Such patterns have opened the way to new open doors for refreshment makers.

Market Estimations:

By Product Type:

The filtered water portion held the biggest piece of the pie in 2021 and is supposed to keep up with its predominance during the conjecture time frame. Rising shopper cognizance toward the medical advantages of polishing off filtered water is projected to drive section development during the figure time frame. In any case, the juices fragment is projected to enroll the second-quickest development from 2022 to 2028. The rising significance of driving a sound way of life is supposed to support the item interest. Moreover, new item dispatches by key producers, like Tropicana and The Coca-Cola Company, are projected to drive the market development.

By Distribution Channel:

By distribution channel, specialty stores are the quickest developing fragment attributable to the increment interest in tweaked items that offer more honey-improved food varieties and beverages. Also, the food and drinks fragment holds the greatest piece of the pie.

By Price Point:

By Price Point, the interest for the premium and extravagance drinks has quickly expanded attributable to the ascent in the reception of premiumization among the purchasers. The purchasers are progressively spending on extravagance items attributable to the medical advantages presented by the fixings utilized, for example, low-sugar contents, without sugar items, and others.

Key Market Segmentation:

By Product Type:

-

Soft Drinks

-

Bottled Water

-

Tea & Coffee

-

Juice

-

Dairy Drinks

-

Others

By Distribution Channel:

-

Supermarket/Hypermarket

-

Convenience stores

-

Specialty Stores

-

Online Retails

-

Others

By Price Point:

-

Standard

-

Premium

-

Luxury

.png)

Regional Analysis:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

The Asia Pacific arose as the quickest developing district on the lookout, attributable to the presence of different undiscovered business sectors, immense populace, and expanding discretionary cash flow. The locale is driven by arising economies, like China, India, Thailand, and Malaysia enjoy a serious upper hand over different regions because of the accessibility of minimal expense work and unrefined components. North America represented the second-biggest market, inferable from the presence of created economies and the early reception of pop items. The district, driven by the U.S., is home to numerous internationally prestigious drink makers, for example, PepsiCo and the Coca-Cola Company.

Key Players:

Kraft Foods Group, Inc., Suja Life, LLC, FreshBev, Pressed Juicery, Suntory Beverage & Food, Unilever, Asahi Group, Jacobs Douwe Egberts, Kirin Holdings Co.

FreshBev-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 800.9 Billion |

| Market Size by 2030 | US$ 1.5Trillion |

| CAGR | CAGR 6.7% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Carbonated Beverage and Non-Carbonated Beverage) • by Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online, and Other Distribution Channels) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Kraft Foods Group, Inc., Suja Life, LLC, FreshBev, Pressed Juicery, Suntory Beverage & Food, Unilever, Asahi Group, Jacobs Douwe Egberts, Kirin Holdings Co. |

| Key Drivers | •Developing worry about the COVID-19 pandemic and expanded attention to medical problems. |

| Market Restraints | •Ascend in awareness a session its impact on wellbeing because of its unreasonable sugar content and unnaturally improved. |