Optical Test System Market Report Scope & Overview:

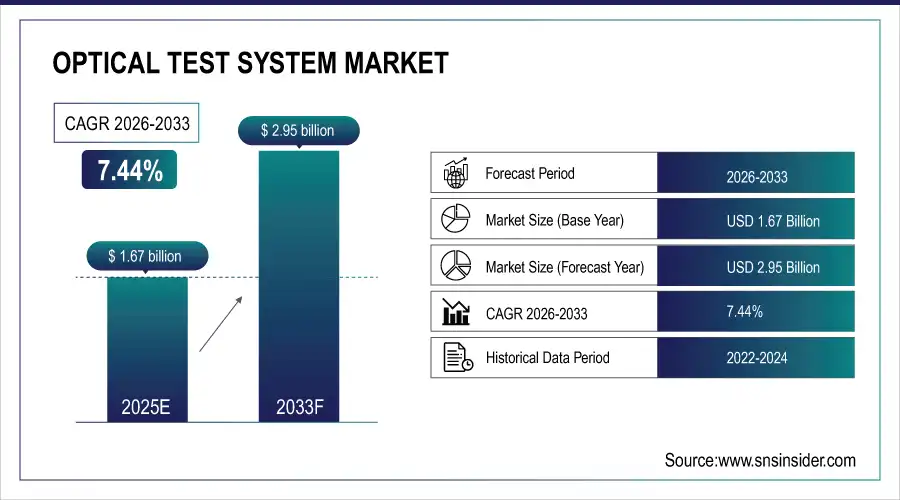

The Optical Test System Market size was valued at USD 1.67 Billion in 2025E and is projected to reach USD 2.95 Billion by 2033, growing at a CAGR of 7.44% during 2026-2033.

The optical test system market is growing due to rising demand for high-speed data transmission, expanding fiber-optic networks, and rapid deployment of 5G and cloud data centers. Increasing complexity of photonic integrated circuits, growing adoption of automated testing in manufacturing, and stringent quality requirements in telecom, aerospace, and semiconductor industries are further driving demand for accurate, high-performance optical testing solutions.

Market Size and Forecast:

-

Market Size in 2025E USD 1.67 Billion

-

Market Size by 2033 USD 2.95 Billion

-

CAGR of 7.44% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information On Optical Test System Market - Request Free Sample Report

Key Optical Test System Market Trends

-

Rapid expansion of fiber-optic networks and widespread 5G/early 6G deployments are driving demand for high-precision optical testing.

-

Increasing complexity in photonic integrated circuits (PICs), optical transceivers, and coherent optics is pushing adoption of automated, high-accuracy test solutions.

-

Rising integration of AI and automation in testing enhances speed, accuracy, and predictive maintenance capabilities.

-

Growth in FTTH, rural broadband, and emerging-market connectivity is boosting demand for portable, cost-effective optical test equipment.

-

Expansion of silicon photonics, LiDAR, optical sensing, and green data centers is creating new applications and revenue opportunities.

The U.S. Optical Test System Market size was valued at USD 0.44 Billion in 2025E and is projected to reach USD 0.76 Billion by 2033, growing at a CAGR of 7.08% during 2026-2033. The U.S. optical test system market is growing due to rapid 5G expansion, rising data center investments, increasing deployment of fiber-optic networks, and growing demand for precise testing of advanced photonic components in telecom, defense, and semiconductor manufacturing sectors.

Optical Test System Market Growth Drivers:

-

Fiber-Optic Expansion 5G Rollout and Advanced Photonics Drive Global Optical Test System Market Growth

The global optical test system market is primarily driven by the rapid expansion of fiber-optic communication networks to support rising data traffic from cloud computing, streaming services, and enterprise digitalization. The global rollout of 5G and early investments in 6G infrastructure are significantly increasing demand for high-precision optical testing across network deployment and maintenance phases. Growing adoption of data centers and hyperscale facilities further fuels the need for advanced optical test systems to ensure signal integrity, low latency, and high bandwidth performance. Additionally, increasing complexity in photonic integrated circuits (PICs), optical transceivers, and coherent optics is pushing manufacturers toward automated and high-accuracy test solutions. Stringent quality and reliability standards in aerospace, defense, and semiconductor industries are also strengthening market demand.

Hyperscale data centers operated by AWS, Google, Microsoft, and Meta constantly upgrade to 400G and 800G optical interconnects between racks and sites, necessitating advanced optical testers to validate high-speed links and modulation formats like PAM4.

Optical Test System Market Restraints:

-

Technical Complexity and Rapid Innovation Pose Challenges to Optical Test System Market Growth

The optical test system market faces restraints from the technical complexity of advanced optical networks, which require highly skilled personnel for accurate testing and interpretation. Rapid technological evolution in photonics and transmission standards shortens product lifecycles, challenging vendors to keep systems updated. Interoperability issues across diverse network architectures and limited standardization in emerging optical technologies also slow adoption and integration.

Optical Test System Market Opportunities:

-

Rising Automation AI Testing and FTTH Expansion Drive New Opportunities in Optical Test Systems

Significant growth opportunities exist with the rising adoption of automation and AI-enabled testing solutions that improve testing speed, accuracy, and predictive maintenance capabilities. The increasing deployment of fiber-to-the-home (FTTH) and rural broadband programs across emerging economies presents strong opportunities for portable and cost-effective optical test equipment. Expansion of silicon photonics, LiDAR, and optical sensing applications in automotive, healthcare, and industrial automation is creating new revenue streams for test system providers. Moreover, the transition toward green data centers and energy-efficient optical networks is driving demand for advanced testing solutions that optimize performance while reducing power consumption.

Rapid commercialization of silicon photonics and co-packaged optics in servers, switches, and optical transceivers requires highly precise wafer-level and module-level optical testing during manufacturing and integration stages.

Optical Test System Market Segment Analysis

-

By Type / Test Instrument, Optical Time Domain Reflectometer (OTDR) dominated with 36.24% in 2025E, and Optical Loss Tester / Optical Power Meter is expected to grow at the fastest CAGR of 8.08% from 2026 to 2033.

-

By Application, Information Technology / Data Centers & Telecom Networks dominated with 46.24% in 2025E, and Biomedical / Medical / Ophthalmic Applications is expected to grow at the fastest CAGR of 8.25% from 2026 to 2033.

-

By End-User / Customer Type, Telecommunication Service Providers / Network Operators dominated with 40.65% in 2025E, and Network Equipment / Component Manufacturers (OEMs) is expected to grow at the fastest CAGR of 8.09% from 2026 to 2033.

-

By Technology / Automation Level, Fully Automated / Automated Test Systems (for high-throughput, production-scale testing) dominated with 46.02% in 2025E, and it is expected to grow at the fastest CAGR of 7.62% from 2026 to 2033.

By Type / Test Instrument, OTDRs Dominate Optical Testing Market While Loss Testers and Power Meters Show Fastest Growth

Optical Time Domain Reflectometers (OTDRs) dominated the market in 2025E due to their widespread use in fiber installation, fault localization, and maintenance across long-haul, metro, and access networks. OTDRs are essential for identifying breaks, splices, and signal attenuation over long distances. Meanwhile, Optical Loss Testers and Optical Power Meters are expected to grow at the fastest pace from 2026–2032, driven by rising FTTH deployments, last-mile connectivity, and routine network certification requirements.

By Application, IT Data Centers and Telecom Dominate While Biomedical Applications Drive Fastest Growth in Optical Testing

Information Technology, Data Centers, and Telecom Networks dominated the market in 2025E due to extensive fiber deployment, 5G expansion, and high-speed optical interconnect testing requirements. Optical test systems are critical for ensuring network reliability, bandwidth performance, and low latency. Biomedical, medical, and ophthalmic applications are expected to grow at the fastest rate from 2026–2033, driven by increasing use of optical diagnostics, imaging systems, and laser-based medical devices requiring precise calibration and performance validation.

By End-User / Customer Type, Telecom Operators Lead Market While OEMs Experience Rapid Growth in Optical Test System Demand

Telecommunication service providers and network operators dominated the market in 2025E, driven by large-scale fiber rollout, 5G densification, and ongoing network maintenance requirements. Network equipment and component manufacturers (OEMs) are expected to register the fastest growth, supported by rising production of optical transceivers, photonic integrated circuits, and high-speed networking hardware requiring advanced testing during design, validation, and manufacturing stages.

By Technology / Automation Level, Automated Optical Test Systems Drive High Throughput Accuracy and Efficiency in Telecom Data Centers

Fully automated test systems dominated the market and are expected to witness the fastest growth, driven by high-throughput, production-scale testing requirements. Increasing complexity of optical components, rising volumes of optical transceivers and photonic devices, and the need for consistent accuracy and reduced human intervention are accelerating adoption of automated testing across telecom, data center, and semiconductor manufacturing environments.

Optical Test System Market Report Analysis

North America Optical Test System Market Insights

North America dominated the optical test system market in 2025E with a 34.46% share, supported by advanced telecom infrastructure, early adoption of 5G, and strong investments in hyperscale data centers. The region benefits from widespread fiber-optic deployment, high demand for high-speed optical interconnect testing, and the presence of leading network equipment manufacturers, semiconductor companies, and defense and aerospace organizations requiring precise optical testing solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Optical Test System Market Insights

The United States dominated the North American optical test system market, driven by large-scale 5G deployment, extensive fiber-optic network expansion, and strong investments in hyperscale data centers. The presence of major telecom operators, cloud service providers, defense contractors, and optical component manufacturers further reinforced market leadership.

Europe Optical Test System Market Insights

Europe accounted for a 24.87% share of the optical test system market, supported by expanding fiber-optic broadband networks, ongoing 5G rollout, and strong investments in digital infrastructure. The region’s focus on smart cities, industrial automation, and cross-border connectivity is increasing demand for reliable optical testing. Additionally, stringent quality standards in aerospace, automotive, and healthcare sectors are driving adoption of high-precision optical test systems.

Germany Optical Test System Market Insights

Germany dominated the European optical test system market, driven by its advanced telecommunications infrastructure, strong industrial automation sector, and significant investments in 5G and fiber-optic networks. The country’s focus on high-quality manufacturing, research, and innovation in photonics and optical technologies further strengthened its market leadership.

Asia Pacific Optical Test System Market Insights

The Asia-Pacific optical test system market is expected to grow at the fastest CAGR of 8.24% from 2026–2033, driven by rapid 5G network expansion, rising fiber-to-the-home (FTTH) deployments, and increasing data center construction. Growing investments in smart cities, industrial automation, and broadband infrastructure across China, India, and Southeast Asia are fueling demand for advanced optical testing solutions to ensure high-speed connectivity and network reliability.

China Optical Test System Market Insights

China dominated the Asia-Pacific optical test system market, driven by massive 5G network rollouts, extensive fiber-optic infrastructure expansion, and significant investments in data centers and smart city projects. The country’s rapid digitalization, government initiatives to enhance broadband connectivity, and strong presence of telecom and optical equipment manufacturers further reinforced its market leadership.

Latin America (LATAM) and Middle East & Africa (MEA) Optical Test System Market Insights

The Latin America and Middle East & Africa (MEA) optical test system markets are witnessing steady growth, driven by increasing fiber-optic network deployments, government initiatives to expand broadband connectivity, and rising investments in telecom infrastructure. Expansion of 4G/5G networks, smart city projects, and industrial automation programs are boosting demand for reliable optical testing solutions. Portable and cost-effective test instruments are particularly favored for remote and underserved regions in these markets.

Competitive Landscape for Optical Test System Market:

Keysight Technologies is a leading provider of advanced optical test and measurement solutions, serving telecom, data center, and photonics industries. The company offers high-precision oscilloscopes, optical analyzers, and automated testing systems that support 5G, AI infrastructure, and next-generation optical networks, enabling reliable, high-speed connectivity and network performance validation.

- In March 2025, Keysight Introduced New Sampling Oscilloscopes for High‑Speed Optical Testing Keysight announced two new DCA‑M sampling oscilloscopes designed for 1.6T optical transceiver testing targeting advanced AI data center interconnects, offering high sensitivity and integrated clock recovery to improve optical test accuracy and throughput.

VIAVI Solutions is a prominent provider of optical test and measurement solutions, catering to telecom, data center, and photonics markets. The company offers portable and benchtop test instruments, automated systems, and photonic inspection tools, supporting 5G, FTTH, and next-generation network deployments while ensuring high-precision testing, network reliability, and performance optimization across diverse optical applications.

- In September 2025, VIAVI expanded its ONE LabPro optical testing platform with the ONE‑1600ER module supporting 1.6Tb optical component testing to meet next‑generation network requirements, including comprehensive Ethernet and performance testing.

Optical Test System Market Key Players:

Some of the Optical Test System Market Companies

- Keysight Technologies

- VIAVI Solutions

- EXFO

- Yokogawa Electric

- Anritsu Corporation

- Tektronix

- Fluke Corporation

- Rohde & Schwarz

- National Instruments

- Fortive

- Pickering Interfaces

- Chroma ATE

- Kingfisher International

- Corning Incorporated

- VeEX Inc.

- OZ Optics Ltd.

- Deviser Instruments

- AFL Telecommunications

- OptoTest Corporation

- Thorlabs Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.67 Billion |

| Market Size by 2033 | USD 2.95 Billion |

| CAGR | CAGR of 7.44% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type / Test Instrument (Optical Time Domain Reflectometer (OTDR), Optical Spectrum Analyzer, Optical Loss Tester / Optical Power Meter, and Optical Modulation Analyzer / Time-Interval Analyzer / Other Specialized Test Instruments) • By Application (Information Technology / Data Centers & Telecom Networks, Aerospace & Defense, Biomedical / Medical / Ophthalmic Applications, and Military / Defense Communications & Secure Networks) • By End-User / Customer Type (Telecommunication Service Providers / Network Operators, Network Equipment / Component Manufacturers (OEMs), Research Laboratories & Academic / R&D Institutions, and Defense Organizations / Government Agencies), • By Technology / Automation Level (Manual / Manual Calibration–based Test Systems, Semi-Automated Test Systems, and Fully Automated / Automated Test Systems (for high-throughput, production-scale testing)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Keysight Technologies, VIAVI Solutions, EXFO, Yokogawa Electric, Anritsu Corporation, Tektronix, Fluke Corporation, Rohde & Schwarz, National Instruments, Fortive, Pickering Interfaces, Chroma ATE, Kingfisher International, Corning Incorporated, VeEX Inc., OZ Optics Ltd., Deviser Instruments, AFL Telecommunications, OptoTest Corporation, Thorlabs Inc |