Organic Personal Care Products Market Report Scope & Overview:

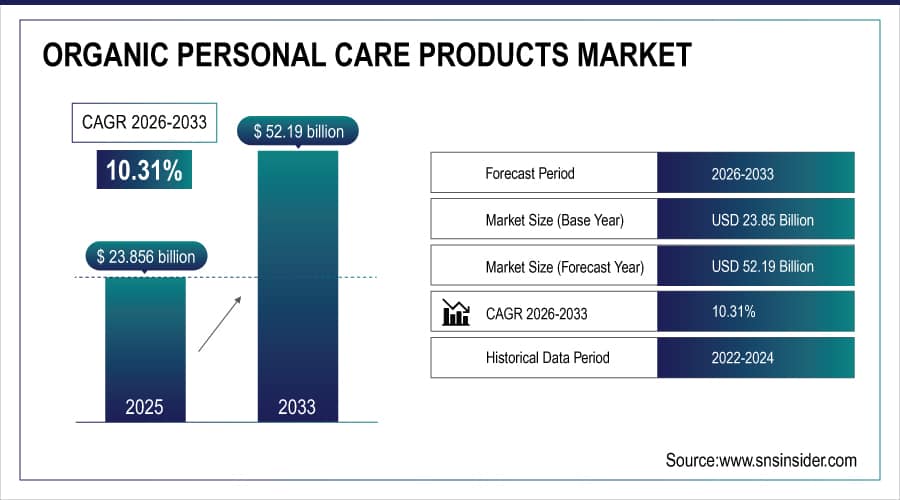

The Organic Personal Care Products Market size is valued at USD 23.85 Billion in 2025E and is projected to reach USD 52.19 Billion by 2033, growing at a CAGR of 10.31% during 2026-2033.

The Organic Personal Care Products Market analysis highlights the increasing consumer shift toward natural, chemical-free, and eco-friendly beauty solutions. Rising awareness of health impacts and sustainability is driving demand across skincare, haircare, and cosmetics categories.

In 2025, 71% of consumers actively avoided parabens, phthalates, and synthetic fragrances, citing skin sensitivity and long-term health risks as key concerns

Market Size and Forecast:

-

Market Size in 2025E: USD 23.85 Billion

-

Market Size by 2033: USD 52.19 Billion

-

CAGR: 10.31% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Organic Personal Care Products Market - Request Free Sample Report

Organic Personal Care Products Market Trends

-

Rising consumer demand for clean-label, chemical-free, and cruelty-free personal care products with transparent ingredient sourcing.

-

Increasing adoption of eco-friendly packaging and sustainable formulations to reduce environmental footprint and enhance brand perception.

-

Rapid expansion of e-commerce and D2C channels driving personalized organic beauty product sales and digital engagement.

-

Growing popularity of multifunctional organic skincare products combining hydration, anti-aging, and sun protection benefits.

-

Surge in R&D investment for plant-based actives, herbal extracts, and biotech-driven natural ingredient innovations.

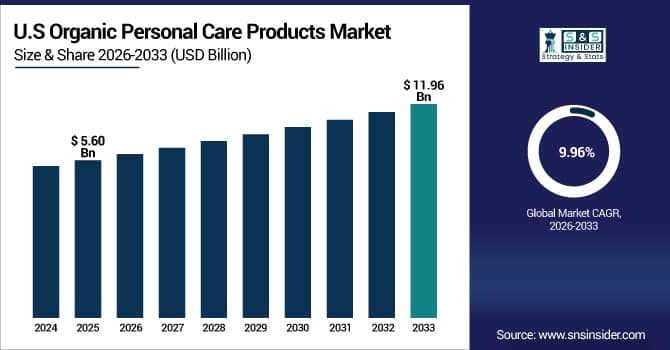

The U.S. Organic Personal Care Products Market size is valued at USD 5.60 Billion in 2025E and is projected to reach USD 11.96 Billion by 2033, growing at a CAGR of 9.96% during 2026-2033. Organic Personal Care Products Market growth is driven by rising awareness of natural and chemical-free ingredients. Consumers are increasingly prioritizing sustainable, vegan, and cruelty-free beauty products. Major brands are expanding organic product portfolios and adopting eco-friendly packaging.

Organic Personal Care Products Market Growth Drivers:

-

Rising Consumer Shift Toward Natural and Chemical-Free Beauty and Personal Care Formulations Globally

Growing consumer awareness of synthetic chemical impacts on skin health is fueling demand for organic personal care products. Increasing preference for plant-based, cruelty-free, and eco-certified formulations across skincare, haircare, and cosmetics is driving market expansion. Additionally, health-conscious consumers are willing to pay premium prices for clean-label and sustainably sourced ingredients, boosting brand innovation and product diversification globally.

Plant-based personal care launches grew by 31% in 2024, with botanical extracts like neem, chamomile, and bakuchiol replacing synthetic actives in skincare and haircare

Organic Personal Care Products Market Restraints:

-

High Production Costs and Limited Availability of Certified Organic Raw Materials Worldwide

The high cost of sourcing certified organic ingredients and maintaining sustainable supply chains poses a significant restraint. Limited availability of organic raw materials like plant oils, herbs, and natural surfactants increases production costs. Moreover, achieving certifications such as USDA Organic or COSMOS involves strict regulatory compliance and testing expenses. These challenges make organic products more expensive, restricting accessibility in price-sensitive markets and hindering mass-scale adoption globally.

Organic Personal Care Products Market Opportunities:

-

Expansion of E-Commerce Platforms and Growing Demand for Sustainable, Eco-Friendly Beauty Products

Rising digitalization and e-commerce growth offer significant opportunities for organic personal care brands to reach wider audiences. Consumers increasingly prefer purchasing certified organic products online, supported by influencer marketing and subscription-based models. Additionally, the push toward sustainable packaging and refillable product formats aligns with global eco-conscious trends, creating new avenues for innovation and customer engagement in the organic beauty and personal care segment.

Online sales of organic personal care products grew by 48% in 2024, accounting for 62% of total category revenue as consumers seek convenience and wider certified brand access.

Organic Personal Care Products Market Segment Analysis

-

By Product, Skin Care led the market with a 42.50% share in 2025, while Hair Care recorded the fastest growth with a CAGR of 9.20%.

-

By Ingredient, Natural Oils dominated with a 36.80% share in 2025, whereas Herbal Extracts showed rapid growth with a CAGR of 8.60%.

-

By Category, Premium products led the market with a 58.40% share in 2025, while Mid-Range products registered the fastest growth at a CAGR of 7.90%.

-

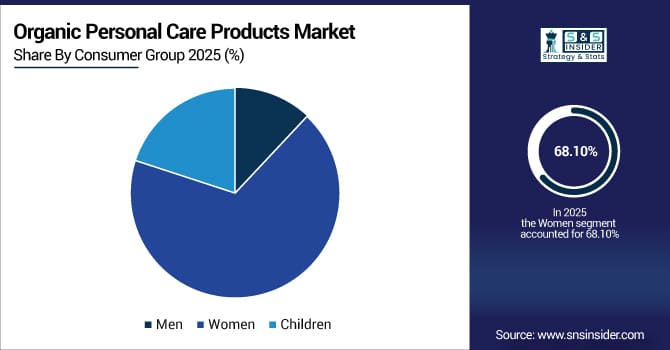

By Consumer Group, Women accounted for the largest share of 68.10% in 2025, while Men registered the fastest growth at a CAGR of 8.30%.

-

By Distribution Channel, Supermarkets/Hypermarkets led with a 61.40% share in 2025, while Online Retail witnessed the fastest growth with a CAGR of 10.10%.

By Product, Skin Care Leads Market While Hair Care Registers Fastest Growth

Skin care dominates the organic personal care products market, driven by growing demand for natural moisturizers, cleansers, and anti-aging formulations. Consumers are increasingly favoring products made with plant-based ingredients and free from synthetic chemicals. Hair care is the fastest-growing segment due to rising concerns about scalp health and chemical damage. The popularity of organic shampoos, conditioners, and hair oils infused with herbal extracts and essential oils continues to rise, particularly among environmentally conscious and health-oriented consumers globally.

By Ingredient, Natural Oils Dominate While Herbal Extracts Shows Rapid Growth

Natural oils hold the leading share in the market, widely used in organic formulations for their deep hydration and restorative benefits. Ingredients like coconut, jojoba, and argan oil remain essential in skincare and haircare ranges. Herbal extracts, including aloe vera, green tea, and chamomile, are rapidly gaining traction due to their proven skin-calming and antioxidant properties. Growing consumer interest in botanically derived and therapeutic ingredients further drives innovation across organic cosmetic and personal care product formulations worldwide.

By Category, Premium Lead While Mid-Range Registers Fastest Growth

The premium category dominates the organic personal care market, supported by rising consumer willingness to invest in high-quality, certified products. Premium brands emphasize transparency, eco-packaging, and advanced natural formulations. However, the mid-range segment is expanding faster as affordability becomes a key factor for wider adoption. Increasing availability of mid-priced organic alternatives in retail and online channels allows more consumers to transition from synthetic to organic personal care products without compromising efficacy or safety standards.

By Consumer Group, Women Lead While Men Registers Fastest Growth

Women remain the dominant consumer group in the organic personal care products market, with high adoption across skincare, cosmetics, and haircare segments. Growing awareness of ingredient safety and long-term benefits drives continued preference for organic options. However, men’s grooming and skincare are witnessing the fastest growth, driven by increasing self-care awareness and new product lines targeting men’s skin and hair needs. Brands are introducing gender-specific, eco-friendly products, expanding their reach within the growing male grooming segment.

By Distribution Channel, Supermarkets/Hypermarkets Lead While Online Retail Grow Fastest

Supermarkets and hypermarkets continue to lead distribution, offering extensive product visibility, diverse brand options, and consumer trust through certified labeling. These stores remain crucial for impulse and routine purchases of organic personal care products. However, online retail channels are growing the fastest, propelled by convenience, digital marketing, and influencer-driven awareness. E-commerce platforms provide direct-to-consumer access, wider product assortments, and sustainable delivery models, making them the preferred choice for tech-savvy and eco-conscious consumers seeking authenticity and transparency.

Organic Personal Care Products Market Regional Analysis:

North America Organic Personal Care Products Market Insights

In 2025 North America dominated the Organic Personal Care Products Market and accounted for 35.69% of revenue share, this leadership is due to the strong consumer awareness and established premium brands. The U.S. and Canada lead in product innovation, with a focus on clean labeling and cruelty-free claims. High spending on skincare and anti-aging products sustains steady growth. Consumers increasingly demand transparency and traceability in sourcing. The market benefits from strong retail distribution networks and rising influence of eco-friendly lifestyle trends.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Organic Personal Care Products Market Insights

The U.S. organic personal care products market is mature and innovation-driven, emphasizing ingredient purity and sustainable sourcing. Growing consumer distrust of synthetic chemicals accelerates demand for certified organic alternatives. Brands prioritize vegan, cruelty-free, and biodegradable formulations to meet ethical expectations.

Europe Organic Personal Care Products Market Insights

Europe is expected to witness the fastest growth in the Organic Personal Care Products Market over 2026-2033, with a projected CAGR of 10.64% due to stringent regulations and eco-conscious consumers. Germany, France, and the U.K. dominate with established organic certifications like COSMOS and Ecocert. Demand for vegan, sustainable, and locally sourced products continues to rise. Innovation in packaging and ingredient traceability enhances consumer trust. The market benefits from strong retail presence and collaboration between beauty and sustainability-focused organizations.

Germany Organic Personal Care Products Market Insights

Germany represents one of Europe’s most mature organic personal care markets, driven by strong consumer preference for natural cosmetics. Local brands emphasize ingredient transparency and dermatological safety. The country’s regulatory framework encourages clean beauty innovation and certified organic labeling.

Asia-Pacific Organic Personal Care Products Market Insights

In 2025, Asia-Pacific emerged as a promising region in the Organic Personal Care Products Market, due to increasing awareness of natural beauty and sustainability. Rising disposable incomes and urbanization are driving demand for chemical-free skincare and haircare products. Countries like China, Japan, South Korea, and India are leading in innovation and herbal formulations. Growing e-commerce penetration enhances accessibility to premium organic brands.

China Organic Personal Care Products Market Insights

China’s organic personal care market is experiencing significant growth, fueled by a shift toward safer, eco-conscious beauty products. Urban consumers increasingly prefer plant-based, non-toxic formulations. Domestic and international brands are investing in “green beauty” innovation and natural ingredient sourcing.

Latin America (LATAM) and Middle East & Africa (MEA) Organic Personal Care Products Market Insights

The Organic Personal Care Products Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to rising middle-class income and growing awareness of sustainable beauty drive adoption. Brazil and South Africa are key growth hubs with expanding local production. Limited regulatory frameworks are gradually aligning with global organic standards. E-commerce expansion and social media influence enhance visibility and access to organic brands across these developing markets.

Organic Personal Care Products Market Competitive Landscape:

L’Oréal continues to strengthen its position in the organic personal care products market through sustainable innovation and clean beauty initiatives. The company focuses on plant-based formulations and eco-friendly packaging under its Garnier and Kiehl’s brands. Ongoing R&D investments support advancements in natural ingredients and biodegradable formulas.

-

In June 2025, L’Oréal acquired a majority stake in British skincare brand Medik8 for about €1 billion, strengthening its leadership in science-driven, sustainable, and premium skincare innovation within the global organic personal care segment.

Unilever drives growth in the organic personal care market through its brands like Love Beauty and Planet and Simple. The company emphasizes sustainability, cruelty-free production, and transparency in ingredient sourcing. Expansion of eco-certified product lines and investment in responsible packaging enhance its competitive edge globally.

-

In September 2024, Unilever partnered with Accenture on a multi-year generative-AI program designed to improve operational efficiency, innovation speed, and productivity across its global personal care and beauty manufacturing network.

P&G leverages its strong skincare portfolio, including Olay and Native, to enter the organic personal care segment. The company is increasingly investing in natural formulations and recyclable packaging. Its digital-first marketing and strategic acquisitions in clean beauty brands support its growth in the conscious consumer market.

-

In June 2025, Procter & Gamble launched a global decarbonisation framework with Durham and Newcastle Universities to accelerate sustainable manufacturing, reduce emissions, and promote circular practices within its personal care and skincare supply chain.

Beiersdorf AG, known for Nivea and Eucerin, has intensified its focus on organic skincare through naturally derived ingredients and sustainable production. The company invests in bio-based R&D and partnerships for eco-friendly innovations. Its commitment to environmental responsibility and transparency enhances global consumer trust and market leadership.

-

In February 2025, Beiersdorf introduced breakthrough innovations like Eucerin’s Epigenetic Serum, achieving record sales and expanding its global footprint in organic skincare through sustainable, clinically tested product lines.

Organic Personal Care Products Market Key Players:

Some of the Organic Personal Care Products Market Companies are:

-

L’Oréal

-

Unilever

-

Procter & Gamble

-

Beiersdorf AG

-

Johnson & Johnson

-

Estée Lauder Companies Inc.

-

Shiseido Company, Limited

-

Kao Corporation

-

Amorepacific Corporation

-

L’Occitane en Provence

-

Clarins Group

-

Avon Products, Inc.

-

Mary Kay Inc.

-

Revlon, Inc.

-

Oriflame Holding AG

-

Natura & Co

-

Henkel AG & Co. KGaA

-

GlaxoSmithKline plc

-

Dr. Bronner’s Magic Soaps

-

MÁDARA Cosmetics

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 23.85 Billion |

| Market Size by 2033 | USD 52.19 Billion |

| CAGR | CAGR of 10.31% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Skin Care, Hair Care, Oral Care, Makeup & Cosmetics, Bath & Shower, and Others) • By Ingredient (Natural Oils, Herbal Extracts, Fruits & Vegetables, Plant-Based Surfactants, Essential Oils, and Others) • By Category (Premium, Mid-Range, and Mass) • By Consumer Group (Men, Women, and Children) • By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Pharmacies, Online Retail, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | L’Oréal, Unilever, Procter & Gamble, Beiersdorf AG, Johnson & Johnson, Estée Lauder Companies Inc., Shiseido Company Limited, Kao Corporation, Amorepacific Corporation, L’Occitane en Provence, Clarins Group, Avon Products Inc., Mary Kay Inc., Revlon Inc., Oriflame Holding AG, Natura & Co, Henkel AG & Co. KGaA, GlaxoSmithKline plc, Dr. Bronner’s Magic Soaps, MÁDARA Cosmetics |