Orthopedic Implants Market Report Scope & Overview:

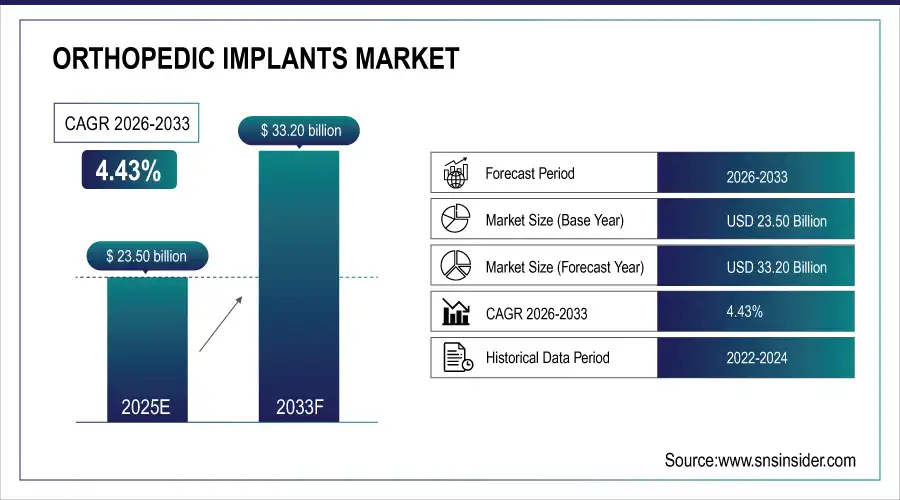

The Orthopedic Implants Market Size is valued at USD 23.50 Billion in 2025E and is expected to reach USD 33.20 Billion by 2033 and grow at a CAGR of 4.43% over the forecast period 2026-2033.

The Orthopedic Implants Market analysis, driven by rising prevalence of musculoskeletal disorders, including osteoarthritis, osteoporosis, fractures, and joint degeneration, driven by ageing populations worldwide and increasingly sedentary lifestyles. As people live longer and maintain active lifestyles, the incidence of joint pain, spinal disorders, and bone injuries grows, increasing demand for implants such as hip and knee replacements, spinal fixation devices, trauma plates, and bone screws.

According to study, orthopedic implant procedure volumes are growing at an estimated 6–8% annually, driven by ageing populations and higher diagnosis rates of musculoskeletal disorders.

Market Size and Forecast:

-

Market Size in 2025: USD 23.50 Billion

-

Market Size by 2033: USD 33.20 Billion

-

CAGR: 4.43% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Orthopedic Implants Market - Request Free Sample Report

Orthopedic Implants Market Trends:

-

Joint replacement procedures increasing due to osteoarthritis and aging populations.

-

3D-printed and patient-specific implants gaining traction for improved surgical outcomes.

-

Minimally invasive orthopedic surgeries driving demand for advanced implant designs.

-

Use of titanium alloys and bio-compatible materials expanding implant durability.

-

Rising medical tourism boosting orthopedic implant adoption in emerging economies.

-

Smart implants with sensors improving post-surgical monitoring and recovery outcomes.

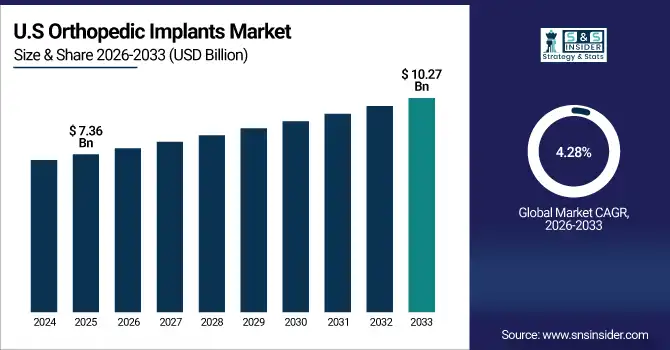

The U.S. Orthopedic Implants Market size is USD 7.36 Billion in 2025E and is expected to reach USD 10.27 Billion by 2033, growing at a CAGR of 4.28% over the forecast period of 2026-2033,

The U.S. orthopedic implants market is growing steadily, driven by high prevalence of musculoskeletal disorders, aging population, and rising incidence of sports injuries and trauma cases. Advanced healthcare infrastructure, widespread access to skilled orthopedic surgeons, and favorable reimbursement policies support high procedure volumes. Increasing adoption of technologically advanced implants, including titanium, bioresorbable, and patient-specific designs, enhances treatment outcomes.

Orthopedic Implants Market Growth Drivers:

-

Aging population and rising orthopedic disorders drive implant market growth.

A major driver for the orthopedic implants market growth is the increasing incidence of orthopedic disorders such as osteoarthritis, osteoporosis, fractures, and sports-related injuries, combined with a rapidly aging population. Elderly individuals are more prone to joint degeneration and bone-related conditions, leading to higher demand for hip, knee, spine, and trauma implants. Additionally, improvements in healthcare infrastructure, greater awareness about surgical treatment options, and advancements in implant materials such as titanium alloys and bio-compatible polymers are boosting adoption. The growing preference for minimally invasive orthopedic procedures further supports sustained market growth worldwide.

Hip and knee implants together represent approximately 45–50% of total implant procedures.

Orthopedic Implants Market Restraints:

-

High implant and surgical costs limit adoption in price-sensitive healthcare markets.

A major challenge lies in the orthopedic implants market is the high cost associated with implants, surgical procedures, and post-operative care. Advanced implants, robotic-assisted surgeries, and customized devices significantly increase treatment expenses, making them less affordable for patients in low- and middle-income regions. Limited insurance coverage, reimbursement challenges, and long approval timelines for new implant technologies further restrict adoption. These cost-related barriers can slow market growth, especially in price-sensitive markets and public healthcare systems.

Orthopedic Implants Market Opportunities:

-

Advanced technologies and emerging economies unlock strong growth opportunities.

A major opportunity lies in the rapid advancement of orthopedic implant technologies and expanding access to orthopedic care in emerging economies. Innovations such as 3D-printed implants, patient-specific designs, smart implants with sensors, and improved bioactive coatings are enhancing implant performance and longevity. Emerging regions in Asia-Pacific, Latin America, and the Middle East are witnessing rising healthcare investments, increasing medical tourism, and growing awareness of advanced orthopedic treatments. These trends present significant opportunities for manufacturers to expand their footprint and capture untapped patient populations.

Emerging markets in Asia-Pacific, Latin America, and Middle East expected to drive 40–45% of new demand.

Orthopedic Implants Market Segmentation Analysis:

-

By Product: In 2025, Lower Extremity Implants led the market with a share of 51.15%, while Dental Implants is the fastest-growing segment with a CAGR of 6.98%.

-

By Material: In 2025, Metallic Materials led the market with a share of 47.36%, while Polymeric Biomaterials is the fastest-growing segment with a CAGR of 7.24%.

-

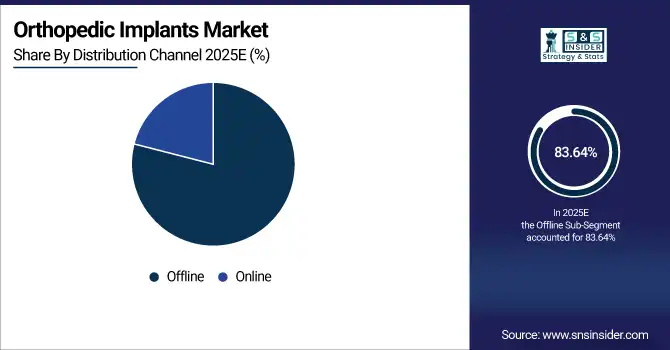

By Distribution Channel: In 2025, Offline led the market with a share of 83.64%, while online is the fastest-growing segment with a CAGR of 8.11%.

-

By End Use: In 2025, Hospitals led the market with a share of 64.94%, while Outpatient Facilities is the fastest-growing segment with a CAGR of 6.85%.

By Product, Lower Extremity Implants Lead Market and Dental Implants Fastest Growth

Lower extremity implants dominated the orthopedic implants market in 2025, driven by the high prevalence of knee and hip disorders such as osteoarthritis, osteoporosis, and sports-related injuries. Aging populations, rising obesity rates, and increasing demand for total knee and hip replacement surgeries have reinforced this segment’s leadership. Continuous product innovations, including minimally invasive implants and improved fixation technologies, further support its dominant position across hospitals and orthopedic centers.

Dental implants represent the fastest-growing product segment, supported by rising awareness of oral health, increasing cosmetic dentistry procedures, and growing demand for long-lasting tooth replacement solutions. Technological advancements such as 3D-printed implants, surface-modified titanium, and digital dentistry workflows are accelerating adoption, particularly in emerging markets and medical tourism hubs.

By Material, Metallic Materials Lead Market and Polymeric Biomaterials Fastest Growth

Metallic materials led the market in 2025, owing to their superior strength, durability, and biocompatibility. Materials such as titanium alloys, stainless steel, and cobalt-chromium are widely used in load-bearing orthopedic implants, including hip, knee, and trauma implants. Their proven clinical performance, long implant lifespan, and compatibility with advanced coating technologies continue to make metallic biomaterials the preferred choice among surgeons and manufacturers.

Polymeric biomaterials are the fastest-growing segment, driven by increasing use in non-load-bearing applications, spinal implants, and soft tissue fixation devices. These materials offer advantages such as flexibility, reduced weight, radiolucency, and improved patient comfort. Ongoing research into bioresorbable and high-performance polymers is further expanding their role in next-generation orthopedic implant designs.

By Distribution Channel, Offline Lead Market and Online Fastest Growth

Offline distribution channels dominated the market in 2025, as orthopedic implants are primarily procured through hospitals, specialty orthopedic clinics, and authorized distributors. The need for surgeon consultation, regulatory compliance, and strict quality assurance favors traditional procurement models. Strong relationships between manufacturers, healthcare institutions, and distributors continue to support offline channel dominance.

Online distribution is the fastest-growing channel, supported by increasing digitalization in healthcare procurement and growing adoption of e-commerce platforms by clinics and ambulatory centers. Online channels offer improved price transparency, faster ordering, and access to a broader product portfolio, making them increasingly attractive, especially in cost-sensitive and emerging healthcare markets.

By End Use, Hospitals Lead Market and Outpatient Facilities Fastest Growth

Hospitals led the orthopedic implants market in 2025, due to their high surgical volumes, advanced infrastructure, and availability of skilled orthopedic surgeons. Complex procedures such as joint replacement, trauma fixation, and revision surgeries are predominantly performed in hospital settings, ensuring consistent demand for orthopedic implants.

Outpatient facilities are the fastest-growing end-use segment, driven by the shift toward minimally invasive surgeries and same-day discharge procedures. Advances in implant technology, anesthesia, and surgical techniques have enabled orthopedic procedures to move into ambulatory and outpatient settings, offering cost savings, shorter recovery times, and increased patient convenience.

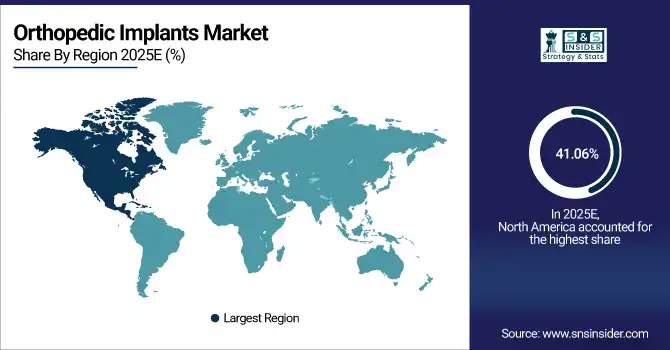

Orthopedic Implants Market Regional Analysis:

North America Orthopedic Implants Market Insights:

The North America dominated the Orthopedic Implants Market in 2025E, with over 41.06% revenue share, due to advanced healthcare infrastructure, high adoption of innovative medical technologies, and strong presence of leading implant manufacturers. Rising prevalence of orthopedic disorders, sports injuries, and obesity-related joint issues increases procedure volumes. An aging population drives demand for joint replacement surgeries, particularly hip and knee implants. Favorable reimbursement policies, widespread access to skilled orthopedic surgeons, and continuous R&D in materials such as titanium alloys and bioresorbable implants further strengthen the region’s leadership in the orthopedic implants market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Orthopedic Implants Market Insights

The U.S. and Canada lead orthopedic implant adoption with advanced healthcare systems, high procedure volumes, technological innovation, favorable reimbursement, and strong demand for knee, hip, and spine implants driven by aging populations.

Asia Pacific Orthopedic Implants Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 4.43%, supported by rapid population aging, rising healthcare expenditure, and improving access to advanced orthopedic treatments. Increasing incidence of trauma, road accidents, and degenerative bone diseases boosts implant demand. Expanding medical tourism, growing awareness of minimally invasive surgeries, and investments in healthcare infrastructure accelerate adoption. Local manufacturing growth, cost-effective implant solutions, and government initiatives to improve healthcare access further contribute to strong market expansion across the region.

China and India Orthopedic Implants Market Insights

China and India show strong orthopedic implants market growth due to large aging populations, rising trauma cases, increasing healthcare access, and growing adoption of joint replacement and trauma fixation procedures supported by improving medical infrastructure.

Europe Orthopedic Implants Market Insights

Europe represents a significant share of the orthopedic implants market, driven by an aging population and high prevalence of musculoskeletal disorders. Strong public healthcare systems and increasing adoption of joint reconstruction and trauma implants support steady demand. Technological advancements in implant design, including 3D-printed and patient-specific implants, enhance treatment outcomes. Emphasis on regulatory compliance, quality standards, and long-term implant durability shapes product development. Growing focus on minimally invasive procedures and faster recovery solutions sustains market growth across Europe.

Germany and U.K. Orthopedic Implants Market Insights

Germany and the U.K. experience steady orthopedic implants growth, supported by aging demographics, high-quality healthcare services, adoption of minimally invasive procedures, and demand for advanced, durable, and patient-specific implant technologies.

Latin America (LATAM) and Middle East & Africa (MEA) Orthopedic Implants Market Insights

Latin America and the Middle East & Africa show steady growth in the orthopedic implants market, driven by expanding healthcare infrastructure, rising urbanization, and increasing awareness of advanced orthopedic treatments. Growing incidence of sports injuries, trauma cases, and age-related joint disorders supports implant demand. Improvements in hospital facilities, access to specialized orthopedic care, and government investments boost adoption. While cost sensitivity and uneven access remain challenges, demand for affordable, durable, and high-quality implants is increasing. Ongoing healthcare modernization, private sector participation, medical tourism, and workforce development strengthen long-term market potential across both regions.

Orthopedic Implants Market Competitive Landscape

ConforMIS, Inc. specializes in personalized knee implants using proprietary 3D imaging and patient-specific design technology. Its solutions aim to improve fit, mobility, and long-term outcomes for patients requiring knee replacement. ConforMIS focuses on innovation, precision, and surgeon support tools, offering implants tailored to individual anatomy. With growing adoption in North America and Europe, the company strengthens its position in the orthopedic implants market by delivering customized, technology-driven solutions that enhance patient care and surgical efficiency.

-

In May 2025, ConforMIS launched its iTotal CR-F patient-specific knee implant in Europe, featuring enhanced personalized fit and improved surgical instrumentation. The move expands the company’s footprint in patient-specific joint replacement solutions.

MicroPort Scientific Corporation develops and markets orthopedic implants including hip, knee, and spinal devices. Its offerings combine advanced materials, modular designs, and patient-centric solutions for improved joint functionality and durability. The company invests heavily in R&D, surgical support tools, and minimally invasive technologies. With strong operations in Asia and expanding international reach, MicroPort addresses growing orthopedic needs and aging populations, establishing itself as a key competitor in the orthopedic implants market.

-

In June 2025, MicroPort introduced the Evolution™ Knee System, targeting Asian markets with advanced knee replacement implants featuring improved alignment guides and durability.

Corin Group is a orthopedic solutions provider specializing in hip, knee, and shoulder implants. Its portfolio includes patient-specific and standard implants designed to improve mobility and surgical outcomes. Corin emphasizes innovation, advanced design technologies, and minimally invasive solutions. With a strong presence in Europe, Asia, and North America, the company focuses on enhancing patient recovery, supporting surgeons with tailored tools, and maintaining high-quality standards, positioning itself as a notable player in the orthopedic implants market.

-

In May 2025, Corin launched the Hip Innovation Project (HIP) 2025, introducing robotic-assisted partial hip replacement systems with enhanced precision and modularity for surgeons.

Orthopedic Implants Market Key Players:

Some of the Orthopedic Implants Market Companies

-

Stryker Corporation

-

Johnson & Johnson

-

Smith & Nephew plc

-

Medtronic plc

-

NuVasive, Inc.

-

Colfax Corporation

-

B. Braun Melsungen AG

-

Globus Medical, Inc.

-

ConforMIS, Inc.

-

Orthofix International N.V.

-

Exactech, Inc.

-

MicroPort Scientific Corporation

-

Heraeus Holding GmbH

-

LimaCorporate S.p.A.

-

Corin Group

-

Arthrex, Inc.

-

Zimmer Biomet Holdings, Inc.

-

DJO Global

-

Amedica Corporation

-

SpineSmith

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 23.50 Billion |

| Market Size by 2033 | USD 33.20 Billion |

| CAGR | CAGR of 4.43% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Lower Extremity Implants, Spinal Implants, Dental, Upper Extremity Implants) •By Material (Metallic Material, Ceramic Biomaterials, Polymeric Biomaterials, Others) •By Distribution Channel (Offline, Online) •By End Use (Hospitals, Outpatient Facilities) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Stryker Corporation, Johnson & Johnson, Smith & Nephew plc, Medtronic plc, NuVasive Inc., Colfax Corporation, B. Braun Melsungen AG, Globus Medical Inc., ConforMIS Inc., Orthofix International N.V., Exactech Inc., MicroPort Scientific Corporation, Heraeus Holding GmbH, LimaCorporate S.p.A., Corin Group, Arthrex Inc., Zimmer Biomet Holdings Inc., DJO Global, Amedica Corporation, and SpineSmith |